All Candlestick Patterns - ExportThis is a copy of the built-in All Candlestick Patterns indicator, but with an additional plot for each indicator to support exporting. When exporting, each candlestick pattern will have its own column, with a 1 indicating the candlestick pattern was detected, and 0 indicating it wasn't. The plots are all overlaid, so are they are not useful for viewing, they are only used to generate values to export. This indicator also does not include alerts, so the built-in indicator should be used for everything except exporting.

W-patterns

[TS] S/R TweezersThe Tweezers pattern is a minor trend reversal pattern that consists of two candlesticks with more or less the same high or the same low or some variation thereof. The user can adjust this variation by changing the 'Tweezer Wick Percentage' input.

The Tweezers Bottom pattern generally appears in a downtrend with the first candlestick being a bearish candlestick, followed by a bullish candlestick.

The Tweezers Top pattern generally appears in an uptrend. The first candlestick in this pattern is a bullish candlestick followed by a bearish candlestick.

To further confirm the trend reversal, we've added an Engulfing filter. If this option is enabled, the indicator will only show Tweezer signals that also engulf the previous 1 or 2 candles.

We've also included a S/R Lookback Filter that will search for previous Support/Resistance Zones and only display those Tweezers that are within those zones. The candle lookback period is fully adjustable.

The Support/Resistance zones are based on Swing Points, which length can be adjusted by the user.

The user can also change the width of the S/R zones, by adjusting the input 'S/R Zone ATR Multiplier'

GreenCrypto Swing Trade Indicator - GC02Overview: This is a swing trading Indictor works using support & resistance and market trend, it is designed for all type of markets (crypto, forex, stock etc.) and works on all commonly used timeframes (preferably on 1H, 4H Candles).

How it works:

Core logic behind this indicator is to finding the Support and Resistance, we find the Lower High (LH) and Higher Low (HL) to find the from where the price reversed(bounced back) and also we use a custom logic for figuring out the peak price in the last few candles (based on the input "Strength" ). Based on the multiple previous Support and Resistance (HH, HL, LL LH) we calculate a price level, this price level is used a major a factor for entering the trade. Once we have the price level we check if the current price crosses that price level, if it crossed then we consider that as a long/short entry (based on whether it crosses resistance or support line that we calculated). Once we have pre long/short signals we further filter it based on the market trend to prevent too early/late signals, this trend is calculated based on the value from the input field "Factor". Along with this if we don't see a clear trend we do the filtering by checking how many support or resistance level the price has bounced off.

Stop Loss and Take Profit : We have also added printing SL and TP levels on the chart to make the it easier for everyone to find the SL/TP values. Script calculates the SL value by checking the previous support level for LONG trade and previous resistance level for SHORT trades. Take profit are calculated in 1:1 ratio as of now.

Available Inputs:

Strength : Define the strength of the support resistance that we calculate. The lower value means less number of candles used for calculating the support & resistance and vice versa

Factor : Specify what level of trend to use. Using higher value will result script looking using the larger trend (zoomed out trend) and using lesser value will result in using the short trends

Note: For most of the charts you don’t need to change the default values. However, feel free to try it out.

How to use:

Add the script to the chart and once the indicator is load it will display the "long" and "short" entry points along with the stopLoss and takeProfit points.

How to get access:

Send a DM to us for getting access to the script.

Harmonic ScannerThis script detects harmonic formations: Gartley, Bat, Butterfly, and Crab.

Unlike the other harmonic scanners, it analyzes more than the last five consecutive points. It checks up to 50 last high/low points and tries to find a pattern there. It also labels point D with information on what type of formation it is and if it's a signal to sell or buy.

The default error margin for each formation is 5% (so each point can be up to 5% different than the ideal value defined in the books).

I don't have enough reputation for linking other charts, but check it out with BATS:V (Visa) and BATS:JPM (JPMorgan Chase) to see more formations.

Harmonic PatternsHello Traders,

This is Harmonic Pattern script . I made this script long time ago and now pubished it for the community. it can find & show following patterns:

- Gartley

- Butterfly

- Bat

- Alternate Bat

- Crab

- Deep Crab

- Shark

- Cypher

- Double Top

- Double Bottom

- ABCD

only ABCD patterns is not enabled by default, you can enable if you want.

The script has many features in it, so you have many options. lets see them

ZigZag Period : is the period for zig zag that is used to find harmonic patterns.

Error Rate % : the patterns may not be perfect and we need to use a threshold. with this option you can set error rate

Deep Search: if you enable this option then the script check combination with old zigzag points. an example is under the explanation part

Pattern Prediction : if you set this option then while price is moving the script checks the possible next patterns that can be possible (shows first possible one). an example is under the explanation part

Show ZigZag: you have option to see zigzag

Show Pattern Names: you have option to see Pattern names

Remove Old Pattern Names : old found patterns can stay on the chart or you have option to delete from the chart by this option

Show Harmonics: you have option to show patterns

Show Targets: you have option to see the target and stop-loss level by each harmonic

Show Statistics: you can see the statictics about harmonic patterns on current chart

Show Full Statistics: you can see the statictics about harmonic patterns on current chart in details

"Stop-loss ATR Len" and "Stop-loss ATR Mult" is used to calculate stop-loss levels

and many options for visualization and alerts...

The scripts works dynamically in real time, it means it may find different patterns on each candles. if it finds a new one in same direction then old one becomes invalid, you should check the last one.

Lets see some examples:

it changes the colors if price reached the target or stop-loss. blue => reached target, black => stop-loss, and if color was not changed it means it found another harmonic pattern.

if it finds a harmonic pattern then it show entrty level, cancelation level of the pattern, target 1 and target 2

and if price reaches entrty level then it shows targets and stop-loss levels

as written above, t has ability to predict patterns if you enable this option:

Deep search is used to find patterns by some old zigzag levels as seen in following screenshot:

it can show full statistics if you enable it in the options:

The source code is hidden but it's free script. so like it/favorite this script, apply it to your chart and start using it ;)

Special thanks to my friend @gornidah who helped while developing the script!

Enjoy!

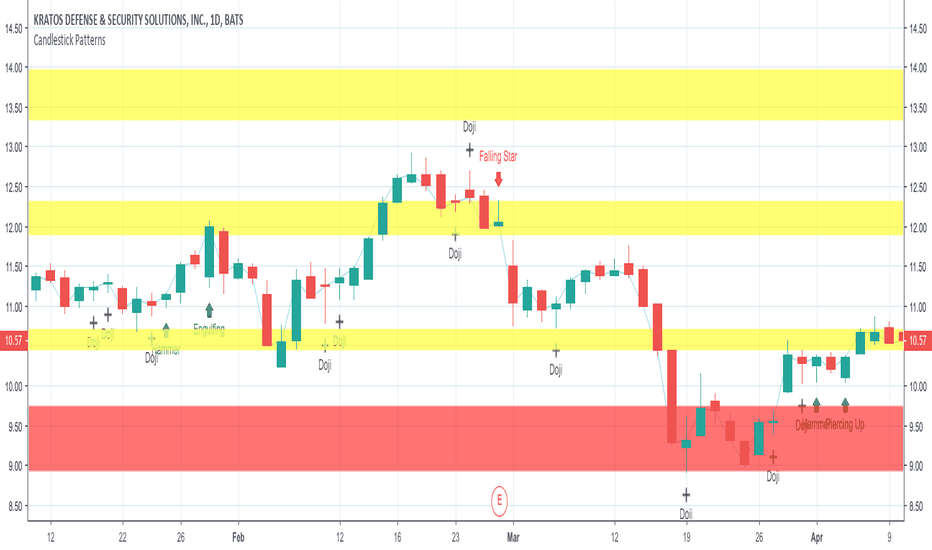

[TrustedSignals] Doji ScalperTrustedSignals Dojji Scalper is our most basic trading algorithm. It is based on Candle Patterns that show potential market reversal points.

The script has 3 different types of signals, which can be individually turned on and off:

- Doji signals, based entirely on the Doji candle pattern and 2 Strong and Weak candle reversal patters

As a bonus, we have included RSI based Support and Resistance bands that, if used correctly can further confirm all the entry signals

All chart signals can be set up as live alerts!

Fractal Trend Trading System [DW]This is an advanced utility that uses fractal dimension and trend information to generate useful insights about price activity and potential trade signals.

In this script, my Advanced FDI algorithm is used to estimate the fractal dimension of the dataset over a user defined period.

Fractal dimension, unlike spatial or topological dimension, measures how complexity or detail in an "object" changes as its unit of measurement changes, rather than the number of axes it occupies.

Many forms of time series data (seismic data, ECG data, financial data, etc.) have been theoretically shown to have limited fractal properties.

Consequently, we can estimate the fractal dimension from this data to get an approximate measure of how rough or convoluted the data stream is.

Financial data's fractal dimension is limited to between 1 and 2, so it can also be used to roughly approximate the Hurst Exponent by the relationship H = 2 - D.

When D=1.5, data statistically behaves like a random walk. D above 1.5 can be considered more rough or "mean reverting" due to the increase in complexity of the series.

D below 1.5 can be considered more prone to trending due to the decrease in complexity of the series.

In this script, you are given the option to apply my Band Shelf EQ algorithm to the dataset before estimating dimension.

This enables you to transform your data and observe how its newly measured complexity changes the outputs.

Whether you want to give emphasis to some frequencies, isolate specific bands, or completely alter the shape of your waveform, EQ filtration makes for an interesting experience.

The default EQ preset in this script removes the low shelf, then attenuates low end and high end oscillations.

The dominant cyclical components (bands 3 - 5 on default settings) are passed at 100%, keeping emphasis on 8 to 64 sample per cycle oscillations.

The estimated dimension is then used to calculate the High Dimension Zone and the Error Bands.

Both of these components are great for analyzing trends and for estimating support and resistance values.

The High Dimension Zone is composed of a high line, low line, and midline that update their values when D is at or above the user defined zone activation threshold.

The zone is then averaged over a user defined amount of updates and zone width is multiplied by a user defined value.

The Error Bands are composed of a high, low, and middle band that are calculated using an error adjusted adaptive filter algorithm that utilizes dimension as the smoothing constant modulator.

The basis filter for the error bands has two calculation types built in:

-> MA - Calculates the filters as adaptive moving averages modulated by D.

-> WAP - Calculates the filters as adaptive weighted average prices modulated by D.

The WAP starting point can be based on the High Dimension Zone being moved or a user defined interval.

You can also define the WAP's minimum and maximum periods for additional control of the initial and decayed sensitivity states.

The alpha (smoothing constant) modulator can be fine tuned using the designated dimension thresholds.

When D is at or below the low dimension threshold, the filter is most responsive, and vice-versa for the high dimension threshold.

Alpha is then multiplied by a user defined amount for additional control of sensitivity.

Band width is then multiplied by a user defined value.

A Hull transformation can be optionally performed on the zone averaging and band filter algorithms as well, which will alter the frequency and phase responses at the cost of some overshoot.

This transformation is the same as a typical Hull equation, but with custom filters being used instead of WMA.

The calculated outputs are then used to gauge the trend for signal and color scheme calculations.

First, a dominant trend indication is selected from its designated dropdown tab.

The available built in indications to choose from are:

-> Band Trend (Outer) - Detects band breakouts and saves their direction to gauge trend.

-> Band Trend (Median) - Uses disparity between source and the band median to gauge trend.

-> Zone Trend (Expansion) - Detects when the high fractal zone expands and saves its direction to gauge trend.

-> Zone Trend (Outer Levels) - Detects zone breakouts and saves their direction to gauge trend.

-> Zone Trend (Median) - Uses disparity between source and the zone median to gauge trend.

Then the trend output is optionally filtered before triggering signals.

There are multiple trend filtration options built into this script that can be used individually or in unison:

-> Filter Trend With High Fractal Zone - Filters the trend using the specified zone level or combination of levels with either disparity or crossover conditions.

There is a set of options for bullish and bearish trends.

-> Filter Trend With Error Bands - Filters the trend using the specified band level or combination of levels with either disparity or crossover conditions.

There is a set of options for bullish and bearish trends.

-> Filter Trend With Band - Zone Disparity Condition - Filters the trend using the specified band level, zone level, and disparity direction.

There is a set of options for bullish and bearish trends.

-> Filter By Zone That Moves With The Trend - Filters the specified trend by detecting when the high fractal zone’s direction correlates.

-> Filter By Bands That Move With The Trend - Filters the specified trend by detecting when the error bands’ direction correlates.

-> Filter Using Wave Confirmation - Filters the specified trend by detecting when source is in a correlating wave with user defined length.

You can also choose separate lengths for bullish and bearish trends.

-> Filter By Bars With Decreasing Dimension - Filters the specified trend by detecting when fractal dimension is decreasing, suggesting source is approaching more linear movement.

The filtered trend output is then used to generate entry and exit signals.

There are multiple options included to fine tune how these signals behave.

For entries, you have the following options built in:

-> Limit Entry Dimension - Limits the range of dimensional values that are acceptable for entry with user defined thresholds.

This can be incredibly useful for filtering out entries taken when price is moving in a more complex pattern,

or when price is approaching a peak and you’re a little late to the party.

-> Enable Position Increase Signals - Enables more entry signals to fire up to a user defined number of times when a position is active.

This is helpful for those who incrementally increase their positions, or for those who want to see additional signals as reference.

-> Limit Number Of Consecutive Trades - Limits the number of consecutive trades that can be opened in a single direction to a user defined maximum.

This is especially useful for markets that only trend for brief durations.

By limiting the amount of trades you take in one direction, you have more control over your market exposure.

There is a set of these options for both bullish and bearish entries.

For exits, you have the following options built in:

-> Include Exit Signals From High Fractal Zone - Enables exit signals generated from either crossover or disparity conditions between price and a specified zone level.

-> Include Exit Signals From Error Bands - Enables exit signals generated from either crossover or disparity conditions between price and a specified zone level.

-> Include Inactive Trend Output For Exits - Triggers exit signals when the filtered trend output is an inactive value.

-> Dimension Target Exit Method - Triggers exit signals based on fractal dimension hitting a user defined threshold.

You can either choose for the exit to trigger instantly, or after dimension reverts from the target by a user specified amount.

-> Exit At Maximum Entry Dimension - Triggers exit signals when dimension exceeds the maximum entry limit.

-> Number Of Signals Required For 100% Exit - Controls the number of exit signals required to close the position.

You can also choose whether or not to include partial exits.

Enabling them will fire a partial signal when an exit occurs, but the position is not 100% closed.

Of course, there is a set of these options for bullish and bearish exits.

In my opinion, no system is complete without some sort of risk management protocol in place.

So in this script, bullish and bearish trades come equipped with optional protective SL and TP levels with signals.

The levels can be fixed or trailing, and are calculated with a user defined scale.

The available scales for SL and TP distances are ticks, pips, points, % of price, ATR, band range, zone range, or absolute numerical value.

Now what if you have some awesome signals of your own that you’d like to use in conjunction with this script?

Well good news. You can!

In addition to all of the customizable features built into the script, you can integrate your own signals into the system using the external data inputs and linking your script.

This adds a whole new layer of customization to the system.

With external signals, you can use your own custom dominant trend indication, filter the dominant trend, and trigger exits and protective stops using custom signals.

The signal input is an integer format. 1=Bull Signal, -1=Bear Signal, 2=Bull Exit, -2=Bear Exit, 3=Bull SL Hit, -3=Bear SL Hit, 4=Bull TP Hit, -4=Bear TP Hit.

You can also use the external input as a custom source value for either dimension or global sources to further tailor the system to your liking.

The color scheme in this script utilizes two custom gradients that can be chosen for bar and background colors:

-> Trend (Dominant or Filtered) - A polarized gradient that shows green scaled values for bullish trend and red scaled values for bearish trend.

The colors are brighter and more vibrant as perceived trend strength increases.

-> Dimension - A thermal gradient that shows cooler colors when dimension is higher, and hotter colors when dimension is lower.

Both color schemes are dependent on the designated dimension thresholds.

The script comes equipped with alerts for entries, additional entries, exits, partial exits, and protective stops so you can automate more and stare at your charts less.

And lastly, the script comes equipped with additional external outputs to further your analysis:

-> Entry And Exit Signals - Outputs in the same format as the external signal input with these additions: 5=Bull Increase, -5=Bear Increase, 6=Bull Reduce, -6=Bear Reduce.

You can use these to send to other scripts, including strategy types so you can backtest your performance on TV’s engine.

-> Dominant Trend - Outputs 1 for bullish and -1 for bearish. Can be used to send trend signals to another script.

I designed this tool with individuality in mind.

Every trader has a different situation. We trade on different schedules, markets, perspectives, etc.

Analytical systems of basically any type are very seldom (if ever) “one size fits all” and usually require a fair amount of modification to achieve desirable results.

That’s why this system is so freely customizable.

Your system should be flexible enough to be tailored to your analytical style, not the other way around.

When a system is limited in what you can control, it limits your experience, analytical potential, and possibly even profitability.

This is not your typical pre-set system. If you're looking for just another "buy, sell" script that requires minimal thought, look elsewhere.

If you’re ready to dive into a powerful technical system that allows you to tailor the experience to your style, welcome!

-----------------------------------------------------------------------------------------------------------------------------------------------------------------

This is a premium script, and access is granted on an invite-only basis.

To gain access, get a copy of the system overview, or for additional inquiries, send me a direct message.

I look forward to hearing from you!

-----------------------------------------------------------------------------------------------------------------------------------------------------------------

General Disclaimer:

Trading stocks, futures, Forex, options, ETFs, cryptocurrencies or any other financial instrument has large potential rewards, but also large potential risk.

You must be aware of the risks and be willing to accept them in order to invest in stocks, futures, Forex, options, ETFs or cryptocurrencies.

Don’t trade with money you can’t afford to lose.

This is neither a solicitation nor an offer to Buy/Sell stocks, futures, Forex, options, ETFs, cryptocurrencies or any other financial instrument.

No representation is being made that any account will or is likely to achieve profits or losses of any kind.

The past performance of any trading system or methodology is not necessarily indicative of future results.

Candlestick Pattern FinderThis script identifies common candlestick patterns and marks them with a tool-tip on the chart. It is a compilation of Tradingview's built-in candlestick finding scripts so it uses the same rules defined by Tradingview to identify the patterns. Instead of using a separate indicator for each candlestick pattern, you can use this script to find all the candlestick patterns with a single indicator.

By default, the script does not mark any of the detected patterns on the chart. You will have to open the indicator settings and enable the patterns you would like to see on the chart. There are also three tick-boxes that let you to enable/disable all the selected bearish/bullish/neutral patterns at once, i.e. if you would like to only see bearish patterns, you can disable all the bullish and neutral patterns at once with the corresponding tick boxes. When you enable bullish patterns again, the script will show your selection of bullish patterns again on the chart.

When you hover on the tool-tips with your cursor, a short description about the pattern will be displayed.

Candlestick Pattern Detector - Aitch-TThis script detects the following candlestick patterns:

Bullish Patterns:

- Normal 3 Bar Fractal

- Enhanced 3 Bar Fractal

- Engulfing

- Harami ( Inside bar )

- Bullrami (Altenate Bull Harami)

Bearish Patterns:

- Normal 3 Bar Fractal

- Enhanced 3 Bar Fractal

- Engulfing

- Harami ( Inside bar )

- Bearami (Alternate Bear Harami)

- Shooting Star

How it works:

- When you add the script to your chart, green and red dots will appear at the top and the bottom of the chart.

- Red dots at the top of the chart point out the candles that have completed a bearish pattern .

- Green dots at the bottom of the chart point out the candles that have completed a bullish pattern .

How to use:

Use it in conjunction with other analysis tools ( Fibonacci Retracements, Histogram, Willy, RSI , volume , etc) to determine high probability levels.

Candlestick PatternsCandlestick Patterns

- Candlesticks are graphical representations of price movements for a given period of time.

- There are candlestick patterns that try to predict the final direction, caused by pressure between buyers and sellers.

As a general recommendation, use the candlestick patterns in the same direction of the current trend (continuations),

for reverse patterns we must expect the price to be over extended, for example,

that it is the highest or lowest value of (20-50) periods,

or that the RSI is overbought or oversold (14-50),

or that the price is far from its standard deviation.

- This indicator allows you to view more than 20 different patterns, some of them:

Doji

Engulfing

Hammer

Shooting Star

Inverted Hammer

Hanging Man

Morning Star

Evening Star

etc...

- The indicator allows displaying the full name of the pattern

- It allows you to view the labels at the top of the chart, to avoid this affecting the technical analysis

S&R Zone SignalsThis indicator allows you to specify price zones in which to detect basic candlestick patterns.

In the example above, I have specified the most immediate support and resistance zones on GBP/USD and set the script to detect engulfing candles. If a bearish engulfing candle occurs within the resistance zone a signal will be generated; likewise for bullish engulfing candles within the support zone .

The purpose of this indicator is to generate trading alerts when these patterns occur in order to reduce the screen-time required to monitor setups. This indicator is intended for structure traders primarily, although it could be used by anyone who uses zones and candlestick patterns to enter trades.

If you leave either zone set to 0 then that zone will not be used, meaning that you can use this to detect both support and resistance signals, or only signals at support, or only signals at resistance.

Settings:

R1: First Resistance Price

R2: Second Resistance Price

S1: First Support Price

S2: Second Support Price

Draw Signals: Enable/Disable Visual Signals

How Far To Look Back: Used For Detecting Fractal Highs/Lows

Doji Size (in pips): This Changes the Size of Detected Doji Candles

Hammer Wick Size: This Changes the Size of Detected Hammers/Shooting Stars

Engulf Wick: If Enabled, Only Engulfing Candles That Engulf the Wick Will Be Valid

Show Engulfing Candles: Enable/Disable Visual Signals For Engulfing Candles

Show Doji Candles: Enable/Disable Visual Signals For Doji Candles

Show Hammer Candles: Enable/Disable Visual Signals For Hammer/Shooting Star Candles

Source Code:

Go to zenandtheartoftrading.com for the source code – it’s free!

Function To Candles - Another way to see indicatorsIntroduction

There are different and better way's to see price data, a candlestick chart is one of the best way to see the price since you have access to the open/high/low/close information, this is really efficient and can allow for naked non parametric trading strategies (candlesticks patterns) . But what about making candles out of indicators ? There are tons of studies about candlesticks patterns in price data but none (?) about candlestick patterns using indicator data, therefore i made this script in order to show candles from various indicators, i also made an heikin-ashi mode.

Rsi To Candles

All the indicators are use the open/high/low/close price as input in order to return candles. length control the indicator period.

Stochastic To Candles

The stochastic oscillator is restrained in a range of 0/100, therefore when equal to 0 or 100 the candles can be flat.

Rate Of Change To Candles

The rate of change don't distort price as heavily as other indicators since its based on differencing.

Center Of Gravity To Candles

The center of gravity (cog) is defined from tradingview as "an indicator based on statistics and the Fibonacci golden ratio", its not an indicator i'am familiar with and i don't know if its the same proposed by Elhers. The candles are smooth, high length can flatten the candles heavily making them hard to see.

Correlation Oscillator

In a range of -1/1 this indicator is quite smooth and can also flatten candles.

Patterns And Heikin-Ashi

There are tons of patterns that can be generated from candlesticks, they can be applied to this indicator as well.

The indicator can show an heikin-ashi mode, heikin-ashi candlestick use averaging to plot candles, this is why they appear smoother, some signals generated from heikin-ashi candles are :

Bullish body with no lower shadows = Strong Uptrend

Bearish body with no higher shadows = Strong Downtrend

High range and small body = Indecision/Risk of reversal

Conclusion

I made an indicator able to draw candles from other indicators, those candles contain various information that can generate decision from patterns. I hope you find a use to it, if its the case share your findings with me, maybe that you will even be able find a new candlestick pattern :)

Thanks for reading !

High Performance Candlestick Patterns Colors//Candle Patterns Ranked by Performance THOMAS N. BULKOWSKI

//1. Bearish Three Line Strike +Up 67.38%

//2. Bullish Three Line Strike -Down 65.23%

//3. Bearish Three Black Crows -Down 59.83%

//4. Bearish Evening Star -Down 55.85%

//5. Bullish Upside Tasuki Gap +Up 54.44%

//6. Bullish Inverted Hammer -Down 51.73%

//7. Bullish Matching Low -Down 50.00%

//8. Bullish Abandone Baby +Up 49.73%

//9. Bearish Two Black Gapping -Down 49.64%

//10. Brearish Breakaway -Down 49.24%

//11. Bullish Morning Star +Up 49.05%

//12. Bullish Piercing Line +Up 48.37%

//13. Bullish Stick Sandwich +Up 48.20%

//14. Bearish Thrusting Line During Dowtrend +Up 48.10%

//15. Bearish Meeting Line +Up 48.07%

//Down=Yellow Bar Color and Black Text

//Up=Blue Bar Color and Blue Text

//High Performance Candlestick Patterns Colors Top 15

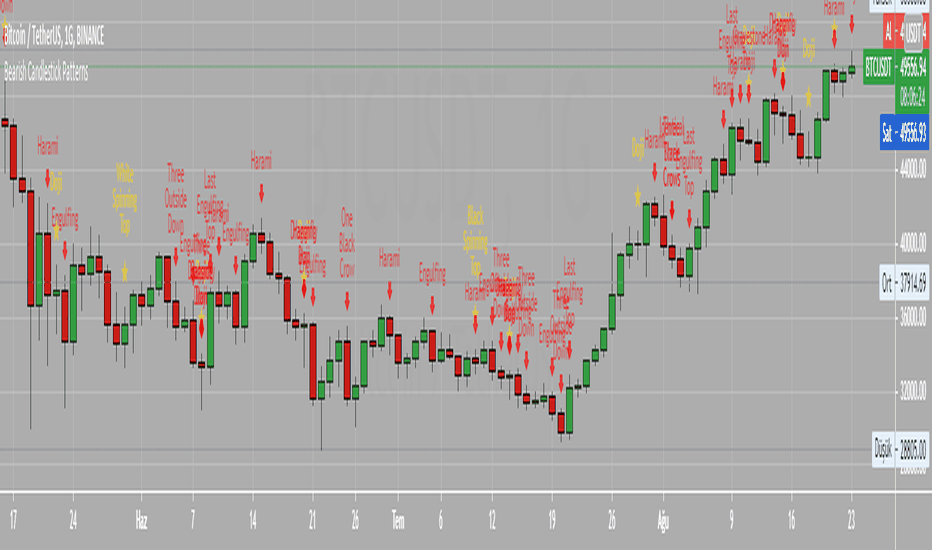

Bearish Candlestick PatternsDoji

Black Spinning Top

White Spinning Top

Bearish Abandoned Baby

Bearish Advance Block

Bearish Below The Stomach

Bearish Belt Hold

Bearish Breakaway

Bearish Counter Attack Lines

Bearish Dark Cloud Cover

Bearish Deliberation Blok

Bearish Descending Hawk

Bearish Doji Star

Bearish Downside Gap Three Methods

Bearish Downside Tasuki Gap

Bearish Dragonfly Doji

Bearish Engulfing

Bearish Evening Doji Star

Bearish Evening Star

Bearish Falling Three Methods

Bearish Falling Window

Bearish Gravestone Doji

Bearish Hanging Man

Bearish Harami

Bearish Harami Cross

Bearish Hook Reversal

Bearish Identical Three Crows

Bearish In Neck

Bearish Island Reversal

Bearish Kicking

Bearish Ladder Top

Bearish Last Engulfing Top

Bearish Low Price Gapping Play

Bearish Mat Hold

Bearish Matching High

Bearish Meeting Line

Bearish On Neck

Bearish One Black Crow

Bearish Separating Lines

Bearish Shooting Star

Bearish Side by side White Lines

Bearish Three Black Crows

Bearish Three Gap Up

Bearish Three Inside Down

Bearish Three Line Strike

Bearish Three Outside Down

Bearish Three Stars in the North

Bearish Thrusting Line During Dowtrend

Bearish Tower Top

Bearish Tristar

Bearish Tweezers Top

Bearish Two Black Gapping

Bearish Two Crows

Bearish Upside Gap Two Crows

Bullish Candlestick PatternsBullish Abandone Baby

Bullish Above The Stomach

Bullish Belt Hold

Bullish Breakaway

Bullish Concealing Baby Swallow

Bullish Counterattack Lines

Bullish Deliberation Block

Bullish Descent Block

Bullish Doji Star

Bullish Downside Gap Two Rabbits

Bullish Dragonfly Doji

Bullish Engulfing

Bullish Hammer

Bullish Harami

Bullish Harami Cross

Bullish High Price Gapping Play

Bullish Homing Pigeon

Bullish Hook Reversal

Bullish Inverted Hammer

Bullish Island Reversal

Bullish Kicking

Bullish Ladder Bottom

Bullish Last Engulfing Bottom

Bullish Mat Hold

Bullish Matching Low

Bullish Meeting Line

Bullish Morning Doji Star

Bullish Morning Star

Bullish On Neck

Bullish One White Soldier

Bullish Piercing Line

Bullish Rising Three Methods

Bullish Rising Window

Bullish Separating Lines

Bullish Side by Side White Lines

Bullish Stick Sandwich

Bullish Takuri Line

Bullish Three Gap Downs

Bullish Three Inside Up

Bullish Three Line Strike

Bullish Three Outside Up

Bullish Three Stars in the South

Bullish Three White Soldiers

Bullish Thrusting Line During Uptrend

Bullish Tower Bottom

Bullish Tristar

Bullish Tweezers Bottom

Bullish Two Rabbits

Bullish Unique Three River Bottom

Bullish Upside Gap Three Methods

Bullish Upside Tasuki Gap

9 Seasons Rainbow Multiple Time Frames Pattern PRO [9SPEN]The indicator discovers profitable patterns by associating Price Season of multiple time frames.

Full Name: 9 Seasons Rainbow - Multiple Time Frames Associated Price Wave Pattern Indicator

This is redefined from “9 Seasons Rainbow Indicator PRO”, with clearer definition of 9 Seasons and user manual.

Version: Invite-Only PRO

Language: English

Copyright: 2019

---------- How to use the indicator ----------

Go through the manual and related ideas underneath or follow the tutorials list. Look through the profitable patterns and related cases, wait for or set alert for specific profitable pattern.

---------- Definition: 9 Seasons ----------

A life cycle of Price Wave is divided into 9 Seasons. Each time frame, from 5 minute to 1 month, has 9 seasons, Independent of each other:

Bull (Green)

Bull Pullback (Light Green): a pullback or retracement

Resistance / Overbought (Yellow): a resistance area, may become a Top, or be broken through.

Crazy Bought (Lime): Price is going up in a high volatility, could be a valid breakout, or a Bull Trap.

Neutral (White): a wandering season without direction, evolves into Bull or Bear

Bear (Red)

Bear Bounce (Light Red): Price bounces

Support / Oversold (Blue): a support area, may become a Bottom, or be broken through.

Crazy Sold (Fuchsia): Price is going down in a high volatility, could be a valid breakdown, or a Bear Trap.

---------- Some important evolution between seasons ----------

Resistance / Overbought (Yellow) -> Crazy Bought (Lime):

Bull is breaking through a resistance.

Crazy Bought (Lime) -> Resistance / Overbought (Yellow):

This normally indicates a failed breakout, Price goes back to the resistance.

Crazy Bought (Lime) -> Bull Pullback (Light Green):

This normally indicates Price has risen to a new level

Support / Oversold (Blue) -> Crazy Sold (Fuchsia):

Bear is breaking through a support.

Crazy Sold (Fuchsia) -> Support / Oversold (Blue):

This normally indicates a failed breakdown, Price recovers to the support.

Crazy Sold (Fuchsia) -> Bear Bounce (Light Red):

This normally indicates price has dropped to a new level

---------- Rainbow Ribbons for Multiple Time Frames ----------

Each ribbon of a rainbow represents a time frame.

The uppermost ribbon represents the shortest-term time frame - current time period of the chart, which is the time frame for trading.

The lowermost ribbon represent longest-term time frame, which work as environment, together with the other medium-term and long-term time frames.

The difference between two frames is 1.4142 fold (square root of 2), if level 1 is 15 minute, level 2 is 15 minute * (square root of 2) .

Examples of time frames in a rainbow:

For STANDARD in 15M: 15M - 21M - 30M - 42M - 60M(1H) - 85M - 120M(2H) - 170M

For PRO in 15M: 15M - 21M - 30M - 42M - 60M(1H) - 85M - 120M(2H) - 170M - 240M(4H) - 339M - 480M(8H) - 679M

---------- Trading Methods ----------

How to open a Long position?

When a profitable Long pattern appears, open small position first based on signal on shortest-term time frame; after retesting and confirming the support, open 2nd position; when it breaks through the resistance, pullbacks and confirms the breakout, open 3rd position.

How to exit a Long position?

Lift the Stop to a confirmed higher low, so that to take advantages of the bull run as possible.

How to open a Short position?

When a profitable Short pattern appears, open small position first based on signal on shortest-term time frame; after retesting and confirming the resistance, open 2nd position; when it breaks through the support, bounces and confirms the breakdown, add 3rd position.

How to exit a Short position?

Lower the Stop to a confirmed lower high, so that to take advantages of the bear run as possible.

---------- Versions Description ----------

The features may change later without advance notice.

PRO:

Invite-Only, with the following advanced features:

12 Ribbons Rainbow displays 9 Seasons of 12 time frames on a chart.

Advanced alert sets allows set alerts on short-term, medium-term, and long-term time frames.

Capability to input different trading instrument to compare with the current ticker.

Full time periods access allows apply it to broadest time periods, from 1 minute to 1 week (if history data is enough)

More new features in updates.

STANDARD:

Invite-Only, with the following advanced features:

8 Ribbons Rainbow displays 9 Seasons of 8 time frames on a chart.

Advanced alert sets allows set alerts on upper and lower frames.

Broad time periods access allows apply it to the most popular time periods, from 15 minute to 1 week (if history data is enough)

More new features in updates.

DEMO:

DEMO version is for trial purpose, having most of the features.

It is applicable to a list of trading instruments and specific time periods (1 hour to 1 day), which may change later without advance notice.

---------- Access to Indicators ----------

Please use DEMO version for Trial

Asking access to Invite-Only PRO and STANDARD versions:

9seasonsrainbowindicator.blogspot.com

Or contact the author.

---------- Install Invite Only: STANDARD & PRO Version----------

Ask access to STANDARD or PRO version

Open the chart -> Indicators (On the Top) -> Invite-Only Scripts (2nd button of the left bar)

Like/Favorite the indicator

Click to install on the chart

---------- About Loading Time ----------

It may take up to 2 minutes for your browser to load a new setting, depending on the your computer and network speed.

---------- List of the author's Indicators ----------

www.tradingview.com

---------- Disclaimer ----------

By using or requesting access to the indicator, you acknowledge that you have read and accepted that the indicator and any related content, including but not limited to: user manual, tutorials, ideas, videos, chats, emails, blog, are for the purpose of trading strategies studying and paper trading.

If a customer or user uses the indicator or related content mentioned above for live trading or investment, she/he should take all risks and be responsible for her/his own trading and investment activities.

---------- Updates ----------

The latest updates override the previous description.

To activate a update: Close the browser, Reopen the chart and apply the indicator.

Doji - PatternsПаттерн "Доджи" - показывает равновесие сил продавцов и покупателей. Хотя сам по себе этот паттерн не является сигналом к открытию сделки, не стоит его всегда игнорировать. Доджи встречается в более сложных паттернах, состоящих из двух - трех свечей, например: "Утренняя звезда", "Вечерняя звезда" и "Крест харами" (подробнее о них я расскажу в своих следующих публикациях). Часто появление данного паттерна указывает на окончание трендового движения и/или начале "рэнджа".

Accumulation/Distribution ViewsThis is a script for a view I wanted to go along with the Autoview plugin I bought. Keep in mind this is my first script and was created for me to learn the Pinescript framework. This isn't meant to be perfect. Indicator colors are usually blue or green or red. Also keep in mind since this is my first script in a new framework, the more stuff I build the better improvement. This is just something I wanted to first create with settings I wanted for variance and colors. The things I create in the future will obviously be an improvement.

Candlestick Patterns [DW]This is a simple study designed to track multiple candlestick patterns. Custom alerts included.

clouded pastSearch indicators for "clouded" to find this one, and add to your chart.

Takes lowest(min) and highest(max) of several bars,

averages that over several bars,

shifts by half of the middle of those two bar numbers,

and colors the inbetween by candle color.

You can choose 3 parameters.

Please give feedback, or donation.

Thanks.