[Sniper] SuperTrend + SSL Hybrid + QQE MODHi. I’m DuDu95.

**********************************************************************************

This is the script for the series called "Sniper".

*** What is "Sniper" Series? ***

"Sniper" series is the project that I’m going to start.

In "Sniper" Series, I’m going to "snipe and shoot" the youtuber’s strategy: to find out whether the youtuber’s video about strategy is "true or false".

Specifically, I’m going to do the things below.

1. Implement "Youtuber’s strategy" into pinescript code.

2. Then I will "backtest" and prove whether "the strategy really works" in the specific ticker (e.g. BTCUSDT) for the specific timeframe (e.g. 5m).

3. Based on the backtest result, I will rate and judge whether the youtube video is "true" or "false", and then rate the validity, reliability, robustness, of the strategy. (like a lie detector)

*** What is the purpose of this series? ***

1. To notify whether the strategy really works for the people who watched the youtube video.

2. To find and build my own scalping / day trading strategy that really works.

**********************************************************************************

*** Strategy Description ***

This strategy is from " QQE MOD + supertrend + ssl hybrid" by korean youtuber "코인투데이".

"코인투데이" claimed that this strategy will make you a lot of money in any crypto ticker in 15 minute timeframe.

### Entry Logic

1. Long Entry Logic

- Super Trend Short -> Long

- close > SSL Hybrid baseline upper k

- QQE MOD should be blue

2. Short Entry Logic

- Super Trend Long -> Short

- close < SSL Hybrid baseline lower k

- QQE MOD should be red

### Exit Logic

1. Long Exit Logic

- Super Trend Long -> Short

2. Short Entry Logic

- Super Trend Short -> Long

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

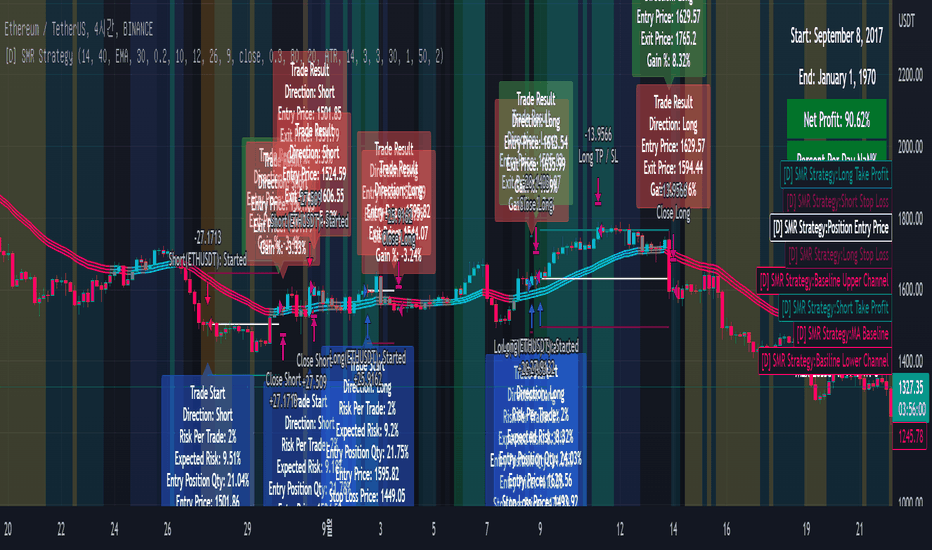

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

3. SuperTrend and SSL Hybrid Baseline is by default drawn on the chart.

4. If you check EMA filter, EMA would be drawn on the chart.

5. Should add QQE MOD indicator manually if you want to see QQE MOD.

**********************************************************************************

*** Rating: True or False?

### Rating:

→ 3.5 / 5 (0 = Trash, 1 = Bad, 2 = Not Good, 3 = Good, 4 = Great, 5 = Excellent)

### True or False?

→ True but not a 'perfect true'.

→ It did made a small profit on 15 minute timeframe. But it made a profit so it's true.

→ It worked well in longer timeframe. I think super trend works well so I will work on this further.

### Better Option?

→ Use this for Day trading or Swing Trading, not for Scalping. (Bigger Timeframe)

→ Although the result was not good at 15 minute timeframe, it was quite profitable in 1h, 2h, 4h, 8h, 1d timeframe.

→ Crypto like BTC, ETH was ok.

→ The result was better when I use EMA filter.

### Robust?

→ Yes. Although result was super bad in 5m timeframe, backtest result was "consistently" profitable on longer timeframe (when timeframe was bigger than 15m, it was profitable).

→ Also, MDD was good under risk management option on.

**********************************************************************************

*** Conclusion?

→ I recommend you not to use this on short timeframe as the youtuber first mentioned.

→ In my opinion, I can use on longer timeframe like 2h or bigger with EMA filter, stoploss and risk management.

Sslhybrid

[Sniper] SSL Hybrid + QQE MOD + Waddah Attar StrategyHi. I’m DuDu95.

**********************************************************************************

This is the script for the series called "Sniper".

*** What is "Sniper" Series? ***

"Sniper" series is the project that I’m going to start.

In "Sniper" Series, I’m going to "snipe and shoot" the youtuber’s strategy: to find out whether the youtuber’s video about strategy is "true or false".

Specifically, I’m going to do the things below.

1. Implement "Youtuber’s strategy" into pinescript code.

2. Then I will "backtest" and prove whether "the strategy really works" in the specific ticker (e.g. BTCUSDT) for the specific timeframe (e.g. 5m).

3. Based on the backtest result, I will rate and judge whether the youtube video is "true" or "false", and then rate the validity, reliability, robustness, of the strategy. (like a lie detector)

*** What is the purpose of this series? ***

1. To notify whether the strategy really works for the people who watched the youtube video.

2. To find and build my own scalping / day trading strategy that really works.

**********************************************************************************

*** Strategy Description ***

This strategy is from "SSL QQE MOD 5MIN SCALPING STRATEGY" by youtuber "Daily Investments".

"Daily Investments" claimed that this strategy will make you some money from 100 trades in any ticker in 5 minute timeframe.

### Entry Logic

1. Long Entry Logic

- close > SSL Hybrid Baseline.

- QQE MOD should turn into blue color.

- Waddah Attar Explosion indicator must be green.

2. Short Entry Logic

- close < SSL Hybrid Baseline

- QQE MOD should turn into red color.

- Waddah Attar Explosion indicator must be red.

### Exit Logic

1. Long Exit Logic

- When QQE MOD turn into red color.

2. Short Entry Logic

- When QQE MOD turn into blue color.

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

3. SSL Hybrid Baseline is by default drawn on the chart.

4. If you check EMA filter, EMA would be drawn on the chart.

5. Should add QQE MOD and Waddah Attar Explosion indicator manually if you want to see QQE MOD.

**********************************************************************************

*** Rating: True or False?

### Rating:

→ 1.5 / 5 (0 = Trash, 1 = Bad, 2 = Not Good, 3 = Good, 4 = Great, 5 = Excellent)

### True or False?

→ False

→ Doesn't Work on 5 minute timeframe. Also, it doesn't work on crypto.

### Better Option?

→ Use this for Day trading or Swing Trading, not for Scalping. (Bigger Timeframe)

→ Although the result was bad at 5 minute timeframe, it was profitable in 1h, 2h, 4h, 8h, 1d timeframe.

→ BTC, ETH was ok.

→ The result was better when I use EMA filter (only on longer timeframe).

### Robust?

→ So So. Although result was bad in short timeframe (e.g. 30m 15m 5m), backtest result was "consistently" profitable on longer timeframe.

→ Also, MDD was not that bad under risk management option on.

**********************************************************************************

*** Conclusion?

→ Don't use this on short timeframe.

→ Better use on longer timeframe with filter, stoploss and risk management.

[DuDu95] SSL 4C MACD Laugerre RSI StrategyHello Guys! Nice to meet you all!

Before I start, my nickname has changed to 'DuDu95'!!

This is the Strategy introduced by youtube channel.

I made this based on the open source indicator by kevinmck100, vkno422, KivancOzbilgic. Thank you All!

### Entry Logic

1. Long Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0 and current MACD value > previous MACD value

- Laguerre RSI < overbought Line.

2. short Entry Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0 and current MACD value < previous MACD value

- Laguerre RSI > overbought Line.

### Exit Logic

1. Long Exit Logic

- close < SSL Hybrid baseline lower k (keltner channel)

- macd signal < 0

2. short Entry Logic

- close > SSL Hybrid baseline upper k (keltner channel)

- macd signal > 0

### StopLoss

1. Can Choose Stop Loss Type: Percent, ATR, Previous Low / High.

2. Can Chosse inputs of each Stop Loss Type.

### Take Profit

1. Can set Risk Reward Ratio for Take Profit.

- To simplify backtest, I erased all other options except RR Ratio.

- You can add Take Profit Logic by adding options in the code.

2. Can set Take Profit Quantity.

### Risk Manangement

1. Can choose whether to use Risk Manangement Logic.

- This controls the Quantity of the Entry.

- e.g. If you want to take 3% risk per trade and stop loss price is 6% below the long entry price,

then 50% of your equity will be used for trade.

2. Can choose How much risk you would take per trade.

### Plot

1. Added Labels to check the data of entry / exit positions.

2. Changed and Added color different from the original one. (green: #02732A, red: #D92332, yellow: #F2E313)

[fpemehd] SSL Baseline StrategyHello Guys! Nice to meet you all!

This is my third script!

This Logic is trend following logic, This detects long & short trends based on SSL Hybrid Baseline.

This fits to the longer time frame like 4hr and 1d.

### Long Condition

1. close > SSL Hybrid baseline upper k

- Baseline is the ma of close price. (You can choose ma type and length)

- Upper k is the upper Keltner Channel.

### Short Condition

1. close < SSL Hybrid baseline lower k

- Baseline is the ma of close price. (You can choose ma type and length)

- Lower k is the lower Keltner Channel.

### Etc

1. Added Stoploss based on highest high or lowest low with lookback.

2. Strategy Template is based on @kevinmck100 template. Thank you!

SSL + Wave Trend StrategyStrategy incorporates the following features:

Risk management:

Configurable X% loss per stop loss

Configurable R:R ratio

Trade entry:

Based on strategy conditions below

Trade exit:

Based on strategy conditions below

Backtesting:

Configurable backtesting range by date

Trade drawings:

Each entry condition indicator can be turned on and off

TP/SL boxes drawn for all trades. Can be turned on and off

Trade exit information labels. Can be turned on and off

NOTE: Trade drawings will only be applicable when using overlay strategies

Alerting:

Alerts on LONG and SHORT trade entries

Debugging:

Includes section with useful debugging techniques

Strategy conditions

Trade entry:

LONG

C1: SSL Hybrid baseline is BLUE

C2: SSL Channel crosses up (green above red)

C3: Wave Trend crosses up (represented by pink candle body)

C4: Entry candle height is not greater than configured threshold

C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

C6: Take Profit target does not touch EMA (represents resistance)

SHORT

C1: SSL Hybrid baseline is RED

C2: SSL Channel crosses down (red above green)

C3: Wave Trend crosses down (represented by orange candle body)

C4: Entry candle height is not greater than configured threshold

C5: Entry candle is inside Keltner Channel (wicks or body depending on configuration)

C6: Take Profit target does not touch EMA (represents support)

Trade exit:

Stop Loss: Size configurable with NNFX ATR multiplier

Take Profit: Calculated from Stop Loss using R:R ratio

Credits

Strategy is based on the YouTube video "This Unique Strategy Made 47% Profit in 2.5 Months " by TradeSmart.

It combines the following indicators to determine trade entry/exit conditions:

Wave Trend: Indicator: WaveTrend Oscillator by @LazyBear

SSL Channel: SSL channel by @ErwinBeckers

SSL Hybrid: SSL Hybrid by @Mihkel00

Keltner Channels: Keltner Channels Bands by @ceyhun

Candle Height: Candle Height in Percentage - Columns by @FreeReveller

NNFX ATR: NNFX ATR by @sueun123

QQE MOD + SSL Hybrid + Waddah Attar ExplosionTRADE CONDITIONS

Long entry:

QQE Mod changes to Blue (leading indicator)

SSL Hybrid is Blue and price is above MA Channel line

Waddah Attar Explosion is Green and above Explosion line

Short entry:

QQE Mod changes to Red (leading indicator)

SSL Hybrid is Red and price is below MA Channel line

Waddah Attar Explosion is Red and above Explosion line

Risk management:

Each trade risks 2% of account (configurable in settings)

SL size determined by swing low/high of previous X candles (configurable in settings)

TP is triggered on SSL Hybrid EXIT arrow signals

TIPS

Timeframe: Personally I've found best results running this on 1H timeframe.

Note: To help visual identification of trade entries and exits you may wish to add the SSL Hybrid and Waddah Attar Explosion to the chart separately. They are being used to determine trade entry/exit within the code of this strategy but it was not possible to display them in a clear way within a single panel. Make sure you set the settings of the auxiliary indicators to match what is in the settings of this indicator if you do decide to add them.

CREDITS

QQE MOD byMihkel00

SSL Hybrid by Mihkel00

Waddah Attar Explosion by shayankm