Trail with Bar Time [NBL]Hello Everyone its Trailing stop loss Indicator with Bar Time if you want to Trail Your position with Specific Bar or time You can also Trail. Basically, its indicator we are using automation Trading

How to work its indicator?

➤ if you want to Trail Your Position according to Specific Bar or time

Indicator Feature

➤ Long Side TSL hit With Alerts

➤ Short Side TSL hit With Alerts

➤ Both Side TSL hit With Alerts

➤ You can also Select Specific Bar

➤ You Can Also add Trailing with Percentage or Point

➤ You Can Also Select Trailing calculate Bar Source Like Open, Close, High, Low etc More.

Important: This Indicator we are using for Automation Trading if You Want This Indicator Access Please Contact me PM on Tradingview

Trailing_stop

Jackrabbit.modulus.TrailingThis is a full, true, and pure implementation of trailing buy/sell for the Jackrabbit suite and modulus framework.

This module is not a standalone and relies on previous modules to send a signal data in order to function properly. This module acts on buy and sell data from within the indicator on indicator framework that TradingView supports.

This module adds the ability to trail a buying position to its lowest value or if it breaks a retracement percentage (user defined). It also allows trailing a sell position with an user defined retracement. It can managing buy and selling or just buying or selling.

This module does NOT allow accumulation during the trailing process. If a buy signal is received while the module is already trailing a previous position, if the price is lower then the previous position, the current position is used, otherwise it is ignored. The same holds true for selling. Once the position is bought, accumulation will resume as normal for the next position.

The chart displays (for both buying and selling):

The current price, its retracement value, and the original price.

Note that the buy or sell does NOT actually take place until the price action crosses retracement.

The Jackrabbit modulus framework is a plug in play paradigm built to operate through TradingView's indicator on indicatior (IoI) functionality. As such, this script receives a signal line from the previous script in the IoI chain, and evaluates the buy/sell signals appropriate to the current analysis.

This script is by invitation only. To learn more about accessing this script, please see my signature or send me a PM. Thank you.

MTF Trailing SL Alerts [QuantNomad]These are alerts for my MTF Trailing SL Strategy.

Entry Long position if all 4 time-frames agree on the long signal.

Exit Long positions when at least 2 time-frames disagree on the long signals.

Entry to Short position if all 4 time-frames agree on Short signal.

Exit from Short positions when at least 2 time-frames disagree on Short signal.

Use "Once Per Bar Close" when creating alerts.

Link to the strategy:

Trailing SL Alerts [QuantNomad]It's alerts version of my Trailing SL strategy:

Use "Once Per Bar" param when creating alerts.

Trailing Stop Loss ATR + AlertI share this TSL indicator with alert (I use it only for Stocks), the configuration is very simple, you must select if it is a Short or Long operation, time at which the operation was opened,% of the daily ATR for TSL. It also contains:

- Alert

- Panel Info

Trailing SL or TP with Alerts (MV)Hey

Trailing SL or TP with Alerts (MV)

if you want trailing Stoploss Alerts

Alert condition

select by default Symbol

Less Than

Select Trailing SL or TP with Alerts (MV)

Second Plot

if you want trailing Takeprofit Alerts

Alert condition

Select by default Symbol

Greater Than

Select Trailing SL or TP with Alerts (MV)

First plot

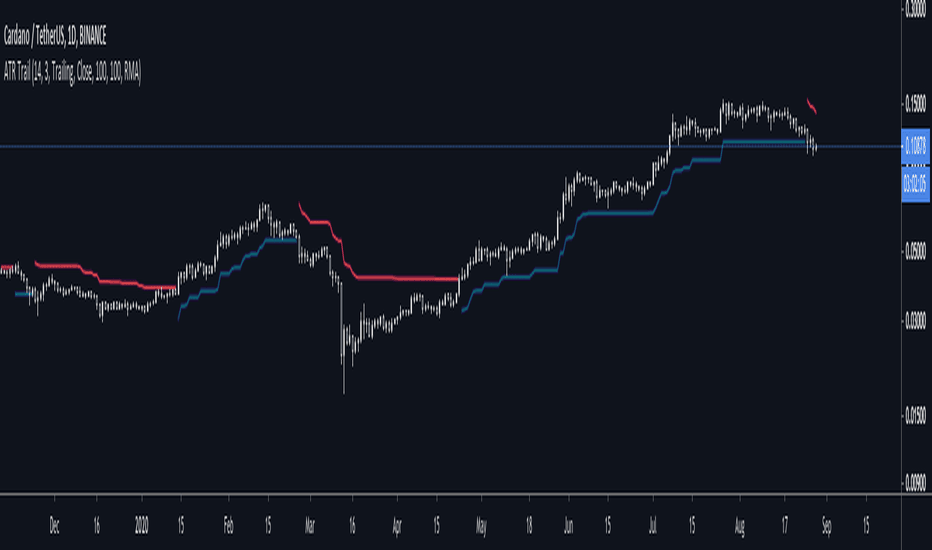

ATR + Trailing StopsSimple visualisation of Average True Range in Pinescript V4.

The script has two modes: Running and Trailing.

In Running mode, it continuously displays the ATR above and below the price. Specifically, it displays the High and Low price plus and minus the ATR times a user-supplied multiplier. This can be helpful for visualising volatility.

In Trailing mode, it displays the same ATR line, except the line trails until price crosses it. When price crosses it, it flips from long to short or vice-versa.

You could use trailing ATR as a stop loss. Adjust the multiplier and lookback period for your asset and preference.