AUDUSD.P trade ideas

AUDUSD InsightHello, subscribers!

Please share your personal opinions in the comments. Don't forget to like and subscribe!

Key Points

- The Reserve Bank of Australia (RBA) kept its benchmark interest rate at 4.10%, citing uncertainties in leading economic indicators, including the impact of President Trump’s tariff policies. Markets expect the RBA to cut rates in May.

- The Washington Post reported that White House staff have drafted a proposal to impose a 20% tariff on most U.S. imports.

- European Commission President Ursula von der Leyen stated that the European Union has the power to negotiate with the U.S. and to retaliate if necessary.

- The March ISM Manufacturing PMI came in at 49.0, indicating that the U.S. manufacturing sector has entered a contraction phase. Meanwhile, the February JOLTS Job Openings report showed 7.57 million job openings, missing market expectations, suggesting a gradual slowdown in the labor market. These two indicators hint at the formation of stagflation in the U.S. economy.

Key Economic Events This Week

+ April 2: U.S. March ADP Nonfarm Employment Change

+ April 4: U.S. March Nonfarm Payrolls, March Unemployment Rate, Fed Chair Powell’s Speech

AUDUSD Chart Analysis

With the market frozen ahead of Trump's reciprocal tariffs, AUDUSD remains largely range-bound. Technically, a short-term rise to 0.63500 is likely, followed by a decline toward 0.60000. However, given potential variables, a breakout above 0.63500 is possible, which could extend gains toward 0.66000.

Potential bullish rise?The Aussie (AUD/USD) has bounced off the pivot and could rise to the 1st resistance.

Pivot: 0.6261

1st Support: 0.6229

1st Resistance: 0.6322

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

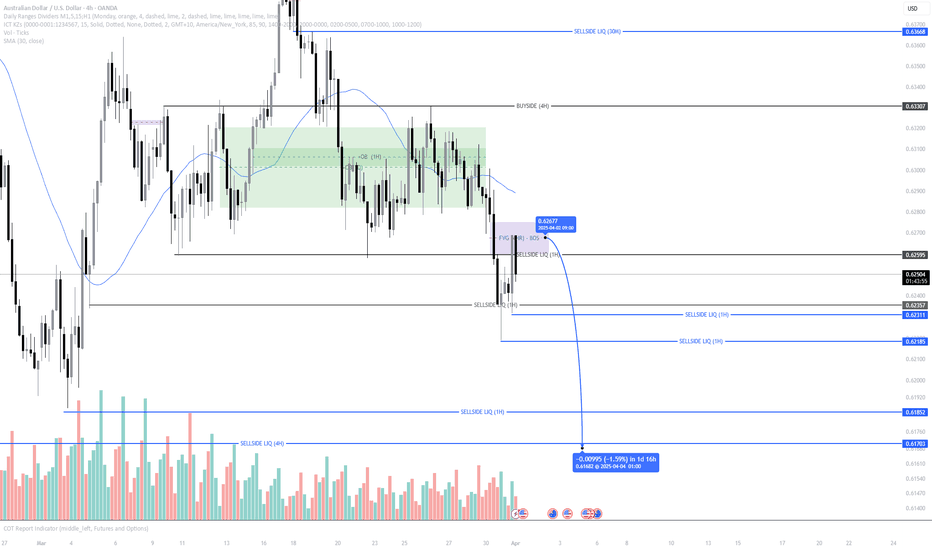

AUD/USD - Sell SetupThis pair has been showing us some choppy price action for a little while now with some small price movements but we are finally starting to see some movements

Higher Time frames show us a break of support as well as a breakout trade from this Liquidity Trend in the Long Term

The Short Term movement Im looking for will be price respecting this Supply zone and sweeping Buy Side Liquidity before taking out our protected Low. I will then refer to my entry model before entering

We currently have sellers momentum, also are below the 200 EMA

Good luck to the Traders that follow

Short trade

Day TF overview

Sellside trade

Mon 31st March 25

5.00 pm (NY Time)

NY Session AM

Structure Day

Entry 4Hr

Entry 0.62668

Profit level 0.61308 (2.17%)

Stop level 0.63038 (0.59%)

RR 3.68

Reason: WMA (100) and EMA (50)

Observed for sellside directional bias

along with the price failing to make a

higher high.

Target 0.382 (PD Array)

4Hr TF overview

AUD_USD WILL FALL|SHORT|

✅AUD_USD is trading in an

Downtrend and the pair

Made a bearish breakout

Then made a retest and

Is going down now again

So we are bearish biased

And a bearish continuation

Is to be expected

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD Triangle Break Looms on Tariff RiskAUDUSD is trading inside a triangle pattern that's been forming for 83 days. A break below 0.6215 could trigger a 188-pip drop, with a 3.82 risk-reward setup. While the RBA held rates at 4.1%, upcoming US tariffs on Liberation Day may pressure the Aussie. Fundamentals and technicals align for a potential bearish move.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information

AUDUSD 4h Descending ChannelAUD/USD Analysis - April 1, 2025 (1H Timeframe)

Trend Overview

The pair is currently in a descending channel, forming lower highs and lower lows—indicating a downtrend.

Price has reached a strong demand zone (purple box) around 0.6240 - 0.6260, which has previously acted as support.

Key Levels to Watch

Support Zone (0.6240 - 0.6260)

If price holds and forms bullish price action (e.g., higher low, engulfing candle), we could see a reversal to the upside toward 0.6280 - 0.6300.

Bullish Confirmation: Break above 0.6260 and a close above the descending trendline.

Resistance Levels:

0.6260 (Immediate resistance & trendline rejection zone)

0.6280 - 0.6300 (Major resistance if the breakout happens)

Bearish Breakdown Scenario

If price fails to break 0.6260 and gets rejected at the trendline, it could lead to a drop toward 0.6220 - 0.6200.

Bearish Confirmation: A strong rejection from 0.6260 or a break below 0.6240.

Trade Scenarios

✅ Bullish Case (Reversal / Breakout)

Entry: Above 0.6260 with confirmation (trendline breakout)

Target 1: 0.6280

Target 2: 0.6300

Stop Loss: Below 0.6235

🔻 Bearish Case (Continuation of Downtrend)

Entry: On rejection at 0.6260 or breakdown below 0.6240

Target 1: 0.6220

Target 2: 0.6200

Stop Loss: Above 0.6270

Conclusion

Watch for price action at 0.6260. A breakout = bullish move, rejection = bearish continuation.

Bias: Neutral for now, waiting for confirmation.

No Rate Hike, No Mercy – AUD/USD Selling in Style!Riding the wave of bearish structure, AUD/USD continues to follow the macro trend with laser precision. After the RBA held rates steady, we’re seeing the typical post-news dump play out—fueled by the market’s disappointment and reduced sentiment.

Technically, price respected the 4H Fair Value Gap (FVG) and showed strong displacement to the downside, confirming continuation.

Key Targets:

🔻 0.62311 – Minor liquidity

🔻 0.62185 – 1H Sell-side liquidity

🔻 0.61703 – Ultimate short-term sell-side target

Expecting the market to bleed lower unless major fundamentals flip the bias. Until then... the trend is your bestie.

DYOR 🧠📉

AUDUSD SELL 0.6280On the daily chart, AUDUSD fluctuated downward, and the bears had the upper hand. At present, you can pay attention to the resistance near 0.6280. If the rebound encounters resistance, you can consider continuing to sell. The support below is around 0.6190. If it falls below, it will go to around 0.6100. If the price breaks through the resistance near 0.6330, it will start to rise.

RBA Holds Their Cash Rate, May Cut Neither Confirmed Nor DeniedThe RBA held their cash rate at 4.1%, and keep a May cut up in the air without any appetite to commit to one. I highlight my observations on the RBA's statement, before updating my analysis for AUD/USD, AUD/CAD and GBP/AUD.

Matt Simpson, Market Analyst at City Index and Forex.com

AUDUSD-SHORTAU is forming a beautiful bearish trend on a 4 hr time frame. AU is also a correlative pair with GA and we see that GA just broke a consolidation zone to the upside giving potential signs of bullish continuation. If AU respects FIB zones, it should continue to the downside to form next lower low. Of course, news will play a role in our bias for now and we will wait for entry before taking sells on AU.

AUDUSD & NZDUSD Sell idea/analysis based on daily timeframeTook this trade based on a downtrend forming and the retest of a H&S on the daily chart with a minimum requirement of 1 lower low and 1 lower high. I saw a bounce before the price touches the previous low on the 4-hour chart, which could shape my 2nd lower high, and I entered the trade.

Why the RBA should cut rates todayThe Reserve Bank of Australia should cut rates today, argues James Glynn in the Wall Street Journal .

Markets, however, expect the central bank to wait until May for its next move. RBA Governor Michele Bullock remains cautious, citing lingering inflation.

But Glynn contends that global uncertainty now outweighs the RBA’s desire to wait for marginal improvements in inflation data. That uncertainty is set to escalate this Wednesday, with the Trump administration announcing sweeping tariffs on U.S. trading partners—likely triggering retaliatory measures.

Andrew Boak, chief economist at Goldman Sachs Australia, appears to support Glynn’s view: “There are costs to waiting until May to cut. Waiting is not always a virtue.”

Is Glynn simply chasing a contrarian headline or is there actually a possibility the RBA could act today?

AUD/USD BUY zone H4 chart analysisAUD/USD:

Trade Setup

Entry: 0.62517

Final Target (TP): 0.64963

Stop Loss (SL): 0.61800 (Below recent support to protect against invalidation)

Support & Resistance Levels

Support Levels: 0.62200 - 0.62500 (Potential demand zone)

Resistance Levels: 0.64000 - 0.64963 (Major supply zone & upper trendline resistance)

Trade Outlook

Bullish Bias: Price is expected to rise from the support zone.

Confirmation Signals: Look for bullish rejection wicks, engulfing candles, or a break above 0.63100 for momentum confirmation.

Risk-to-Reward: Favorable setup with a good upside potential.