AUDUSD INTRADAY key resistance retest at 0.6390 AUDUSD maintains a bullish bias, supported by the prevailing upward trend. Recent intraday movement indicates a corrective pullback toward a key consolidation zone, offering a potential setup for trend continuation.

Key Support Level: 0.6266 – previous consolidation range and pivotal support

Upside Targets:

0.6390 – initial resistance

0.6420 and 0.6550 – extended bullish targets on higher timeframes

A bullish breakout from 0.6390 would suggest continuation of the uptrend, confirming buying momentum.

However, a decisive reversal and daily close below 0.6390 would invalidate the bullish structure, opening the door for further retracement toward 0.6266, with additional support at 0.6100 and 0.6030.

Conclusion

AUDUSD remains bullish above 0.6390. A bounce from this level supports further gains. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

AUDUSD.P trade ideas

AUDUSD Wave Analysis – 14 April 2025- AUDUSD reversed from the long-term support level 0.5945

- Likely to rise to resistance level 0.6400

AUDUSD currency pair recently reversed up from the support area between the major long-term support level 0.5945 (which started the sharp weekly uptrend in 2020) and the lower weekly Bollinger Band.

The upward reversal from this support area created the weekly Japanese candlesticks reversal pattern Bullish Engulfing – strong buy signal for AUDUSD .

Given the clear bullish divergence on the weekly Stochastic indicator and the strongly bearish US dollar sentiment, AUDUSD currency pair can be expected to rise to the next resistance level 0.6400.

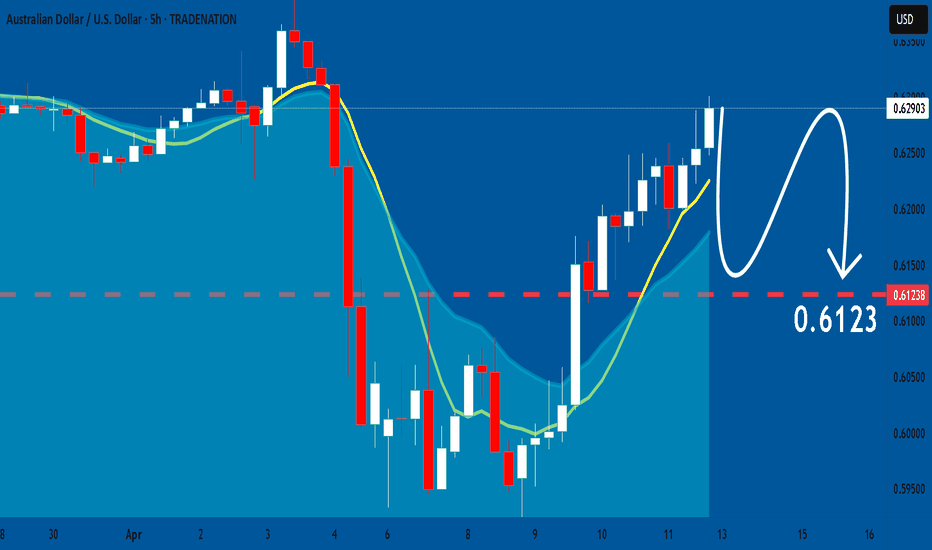

AUD/USD BEARS ARE GAINING STRENGTH|SHORT

Hello, Friends!

We are going short on the AUD/USD with the target of 0.621 level, because the pair is overbought and will soon hit the resistance line above. We deduced the overbought condition from the price being near to the upper BB band. However, we should use low risk here because the 1W TF is green and gives us a counter-signal.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

AUDUSD – Back From the Brink Below 0.6000, But What Next?Last week, AUDUSD was one of the main beneficiaries of the shift from despair, over Donald Trump's seemingly relentless tariff onslaught at the start of the week, to sheer relief into the Friday close, as the US President paused the tariff start date for 90 days. This move saw AUDUSD rally an impressive 5% from opening levels on Monday at 0.5992 to close the week at 0.6290.

Of course, there was a lot for traders to digest across the week, which included headlines regarding the potential for a fresh round of stimulus from Australia's most important trading partner China, to help support its economy through the escalating trade war with the US. Throw in the fact that traders were short AUDUSD and had to rush to cover these positions in response to the China news, as well as adjusting them again once the narrative shifted to a sell dollar story mid week, and you can see why a 5% rally occurred.

That explains last week's move, but where next for AUDUSD in the week ahead?

Traders again could have a lot to consider, including scheduled events, like the release of the RBA minutes at 0230 BST on Tuesday, which may help to give more context to why the Australian central bank decided to leave interest rates unchanged at the start of April.

China GDP, Industrial Production and Retail Sales are released at 0300 BST on Wednesday. The strength of this data could determine whether a more expansive package of stimulus measures are rolled out to support the economy.

Then it may be back to a dollar focus when US Retail Sales are released at 1330 BST on Wednesday. US consumer sentiment has collapsed at the start of 2025 as inflation and job security concerns dominate their outlook. This release may provide an insight into whether weak sentiment is leading to a pullback in spending, which could be bad news for the US economy and corporate earnings later in the year.

On the unscheduled side of things, tariff news may well be important again as traders try and digest further updates from the US and China, as well as news surrounding potential trade deals that are being negotiated between the US and allies.

Technical Outlook: Back To Important Resistance

While on April 9th AUDUSD posted a new correction low at 0.5914, which was the currency pairs lowest level since the March 2020 covid spike low, the balance of the week saw a sharp recovery in price. This rally, while impressive, only appears to have taken prices back to what might potentially be a strong resistance focus for traders in the week ahead.

Fibonacci retracements calculated on previous declines in price can reflect possible important resistance areas to consider when a price recovery is seen. As such, 0.6308, which is equal to the 38.2% retracement of the weakness seen between September 30th 2024 to April 9th 2025, may be a level to monitor.

As the chart above shows, this morning is seeing this 0.6308 resistance level tested, and how this level is defended on a closing basis in the week ahead could be important.

We also know previous highs in AUDUSD can potentially act as resistance levels. This suggests the 3 price failure highs at 0.6389 (April 3rd), 0.6391 (March 17th) and 0.6408 (February 21st) could be important and may possibly add to the strength of resistance just above current levels.

The next possible directional price moves may depend on how the 0.6308 to 0.6408 resistance range is defended on a closing basis.

What if The Resistance Area is Broken?

Of course, resistance up to the 0.6408 level currently remains intact and further significant buying may be required to prompt a successful upside closing break, however, while not a guarantee of future price strength, closes above 0.6408 might be an indication that potential is turning towards further attempts at upside, in which case the next resistance might then be 0.6549, which is equal to the higher 61.8% Fibonacci retracement level.

What if The Resistance Area Caps the Upside?

While the 0.6308/0.6408 resistance area remains intact, it’s possible it can turn directional risks lower again. If AUDUSD prices do turn down it might be that closing breaks of support at 0.6161, which is equal to the 38.2% Fibonacci retracement of latest strength, are required to suggest a deeper phase of price weakness.

Such activity while not confirming a more extended decline in price, might lead to tests of 0.6114, even deeper corrections towards 0.6067, the respective 50% and 61.8% Fibonacci retracement levels.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

AUD/USD - Potential TargetsDear Fellow Traders,

How I see it:

First "SHORT" then "LONG"

My "BEARISH" targets in case Daily "Trend Resistance" holds -

* TP1 & TP 2 as indicated.

My "BULLISH" targets in case Daily "Trend Resistance" are breached -

* TP1 & TP2 as indicated.

Feel free to ask if anything is unclear.

Thank you for taking the time to study my analysis.

Long trade

1Hr TF overview

✅ Trade Breakdown – Buy-Side (AUD/USD)

📅 Date: Thursday, April 10, 2025

⏰ Time: 9:00 AM (NY Time) – London Session AM

📈 Pair: AUD/USD

🧭 Direction: Long (Buy)

📐 Structure TF: 1-Hour (Directional Bias)

🎯 Entry TF: 2-Minute (Precision Entry)

Trade Parameters:

Entry: 0.61804

Take Profit (TP): 0.63266 (+2.37%)

Stop Loss (SL): 0.61588 (–0.36%)

Risk-Reward Ratio (RR): 6.77 🔥

Reason: Being timed with London–NY overlap, the byuside trade idea is assumed prime territory for-accumulation > displacement > continuation > was the reason for entry and buyside directional bias.

Market Analysis: AUD/USD Gains Pace, Bulls Are Back?Market Analysis: AUD/USD Gains Pace, Bulls Are Back?

AUD/USD started a decent increase above the 0.6150 and 0.6200 levels.

Important Takeaways for AUD USD Analysis Today

- The Aussie Dollar rebounded after forming a base above the 0.6000 level against the US Dollar.

- There is a connecting bullish trend line forming with support at 0.6260 on the hourly chart of AUD/USD at FXOpen.

AUD/USD Technical Analysis

On the hourly chart of AUD/USD at FXOpen, the pair started a fresh increase from the 0.5940 support. The Aussie Dollar was able to clear the 0.6065 resistance to move into a positive zone against the US Dollar.

There was a close above the 0.6200 resistance and the 50-hour simple moving average. Finally, the pair tested the 0.6315 zone. A high was formed near 0.6314 and the pair recently started a consolidation phase.

There was a move below the 0.6300 level. The pair remained above the 23.6% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the downside, initial support is near the 0.6260 level. There is also a connecting bullish trend line forming with support at 0.6260. The next major support is near the 0.6220 zone. If there is a downside break below the 0.6220 support, the pair could extend its decline toward the 0.6205 level.

Any more losses might signal a move toward 0.6065 and the 61.8% Fib retracement level of the upward move from the 0.5913 swing low to the 0.6314 high.

On the upside, the AUD/USD chart indicates that the pair is now facing resistance near 0.6315. The first major resistance might be 0.6340. An upside break above the 0.6340 resistance might send the pair further higher.

The next major resistance is near the 0.6385 level. Any more gains could clear the path for a move toward the 0.6450 resistance zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Aussie H4 | Potential bullish bounceThe Aussie (AUD/USD) is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 0.6264 which is a pullback support.

Stop loss is at 0.6170 which is a level that lies underneath an overlap support.

Take profit is at 0.6390 which is a multi-swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

AUDUSD(20250414)Today's AnalysisMarket news:

Fed Collins: It is currently expected that the Fed will need to keep interest rates unchanged for a longer period of time. If necessary, the Fed is "absolutely" ready to help stabilize the market; Kashkari: No serious chaos has been seen yet, and the Fed should intervene cautiously only in truly urgent situations; Musallem: The Fed should be wary of continued inflation driven by tariffs.

Technical analysis:

Today's buying and selling boundaries:

0.6256

Support and resistance levels:

0.6374

0.6330

0.6301

0.6210

0.6182

0.6138

Trading strategy:

If the price breaks through 0.6301, consider buying, the first target price is 0.6330

If the price breaks through 0.6256, consider selling, the first target price is 0.6210

AUDUSD Technical and Order Flow AnalysisOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

Week of 4/13/25: AUDUSD AnalysisDaily bias is bullish, prior week ended bullish with a V shape recovery showing that bulls are in control. As always our MTF internal structure dictates our immediate bias (bullish) and until it breaks, we're continuing our longs.

Price is reaching an important level at the extreme of the HTF supply level so once price gets there, it's good to see what happens next.

Major News: Unemployment Claims - Thursday

Preview strong resistance and also the nec line!Those who are passionate about trading know that this is a tough business. You have to understand that the predictions people make regarding the price movement directions are based on probabilities. There is no such thing as 100 percent direction in the market and that is because the market can turn against you or your direction any time it wants. The reason doesn't even matter, it could be the news of some geopolitical changes, oil cut production or war, or many other factors that could impact the financial market. If you have one or more good reasons that the price will follow a certain direction all you have to do is to take a small risk entry in your direction with a good risk-to-reward ratio and just wait and see how the market will perform. A trader could have 1 good reason or a few reasons why his bias is up or down. The reasons could be based on particular studies, past behavior, fundamentals, technical analysis, or certain observations. The important part for you to understand is that the market is in a continuously changing process this means that yesterday's prediction, today could be irrelevant. The market does not have to follow your analysis. You have to follow the market, observe its changes, and react accordingly to them! I hope some of you will find this helpful, good luck!

AUDUSD: Expecting Bearish Movement! Here is Why:

The analysis of the AUDUSD chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUDUSD Waiting for Pullbacks

Price began a recovery process to the upside since the beginning of this week.

We should be completing wave 1/A pretty soon, and I´ll be looking for 2/B correction for long trades.

Green support would be a very interesting spot for the correction.

To the upside, there is strong resistance just below 0.64 (gray zone).

AUDUSD I Weekly CLS I KL - OB I Model 2, Target - CLS HHey, Market Warriors, here is another outlook on this instrument

If you’ve been following me, you already know every setup you see is built around a CLS range, a Key Level, Liquidity and a specific execution model.

If you haven't followed me yet, start now.

My trading system is completely mechanical — designed to remove emotions, opinions, and impulsive decisions. No messy diagonal lines. No random drawings. Just clarity, structure, and execution.

🧩 What is CLS?

CLS is real smart money — the combined power of major investment banks and central banks moving over 6.5 trillion dollars a day. Understanding their operations is key to markets.

✅ Understanding the behaviour of CLS allows you to position yourself with the giants during the market manipulations — leading to buying lows and selling highs - cleaner entries, clearer exits, and consistent profits.

🛡️ Models 1 and 2:

From my posts, you can learn two core execution models.

They are the backbone of how I trade and how my students are trained.

📍 Model 1

is right after the manipulation of the CLS candle when CIOD occurs, and we are targeting 50% of the CLS range. H4 CLS ranges supported by HTF go straight to the opposing range.

📍 Model 2

occurs in the specific market sequence when CLS smart money needs to re-accumulate more positions, and we are looking to find a key level around 61.8 fib retracement and target the opposing side of the range.

👍 Hit like if you find this analysis helpful, and don't hesitate to comment with your opinions, charts or any questions.

⚔️ Listen Carefully:

Analysis is not trading. Right now, this platform is full of gurus" trying to sell you dreams based on analysis with arrows while they don't even have the skill to trade themselves.

If you’re ever thinking about buying a Trading Course or Signals from anyone. Always demand a verified track record. It takes less than five minutes to connect 3rd third-party verification tool and link to the widget to his signature.

"Adapt what is useful, reject what is useless, and add what is specifically your own."

— David Perk aka Dave FX Hunter ⚔️

AUDUSD Technical Analysis! SELL!

My dear friends,

My technical analysis for AUDUSD is below:

The market is trading on 0.6377 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 0.6324

Recommended Stop Loss - 0.6403

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUD_USD BULLISH BREAKOUT|LONG|

✅AUD_USD is going up now

And the pair made a bullish

Breakout of the key horizontal

Level of 0.6200 which is now

A support and the breakout

Is confirmed so we are locally

Bullish biased and we will be

Expecting a further move up

After a potential pullback

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.