AUDUSD.P trade ideas

AUDUSD SHORT DAYTRADING SIGNALStock traders may advise shareholders and help manage portfolios. Traders engage in buying and selling bonds, stocks, futures and shares in hedge funds. A stock trader also conducts extensive research and observation of how financial markets perform. This is accomplished through economic and microeconomic study; consequently, more advanced stock traders will delve into macroeconomics and industry specific technical analysis to track asset or corporate performance. Other duties of a stock trader include comparison of financial analysis to current and future regulation of his or her occupation.

AUDUSD 15M Trade IdeaThe AUDUSD pair is showing strong signs of bullish momentum as we anticipate further upside potential. With an overall positive outlook on the Australian Dollar and supportive technical indicators, this pair is poised for a potential rally. Watch for favorable market conditions that could drive the price higher in the coming sessions.

AUDUSDHello Traders! 👋

What are your thoughts on AUDUSD?

The AUDUSD pair is moving within an ascending channel and has recently broken its downtrend line to the upside. This breakout could signal a continuation of the bullish trend.

We expect the price to make a pullback and correction toward the broken trendline before continuing its upward move towards the channel’s upper boundary.

Don’t forget to like and share your thoughts in the comments! ❤️

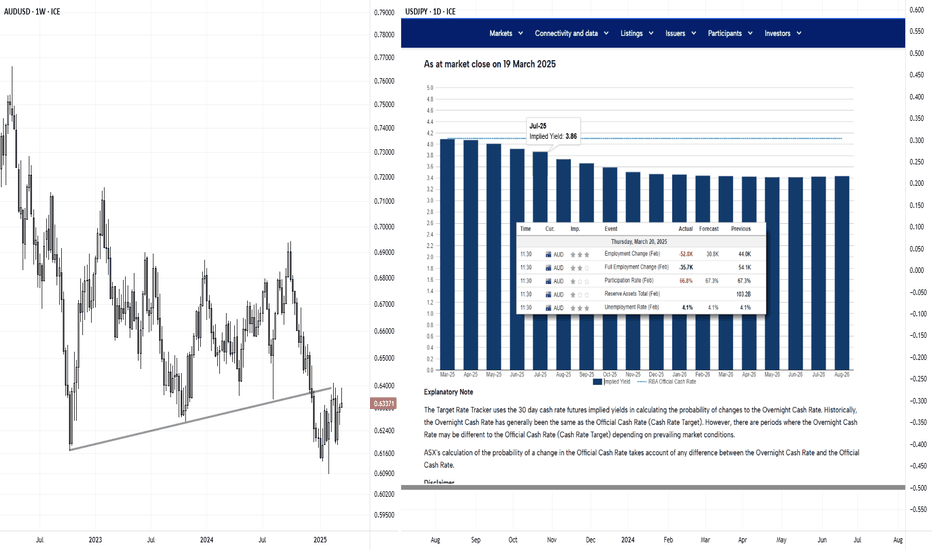

Why the Weak AU Jobs Report Might Not Force the RBA's HandAustralia's employment report for February delivered a surprising set of weak figures. Understandably, markets reacted by pricing in another RBA cut to arrive sooner than later. But if we dig a little deeper, an April or May cut may still not be a given.

Matt Simpson, Market Analyst at City Index and Forex.com

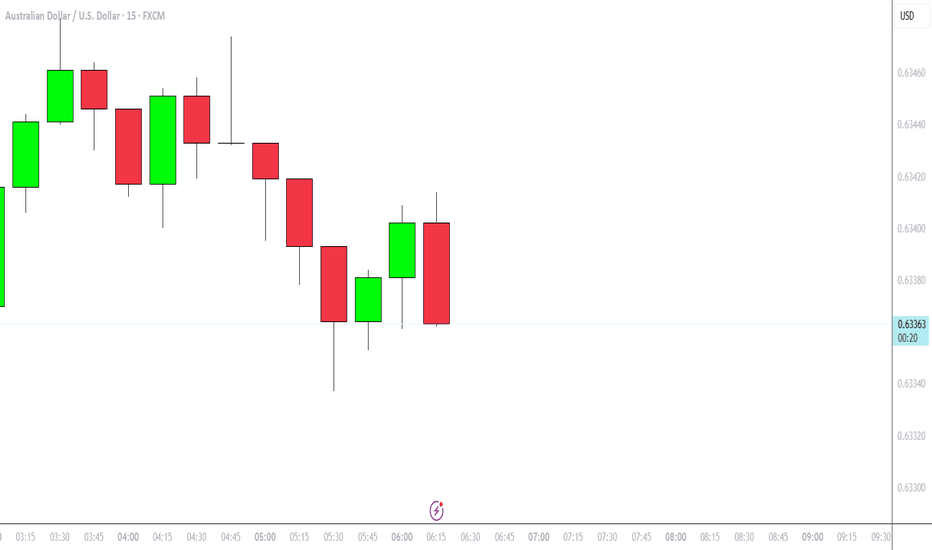

Setup #006 - AUDUSD - Long (Not the cleanest)Trade entered. I used the 5 min for entry but Tradingview doesn't let me post it on a small time frame.

We should find out if this is a winner or loser during the rest of US/UK overlap. I personally think price wants to drop more, but my strategy says to buy, so I'm listening to the strategy, plus there is a nice risk to reward for this trade.

Confluences:

✅ Bullish overall bias

✅ Bulllish demand zone

✅ Bullish ABCD on 15 min chart, bullish impulse crab on H4

✅ Bullish divergence in price reversal zone

✅ Buillish break of structure

✅ Entering NY open

✅ Break of structure confirmed

✅ Required risk:reward met

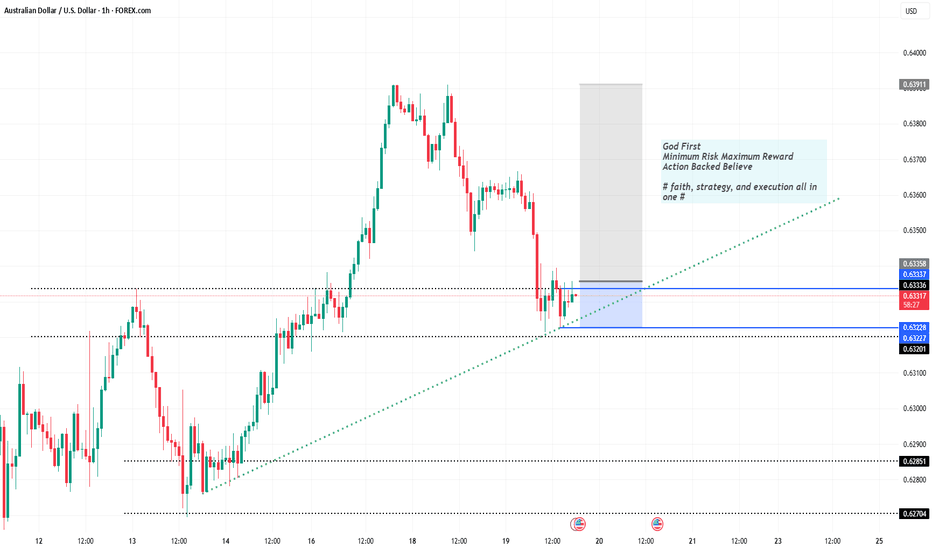

Bullish bounce off 50% Fibonacci support?AUD/USD is reacting off the support level which is a pullback support that aligns with the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 0.6333

Why we like it:

There is a pullback support level that aligns with he 50% Fibonacci retracement.

Stop loss: 0.6298

Why we like it:

There is a pullback support level that line sup with the 78.6% Fibonacci retracement.

Take profit: 0.6387

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

AUDUSD: Growth & Bullish Continuation

The price of AUDUSD will most likely increase soon enough, due to the demand beginning to exceed supply which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AUD/USD (4H timeframe) chart shows a key development:Key Analysis:

Harmonic Pattern & Breakout: The price broke out from the triangle pattern, confirming bullish momentum.

Retest & Buy Zone: The market is currently retesting the breakout level, aligning with the previous resistance turned support.

Trade Setup:

Entry: Around 0.6330 (support zone)

Stop Loss (SL): Below 0.6316

Take Profit (TP): Around 0.6415, targeting previous highs

Trading Outlook:

If price holds above 0.6330, a bullish move toward 0.6400+ is expected.

A break below 0.6316 could invalidate the setup, leading to a deeper correction

WILL AUDUSD STRUCTURE LEADS TO A LONG TRADE?With AUDUSD making HH and HL with this bullish trend results into a long trade for the pair?

N.B!

- AUDUSD price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#audusd

AUDUSD: Pullback From Support 🇦🇺🇺🇸

There is a high chance that AUDUSD will pull back from

the underlined daily support.

As a confirmation, I see a tiny double bottom on an hourly time frame.

Goal - 0.6342

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD Will Go Up! Buy!

Please, check our technical outlook for AUDUSD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 0.632.

Considering the today's price action, probabilities will be high to see a movement to 0.643.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!