INVITE-ONLY SCRIPT

QaSH DCA Daytrader

Updated

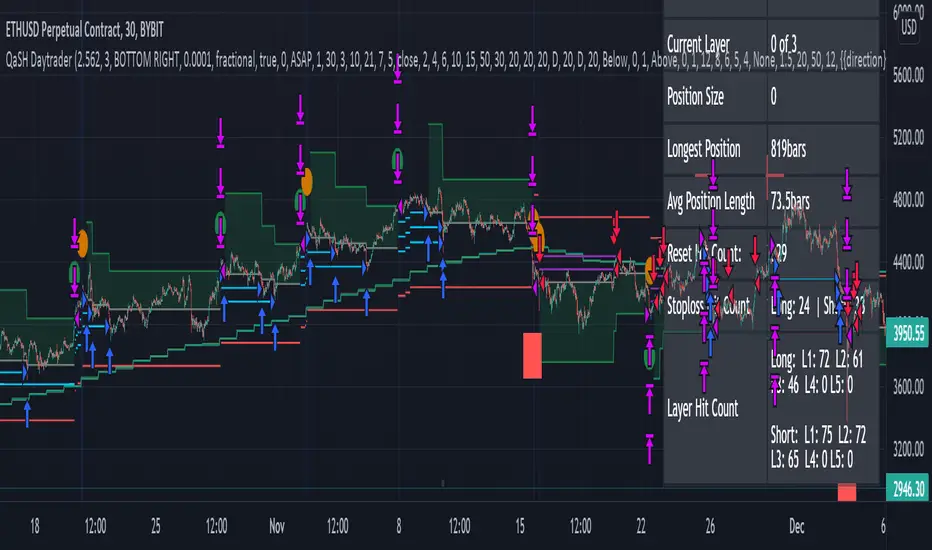

This script takes advantage of the power of DCA implemented in the QaSH DCA Algorithm script, and it applies it to new entry conditions. A "Quickfingers Luc" mode has been added, which creates new entry orders whenever a level of support has been identified. If price breaks the support level and quickly drops down, the orders will already be in place to catch the dip. This method can even catch the 1-second long, 50% flash dips that occur in some exchanges.

Settings advice:

- If you think price is inflated, try conservative settings that either use a stoploss and EMA filter, or no stoploss but have some of your orders placed far below the current price with increasing volume. In a bear market this will beat the buy and hold.

- If you think the market is ready for a new bull run, then try experimenting with very aggressive settings to beat the buy and hold. For example: ASAP mode with 3 layers turned on. Orders placed at 0.5%, 3%, and 5%. Volumes at 30%, 30%, and 40% respectively. No stoploss. These settings were tested on ETH and beat the buy and hold during an extreme bull market period.

- Four entry conditions are included in this initial release : ASAP, Quickfingers Luc, Bullish Pivot point, and Bearish Pivot point

- All order placements are customizable

- All take profit % values are based on the average entry price

- Take profit % values can change based on how big the price dip was

- Entry condition filter has been added and it uses a variable timeframe EMA

- Stoploss function is available

- Order size can be sent in the alerts, which allows for multiple setups to be running simultaneously in one account

- All alerts are sent using the new "Any alert() function call" feature, which means this indicator will only take up one alert slot to cover all entry and exit alerts

Settings advice:

- If you think price is inflated, try conservative settings that either use a stoploss and EMA filter, or no stoploss but have some of your orders placed far below the current price with increasing volume. In a bear market this will beat the buy and hold.

- If you think the market is ready for a new bull run, then try experimenting with very aggressive settings to beat the buy and hold. For example: ASAP mode with 3 layers turned on. Orders placed at 0.5%, 3%, and 5%. Volumes at 30%, 30%, and 40% respectively. No stoploss. These settings were tested on ETH and beat the buy and hold during an extreme bull market period.

Release Notes

updated tooltips and default valuesRelease Notes

disable ATR plot by defaultRelease Notes

-fixed asap mode not resetting when it shouldRelease Notes

added new placeholdersupdated tooltips to document the placeholders

Release Notes

Fixed an issue with layers hitting when they shouldn'tRelease Notes

prevented ema cross from resetting the layers if you're already in a tradeRelease Notes

some logic fixes / improvementsRelease Notes

fixed default input text to utilize new placeholderRelease Notes

fixed an error that arose from the last updateRelease Notes

stoploss to use the open as reference instead of previous closeRelease Notes

prevented live data streams from causing some actions to happen multiple times in the same barRelease Notes

improved the backtest accuracyRelease Notes

improved backtest accuracysimplified ruleset for simulated orders

Release Notes

This update completes the functional additions I plan to add to this script. **SHORT POSITIONS ARE NOW POSSIBLE**

* with this addition, you can now switch to a short position during large market swings (if using a stoploss)

-Long and Short trades operate on two independent, configurabele, multiple timeframe EMA's

-fixed ATR-based TP% updating a bar late

-fixed {{filled_size}} placeholder changing to zero right before sending a "take profit" or "stoploss" alert

-added new warning popups

-added checkbox to disable warning popups

-added several placeholders such as {{LX_size_USD}} which returns the trade size in USD, useful for inverse perpetuals

Release Notes

fixed TP placeholder not updating before sending a layer alert when shortRelease Notes

-changed the "bot start" logic for "ASAP" mode. Now, if you pause your alert and then start it again, it will go ahead and start running the first trade. Before, you would have had to change your start time and recreate the alert to get it running again-fixed a hidden plot that was forcing the chart to zoom out

Release Notes

fixed the bounce % input for quickfingers luc entriesRelease Notes

After discussions with the Pinescript staff, I decided to remove many references to "barstate.isrealtime" to better align backtest and live trade code.Instead, I've added a "kill switch" that can disable your running alert whenever its execution is interrupted due to server maintenance

- improved the aesthetics of the data table

- fixed "breakeven price" displaying 0 when in a short position

Release Notes

moved "kill switch" checkboxchanged chart picture

Release Notes

added an input for "tick overshoot" requirement to consider limit orders filledchanged "killswitch" error message for clarity

Release Notes

added condition that orders must be placed when the bar closes.added condition that limit orders cannot be considered filled on the same bar as when the orders were placed.

Release Notes

minor edit to how price gaps are handled with simulated ordersRelease Notes

fixed a bug that sometimes appeared on higher time framesInvite-only script

Access to this script is restricted to users authorized by the author and usually requires payment. You can add it to your favorites, but you will only be able to use it after requesting permission and obtaining it from its author. Contact ParabolicValue for more information, or follow the author's instructions below.

Please note that this is a private, invite-only script that was not analyzed by script moderators. Its compliance to House Rules is undetermined. TradingView does not suggest paying for a script and using it unless you 100% trust its author and understand how the script works. In many cases, you can find a good open-source alternative for free in our Community Scripts.

Author's instructions

″For indicator access:

Patreon: https://www.patreon.com/QaSH

For questions and support:

Discord: https://discord.gg/kahPkedYpD

Want to use this script on a chart?

Warning: please read before requesting access.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.