OPEN-SOURCE SCRIPT

IV/HV ratio 1.0 [dime]

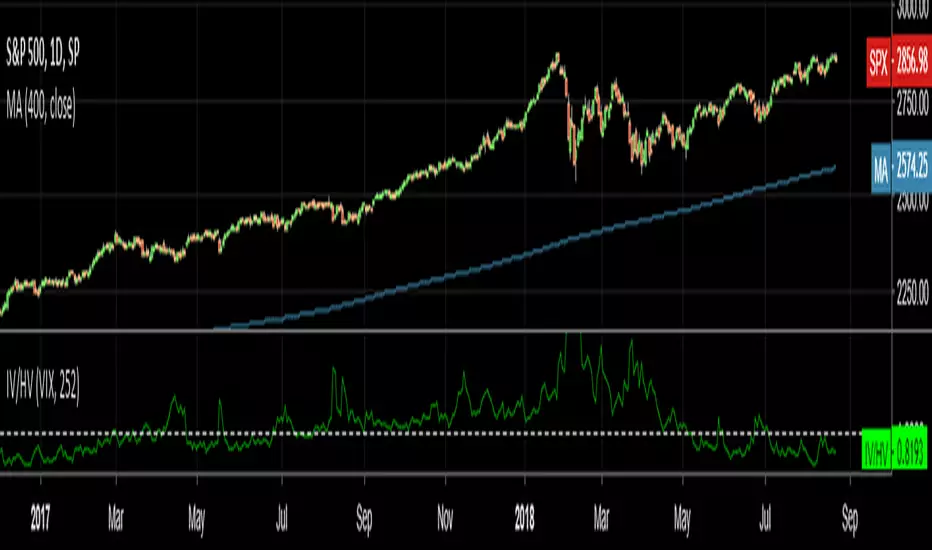

This script compares the implied volatility to the historic volatility as a ratio.

The plot indicates how high the current implied volatility for the next 30 days is relative to the actual volatility realized over the set period. This is most useful for options traders as it may show when the premiums paid on options are over valued relative to the historic risk.

The default is set to one year (252 bars) however any number of bars can be set for the lookback period for HV.

The default is set to VIX for the IV on SPX or SPY but other CBOE implied volatility indexes may be used. For /CL you have OVX/HV and for /GC you have GVX/HV.

Note that the CBOE data for these indexes may be delayed and updated EOD

and may not be suitable for intraday information. (Future versions of this script may be developed to provide a realtime intraday study. )

There is a list of many volatility indexes from CBOE listed at:

cboe.com/micro/volatility/introduction.aspx

(Some may not yet be available on Tradingview)

RVX Russell 2000

VXN NASDAQ

VXO S&P 100

VXD DJIA

GVX Gold

OVX OIL

VIX3M 3-Month

VIX6M S&P 500 6-Month

VIX1Y 1-Year

VXEFA Cboe EFA ETF

VXEEM Cboe Emerging Markets ETF

VXFXI Cboe China ETF

VXEWZ Cboe Brazil ETF

VXSLV Cboe Silver ETF

VXGDX Cboe Gold Miners ETF

VXXLE Cboe Energy Sector ETF

EUVIX FX Euro

JYVIX FX Yen

BPVIX FX British Pound

EVZ Cboe EuroCurrency ETF Volatility Index

Amazon VXAZN

Apple VXAPL

Goldman Sachs VXGS

Google VXGOG

IBM VXIBM

The plot indicates how high the current implied volatility for the next 30 days is relative to the actual volatility realized over the set period. This is most useful for options traders as it may show when the premiums paid on options are over valued relative to the historic risk.

The default is set to one year (252 bars) however any number of bars can be set for the lookback period for HV.

The default is set to VIX for the IV on SPX or SPY but other CBOE implied volatility indexes may be used. For /CL you have OVX/HV and for /GC you have GVX/HV.

Note that the CBOE data for these indexes may be delayed and updated EOD

and may not be suitable for intraday information. (Future versions of this script may be developed to provide a realtime intraday study. )

There is a list of many volatility indexes from CBOE listed at:

cboe.com/micro/volatility/introduction.aspx

(Some may not yet be available on Tradingview)

RVX Russell 2000

VXN NASDAQ

VXO S&P 100

VXD DJIA

GVX Gold

OVX OIL

VIX3M 3-Month

VIX6M S&P 500 6-Month

VIX1Y 1-Year

VXEFA Cboe EFA ETF

VXEEM Cboe Emerging Markets ETF

VXFXI Cboe China ETF

VXEWZ Cboe Brazil ETF

VXSLV Cboe Silver ETF

VXGDX Cboe Gold Miners ETF

VXXLE Cboe Energy Sector ETF

EUVIX FX Euro

JYVIX FX Yen

BPVIX FX British Pound

EVZ Cboe EuroCurrency ETF Volatility Index

Amazon VXAZN

Apple VXAPL

Goldman Sachs VXGS

Google VXGOG

IBM VXIBM

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.