OPEN-SOURCE SCRIPT

Volume Weighted Average Range Bands [DW]

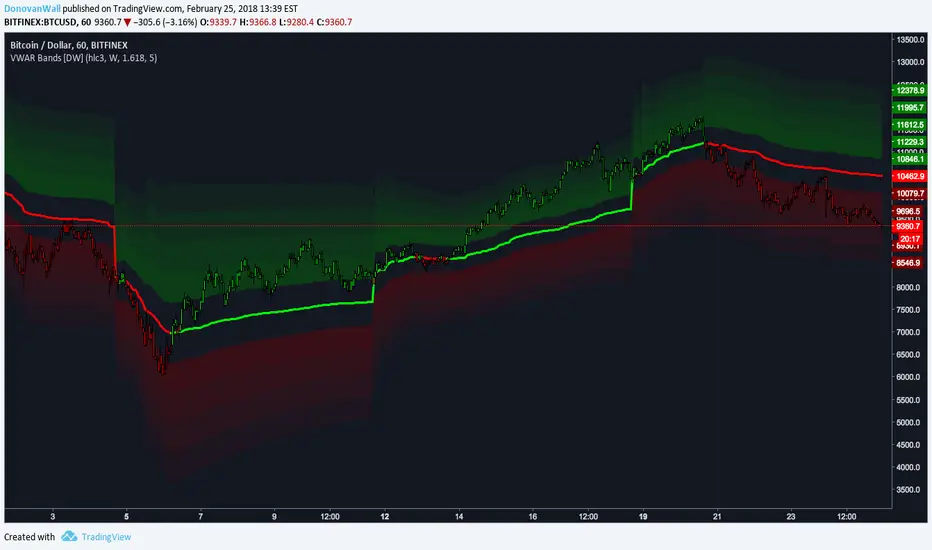

This is an experimental study designed to identify the underlying trend bias and volatility of an instrument over any custom interval TradingView supports.

First, reset points are established at points where the opening price of the interval changes.

Next, Volume Weighted Average Price (VWAP) is calculated. It is the cumulative sum of typical price times volume divided by the cumulative volume. The cumulation starts over upon each reset point.

After that, Volume Weighted Average Range (VWAR) is calculated. The formula structure is the same as VWAP, except using range rather than typical price.

Lastly, the bands are calculated by multiplying the VWAR by the specified multiplier (approximate Golden Ratio by default) and by 1 through 5, then adding to and subtracting from the VWAP.

Custom Bar Colors are included.

First, reset points are established at points where the opening price of the interval changes.

Next, Volume Weighted Average Price (VWAP) is calculated. It is the cumulative sum of typical price times volume divided by the cumulative volume. The cumulation starts over upon each reset point.

After that, Volume Weighted Average Range (VWAR) is calculated. The formula structure is the same as VWAP, except using range rather than typical price.

Lastly, the bands are calculated by multiplying the VWAR by the specified multiplier (approximate Golden Ratio by default) and by 1 through 5, then adding to and subtracting from the VWAP.

Custom Bar Colors are included.

For my full list of premium tools, check the blog:

wallanalytics.com/

Reach out on Telegram:

t.me/DonovanWall

wallanalytics.com/

Reach out on Telegram:

t.me/DonovanWall

Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.