AUDUSD Discretionary Analysis: Recovery Mode ActivatedIt’s that feeling when the engine’s been cold for a while, but now it’s starting to rev. AUDUSD is flashing signs it wants to push up — not in a rush, but with purpose. I’m seeing strength building, like it’s getting ready to climb. Recovery mode’s not just activated — it’s already in motion. I’m calling for upside here. If it plays out, I’ll be riding the move. If not, hey, I’ll wait for the next setup. But right now? I like the long.

Just my opinion, not financial advice.

AUDUSD.P trade ideas

AUDUSD I Weekly CLS I KL - OB I Model 2, Target - CLS HHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

Connecting Your Tickmill Account to TradingView: A Step-by-Step In this step-by-step guide, we’ll show you exactly how to connect your Tickmill account to TradingView in just a few seconds.

✅ Easy walkthrough

✅ Real-time trading from charts

✅ Tips for a smooth connection

Don’t forget to like, comment, and subscribe for more trading tutorials!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

AUD/USD - Sellers remain in control!The AUD/USD pair has been in a clear and consistent downtrend on both the 4-hour and daily timeframes. Sellers have maintained firm control over price action, driving the pair lower while it continues to respect the prevailing bearish market structure. Each failed bullish attempt further validates the dominance of the bears, reinforcing the narrative that the path of least resistance remains to the downside.

Recently, however, the 4-hour chart witnessed a sharp move to the upside, tapping into and filling a previously unmitigated 4H Fair Value Gap (FVG). Despite this temporary rally, the broader structure remains bearish, with the market still printing lower highs and lower lows, a classic hallmark of a sustained downtrend. As such, the current momentum favors a continuation lower, potentially targeting the green imbalance/FVG zone on the 4H timeframe, which aligns with the next logical area of liquidity.

This green FVG also coincides with the golden pocket retracement zone (61.8%–65%), adding confluence and strengthening its validity as a potential support area. A reaction here could provide an opportunity for a short-term bullish correction or even the start of a larger reversal, depending on how price behaves around this level.

That said, a bullish scenario is not entirely off the table. Should price decisively break above the red FVG to the upside, and ideally close above it with conviction, it may signal a potential shift in market sentiment. This would be the first sign of buyers regaining control, suggesting a possible trend reversal or at least a deeper retracement toward higher time frame resistance zones.

Until such confirmation is seen, however, bearish momentum prevails. Traders can continue to favor short setups, with particular interest around premium zones on the 4H chart. Any bullish setups should be approached cautiously and ideally considered only at key areas of support like the green FVG, especially where it aligns with high-probability fib levels.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

AUDUSD Waiting for Pullbacks

Price began a recovery process to the upside since the beginning of this week.

We should be completing wave 1/A pretty soon, and I´ll be looking for 2/B correction for long trades.

Green support would be a very interesting spot for the correction.

To the upside, there is strong resistance just below 0.64 (gray zone).

AUDUSD ShortI noticed we have a bearish structure on the 15m, and the entire push was created from the 15m Orderblock we're currently in. We've had a bearish reaction from there (1m BOS), and now I'm waiting to see if the price will revisit the OB left behind for a potential continuation to the downside.

My first target is 1:3 (30pips) and overall i expect price to fill previous Asia.

AUDUSD - ANALYSIS👀 Observation:

Hello, everyone! I hope you're doing well. I’d like to share my analysis of AUD-USD with you.

Looking at the AUD-USD chart, I expect a slight price decline towards the 50% Fibonacci level, around 0.61138. After this price drop, I anticipate a price increase to around 0.63000.

📉 Expectation:

Bearish Scenario: A slight decline towards 0.61138 (50% Fibonacci level).

Bullish Scenario: After reaching 0.61138, expect a rise to 0.63000.

💡 Key Levels to Watch:

Support: 0.61138

Resistance: 0.63000

💬 What are your thoughts on AUD-USD this week? Let me know in the comments!

Trade safe

AUDUSDWe await a retest and withdrawal of liquidity and a correction to the area we specified at points 0.6135 and 0.61084. From this area, we wait for a confirmation candle and a buy entry, targeting 0.62555. But noticing any movement in the market may change the goals. This is a region, so we will wait and see what update we publish.

Turn or Burn Deep retracement within this current TR. Volume price analysis suggest manipulation as price is rising but demand volume is declining, Either supply is deeply diminished allowing ease of movement or is this slow profit taking by larger interest.

In a bullish scenario price creates momentum to push, close, and maintain above .64080. In what my opinion is more favorable based on market conditions, price takes out one of the previous highs in this range near .64000 where liquidity rest and resumes the htf downtrend. Catalyst being AUD unemployment rates and Fed Powell Speech, FOMO would likely induce a buy trap / false breakout.

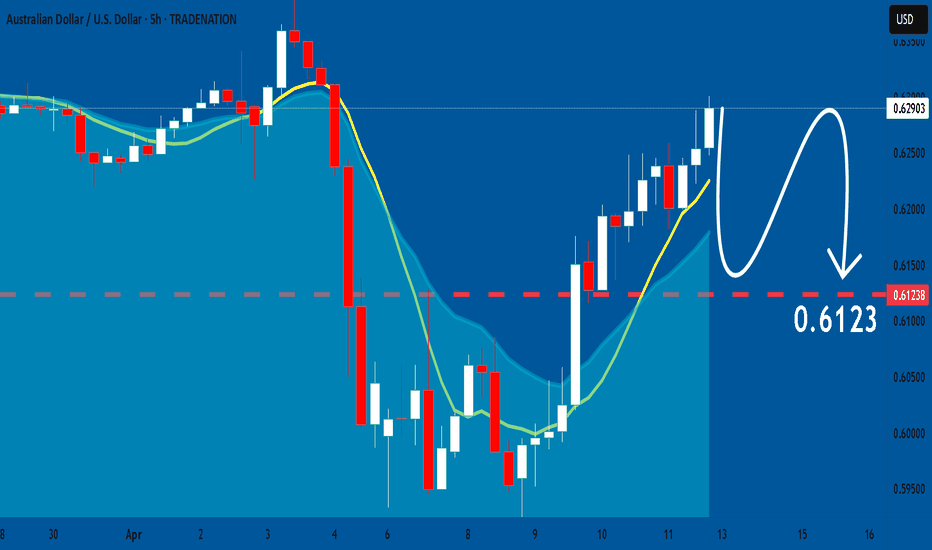

AUDUSD: Expecting Bearish Movement! Here is Why:

The analysis of the AUDUSD chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUD/USD - Potential TargetsDear Fellow Traders,

CPI - Inflation Data Today, be safe.

1) Potential return - "SHORT" to breakout area if trend resistance holds.

2) Strong bullish breakout yesterday, price can also just attempt a minor correction and

continue to rally - "LONG".

Feel free to ask if anything is unclear.

Thank you for taking the time to study my analysis.

AUD/USD - Bullish SetupDaily View - We can actknowedlge that price is currently consolidation within a Large supply zone from where we saw last weeks news.. I would like to see us return into the Demand further down as we will be getting close to being over sold. From there we can notice smaller amounts of Sell side Liquidity to test before powering into Buy side Highs.

Currently we are also testing a Resistance zone which is still currently strong so that tells me price will need to really push through with volume to invalidate this level.

Smaller Time frames suggest a break and retest from this supply zone. If we get a Bearish break and retest I would consider this a fadeout for the favour of resting Liquidity sitting lower to collect as mentioned before.

Please follow for any questions

AUDUSD INTRADAY key resistance retest at 0.6390 AUDUSD maintains a bullish bias, supported by the prevailing upward trend. Recent intraday movement indicates a corrective pullback toward a key consolidation zone, offering a potential setup for trend continuation.

Key Support Level: 0.6266 – previous consolidation range and pivotal support

Upside Targets:

0.6390 – initial resistance

0.6420 and 0.6550 – extended bullish targets on higher timeframes

A bullish breakout from 0.6390 would suggest continuation of the uptrend, confirming buying momentum.

However, a decisive reversal and daily close below 0.6390 would invalidate the bullish structure, opening the door for further retracement toward 0.6266, with additional support at 0.6100 and 0.6030.

Conclusion

AUDUSD remains bullish above 0.6390. A bounce from this level supports further gains. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUD-USD BEARISH BIAS|SHORT|

✅AUD_USD will soon retest a key resistance level of 0.6409

So I think that the pair will make a pullback

And go down to retest the demand level below at 0.6318

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUD/USD (Australian Dollar/U.S. Dollar) oChart AnalysisSure! Here's a detailed description of the chart:

---

### 📈 **Chart Overview**

- **Asset**: AUD/USD (Australian Dollar / U.S. Dollar)

- **Timeframe**: 1-hour (1H)

- **Platform**: TradingView

- **Date/Time**: April 13, 2025

---

### 🧠 **Technical Elements on the Chart**

1. **Trend Context**:

- The chart shows a **downtrend**, followed by a **sharp reversal** and steady **uptrend**.

- The downtrend made lower lows until a significant shift occurred, forming higher lows and higher highs — a potential **trend reversal**.

2. **Highlighted Zones**:

- **Inducement Zone (Purple Box)**:

- Positioned at the top right between **0.63401 and 0.63940**.

- This is likely a **liquidity zone**, where price may entice traders into long positions (buy inducement) before reversing.

- Labeled explicitly as **"Inducement"**.

3. **Support Formations**:

- Two **swing lows** are circled in orange near April 6 and April 9.

- The second low is labeled **"L.S"** — possibly meaning **Liquidity Sweep** or **Left Shoulder** (if part of an inverse head-and-shoulders pattern).

- These lows were followed by a strong upward move, suggesting a **stop-loss hunt** before a bullish rally.

4. **Current Price Action**:

- Price is currently trading around **0.62902**.

- It's moving upward toward the inducement zone, potentially seeking liquidity or a supply reaction.

5. **Shaded Area**:

- A **gray shaded rectangle** projects upward toward the inducement zone.

- Likely represents a **forecasted bullish move**, showing where price is expected to reach before encountering resistance.

---

### 📊 **Price Levels of Interest**:

- **Current Price**: 0.62902

- **Inducement Zone**: 0.63401 – 0.63940

- **Swing Low Support**: Around 0.59559 (marked on the right)

---

### 📌 Summary

The chart illustrates a **liquidity-based trading concept**:

- Price made **equal lows**, swept them (liquidity grab), then reversed bullish.

- Now, it's approaching a **potential trap zone (inducement)**, where smart money may be looking to offload positions or reverse the market.

- The setup implies a **bullish move into resistance**, followed by a possible **bearish reaction**.

AUDUSD is ready to push againNo comment needed. All information is in the chart analysis.

Steps to follow:

Analyze yourself.

Take the position with SL and Take Profits.

Wait, it may take a couple of days, so take a break and step away from the screen from time to time, just like I do :)

Get the result.

I will update the trade every day.

Like, comment with your good mood or viewpoint, share with your circle. It’s together that we get stronger!

Good trades, Traders!

The golden bear

Market Analysis: AUD/USD Gains Pace, Bulls Are Back?Market Analysis: AUD/USD Gains Pace, Bulls Are Back?

AUD/USD started a decent increase above the 0.6150 and 0.6200 levels.

Important Takeaways for AUD USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6000 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6260 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.5940 support. The Aussie Dollar was able to clear the 0.6065 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6200 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6315 zone. A high was formed near 0.6314 and the pair recently started a consolidation phase.

There was a move below the 0.6300 level. The pair remained above the 23.6% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the downside, initial support is near the 0.6260 level. There is also a connecting bullish trend line forming with support at 0.6260. The next major support is near the 0.6220 zone. If there is a downside break below the 0.6220 support, the pair could extend its decline toward the 0.6205 level.

Any more losses might signal a move toward 0.6065 and the 61.8% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6315. The first major resistance might be 0.6340. An upside break above the 0.6340 resistance might send the pair further higher.

The next major resistance is near the 0.6385 level. Any more gains could clear the path for a move toward the 0.6450 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.