OPEN-SOURCE SCRIPT

ICT Balanced Price Range [TradingFinder] BPR | FVG + IFVG

🔵Introduction

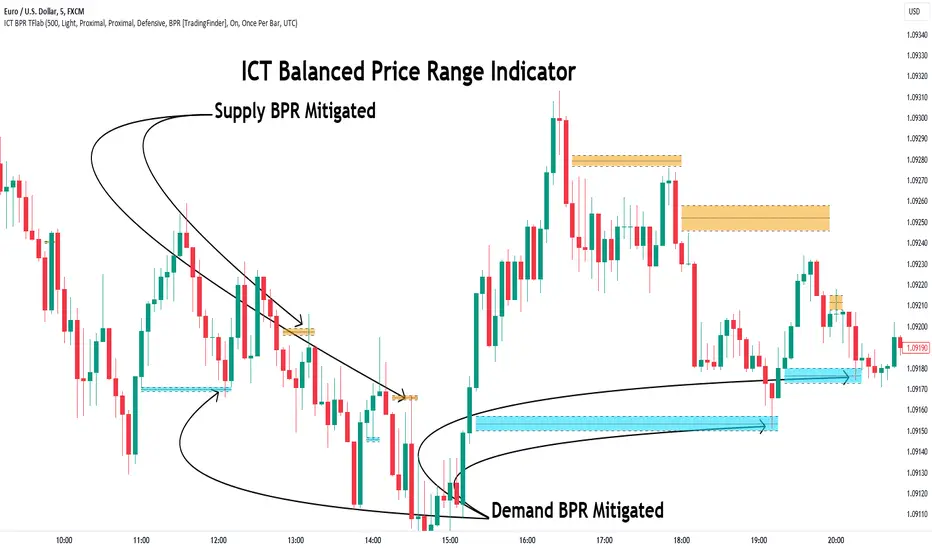

The ICT Balanced Price Range (BPR) indicator is a valuable tool that helps traders identify key areas on price charts where a balance between buyers and sellers is established. These zones can serve as critical points for potential price reversals or continuations.

🟣Bullish Balanced Price Range

A Bullish BPR forms when a buying pressure zone (Bullish FVG) overlaps with a Bullish Inversion FVG. This overlap indicates a high probability of price moving upwards, making it a crucial area for traders to consider.

🟣Bearish Balanced Price Range

Similarly, a Bearish BPR is created when a selling pressure zone (Bearish FVG) overlaps with a Bearish Inversion FVG. This zone is often seen as a key area where the price is likely to move downward.

🔵How to Use

🟣Identifying the Balanced Price Range (BPR)

To identify the Balanced Price Range (BPR), you must first locate two Fair Value Gaps (FVGs) on the price chart. One FVG should be on the sell side, and the other on the buy side. When these two FVGs horizontally oppose each other, the area where they overlap is recognized as the Balanced Price Range (BPR).

This BPR zone is highly sensitive to price movements due to the combination of two FVGs, often leading to strong market reactions. As the price approaches this area, the likelihood of a significant market move increases, making it a prime target for professional traders.

🟣Bullish Balanced Price Range (Bullish BPR)

To effectively trade using a Bullish BPR, begin by identifying a bullish market structure and searching for bullish Price Delivery Arrays (PD Arrays). Once the market structure shifts to bullish in a lower time frame, locate a Bullish FVG within the Discount Zone that overlaps with a Bearish FVG.

Mark this overlapping zone and wait for the price to test it before executing a buy trade. Alternatively, you can set a Buy Limit order with a stop loss below the recent swing low and target profits based on higher time frame liquidity draws.

🟣Bearish Balanced Price Range (Bearish BPR)

For bearish trades, start by identifying a bearish market structure and look for bearish PD Arrays. After the market structure shifts to bearish in a lower time frame, identify a Bearish FVG within the Discount Zone that overlaps with a Bullish FVG. Mark this overlapping zone and execute a sell trade when the price tests it.

You can also use a Sell Limit order with a stop loss above the recent swing high and target profits according to higher time frame liquidity draws.

🔵Settings

🟣Global Settings

Show All Inversion FVG & IFVG: If disabled, only the most recent FVG & IFVG will be displayed.

FVG & IFVG Validity Period (Bar): Determines the maximum duration (in number of candles) that the FVG and IFVG remain valid.

Switching Colors Theme Mode: Includes three modes: "Off", "Light", and "Dark". "Light" mode adjusts colors for light mode use, "Dark" mode adjusts colors for dark mode use, and "Off" disables color adjustments.

🟣Display Settings

Show Bullish BPR: Toggles the display of demand-related boxes.

Show Bearish BPR: Toggles the display of supply-related boxes.

Mitigation Level BPR: Options include "Proximal", "Distal", or "50 % OB" modes, which you can choose based on your needs. The "50 % OB" line is the midpoint between distal and proximal.

Show Bullish IFVG: Toggles the display of demand-related boxes.

Show Bearish IFVG: Toggles the display of supply-related boxes.

Mitigation Level FVG and IFVG: Options include "Proximal", "Distal", or "50 % OB" modes, which you can choose based on your needs. The "50 % OB" line is the midpoint between distal and proximal.

🟣Logic Settings

FVG Filter: This refines the number of identified FVG areas based on a specified algorithm to focus on higher quality signals and reduce noise.

Types of FVG filters:

🟣Alert Settings

Alert Inversion FVG Mitigation: Enables alerts for Inversion FVG mitigation.

Message Frequency: Determines the frequency of alerts. Options include 'All' (every function call), 'Once Per Bar' (first call within the bar), and 'Once Per Bar Close' (final script execution of the real-time bar). Default is 'Once per Bar'.

Show Alert Time by Time Zone: Configures the time zone for alert messages. Default is 'UTC'.

Display More Info: Provides additional details in alert messages, including price range, date, hour, and minute. Set to 'Off' to exclude this information.

🔵Conclusion

The ICT Balanced Price Range is a powerful and reliable tool for identifying key points on price charts. This strategy can be applied across various time frames and serves as a complementary tool alongside other indicators and technical analysis methods.

The most crucial aspect of utilizing this strategy effectively is correctly identifying FVGs and their overlapping areas, which comes with practice and experience.

The ICT Balanced Price Range (BPR) indicator is a valuable tool that helps traders identify key areas on price charts where a balance between buyers and sellers is established. These zones can serve as critical points for potential price reversals or continuations.

🟣Bullish Balanced Price Range

A Bullish BPR forms when a buying pressure zone (Bullish FVG) overlaps with a Bullish Inversion FVG. This overlap indicates a high probability of price moving upwards, making it a crucial area for traders to consider.

🟣Bearish Balanced Price Range

Similarly, a Bearish BPR is created when a selling pressure zone (Bearish FVG) overlaps with a Bearish Inversion FVG. This zone is often seen as a key area where the price is likely to move downward.

🔵How to Use

🟣Identifying the Balanced Price Range (BPR)

To identify the Balanced Price Range (BPR), you must first locate two Fair Value Gaps (FVGs) on the price chart. One FVG should be on the sell side, and the other on the buy side. When these two FVGs horizontally oppose each other, the area where they overlap is recognized as the Balanced Price Range (BPR).

This BPR zone is highly sensitive to price movements due to the combination of two FVGs, often leading to strong market reactions. As the price approaches this area, the likelihood of a significant market move increases, making it a prime target for professional traders.

🟣Bullish Balanced Price Range (Bullish BPR)

To effectively trade using a Bullish BPR, begin by identifying a bullish market structure and searching for bullish Price Delivery Arrays (PD Arrays). Once the market structure shifts to bullish in a lower time frame, locate a Bullish FVG within the Discount Zone that overlaps with a Bearish FVG.

Mark this overlapping zone and wait for the price to test it before executing a buy trade. Alternatively, you can set a Buy Limit order with a stop loss below the recent swing low and target profits based on higher time frame liquidity draws.

🟣Bearish Balanced Price Range (Bearish BPR)

For bearish trades, start by identifying a bearish market structure and look for bearish PD Arrays. After the market structure shifts to bearish in a lower time frame, identify a Bearish FVG within the Discount Zone that overlaps with a Bullish FVG. Mark this overlapping zone and execute a sell trade when the price tests it.

You can also use a Sell Limit order with a stop loss above the recent swing high and target profits according to higher time frame liquidity draws.

🔵Settings

🟣Global Settings

Show All Inversion FVG & IFVG: If disabled, only the most recent FVG & IFVG will be displayed.

FVG & IFVG Validity Period (Bar): Determines the maximum duration (in number of candles) that the FVG and IFVG remain valid.

Switching Colors Theme Mode: Includes three modes: "Off", "Light", and "Dark". "Light" mode adjusts colors for light mode use, "Dark" mode adjusts colors for dark mode use, and "Off" disables color adjustments.

🟣Display Settings

Show Bullish BPR: Toggles the display of demand-related boxes.

Show Bearish BPR: Toggles the display of supply-related boxes.

Mitigation Level BPR: Options include "Proximal", "Distal", or "50 % OB" modes, which you can choose based on your needs. The "50 % OB" line is the midpoint between distal and proximal.

Show Bullish IFVG: Toggles the display of demand-related boxes.

Show Bearish IFVG: Toggles the display of supply-related boxes.

Mitigation Level FVG and IFVG: Options include "Proximal", "Distal", or "50 % OB" modes, which you can choose based on your needs. The "50 % OB" line is the midpoint between distal and proximal.

🟣Logic Settings

FVG Filter: This refines the number of identified FVG areas based on a specified algorithm to focus on higher quality signals and reduce noise.

Types of FVG filters:

- Very Aggressive Filter: Adds a condition where, for an upward FVG, the last candle's highest price must exceed the middle candle's highest price, and for a downward FVG, the last candle's lowest price must be lower than the middle candle's lowest price. This minimally filters out FVGs.

- Aggressive Filter: Builds on the Very Aggressive mode by ensuring the middle candle is not too small, filtering out more FVGs.

- Defensive Filter: Adds criteria regarding the size and structure of the middle candle, requiring it to have a substantial body and specific polarity conditions, filtering out a significant number of FVGs.

- Very Defensive Filter: Further refines filtering by ensuring the first and third candles are not small-bodied doji candles, retaining only the highest quality signals.

🟣Alert Settings

Alert Inversion FVG Mitigation: Enables alerts for Inversion FVG mitigation.

Message Frequency: Determines the frequency of alerts. Options include 'All' (every function call), 'Once Per Bar' (first call within the bar), and 'Once Per Bar Close' (final script execution of the real-time bar). Default is 'Once per Bar'.

Show Alert Time by Time Zone: Configures the time zone for alert messages. Default is 'UTC'.

Display More Info: Provides additional details in alert messages, including price range, date, hour, and minute. Set to 'Off' to exclude this information.

🔵Conclusion

The ICT Balanced Price Range is a powerful and reliable tool for identifying key points on price charts. This strategy can be applied across various time frames and serves as a complementary tool alongside other indicators and technical analysis methods.

The most crucial aspect of utilizing this strategy effectively is correctly identifying FVGs and their overlapping areas, which comes with practice and experience.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.