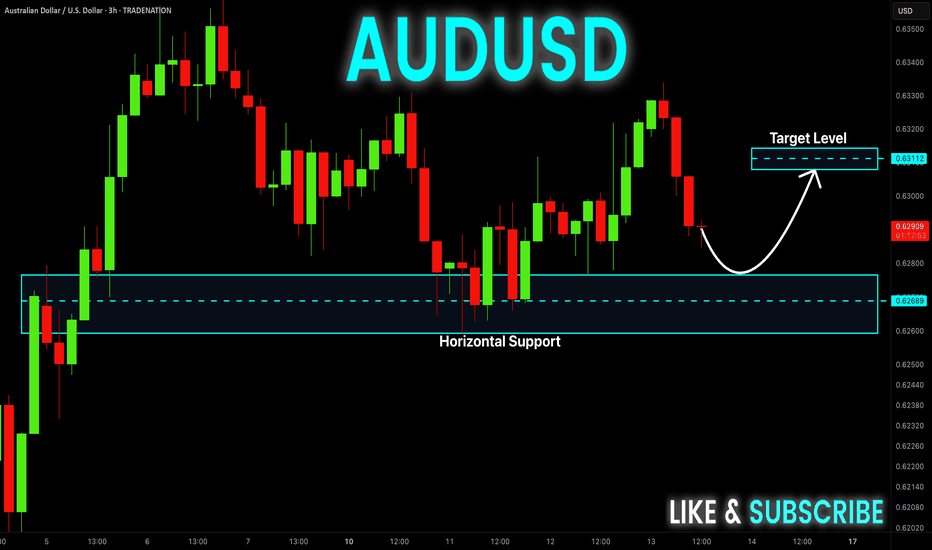

AUD-USD Support Ahead! Buy!

Hello,Traders!

AUD-USD is going down

And will soon retest a

Horizontal demand level

Of 0.6260 from where we

Will be expecting a local

Rebound and a move up

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD.P trade ideas

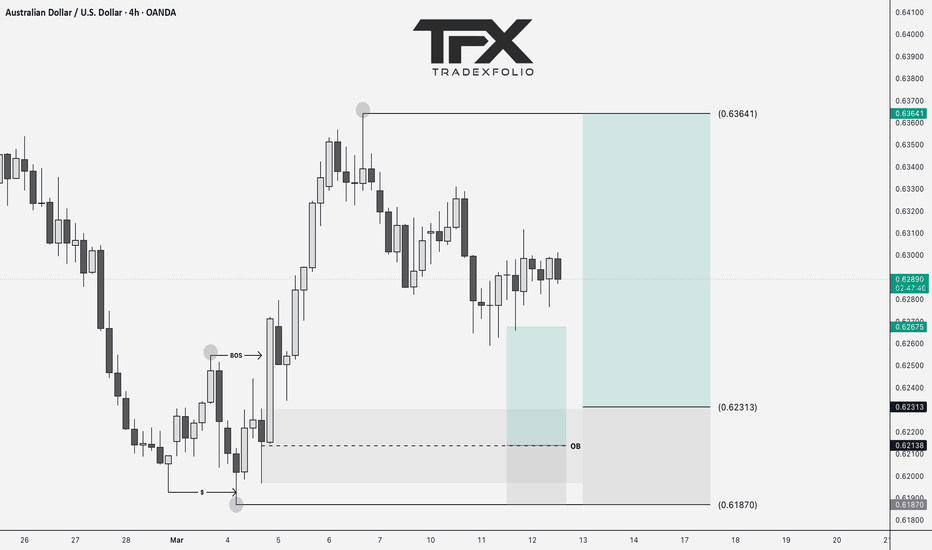

Trading AUDUSD | Judas Swing Strategy 07/03/2025Last week was a slow one for the Judas Swing strategy, with barely any setups presenting themselves. Throughout the week, we closely monitored the currency pairs we trade ( FX:EURUSD , FX:GBPUSD , OANDA:AUDUSD , and OANDA:NZDUSD ) scouting for setups with the Judas swing strategy. After days of waiting, a promising opportunity finally emerged on $AUDUSD. In this write-up, we’ll take you through the details of how this trade unfolded.

We arrived at our trading desk five minutes before our trading session began and immediately started looking for potential setups. After 35 minutes, we saw a sweep of liquidity at the lows of $AUDUSD. The next requirement on our checklist was to wait for a break of structure (BOS) to the buy side to confirm our bias. An hour later, the BOS finally occurred, leaving us with just one last condition to fulfill before executing our trade.

We saw a retrace into the Fair Value Gap (FVG), completing all the criteria on our entry checklist. With our conditions met, we executed the trade with the following parameters:

Entry: 0.63024

Stop Loss (SL): 0.62822

Take Profit (TP): 0.83431

After executing the trade, we were in profit for a few minutes before price reversed, putting us in deep drawdown. But did this phase us? Not at all. Why? Because we had risked only 1% of our trading account an amount we were fully prepared to lose. This meant that regardless of the trade’s outcome, it wouldn’t affect us emotionally or disrupt our trading mindset.

This is exactly how we want you, as traders, to approach the market. When you risk only what you can afford to lose, you protect yourself psychologically, avoid unnecessary emotional stress, and create the foundation for long term success. Trading with this mindset will allow you to stay disciplined, make rational decisions, and ultimately see better results

When we checked on the trade again, we saw that we were back in profit. We didn’t let this affect our mindset because our objective for this trade had not yet been met. Instead of getting caught up in temporary gains, we remained patient and focused, waiting for the trade to play out fully

Unfortunately, we had to hold this trade longer than expected as we waited for the final outcome. This time our patience didn’t pay off, and our OANDA:AUDUSD trade ended in a loss.

Some of you may be wondering why did we hold for so long? Based on our backtesting data, the odds are in our favor when we take a set-and-forget approach rather than actively managing the trade by moving stops to breakeven after reaching 1R or taking partial profits. We have a system, and we followed it. Our data has shown that sticking to this strategy yields better results over time. As traders, we encourage you to remain disciplined and trust your system. No matter the outcome of a single trade, staying committed to your plan is a win in itself

AUDUSD SHOOTING UP?AUDUSD about to shoot up on both small timeframe and higher timeframe, we have some bullish momentum and buyers are more than sellers which means the market is about to continue up for some time, studying the chart and the use of S&R and some trend lines I've come to the conclusion that AUDUSD will shoot up🚀 , let's wait and see how it plays out

comment your views on AUDUSD😊

AUDUSD BUY signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

AUD/USD Trade Setup (Multi-Timeframe Analysis)Trade Bias: Bearish

Looking at all three timeframes, we're in a bearish cycle on the 4H chart after a recent rejection from the 0.6340-0.6360 resistance zone. On the 1H chart, we can see a recent pullback that may be losing momentum, setting up a potential continuation of the downtrend.

Entry Price: 0.6287

Looking to enter short on the current pullback to the 0.6285-0.6290 zone, which aligns with previous support/resistance levels.

Stop Loss: 0.6320

Placing the stop loss above the recent swing high on the 1H chart, keeping the risk within your 35 pip maximum.

Take Profit Levels:

Primary TP: 0.6235 (Previous support zone from March 8-9)

Extended TP: 0.6190 (Major support from early March)

Risk-to-Reward Ratio:

Primary TP: 1:1.5 (33 pips risk for 52 pips reward)

Extended TP: 1:2.9 (33 pips risk for 97 pips reward)

Trade Rationale:

The AUD/USD shows bearish pressure across multiple timeframes:

On the 4H chart:

Price is in a bearish structure after rejection from the 0.6400 level

Current upward movement appears to be a countertrend pullback

The pair is showing resistance at the 0.6320-0.6340 zone

On the 1H chart:

Failed rally attempt with lower highs being formed

Price is showing resistance near 0.6310-0.6320

Overall structure suggests a potential continuation of the downtrend

On the 15m chart:

Recent bullish momentum appears to be waning

Price is struggling to break above recent resistance levels

Entry Triggers and Trade Management:

Wait for rejection candles at the 0.6285-0.6290 zone (bearish engulfing, shooting star, or doji)

Consider partial profit-taking at the primary target (0.6235)

Move stop loss to breakeven after price moves 25+ pips in favor

Consider trailing stop for the remainder of the position if targeting the extended TP

This bearish setup offers favorable risk-reward while aligning with the multi-timeframe technical structure. The current position of price near resistance levels provides a good entry opportunity with defined risk.

#AUDUSD FALLING WEDGEAUDUSD has formed a falling wedge on the 4h chart which implies a breakout to the upside, however, today's CPI will have an impact on whether we go lower first before the breakout.

There is a chance AUDUSD may touch 0.62 first before the bounce up and in this case, the next resistance is at 0.6355 (white zone).

If a breakout does occur in the short-term, the next target to the upside will be the 0.64 resistance zone (blue zone).

AUDUSD Analysis Today: Technical and Order Flow Analysis !In this video I will be sharing my AUDUSD analysis today, by providing my complete technical and order flow analysis, so you can watch it to possibly improve your forex trading skillset. The video is structured in 3 parts, first I will be performing my complete technical analysis, then I will be moving to the COT data analysis, so how the big payers in market are moving their orders, and to do this I will be using my customized proprietary software and then I will be putting together these two different types of analysis.

AUDUSD | H4 Market OutlookWait for a retest of the entry level before taking a buy trade. If the price does not revisit this level, avoid entering the trade. Also, since the USD CPI release is today, remove the limit order before the news announcement. If the entry criteria remain valid after the news, we can still enter the trade.

AUDUSD InsightHello, Subscribers!

Great to see you all. Please share your personal opinions in the comments. Don’t forget to like and subscribe!

Key Points

- The U.S. and Ukraine have agreed in a joint statement to a 30-day ceasefire in the Russia-Ukraine war.

- Germany’s Green Party, which had opposed easing the "debt limit," has now shown openness to negotiations.

- In response to Canada’s tariff surcharge on U.S. electric products, President Trump imposed an additional 25% tariff on Canadian steel and aluminum. However, both countries have since withdrawn these measures.

Key Economic Events This Week

+ March 12: U.S. February CPI, Bank of Canada interest rate decision

+ March 13: U.S. February PPI

+ March 14: Germany February CPI

AUDUSD Chart Analysis

After facing resistance at the 0.64000 level and pulling back, AUDUSD appeared to rebound from the 0.62000 level. However, the upside remains limited. While a slight upward movement is still possible, the pair is likely to face resistance again and form a bottom near the 0.60000 level.

AUD/USD - Trade IdeaHere we are currently looking at long positions, this can also been considered as a breakout Trade.

We have a Liquidity Trend Line that we are respecting.

We are currently in short sell positions into the two possible demand zones. I would prioritise our second Demand zone as that would be between our 71% level.

From there I will be looking for long Term Breakout trades

AUDUSD - Trade IdeaHi everyone! The AUD/USD looks bearish on the daily and 4-hour time frames and is following a downtrend momentum. After creating a CHoCH and BOS on the 1-hour time frame, I decided to short this trade when it retests the 15 OB. Below is my trade idea; please conduct your own analysis before entering any trades.

Sell limit order

Entry @ 0.63265

SL - 0.63645, 38pips

TP1 - 0.62885, 38pips

TP2 - 0.62500, 76pips

TP3 - 0.61885, 138pips

Have a great trading week ahead

Golden Waves of AUD: Short & Mid-Term Uptrend📈 AUD Analysis on Short & Mid-Term Timeframes

🔍 Although the country remains somewhat ambiguous, the market is correcting upward.

💡 The completion of the ABC wave is expected to further boost the uptrend.

🎯 The key mid-term level is 0.62858; maintaining this level could lead to a continuation of the uptrend towards 0.64400.