OPEN-SOURCE SCRIPT

Buy Sell Calendar [LuxAlgo]

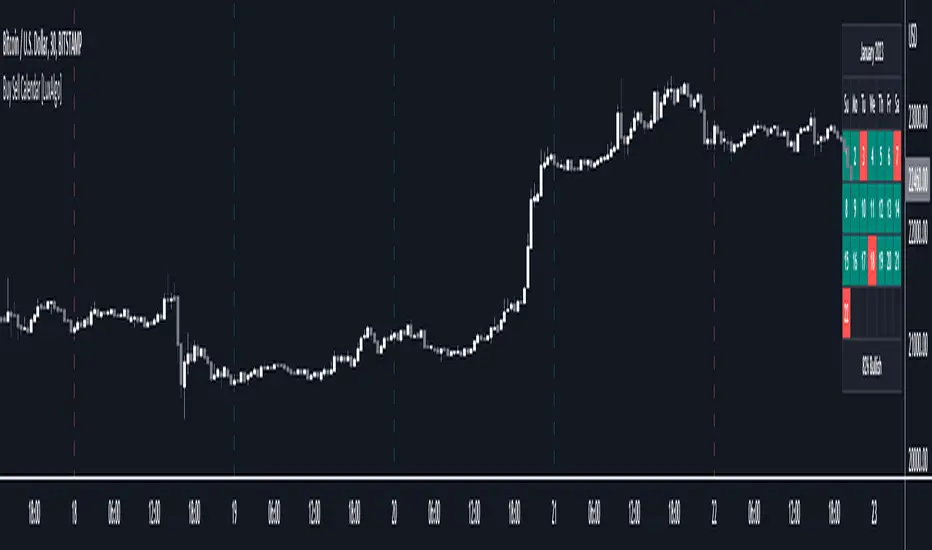

The Buy Sell Calendar indicator displays a calendar showing the sentiment for the current day/month. Three different methods can be used to determine this sentiment.

The calendar can also highlight the percentage of bullish days/months for a month/year.

🔶 SETTINGS

🔹 Calendar

🔶 USAGE

The proposed script can allow users to quickly determine if a specific day/month is considered bullish or bearish. A green cell is used for bullish days/months, while a red one is used for bearish days/months.

Additionally vertical lines are displayed on new days/months with a color highlighting the current sentiment for this specific day/month. Note that this is done retrospectively, the color of a line set at time t might differ at time t+n.

🔶 SENTIMENT METHODS

Determining whether a day/month is bullish or bearish can be done using three different methods. Note that each method makes use of the closing price as the input, and as such can eventually return different results depending on the selected timeframe. Each method is described below:

🔹 Linreg

The Linreg method fit lines between each day/month using the method of least squares and determines if that particular day is bullish or bearish based on the line slope sign. For example, a rising line would indicate a bullish day/month.

🔹 Accumulated Deltas

The method of accumulated deltas simply accumulates bullish and bearish price changes for the current day/month, the result with the highest magnitude determines the sentiment for that day/month.

🔹 Max/Min

The max/min method computes a trailing maximum and a trailing minimum for the current day/month. The sentiment is determined by the price position relative to the average between the obtained maximum/minimum, with a bullish sentiment being determined if price is above the average.

The calendar can also highlight the percentage of bullish days/months for a month/year.

🔶 SETTINGS

- Frequency: Calendar frequency, options include "Daily" and "Monthly"

- Sentiment Method: Method used to determine the sentiment for the day/month, options include: "Linreg", "Accumulated Deltas", and "Max/Min"

- Timezone Offset: UTC time zone offset.

- Limit Date: Limit date used by the calendar, the sentiment of days/months outside this limit will not be returned.

🔹 Calendar

- Show Calendar: Determines whether to display or hide the calendar.

- Location: Location of the calendar on the chart.

- Size: Calendar size.

🔶 USAGE

The proposed script can allow users to quickly determine if a specific day/month is considered bullish or bearish. A green cell is used for bullish days/months, while a red one is used for bearish days/months.

Additionally vertical lines are displayed on new days/months with a color highlighting the current sentiment for this specific day/month. Note that this is done retrospectively, the color of a line set at time t might differ at time t+n.

🔶 SENTIMENT METHODS

Determining whether a day/month is bullish or bearish can be done using three different methods. Note that each method makes use of the closing price as the input, and as such can eventually return different results depending on the selected timeframe. Each method is described below:

🔹 Linreg

The Linreg method fit lines between each day/month using the method of least squares and determines if that particular day is bullish or bearish based on the line slope sign. For example, a rising line would indicate a bullish day/month.

🔹 Accumulated Deltas

The method of accumulated deltas simply accumulates bullish and bearish price changes for the current day/month, the result with the highest magnitude determines the sentiment for that day/month.

🔹 Max/Min

The max/min method computes a trailing maximum and a trailing minimum for the current day/month. The sentiment is determined by the price position relative to the average between the obtained maximum/minimum, with a bullish sentiment being determined if price is above the average.

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Get access to our exclusive tools: luxalgo.com

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Join our 150k+ community: discord.gg/lux

All content provided by LuxAlgo is for informational & educational purposes only. Past performance does not guarantee future results.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.