MTF Smoothed Moving Averages x4A set of smoothed moving averages that stay at a fixed timeframe, regardless of the timeframe of the chart but don't have nasty jaggedy lines. Instead, they are smooooooooooooth...

Multipletimeframe

[BA] Multi Time Frame Moving Averages for BTCThis is a multi time frame moving average script. It includes 7 moving averages. Most of them are SMAs and WMAs but EMA were also used. Time frame was set to 1 day. It means that you can change the time frame of your chart freely without losing your lines. Levels will not change.

I wrote this script just to trade BTC. I prefer daily and weekly charts with this script but lower time frames are also preferable.

Since some of the lengths are too high; older exchanges are recommended due to their relatively deep historical data.

While MA1 is for taking actions like 'take profit' or 'stop loss' or just to follow 'price action' easily, other MAs are for seeing supports and resistances.

MA6 and MA7 are disabled by default in order to minimize the confusion but you can enable them from settings if you need to.

Since some newer exchanges have less historical data, you may not see MA4 and MA5 on the daily chart. In such circumstances MA6 and MA7 might be helpful to use as substitution. Some may like to use all of them.

I am using this script just for BTC but it can be useful for other coins as well.

Adedeji_Oracle_v1.0This indicator was designed to give an easy overview of trends based on Multiple Time-frame Analysis.

It gives a holistic overview of several time-frames all at the same time regardless of the TF being viewed. It works for majority of the most commonly used time-frames (15m, 30m, 45m, 1H, 2H, 3H, 4H, 6H, 12H, 18H, 1D, 2D, 3D and 1W).

Tool is best used in conjunction with my other scripts:

1. Cynotronic Divergence tool () or any other reliable momentum indicator

2. Adedeji_Edge_v1.1

How to use:

Simply add the indicator to your chart, keep an eye on the color flips of the various layers from top to bottom sequence (from red to blue, or blue to red).

1. Fully engulfed layers colored in blue indicate bullish trend is underway at the chosen time-frame.

2. If the prevailing color is red this is indicative that the overall trend is a bearish one.

3. When there is a mix of red and blue, the dominant trend is determined by the color that dominates the lowest levels of the indicator.

It's advised to keep a keen eye on demand and supply zones (draw relevant Support, Resistance as well as dynamic trendl-lines on the charts) as targets and take profit zones. The suggested complimentary divergence tool gives reliable indication of areas where there is strength or weakness.

This tool works pretty well with all trading pairs, all exchanges and in all markets.

Development/improvement is a continuous thing!

Disclaimer:

Past performance does not guarantee future results. This tool/indicator is for educational purposes. As always you should fully understand there are high risks involved when trading cryptocurrencies and other digital instruments.

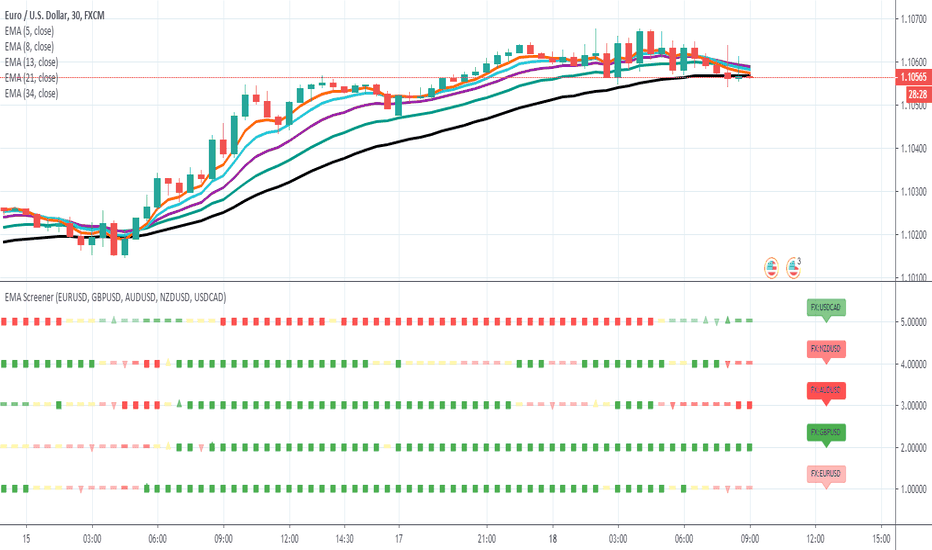

Ultimate EMA ScreenerHello traders

Very busy preparing a few stuff for Black Friday but wanted to remind that I still know Pinescript and how to step up my game :)

My master @RicardoSantos once again showed me how to push the pinescript limits one step/dimension further. Kudo also to my client (Judy) for this amazing idea.

I inspired myself from his script () to display multiple assets in the same panel - without breaking the chart scaling.

In that case, I'm comparing 5 EMAs relatively to each other and display:

- a square if they're stacked properly

- a triangle if two of them are stacked properly

- a dash otherwise

For those interested, the conditions are in the f_securitys function.

I posted in the past a few screeners using labels but we're limited to 50 labels per script. There isn't such limitation when using the plotshape function - giving us more complete screeners. #uhuuuu

I'll post a few more examples this week with different trading strategies/combinations. The possibilities here are (close to) limitless.

I'm using the security built-in function to call external assets (here different forex pairs) and we're limited to 40 security calls per script.

But nothing preventing us from duplicating the same script a few times and calling different assets each time :) If you'd like to display 10 forex pairs, you only need to add that script on your chart twice and select 5 pairs for the first panel, 5 other pairs for the second panel.

You're welcome <3

All the BEST

Dave

Adedeji_Edge_v1.0This tool was developed to capture good entries for long and short positions. It utilizes moving averages to find best times to executive trades (long or short) and it overlays same on the chart thus minimizing chart noise i.e. no need for indicators. New traders can use this without any hassle or confusion.

In addition to the long (buy or strong buy) and short (sell or strong sell) overlays, the tool also indicates, with the background colour, areas and periods of potential upside or downside movements.

1. Blue background shows areas most conducive for potentially sustained upside price action;

2. Red background shows areas most conducive for potentially sustained downside price action.

Back-testing:

Results show that the indicator is more profitable than “Buy and Hold” (aka hodl). The back-test period was from the beginning of BTC bear market (17th December 2017) to date (10th Nov. 2019). 10% equity on $1,000 was applied to all back-test trades. Using 100% equity gives even better results.

Control conditions:

- Start date: 17th Dec 2016 (BTC ATH)

- Buy and Hold ROE: about 51% loss

Strategy script condition 1:

- Start date: Same as control date

- TF 4H

- Initial Capital $1,000

- Order size: 10% of equity

- ROE: approx. 131%

Strategy script condition 2:

- Start date: Same as control date

- TF 4H

- Initial Capital $1,000

- Order size 100% of equity

- ROE: approx. 67,000%

How to use:

Simply add the indicator to your chart, WAIT FOR CANDLE with the signal (buy or sell) to CLOSE before you go long or short .

Please note that this version 1.0 is suitable for ONLY 4H and 6H timeframes. Subsequent version(s) will include more TFs.

This tool can be used in isolation, however using it in conjunction with

1. A Moving Average (preferably the 32 EMA) gives users more information about ongoing price-action.

2. Applying trendlines (horizontal and/or dynamic support and resistance) give users better overview of the space and where sudden price bursts or reversals may occur.

Possible scenarios:

a. Buy signals (buy or strong buy) above the EMA is very bullish;

b. Sell signals (sell or strong sell) below the EMA is extremely bearish.

Variant conditions that do not confirm to the above two conditions may occur.

This tool was developed SPECIFICALLY for XBTUSD pair on Bitmex. It may be used for other trading pairs and exchanges although primary back-testing was not extended to other pairs or exchanges.

Development/improvement is a continuous thing!

Disclaimer:

Past performance does not guarantee future results. This tool/indicator is for educational purposes. As always you should fully understand there are high risks involved when trading cryptocurrencies and other digital instruments.

Multiple Time Frame: RSI - Stochastic - Stochastic RSIDeveloped per request.

An RSI, Stochastic, and Stochastic RSI oscillator all in one.

Use the drop down selection to choose which of the 3 indicators to view. Each indicator has the option to show 3 time frames. Time frames are entered in minutes, for example, to view the 1 hour, 4 hour, and 6 hour, enter 60, 240, and 360 in the respective option windows. Currently, the indicator has the Daily as a max resolution (1440 minutes). This might be changed in a future update.

The oscillator has been centered, as opposed to the normal 0-100. There are overbought and oversold boundaries defaulted at 40 and -40, respectively. When any of the 3 main indicators cross one of these boundaries, either a green or red signal is displayed. This can be turned off in the options.

A "Total Line" and "Average Line" can be toggled on/off in the options. The "Total Line" is a simple summation of each of 3 main indicator lines. The "Average Line" is the average of the 3 main indicator lines. If you wish to only view one or both of these lines, the main 3 indicator lines can be turned off in the "Style" section of the options. The "Average" and "Total" lines do not highlight if they cross the upper and lower boundaries.

Supertrend Multi Time Frame (No Repaint)This is non repaiting Supertrend Multi Time Frame script.

There is an option for Higher Tİme Frame Period. if you choose "Auto" then Higher Time Frame calculation would be made by script. Or you can choose "User Defined" and then you must choose the period for Higher Time Frame.

You better use this script with some indicators, RSI , Momentum etc.

_ LonesomeTheBlue _

9 Seasons Rainbow Indicator EXPERT [GO8686]A stable release of EXPERT version.

"Expert" is a release with features between Standard and PRO version, with initial features:

9 Ribbons, 4 Alerts Set, Time frame >= 15m, which may change later.

The indicator discovers profitable patterns by associating Price Season of multiple time frames.

Full Name: 9 Seasons Rainbow - Multiple Time Frames Associated Price Wave Pattern Indicator

This is redefined from “9 Seasons Rainbow Indicator PRO”, with clearer definition of 9 Seasons and user manual.

Version: Invite-Only Expert

Language: English

Copyright: 2019

---------- How to use the indicator ----------

Go through the manual and related ideas underneath or follow the tutorials list. Look through the profitable patterns and related cases, wait for or set alert for specific profitable pattern.

---------- Definition: 9 Seasons ----------

A life cycle of Price Wave is divided into 9 Seasons. Each time frame, from 5 minute to 1 month, has 9 seasons, Independent of each other:

Bull (Green)

Bull Pullback (Light Green): a pullback or retracement

Resistance / Overbought (Yellow): a resistance area , may become a Top, or be broken through.

Crazy Bought (Lime): Price is going up in a high volatility , could be a valid breakout, or a Bull Trap.

Neutral (White): a wandering season without direction, evolves into Bull or Bear

Bear (Red)

Bear Bounce (Light Red): Price bounces

Support / Oversold (Blue): a support area , may become a Bottom, or be broken through.

Crazy Sold (Fuchsia): Price is going down in a high volatility , could be a valid breakdown, or a Bear Trap.

---------- Some important evolution between seasons ----------

Resistance / Overbought (Yellow) -> Crazy Bought (Lime):

Bull is breaking through a resistance.

Crazy Bought (Lime) -> Resistance / Overbought (Yellow):

This normally indicates a failed breakout, Price goes back to the resistance.

Crazy Bought (Lime) -> Bull Pullback (Light Green):

This normally indicates Price has risen to a new level

Support / Oversold (Blue) -> Crazy Sold (Fuchsia):

Bear is breaking through a support.

Crazy Sold (Fuchsia) -> Support / Oversold (Blue):

This normally indicates a failed breakdown, Price recovers to the support.

Crazy Sold (Fuchsia) -> Bear Bounce (Light Red):

This normally indicates price has dropped to a new level

---------- Rainbow Ribbons for Multiple Time Frames ----------

Each ribbon of a rainbow represents a time frame.

The uppermost ribbon represents the shortest-term time frame - current time period of the chart, which is the time frame for trading.

The lowermost ribbon represent longest-term time frame, which work as environment, together with the other medium-term and long-term time frames.

The difference between two frames is 1.4142 fold (square root of 2), if level 1 is 15 minute, level 2 is 15 minute * (square root of 2) .

Examples of time frames in a rainbow:

For STANDARD in 15M: 15M - 21M - 30M - 42M - 60M(1H) - 85M

For EXPERT: 15M - 21M - 30M - 42M - 60M(1H) - 85M - 120M(2H) - 170M - 240M(4H)

For PRO in 15M: 15M - 21M - 30M - 42M - 60M(1H) - 85M - 120M(2H) - 170M - 240M(4H) - 339M - 480M(8H) - 679M

---------- Trading Methods ----------

How to open a Long position?

When a profitable Long pattern appears, open small position first based on signal on shortest-term time frame; after retesting and confirming the support, open 2nd position; when it breaks through the resistance, pullbacks and confirms the breakout, open 3rd position.

How to exit a Long position?

Lift the Stop to a confirmed higher low, so that to take advantages of the bull run as possible.

How to open a Short position?

When a profitable Short pattern appears, open small position first based on signal on shortest-term time frame; after retesting and confirming the resistance, open 2nd position; when it breaks through the support, bounces and confirms the breakdown, add 3rd position.

How to exit a Short position?

Lower the Stop to a confirmed lower high, so that to take advantages of the bear run as possible.

---------- Access to Indicators ----------

Please use DEMO version for Trial

PM the author for access to Invite-Only PRO, EXPERT and STANDARD versions:

---------- How to Install Invite Only: STANDARD, EXPERT & PRO Version----------

Ask access to STANDARD, EXPERT or PRO version

Open the chart -> Indicators (On the Top) -> Invite-Only Scripts (2nd button of the left bar)

Like/Favorite the indicator

Click to install on the chart

---------- About Loading Time ----------

It may take up to 2 minutes for your browser to load a new setting, depending on the your computer and network speed.

---------- List of the author's Indicators ----------

www.tradingview.com

---------- Disclaimer ----------

By using or requesting access to the indicator, you acknowledge that you have read and accepted that the indicator and any related content, including but not limited to: product details, user manual, tutorials, ideas, videos, chats, emails, blog, talks are for the purpose of trading strategies studying and paper trading only.

If a customer or user uses the indicator or related content mentioned above for live trading or investment, she/he should take all risks and be responsible for her/his own trading and investment activities.

---------- Updates ----------

The latest updates override the previous description.

To activate a update: Close the browser, Reopen the chart and apply the indicator.

The features may change later.

---------- Tags ----------

MTF, multiple timeframes, multiple time frames, multi timeframes, multi time frames

9 Seasons Rainbow Multi Time Frames Pattern Expert [9SRPEN]"Expert" is a release with features between Standard and PRO version, with initial features:

9 Ribbons, 4 Alerts Set, Time frame >= 15m, which may change later.

The indicator discovers profitable patterns by associating Price Season of multiple time frames.

Full Name: 9 Seasons Rainbow - Multiple Time Frames Associated Price Wave Pattern Indicator

This is redefined from “9 Seasons Rainbow Indicator PRO”, with clearer definition of 9 Seasons and user manual.

Version: Invite-Only Expert

Language: English

Copyright: 2019

---------- How to use the indicator ----------

Go through the manual and related ideas underneath or follow the tutorials list. Look through the profitable patterns and related cases, wait for or set alert for specific profitable pattern.

---------- Definition: 9 Seasons ----------

A life cycle of Price Wave is divided into 9 Seasons. Each time frame, from 5 minute to 1 month, has 9 seasons, Independent of each other:

Bull (Green)

Bull Pullback (Light Green): a pullback or retracement

Resistance / Overbought (Yellow): a resistance area , may become a Top, or be broken through.

Crazy Bought (Lime): Price is going up in a high volatility , could be a valid breakout, or a Bull Trap.

Neutral (White): a wandering season without direction, evolves into Bull or Bear

Bear (Red)

Bear Bounce (Light Red): Price bounces

Support / Oversold (Blue): a support area , may become a Bottom, or be broken through.

Crazy Sold (Fuchsia): Price is going down in a high volatility , could be a valid breakdown, or a Bear Trap.

---------- Some important evolution between seasons ----------

Resistance / Overbought (Yellow) -> Crazy Bought (Lime):

Bull is breaking through a resistance.

Crazy Bought (Lime) -> Resistance / Overbought (Yellow):

This normally indicates a failed breakout, Price goes back to the resistance.

Crazy Bought (Lime) -> Bull Pullback (Light Green):

This normally indicates Price has risen to a new level

Support / Oversold (Blue) -> Crazy Sold (Fuchsia):

Bear is breaking through a support.

Crazy Sold (Fuchsia) -> Support / Oversold (Blue):

This normally indicates a failed breakdown, Price recovers to the support.

Crazy Sold (Fuchsia) -> Bear Bounce (Light Red):

This normally indicates price has dropped to a new level

---------- Rainbow Ribbons for Multiple Time Frames ----------

Each ribbon of a rainbow represents a time frame.

The uppermost ribbon represents the shortest-term time frame - current time period of the chart, which is the time frame for trading.

The lowermost ribbon represent longest-term time frame, which work as environment, together with the other medium-term and long-term time frames.

The difference between two frames is 1.4142 fold (square root of 2), if level 1 is 15 minute, level 2 is 15 minute * (square root of 2) .

Examples of time frames in a rainbow:

For STANDARD in 15M: 15M - 21M - 30M - 42M - 60M(1H) - 85M

For EXPERT: 15M - 21M - 30M - 42M - 60M(1H) - 85M - 120M(2H) - 170M - 240M(4H)

For PRO in 15M: 15M - 21M - 30M - 42M - 60M(1H) - 85M - 120M(2H) - 170M - 240M(4H) - 339M - 480M(8H) - 679M

---------- Trading Methods ----------

How to open a Long position?

When a profitable Long pattern appears, open small position first based on signal on shortest-term time frame; after retesting and confirming the support, open 2nd position; when it breaks through the resistance, pullbacks and confirms the breakout, open 3rd position.

How to exit a Long position?

Lift the Stop to a confirmed higher low, so that to take advantages of the bull run as possible.

How to open a Short position?

When a profitable Short pattern appears, open small position first based on signal on shortest-term time frame; after retesting and confirming the resistance, open 2nd position; when it breaks through the support, bounces and confirms the breakdown, add 3rd position.

How to exit a Short position?

Lower the Stop to a confirmed lower high, so that to take advantages of the bear run as possible.

---------- Access to Indicators ----------

Please use DEMO version for Trial

PM the author for access to Invite-Only PRO, EXPERT and STANDARD versions:

---------- How to Install Invite Only: STANDARD, EXPERT & PRO Version----------

Ask access to STANDARD, EXPERT or PRO version

Open the chart -> Indicators (On the Top) -> Invite-Only Scripts (2nd button of the left bar)

Like/Favorite the indicator

Click to install on the chart

---------- About Loading Time ----------

It may take up to 2 minutes for your browser to load a new setting, depending on the your computer and network speed.

---------- List of the author's Indicators ----------

www.tradingview.com

---------- Disclaimer ----------

By using or requesting access to the indicator, you acknowledge that you have read and accepted that the indicator and any related content, including but not limited to: product details, user manual, tutorials, ideas, videos, chats, emails, blog, talks are for the purpose of trading strategies studying and paper trading only.

If a customer or user uses the indicator or related content mentioned above for live trading or investment, she/he should take all risks and be responsible for her/his own trading and investment activities.

---------- Updates ----------

The latest updates override the previous description.

To activate a update: Close the browser, Reopen the chart and apply the indicator.

---------- Tags ----------

multiple timeframes, MTF, multiple time frames, multi timeframes, multi time frames

Scott’s MTF SpaghettiIt may be useful to view higher time frame emas on the same chart. For example: view 4hour ema and daily 21ema

Scott’s MTF SpaghettiIt may be useful to observe emas on higher time frames: to see how 4 hour candles are reacting to daily emas, for example.

Scott's MTF: RSI with ema and stochasticMultiple time frame rsi and stoch may be useful for backtesting.... like... one won't have to switch between time frames when using candle replay mode.

MTF RSI [mushoku]Multi Time Frame RSI

異なる時間軸のRSIを同時に表示できるインジケーターです。

無料で使用できます。

こちらでも簡単ですが紹介しています。

note.mu

Multi-Time Frame MonitorThis script monitors the RSI on all timeframes; no matter what chart or timeframe you are viewing.

Currently it's setup with a basic Buy/Sell indicator based off of common rsi overbought and oversold levels.

You can choose to show all the data or only have the data show up when there is a buy/sell condition.

In the future, I will be adding more multitimeframe indicators to monitor. Suggestions and feedback are welcomed!

The All Seeing EyeThe All Seeing Eye is the Logarithmic Ultimate Oscillator (marked blue) interposed with a special Choppiness Index I call the "Trend Energy Index" (marked red) that has been averaged over multiple time frames. Key levels are set at the 50 center line, and then 1 and 2 standard deviations from the center line. This oscillator is intended for use in the standard stock market but can very likely be applied to the Forex market as well.

The 50 center line indicates the beginning or end of a trend based on the direction of the cross of the Ultimate Oscillator . Trend Strength is indicated by the position of the Trend Energy Index. Use this oscillator in the same way you would use the Ultimate Oscillator while considering the strength of the trend via the multiple Trend Energy Index. Entry and exit points are identified when the Trend Energy Index is in a trending state or spikes sharply downwards from an energy level near 61.8 and higher than 50. When the Trend Energy Index crosses above the 50 center line, it indicates the trend has ended. When it crosses below the 50 center line, it indicates a trend is beginning. Sharp changes in the direction of the Trend Energy Index at the 1 and 2 standard deviation key levels are usually accompanied by the same reaction from the Ultimate Oscillator indicating the trend may be entering a pullback or consolidation period. The Ultimate Oscillator will tell you the likely direction of the trend based on its slope between time intervals, as well as its position being above or below 50. Again, use the Ultimate Oscillator as you would RSI . Overbought and Oversold levels are indicated at the 2 standard deviation levels from the center line in relation to the Ultimate Oscillator . These levels are 27.2 for oversold and 72.8 for overbought.

The power of this oscillator comes from the reactivity of the Trend Energy Index in alerting you of trend strengthening or weakening of the predominant trend indicated by the Ultimate Oscillator . Pairing these two together produces great accuracy in Identifying reversals, exit points, and entry points. Additionally, the Ultimate Oscillator gives much less false divergence readings than standard RSI , and pairing with the ability of the Trend Energy Index to identify trend strength on any time frame allows great versatility while maintaining accuracy.

Because of the nature of this oscillators design, it is suited for use under any time frame and any volatility level. However, I personally have found it to be most accurate under low to medium-high volatility levels in a weekly time frame or shorter. Accuracy begins to be lost once the time frames are monthly or higher. It is recommended to use this oscillator with a volume indicator and a secondary momentum indicator such as MACD to verify signals from the All Seeing Eye for the highest degree of accuracy to be achieved.

Easy to read and notable trend states to get you started:

Blue line above 50 and red line below 50 = Uptrend

Both blue line and red line below 50 = Downtrend

Blue line 2 standard deviations above 50 and red line 2 standard deviations below 50 = Strong uptrend

Both blue line and red line 2 standard deviations below 50 = Strong downtrend

Red line at 1 standard deviation below 50 = weak trend

Red line at 2 standard deviations below 50 = strong trend

Red line at 1 standard deviation above 50 = consolidation phase (very weak or no trend)

Red line at 2 standard deviations above 50 = dead in the water (no trend at all)

My #1 tip: Pay close attention to the slopes of both lines in this oscillator and their relationship to each other!

Scott's MTF: RSI with ema and stochasticI made this for backtesting the 1 hour TF where I am more interested in 4 hour stochastic and RSI than the default 1 hour stoch and RSI.

Multi Time Frame Dual EMA Built this script so that we can have Dual EMA from any time frame on any chart.

Now i can see any cross over from multiple timeframe on single chart. Let me know if anything else is needed

Multi Timeframe Moving Average Collection | Swing [aamonkey]This is a Multi Timeframe Moving Average Collection (Swing Edition).

Why use it?

- Spot cluster of MAs on one chart

- See support and resistance

- Spot "freefall zones"

In the default settings you will get:

20, 100 and 200 MA of the 1D, W, and the W chart.

The color indicates significance!

From weaker to stronger support/resistance:

green(1D),yellow(W),red(M)

- Length of the MAs is modifiable

- Timeframes of the MAs is modifiable

- Which MAs you want to see

- Colors

Why use this if there is a Swing edition, that can do the same?

You can use this Swing Edition if you don't want to change between the Swing and Scalp timeframes in the settings.

Just turn on of the two on or off.

Multi Timeframe Moving Average Collection | Scalp [aamonkey]This is a Multi Timeframe Moving Average Collection (Scalp Edition).

Why use it?

- Spot cluster of MAs on one chart

- See support and resistance

- Spot "freefall zones"

In the default settings you will get:

20, 100 and 200 MA of the 15min, 1h, 4h, and the 1D chart.

The color indicates significance!

From weaker to stronger support/resistance:

white(15min), green(1h),yellow(4h),red(1D)

- Length of the MAs is modifiable

- Timeframes of the MAs is modifiable

- Which MAs you want to see

- Colors

MVA collector cryptoHello Traders

This indicator draw multiple Simple Moving Averages multi-timeframes at once

I use it to define take profit zones for my crypto trading

Hope you'll like it

Enjoy

Dave

Supertrend collectorHello traders

This is an example of how you can add multiple indicators into a unique one

In this instance, I added two supertrend multitimeframes and draw them on a different timeframe chart

Enjoy

David

[feeble] TrenderEver wondered which way the price is trending?!

feeble Trender™ **BETA** shows the trend based on middle crossings in different timeframes, volume weighting and volatility (std Deviations)

--The indicator displays the same on any timeframe.

--Select a FROM and TO period

--Use DuPLiCaToR to make 12 copies - use values between 0.8-1.2

--Coloured bands go purple when price is below the volume-weighted mIdBaNd!

--Shows the trend on a few different scales!!

Multi Time Moving Averageпозволяет выбрать в настройках 2 таймфрейма и 4 МА с разными периодами и отображать выбранные индикаторы на графиках с любым выбранным таймфреймом