AUDUSD Technical and Order Flow AnalysisOur analysis is based on multi-timeframe top-down analysis & fundamental analysis.

Based on our view the price will rise to the monthly level.

DISCLAIMER: This analysis can change anytime without notice and is only for assisting traders in making independent investment decisions. Please note that this is a prediction, and I have no reason to act on it, and neither should you.

Please support our analysis with a like or comment!

AUDUSD.P trade ideas

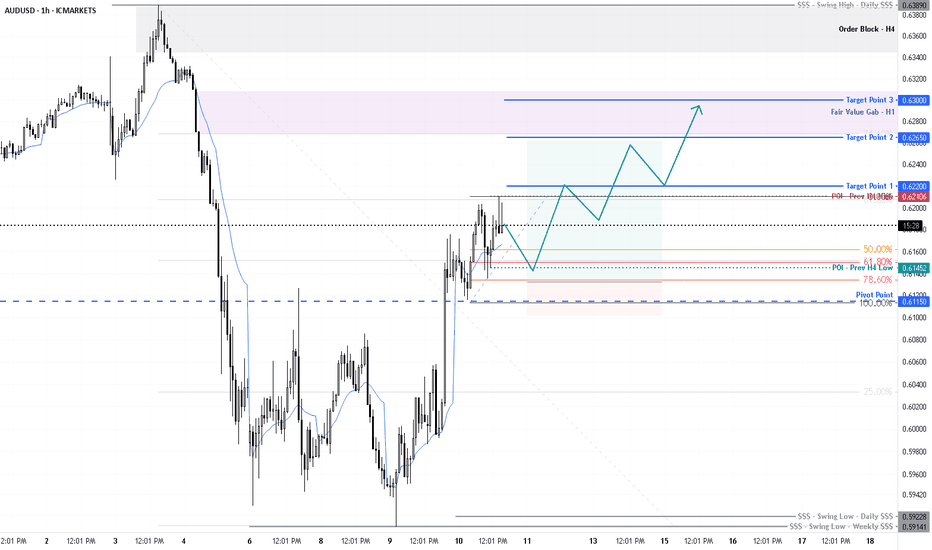

Week of 4/13/25: AUDUSD AnalysisDaily bias is bullish, prior week ended bullish with a V shape recovery showing that bulls are in control. As always our MTF internal structure dictates our immediate bias (bullish) and until it breaks, we're continuing our longs.

Price is reaching an important level at the extreme of the HTF supply level so once price gets there, it's good to see what happens next.

Major News: Unemployment Claims - Thursday

AUD_USD BULLISH BREAKOUT|LONG|

✅AUD_USD is going up now

And the pair made a bullish

Breakout of the key horizontal

Level of 0.6200 which is now

A support and the breakout

Is confirmed so we are locally

Bullish biased and we will be

Expecting a further move up

After a potential pullback

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDUSD SHORT 📉 AUDUSD: Missed the Entry, But Still Watching Closely! 🔍

I already posted about this one: bearish bias on AUDUSD, but I didn’t manage to enter.

Here’s a quick update with a bit more clarity:

🧠 I still believe a downward move is in the cards, but we’ll need to drop to lower timeframes to catch clean confirmations, find a solid entry, and of course, manage risk with a proper stop.

📌 No rush – let’s stick to the plan and wait for the right moment.

💬 How are you approaching this pair?

Good luck and good analysis, traders! 🚀

AUD/USD Update: Potential Targets Dear Fellow Traders,

4HR Calibration - Post CPI

1) Potential return - "SHORT" to breakout area if bullish trend is breached.

2) Potential continuation of rally - in case of breached trend resistance:

* Imbalance to be filled

Feel free to ask if anything is unclear.

Thank you for taking the time to study my analysis.

AUDUSD(20250411)Today's AnalysisMarket news:

The annual rate of the US CPI in March was 2.4%, a six-month low, lower than the market expectation of 2.6%. The market almost fully priced in the Fed's interest rate cut in June. Trump said inflation has fallen.

Technical analysis:

Today's buying and selling boundaries:

0.6195

Support and resistance levels:

0.6328

0.6278

0.6246

0.6144

0.6112

0.6062

Trading strategy:

If the price breaks through 0.6246, consider buying, the first target price is 0.6278

If the price breaks through 0.6195, consider selling, the first target price is 0.6144

AudusdJust my idea not a trade advice,on m15 and m5 we have a symmetrical triangle awaiting breakout,but it seems pushing more to the upside.On m15 this whole channel is a pattern measured by its flag pole you will fine your tp,and again during this whole consolidation on m1,m5 you will find that price is against a major resistance from your left "h1" and seems more to be breaking it soon

Bearish drop?The Aussie (AUD/USD) is reacting off the pivot and could reverse to the 1st support which lines up with the 38.2% Fibonacci retracement.

Pivot: 0.6228

1st Support: 0.6130

1st Resistance: 0.6314

CAD/JPY is falling towards the pivot which is a pullback support and could bounce to the pullback resistance.

Pivot: 102.61

1st Support: 101.62

1st Resistance: 103.68

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

AUDUSD Long – Fair Value Gap + Macro Confluence + Bullish LEI AUDUSD Swing Long Setup – Technical + Macro Confluence

✅ Bias: Long AUD/SD

Based on a multi-factor thesis:

Macro: RBA steady; AUD LEI rising steadily (87 → 96), Endogenous improving

USD Weakness: Fed dovish + GDP downgraded = downside pressure

Seasonality: USD historically weak entire April

AUDUSD – Bullish Trade Setup (1H Short-Term Divergence)✅ Market Snapshot:

Pair: AUDUSD

Timeframe: 1 Hour

Direction: Short-Term Bullish

Signal: Bullish Divergence – Lower lows on price, higher lows on RSI/MACD

Bias: Reversal or retracement likely from recent bearish leg

🔍 Technical Confluence:

Divergence confirms slowing bearish momentum

Price reacting from an intraday support zone or demand area

Candle Structure: Early signs of bullish pressure – e.g. doji, bullish engulfing

📈 Trade Plan – LONG Setup

Entry:

On confirmation candle after divergence

Or breakout of a micro-resistance on 1H timeframe

Stop Loss:

Below the recent swing low (beneath divergence)

Take Profit:

TP1: Previous structure high on 1H

TP2: Near 0.618 Fibonacci retracement of last bearish move

Risk-to-Reward: Aim for 1:1.5 or 1:2

⚠️ Things to Watch:

USD news events that may increase volatility

If price makes another lower low without divergence, setup may weaken

Best paired with a break of trendline or order block confirmation

Connecting Your Tickmill Account to TradingView: A Step-by-Step In this step-by-step guide, we’ll show you exactly how to connect your Tickmill account to TradingView in just a few seconds.

✅ Easy walkthrough

✅ Real-time trading from charts

✅ Tips for a smooth connection

Don’t forget to like, comment, and subscribe for more trading tutorials!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Examples of invalid setups | Judas Swing Strategy 07/04/2025As traders, it's crucial to spend time in the lab backtesting your strategy and exploring ways to optimize it for better performance in live markets. You’ll start to notice recurring patterns, some that work in your favor, and others that consistently lead to unnecessary losses. It might take time to spot these patterns and even longer to refine them to fit your trading system, but going through this process is what helps you evolve. In the long run, this is what you need to do to become a better trader.

We spent a considerable amount of time refining our entry technique for the Judas Swing strategy after noticing a recurring issue where entering with a limit order sometimes gets us stopped out on the very same candle. After testing a few alternative entry methods and making some key adjustments, we finally found an approach that worked consistently for us. On Monday, April 7th, 2025, this refinement proved its worth by saving us from two potentially painful losses. In this post, we’ll walk you through exactly what happened and how the improved entry made all the difference.

We got to our trading desks ready to scout for setups and were drawn to promising setups forming on both FX:AUDUSD and $NZDUSD. This was exciting since the previous week offered no solid trading opportunities. As price swept the liquidity resting above the highs of the zone our bias quickly shifted toward potential selling setups for the session. But before taking any trade, we always ensure every item on our entry checklist is met. Here’s what we look for:

1. A break of structure to the sell side

2. The formation of a Fair Value Gap (FVG)

3. A retracement into the FVG

4. Entry only after a confirmed candle close

With the first two requirements on our checklist confirmed, all that remained were the final two and at this stage, patience is key. As price began retracing toward the FVG on both FX:AUDUSD and OANDA:NZDUSD , things got interesting. Price came into the Fair Value Gap on both pairs, checking off the third requirement. Now, all that was left was to wait for the current candle to close.

But that’s where things will be clear to you now.

Had we jumped in early with a limit order, we would’ve been stopped out on the same candle. This moment served as a perfect reminder of why we now wait for a confirmed candle close before taking any trade. It’s this extra step that helps us avoid unnecessary losses and stick to high-quality setups.

This entry technique like any other, comes with its own set of pros and cons. At times a limit order might offer a more favorable entry price compared to waiting for a candle close and that can influence both your stop-loss and take-profit placements. On the flip side, there are also instances where waiting for the candle close gives you a better entry than the limit order would have. That’s why it’s so important to backtest.

Your job as a trader is to put in the time to study and test what works best for your system. We chose this candle close entry method because we did the work. After extensive backtesting and data analysis, we found this approach aligns best with the results we aim for in the long run.

AUD/USD - Potential TargetsDear Fellow Traders,

CPI - Inflation Data Today, be safe.

1) Potential return - "SHORT" to breakout area if trend resistance holds.

2) Strong bullish breakout yesterday, price can also just attempt a minor correction and

continue to rally - "LONG".

Feel free to ask if anything is unclear.

Thank you for taking the time to study my analysis.

A correction to my previous read of AUDUSDI had to correct my reading of AUDUSD, and taking another look at it, it also makes more sense now.

It had a little more correction to finish, and I believe it has now finished the correction it has been in since '21, and here finished what I call the Z wave.

Now I'm waiting for the pullback into the green box in the area of 0.60588 - 0.60244 where it will finish the second wave.

It might go a little lower to the fiblevel 0.786 but price has no business under 0.59138 level.

Then this count will be invalidated.

If this truly is a new impulse, then after visiting the green box price should go all the way up to minimum of 0.64314 and go into the yellow box area, before it will start the 4th wave correction.

I can't see this as being a A-B-C correction, BUT if it is, price would slow down at the 0.62640 level and eventually end at 0.63220 level. But this is not my favored count.

You are welcome to give me your thoughts on this.