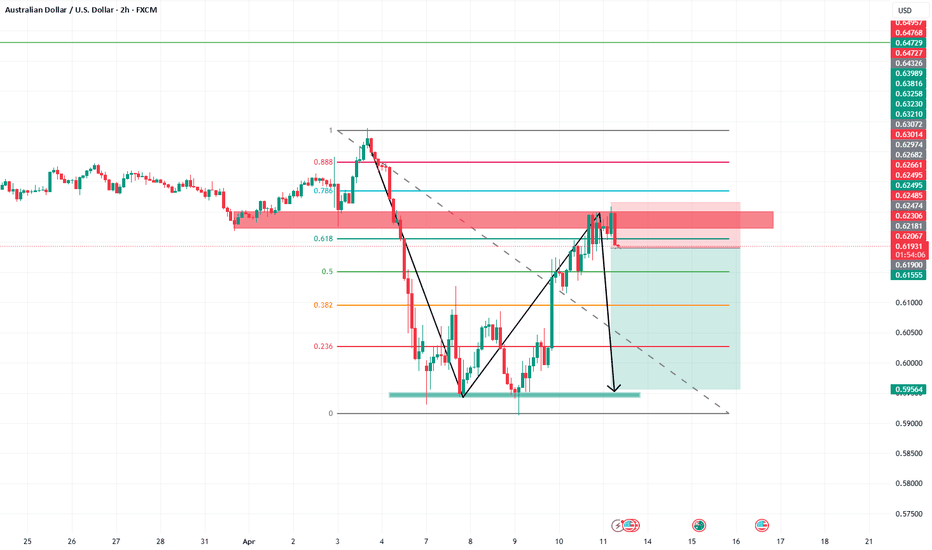

AUDUSD SELL?The market is currently testing the current Daily 0.786 Fib Area and based on 4HR TF, the market seems to be forming a possible reversal pattern which could lead to a possible reversal.

We could see SELLERS coming in strong should the current level hold.

Disclaimer:

Please be advised that the information presented on TradingView is solely intended for educational and informational purposes only.The analysis provided is based on my own view of the market. Please be reminded that you are solely responsible for the trading decisions on your account.

High-Risk Warning

Trading in foreign exchange on margin entails high risk and is not suitable for all investors. Past performance does not guarantee future results. In this case, the high degree of leverage can act both against you and in your favor

AUDUSD.P trade ideas

AUDUSDWe await a retest and withdrawal of liquidity and a correction to the area we specified at points 0.6135 and 0.61084. From this area, we wait for a confirmation candle and a buy entry, targeting 0.62555. But noticing any movement in the market may change the goals. This is a region, so we will wait and see what update we publish.

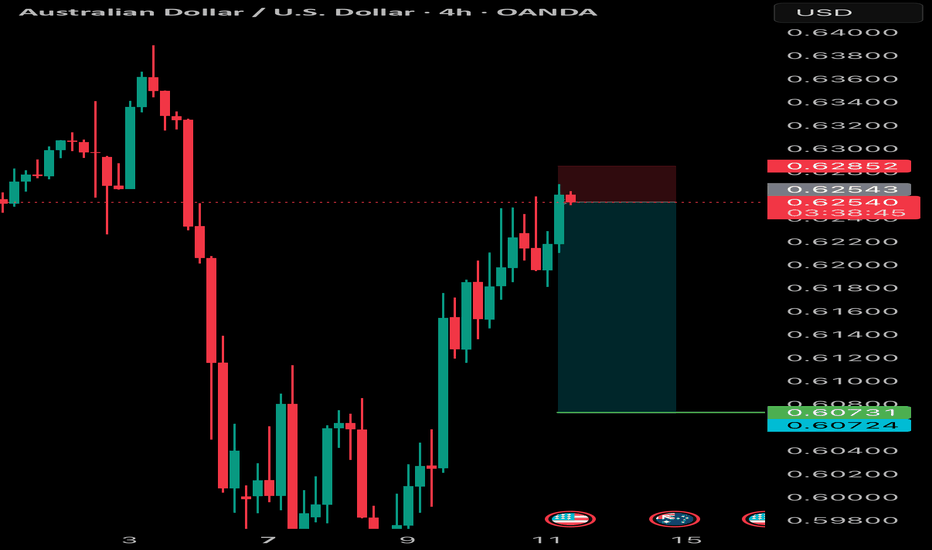

#AUDUSD PERFECT PULLBACK SCENARIOAUDUSD broke structure to the downside earlier and pulled back to this exact zone around 0.62600.

I will now wait for this pullback to complete and confirmation to enter my short trade with 1st target set at 0.60770 and 2nd target set at 0.59.500.

Trade carefully due to PPI news today!

AUDUSD SHORT 📉 AUDUSD: Missed the Entry, But Still Watching Closely! 🔍

I already posted about this one: bearish bias on AUDUSD, but I didn’t manage to enter.

Here’s a quick update with a bit more clarity:

🧠 I still believe a downward move is in the cards, but we’ll need to drop to lower timeframes to catch clean confirmations, find a solid entry, and of course, manage risk with a proper stop.

📌 No rush – let’s stick to the plan and wait for the right moment.

💬 How are you approaching this pair?

Good luck and good analysis, traders! 🚀

AUDUSD Will Fall! Sell!

Please, check our technical outlook for AUDUSD.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a key horizontal level 0.622.

Considering the today's price action, probabilities will be high to see a movement to 0.602.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

AUD/USD Breakdown: Bears in ControlThe AUD/USD pair has officially broken below its medium-term ascending channel on the daily chart, signaling a strong shift in momentum. After failing to hold above the resistance zone at 0.6311 – 0.6386, the pair reversed sharply and is now trading around 0.6213.

🔍 Key technical highlights:

A confirmed breakout beneath the channel support, accompanied by strong bearish candles, suggests growing seller dominance.

Both the EMA 34 and EMA 89 are now positioned well above the current price, reinforcing a medium-term bearish trend.

A potential short-term pullback to the 0.6240 – 0.6266 area may occur before further downside continuation.

📉 Next downside target: If bearish momentum persists and price fails to reclaim the broken support, the pair is likely to slide toward the marked support at 0.59142.

💬 With the USD gaining strength amid hawkish Fed expectations and the AUD facing domestic economic headwinds, selling the rallies remains the favored strategy in the current environment.

AUD/USD Update: Potential Targets Dear Fellow Traders,

4HR Calibration - Post CPI

1) Potential return - "SHORT" to breakout area if bullish trend is breached.

2) Potential continuation of rally - in case of breached trend resistance:

* Imbalance to be filled

Feel free to ask if anything is unclear.

Thank you for taking the time to study my analysis.

AUDUSD(20250411)Today's AnalysisMarket news:

The annual rate of the US CPI in March was 2.4%, a six-month low, lower than the market expectation of 2.6%. The market almost fully priced in the Fed's interest rate cut in June. Trump said inflation has fallen.

Technical analysis:

Today's buying and selling boundaries:

0.6195

Support and resistance levels:

0.6328

0.6278

0.6246

0.6144

0.6112

0.6062

Trading strategy:

If the price breaks through 0.6246, consider buying, the first target price is 0.6278

If the price breaks through 0.6195, consider selling, the first target price is 0.6144

AUDUSD - Wait for 1st Sign of Failed RallyHi Traders, today i'm looking for the first signs of a AUDUSD failed rally. I'm watching on the lower timeframes to see the AUD run out of upside steam, make a break to the downside and then continue downside direction.

Technically; the last few days printed a solid bottom, but downside is likely to be retried towards the 61 cent big figure, and potentially to the 60 cent mark if bears can gather steam.

Watch this space!

AUD\USD SELL IDEASell AUDUSD

Reason:Price has reached our pivot point at 0.62288 a potential reversal formation to the price of 0.61301. Wemight experience a hgher price as market could reach our QML level at 0.63147 where we could there after experience a move down to the QML base at 0.59149

First Entry (Pivot Point)

Entry:0.62439

Tp:0.61301

Sl:40pips

Second Entry(QML)

Entry: 0.63147

Tp1: 0.61301

Tp2: 0.59149

Sl: 20pips above QML head

Disclaimer :This is an idea used for educational purposes, it is not a financial advice or signal for you to take a trade. If you do, do so at your own risk, forex trading may put your funds at risk of losing them. Always trade safe and only risk what can afford to loe

AudusdJust my idea not a trade advice,on m15 and m5 we have a symmetrical triangle awaiting breakout,but it seems pushing more to the upside.On m15 this whole channel is a pattern measured by its flag pole you will fine your tp,and again during this whole consolidation on m1,m5 you will find that price is against a major resistance from your left "h1" and seems more to be breaking it soon

Bearish drop?The Aussie (AUD/USD) is reacting off the pivot and could reverse to the 1st support which lines up with the 38.2% Fibonacci retracement.

Pivot: 0.6228

1st Support: 0.6130

1st Resistance: 0.6314

CAD/JPY is falling towards the pivot which is a pullback support and could bounce to the pullback resistance.

Pivot: 102.61

1st Support: 101.62

1st Resistance: 103.68

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDUSD Long – Fair Value Gap + Macro Confluence + Bullish LEI AUDUSD Swing Long Setup – Technical + Macro Confluence

✅ Bias: Long AUD/SD

Based on a multi-factor thesis:

Macro: RBA steady; AUD LEI rising steadily (87 → 96), Endogenous improving

USD Weakness: Fed dovish + GDP downgraded = downside pressure

Seasonality: USD historically weak entire April