Modern Portfolio Theory

Updated

Modern Portfolio Theory

The indicator is designed to apply the principles of Modern Portfolio Theory, a financial theory developed by Harry Markowitz. MPT aims to maximize portfolio returns for a given level of risk by diversifying investments.

User Inputs:

Users can customize various parameters, including the bar scale, risk-free rate, and the start year for the portfolio. Additionally, users can assign weights to different assets (symbols) in the portfolio.

Asset Selection:

Users can choose up to 10 different symbols (assets) for the portfolio. The script supports a variety of symbols, including cryptocurrencies such as BTCUSD and ETHUSD.

Weights and Allocation:

Users can assign weights to each selected asset, determining its percentage allocation in the portfolio. The script calculates the total portfolio weight to ensure it equals 100%. If total portfolio weight is lower then 100% you will see orange color with additional cash % bellow

If total portfolio weight is bigger then 100% you will see red big % warning.

Warning: (Total Weight must be 100%)

Cash Mode:

Risk and Return Calculation:

The script calculates the daily returns and standard deviation for each selected asset. These metrics are essential for assessing the risk and return of each asset, as well as the overall portfolio.

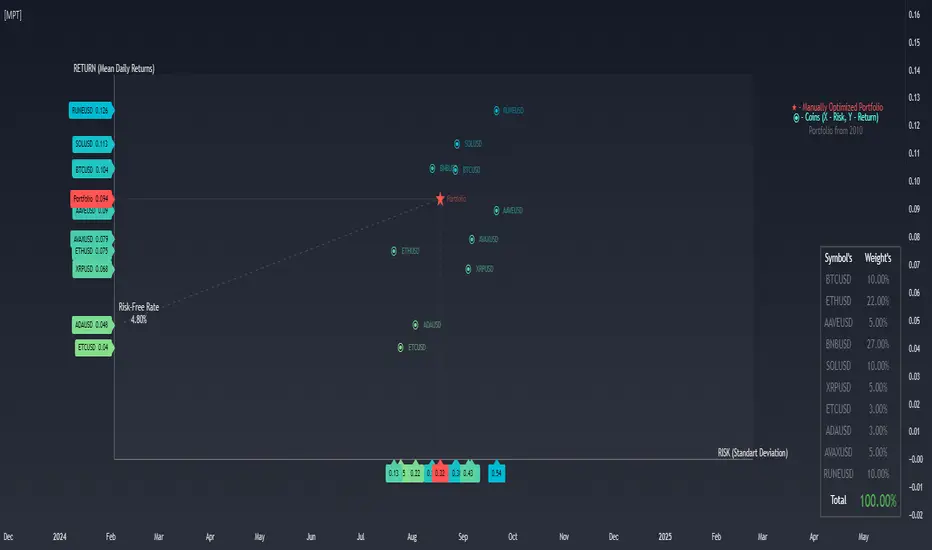

Scatter Plot Visualization:

The indicator includes a scatter plot that visualizes the risk-return profile of each asset. Each point on the plot represents an asset, and its position is determined by its risk (X-axis) and return (Y-axis).

Portfolio Optimization:

The script calculates the risk and return of the overall portfolio based on the selected assets and their weights. Based on the selected assets and their weights user can create optimal portfolio with preferable risk and return.

It then plots the portfolio point on the scatter plot, indicating its risk-return profile.

Additional Information:

The indicator provides a table displaying information about each selected asset, including its symbol, weight, and total portfolio weight. The table also shows the total portfolio weight and, if applicable, the percentage allocated to cash.

Visualization and Legend:

The script includes visual elements such as a legend, capital allocation line (CAL), and labels for risk-free rate and key information. This enhances the overall understanding of the portfolio's risk and return characteristics.

User Guidance:

The script provides informative labels and comments to guide users through the interpretation of the scatter plot, risk-return axes, and other key elements.

Interactivity:

Users can interact with the indicator on the TradingView platform, exploring different asset combinations and weightings to observe the resulting changes in the portfolio's risk and return.

In summary, this Pine Script serves as a comprehensive tool for traders and investors interested in applying Modern Portfolio Theory principles to optimize their portfolio allocations based on individual asset characteristics, risk preferences, and return

The indicator is designed to apply the principles of Modern Portfolio Theory, a financial theory developed by Harry Markowitz. MPT aims to maximize portfolio returns for a given level of risk by diversifying investments.

User Inputs:

Users can customize various parameters, including the bar scale, risk-free rate, and the start year for the portfolio. Additionally, users can assign weights to different assets (symbols) in the portfolio.

Asset Selection:

Users can choose up to 10 different symbols (assets) for the portfolio. The script supports a variety of symbols, including cryptocurrencies such as BTCUSD and ETHUSD.

Weights and Allocation:

Users can assign weights to each selected asset, determining its percentage allocation in the portfolio. The script calculates the total portfolio weight to ensure it equals 100%. If total portfolio weight is lower then 100% you will see orange color with additional cash % bellow

If total portfolio weight is bigger then 100% you will see red big % warning.

Warning: (Total Weight must be 100%)

Cash Mode:

Risk and Return Calculation:

The script calculates the daily returns and standard deviation for each selected asset. These metrics are essential for assessing the risk and return of each asset, as well as the overall portfolio.

Scatter Plot Visualization:

The indicator includes a scatter plot that visualizes the risk-return profile of each asset. Each point on the plot represents an asset, and its position is determined by its risk (X-axis) and return (Y-axis).

Portfolio Optimization:

The script calculates the risk and return of the overall portfolio based on the selected assets and their weights. Based on the selected assets and their weights user can create optimal portfolio with preferable risk and return.

It then plots the portfolio point on the scatter plot, indicating its risk-return profile.

Additional Information:

The indicator provides a table displaying information about each selected asset, including its symbol, weight, and total portfolio weight. The table also shows the total portfolio weight and, if applicable, the percentage allocated to cash.

Visualization and Legend:

The script includes visual elements such as a legend, capital allocation line (CAL), and labels for risk-free rate and key information. This enhances the overall understanding of the portfolio's risk and return characteristics.

User Guidance:

The script provides informative labels and comments to guide users through the interpretation of the scatter plot, risk-return axes, and other key elements.

Interactivity:

Users can interact with the indicator on the TradingView platform, exploring different asset combinations and weightings to observe the resulting changes in the portfolio's risk and return.

In summary, this Pine Script serves as a comprehensive tool for traders and investors interested in applying Modern Portfolio Theory principles to optimize their portfolio allocations based on individual asset characteristics, risk preferences, and return

Release Notes

Fixed: risk labelsRelease Notes

-Release Notes

-Open-source script

In true TradingView spirit, the author of this script has published it open-source, so traders can understand and verify it. Cheers to the author! You may use it for free, but reuse of this code in publication is governed by House rules. You can favorite it to use it on a chart.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.