AUDUSD D1Given that the price is currently below the 200-period EMA, it is highly probable that it will attempt to retest this level. The observed structure suggests a potential reversal. Specifically, a change in structure has occurred, followed by a retest of the lower zone, a liquidity grab, and a subsequent upward movement. Currently, the price is approaching a significant resistance zone. A retracement is anticipated before a potential breakout

AUDUSD.P trade ideas

AUDUSD Trade idea Here's how I am looking at AUDUSD for next week.

-HTF Trend is bullish

- We're currently struggling to take out the internal structure high, marked with the rectangle.

-If we do take out the high, then we will target the swing structure high 0.6400 region

So I'd be staying reactive to see how things develop on this pair.

Please leave us a like and a follow to encourage us come up with more ideas for the community, thank you

AUD/USD "The Aussie" Forex Market Bullish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Robbers, 🤑💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the AUD/USD "The Aussie" Forex market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise placing Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑: Thief SL placed at 0.62500(swing Trade Basis) Using the 6H period, the recent / nearest low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 0.65670 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

AUD/USD "The Aussie" Forex Market market is currently experiencing a bullish trend,., driven by several key factors.

🔵Market Overview

Current Price: 0.63684

30-Day High: 0.6542

30-Day Low: 0.6147

30-Day Average: 0.6215

🟤Fundamental Analysis

Economic Trends: The Australian economy is expected to grow, driven by a rebound in consumer spending and investment

Interest Rates: The Reserve Bank of Australia is expected to maintain low interest rates, supporting the Australian dollar

🟡Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for commodities, including Australian exports

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for commodities and supporting the Australian dollar

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting currency markets

🔴COT Data

Non-Commercial Traders (Institutional):

Net Long Positions: 55%

Open Interest: 120,000 contracts

Commercial Traders (Companies):

Net Short Positions: 30%

Open Interest: 80,000 contracts

Non-Reportable Traders (Small Traders):

Net Long Positions: 15%

Open Interest: 40,000 contracts

COT Ratio: 2.2 (indicating a bullish trend)

🟠Sentimental Analysis

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +30

🟢Positioning Analysis

Institutional Traders: Net long positions increased by 5% over the past week, indicating growing bullish sentiment

Retail Traders: Net long positions decreased by 2% over the past week, indicating decreasing bullish sentiment

Leverage: The average leverage used by traders has increased to 2.5, indicating growing confidence in the market

⚫Next Move Prediction

Bullish Move: Potential upside to 0.65500-0.66000

Target: 0.65670 (primary target), 0.66000 (secondary target)

Stop Loss: 0.62500 (below the 30-day low)

Risk-Reward Ratio: 1:2 (potential profit of 0.02516 vs potential loss of 0.01267)

⚪Overall Outlook

The overall outlook for AUD/USD is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected growth in the Australian economy, low interest rates, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

AUDUSD: 2 year Channel Down is making a rebound.AUDUSD is neutral on its 1D technical outlook (RSI = 53.859, MACD = 0.001, ADX = 20.007) as the price is consolidating on the 1D MA50. The first 3.5 months of 2025 have been a confirmed bottom for the 2 year Channel Down. All similar bullish waves on such bottoms reached at least the 0.618 Fibonacci retracement level. The trade is therefore long, TP = 0.66350.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

AUDUSD swing sellI identified a break in the uptrend structure on the 1-minute timeframe at the 0.6321 level, indicating a possible shift in market direction. Upon confirmation, I entered a sell position at this level, anticipating a further decline. My target profit is set at 0.6169, aligning with a key support level. To manage risk, I placed a stop-loss above the recent swing high to limit potential losses if the price moves against my position. This trade is based on a structural shift in market momentum, aiming to capitalize on a bearish move following the breakdown of the uptrend.

AUDUSD Price ActionHey traders! It's the last trading day of the week, so let's dive into some analysis on this pair.

We can see that price has grabbed liquidity on both the upside and downside. At the top, a new supply zone has formed, sweeping liquidity from the previous supply zone. On the flip side, there's also a demand zone where liquidity has been collected.

Right now, we’ve got internal liquidity on both sides, making this a solid area to look for trade opportunities. Aim for a 1:3 to 1:5 risk-to-reward ratio—stay disciplined and don't get greedy! Risk management is key.

Wishing you all a profitable day and a great weekend—use it to refine your analysis and come back stronger next week! 📊🔥 Happy trading! 🚀

ORB strategy chatgbt🔍 Key Features

Works best on 15-min charts during New York / London / Asia opens

Handles AUD/USD, Crude Oil, and XRP with high success due to volatility and structure

Shows midline, buy/sell entries, and false breakout warnings

Easily customizable for other instruments and sessions

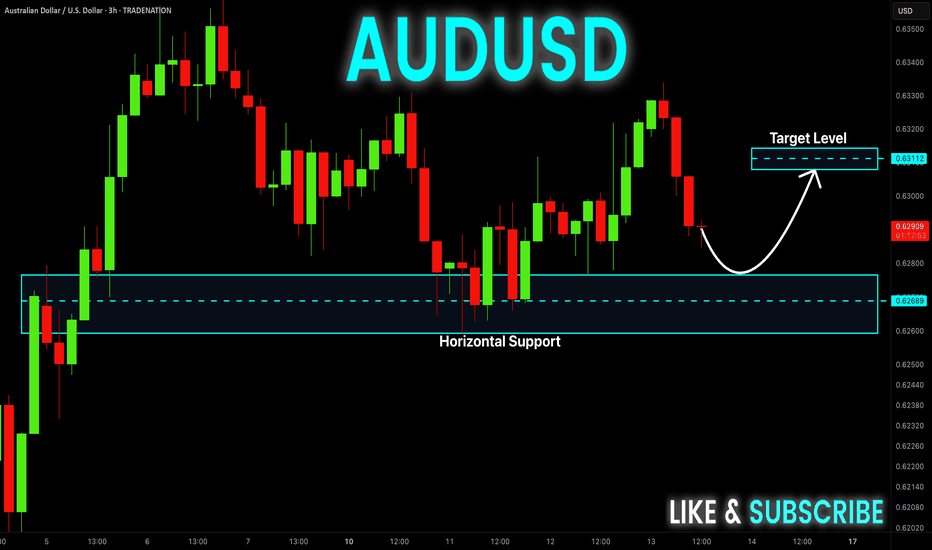

Bearish drop?The Aussie (AUD/USD) is rising towards the pivot which acts as a pullback resistance that line sup with the 61.8% Fibonacci and could drop to the 1st support.

Pivot: 0.6311

1st Support: 0.6272

1st Resistance: 0.6330

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

audusd buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

audusd 4h buy ideaOn the AUDUSD 1D chart, a large bullish channel has formed. Within this channel, a smaller channel broke downward, and the price is now pulling back.

Currently, the price is rising with a bearish pattern, and another smaller pattern has formed inside it. The price is testing its previous high and appears to be rejecting downward. The key level and Fibonacci 0.618 retracement align at the lower point, suggesting that the price may rise toward the previous key level at 0.64584, which is also the upper boundary of the channel.

This chart only includes the smaller timeframe channel for reference.

AUDUSD BUY NOW 120 PipsLooking at the monthly charts, it seems like we've hit a key level where the price has bounced back up nicely. This indicates a shift in the overall trend, making it look like there's potential for some upward movement. Since the DXY (which tracks the strength of the dollar) is weakening, we might be able to ride this wave up and take advantage of the positive momentum in the market. It’s all about following the trend and going with the flow!

Risk to reward is very lovely

Follow me for your support

Thank You

AUDUSD – LONGAUDUSD – LONG

ENTRY PRICE - 0.62850

SL - 0.61800

TP - 0.64900

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

AUDUSD BULLISH OR BEARISH ??? DETAILED ANALYSISAUDUSD is currently trading around 0.62900 and forming a **bearish flag pattern**, a well-known continuation pattern that suggests further downside momentum. After a sharp downward move, price action is consolidating within a parallel channel, indicating a potential breakdown. If the bearish flag confirms with a breakout below the support zone, we could see a strong move toward 0.60900.

Technically, the **0.62500 level acts as a critical support**, and a breakdown below it could accelerate selling pressure. The next key support zone aligns around 0.62000, followed by the ultimate target of 0.60900. Volume confirmation and a decisive close below the flag's lower boundary will strengthen the bearish outlook. Traders should watch for price rejection near resistance levels and any signs of increased selling pressure.

From a fundamental perspective, the **us dollar remains strong amid hawkish Federal Reserve policy**, while risk-off sentiment is weighing on the australian dollar. Factors such as weaker economic data from China, declining commodity prices, and lower demand for high-yielding currencies could further drive audusd lower. Additionally, expectations of **RBA's monetary policy stance** and global risk trends will play a crucial role in shaping the pair’s direction.

In conclusion, audusd is on the verge of breaking out of a **bearish flag pattern**, signaling potential downside movement toward 0.60900. Traders should stay alert for a confirmed breakout with strong bearish momentum, as this setup offers a high-probability trade opportunity.

AUD-USD Support Ahead! Buy!

Hello,Traders!

AUD-USD is going down

And will soon retest a

Horizontal demand level

Of 0.6260 from where we

Will be expecting a local

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trading AUDUSD | Judas Swing Strategy 07/03/2025Last week was a slow one for the Judas Swing strategy, with barely any setups presenting themselves. Throughout the week, we closely monitored the currency pairs we trade ( FX:EURUSD , FX:GBPUSD , OANDA:AUDUSD , and OANDA:NZDUSD ) scouting for setups with the Judas swing strategy. After days of waiting, a promising opportunity finally emerged on $AUDUSD. In this write-up, we’ll take you through the details of how this trade unfolded.

We arrived at our trading desk five minutes before our trading session began and immediately started looking for potential setups. After 35 minutes, we saw a sweep of liquidity at the lows of $AUDUSD. The next requirement on our checklist was to wait for a break of structure (BOS) to the buy side to confirm our bias. An hour later, the BOS finally occurred, leaving us with just one last condition to fulfill before executing our trade.

We saw a retrace into the Fair Value Gap (FVG), completing all the criteria on our entry checklist. With our conditions met, we executed the trade with the following parameters:

Entry: 0.63024

Stop Loss (SL): 0.62822

Take Profit (TP): 0.83431

After executing the trade, we were in profit for a few minutes before price reversed, putting us in deep drawdown. But did this phase us? Not at all. Why? Because we had risked only 1% of our trading account an amount we were fully prepared to lose. This meant that regardless of the trade’s outcome, it wouldn’t affect us emotionally or disrupt our trading mindset.

This is exactly how we want you, as traders, to approach the market. When you risk only what you can afford to lose, you protect yourself psychologically, avoid unnecessary emotional stress, and create the foundation for long term success. Trading with this mindset will allow you to stay disciplined, make rational decisions, and ultimately see better results

When we checked on the trade again, we saw that we were back in profit. We didn’t let this affect our mindset because our objective for this trade had not yet been met. Instead of getting caught up in temporary gains, we remained patient and focused, waiting for the trade to play out fully

Unfortunately, we had to hold this trade longer than expected as we waited for the final outcome. This time our patience didn’t pay off, and our OANDA:AUDUSD trade ended in a loss.

Some of you may be wondering why did we hold for so long? Based on our backtesting data, the odds are in our favor when we take a set-and-forget approach rather than actively managing the trade by moving stops to breakeven after reaching 1R or taking partial profits. We have a system, and we followed it. Our data has shown that sticking to this strategy yields better results over time. As traders, we encourage you to remain disciplined and trust your system. No matter the outcome of a single trade, staying committed to your plan is a win in itself