bchusdt is getting ready for the big dump???Hello, friends, to answer the above question, we need to check the chart. In the 4-hour chart, we see a strong downward trend and a slightly complicated correction, which can be a sign of the beginning of a price drop to lower levels in case of a strong failure of the price support at the level of $315. In addition, a negative hidden divergence in rsi increases the probability of its occurrence. If the price breaks the level of 355 upwards, this possibility will be ruled out.

BCHBULLUSDT trade ideas

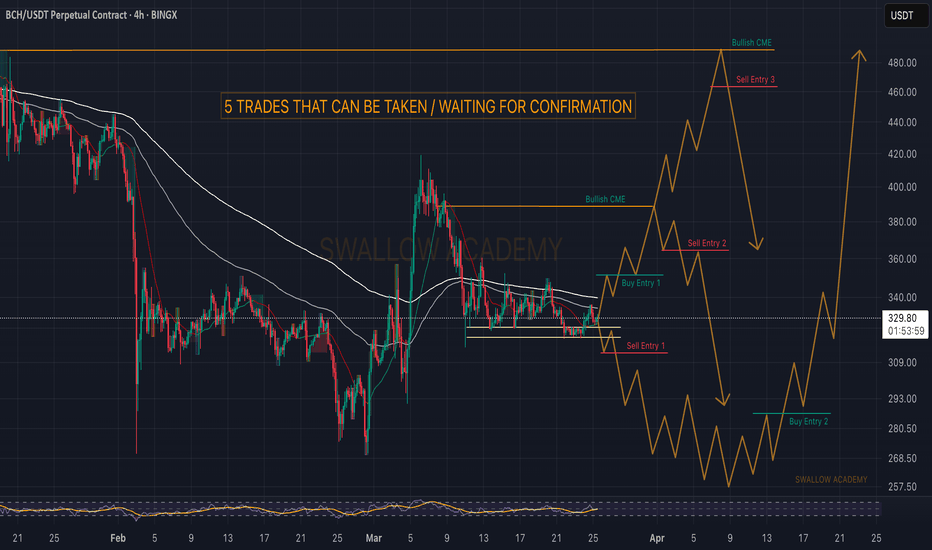

Bitcoin Cash (BCH): 5 Possible Trades That Can Be TakenWell, BCH coin has 2 bullish CME gaps that we have not yet filled while price is still below the 200EMA struggling to breakout from it.

With lots of uncertainty on the chart currently, we have put 5 possible trades that we are going to look for on Bitcoin Cash.

Buy Trades: Possible Moves

Buy Entry 1: Once we see a breakout from the 200EMA line and we see a successful re-test of it, we are going to look for long up until the first bullish CME near $385.

Buy Entry 2: If we see markets to dip more, then BCH will follow with testing to local lows, where we will be looking for some kind of market structure break to occur, which would give us the confidence for upward movement.

Sell Trades: Possible Moves

Sell Entry 1: If we see a breakdown from local support at $320 and sellers manage to secure it with proper re-test, we will be seeing a dip towards the $275.

Sell Entry 2: Once we see the fill of bullish CME and first signs of weakness, we are going to look for market structure breaks on smaller timeframes like 30M, where then we would be looking for movement towards the 200EMA (for a quick re-test).

Sell Entry 3: If we see a huge optimistical push currently that would break both Bullush CMEs and reach the highest one, then we will be looking for a quick rejection there without any MSB to form, just pure volatility hunting!

Get ready, and let's see what we will end up with.

Swallow Team

BCH/USDT "Bitcoin Cash vs Tether" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the BCH/USDT "Bitcoin Cash vs Tether" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the MA breakout (360.00) then make your move - Bullish profits await!"

however I advise placing Place Buy limit orders within a 15 or 30 minute timeframe. Entry from the most recent or closest low or high level should be in retest.

Stop Loss 🛑:

Thief SL placed at the recent / nearest low level Using the 4H timeframe (320.00) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

1st Target - 420.00 (or) Escape Before the target

Final Target - 500.00 (or) Escape Before the target

Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

BCH/USDT "Bitcoin Cash vs Tether" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

🟤Fundamental Analysis

Bitcoin Cash Adoption: Growing adoption of Bitcoin Cash as a payment method, with increasing transaction volumes

Block Reward Halving: The upcoming block reward halving in April 2025 is expected to reduce Bitcoin Cash's block reward, potentially increasing demand and prices

Competition from Other Cryptocurrencies: Increasing competition from other cryptocurrencies, such as Bitcoin and Ethereum, may impact Bitcoin Cash's market share

🔴Macro Economics

Global Economic Trends: The ongoing global economic recovery is expected to drive up demand for cryptocurrencies, including Bitcoin Cash

Inflation Rate: Global inflation is expected to rise to 3.8% in 2025, potentially increasing demand for cryptocurrencies as a hedge against inflation

Interest Rates: Central banks are expected to maintain low interest rates in 2025, supporting cryptocurrency markets

🟠COT Data

Net Long Positions: Institutional traders have increased their net long positions in Bitcoin Cash to 55%

COT Ratio: The COT ratio has risen to 2.2, indicating a bullish trend

Open Interest: Open interest in Bitcoin Cash futures has increased by 15% over the past month, indicating growing investor interest

🟣Sentimental Outlook

Institutional Sentiment: 60% bullish, 40% bearish

Retail Sentiment: 55% bullish, 45% bearish

Market Mood: The overall market mood is bullish, with a sentiment score of +35

🟡Technical Analysis

Moving Averages: 50-period SMA: 320.00, 200-period SMA: 300.00.

Relative Strength Index (RSI): 4-hour chart: 64.21, daily chart: 60.14.

Bollinger Bands: 4-hour chart: 343.00 (upper band), 320.00 (lower band).

🟢Market Overview

Current Price: 343.00

Daily Change: 3.1%

Weekly Change: 12.5%

🔵Overall Outlook

The overall outlook for BCH/USDT is bullish, driven by a combination of fundamental, technical, and sentimental factors. The expected increase in Bitcoin Cash adoption, upcoming block reward halving, and bullish market sentiment are all supporting the bullish trend. However, investors should remain cautious of potential downside risks, including changes in global economic trends and unexpected regulatory developments.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

📌Please note that this is a general analysis and not personalized investment advice. It's essential to consider your own risk tolerance and market analysis before making any investment decisions.

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

Warning: BCHUSDT Is Approaching a Dangerous Trap ZoneYello, Paradisers! Are you ready for what could be the next classic fakeout setup? BCHUSDT is heading straight into a high-probability reversal zone, and if you’re not paying attention, this could turn into another painful reminder of how quickly things change in crypto…

💎BCHUSDT is currently showing signs of weakness as it moves toward a major resistance zone. This area is reinforced by a 4H Fair Value Gap (FVG) and the critical 0.618 Fibonacci retracement level — both of which have historically acted as strong reversal points.

💎Adding to the confluence, we’re spotting clear bearish divergence on the chart, which further increases the likelihood of a downward move from this level.

💎If BCHUSDT taps into our resistance zone, we’ll be monitoring for bearish price action confirmation.

💎Ideal patterns to validate the setup include: M-formation, Head & Shoulders, Inverse Cup & Handle.

💎These patterns can help us reduce our stop-loss exposure and improve the overall risk-to-reward ratio — patience will be key here.

💎On the flip side, if price breaks out and closes above our invalidation level, the bearish setup will be completely invalidated. In that scenario, it’s smarter to wait for new, more favorable price action before making any trading decisions.

🎖This is the kind of moment that separates disciplined traders from the emotional ones. Don’t rush in blindly — timing, confirmation, and strategic entries are everything if you want to win consistently in this game.

MyCryptoParadise

iFeel the success🌴

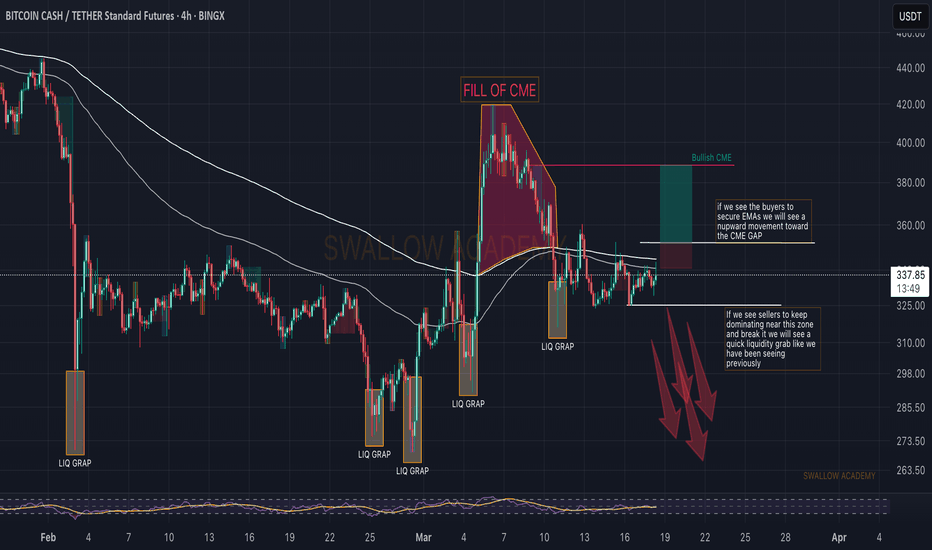

Bitcoin Cash (BCH): Good R:R Trades Can Be Taken Near 200EMABitcoin Cash coin is currently trading below branch of EMAs where recently we had quick fill of bullish CME gap above the EMAs.

As there are still a lot of uncertainties on the market, we are not going to rush into any trade here yet but rather prepare ourselves for both scenarios.

Both setups we see are with good R:R, What do you think based on the current market state? Where will we head?

Swallow Team

Bearish PossibilityLet's not get stuck in a bias. Before I posted a long for Bch, I am starting to lean bearish as I see this symmetrical triangle play out. Usually, it's a continuation pattern, and the target would be about 280. I would wait and see which way the triangle breaks and then enter a position on the retest.

BCH: Current SituationYou asked, and we delivered.

Bitcoin Cash (BCH) is trading at $331, a pivotal level that’s acting as a battleground between buyers and sellers. This price sits near a critical support zone, and recent price action shows BCH struggling to push higher amid broader crypto market weakness. The total crypto market cap has dropped by 4.4% in the last 24 hours, putting pressure on altcoins like BCH and fostering a cautious sentiment. Social media buzz, especially on platforms like X, has flagged $330 as a make-or-break level, holding here could spark optimism, while a breakdown might fuel bearish momentum. That said, take these posts with a grain of salt; they’re often speculative and lack the full technical or fundamental picture.

Technical Breakdown: What the Charts Are Saying

Short-Term (1-Hour and Daily Charts)

Support Levels:

Immediate: $330 – A close below this could signal trouble.

Next: $315.58 – A deeper drop might test this level if selling picks up.

Resistance Levels:

Immediate: $339 – A hurdle to watch for any upside push.

Next: $350 – A tougher ceiling that’s rejected recent rallies.

Indicators:

MACD: Bearish crossover, suggesting short-term weakness.

RSI: At 46.40, it’s neutral but leaning bearish, room to fall or bounce.

Moving Averages: Price is below the 20-period MA on the 1-hour chart, a sign of near-term softness.

Pattern: A falling wedge is forming, a setup that could hint at a bullish reversal if BCH breaks above the upper trendline with solid volume.

Long-Term (Weekly and Monthly Charts)

Support Levels:

Key: $300 – A major floor to hold for bulls.

Next: $263 – A deeper correction could target this if $300 fails.

Resistance Levels:

Key: $536 – A 50% Fibonacci retracement level and a big hurdle.

Next: $800 – A long-term target if momentum flips bullish.

Indicators:

200-Day MA: Trending down, reflecting prolonged bearish pressure.

RSI/MACD: Neutral on weekly, with no extreme signals yet.

Pattern: A double-bottom around $300 is worth watching, confirmation could spark a reversal, while a drop below $263 would sour the outlook.

Potential Scenarios: What Could Happen Next?

Short-Term Scenarios

Bullish Case:

If BCH holds $330 and punches through $339 with strong volume, it could climb to $350. A break above $350 might target $380, especially if MACD flips bullish. Look for a volume surge to confirm this move.

Bearish Case:

A close below $330 could trigger a slide to $315.58, or even $300 if selling accelerates. High volume on the drop would lock in bearish control, watch this closely.

Long-Term Scenarios

Bullish Case:

Holding $300 and breaking $536 could kick off a new uptrend, with $800 or higher in sight by 2026. This depends on a crypto market rebound and growing BCH adoption for payments.

Bearish Case:

A sustained fall below $300 might drag BCH to $263 or lower, especially if altcoins stay weak. This would kill the double-bottom setup and point to a longer downtrend.

Broader Context: What’s Driving BCH?

Market Sentiment: BCH’s identity as a scalable, low-fee payment option (thanks to bigger block sizes) keeps it in the game, but it faces stiff competition from other coins and regulatory uncertainty. Adoption is key, more real-world use could lift its value.

Tech Developments: Network upgrades enhancing scalability could boost BCH’s appeal. Watch for news on this front.

External Factors: Crypto prices often dance to macro tunes, think regulatory shifts, US economic data (like inflation), or Bitcoin’s moves. These could sway BCH in either direction.

Practical Tips for Traders and Investors

Risk Management: Crypto’s wild, set tight stop-losses and don’t over-leverage. A stop below $330 for shorts or $315 for longs could save your bacon.

Volume is King: Breakouts or breakdowns without volume are suspect. Wait for confirmation.

Stay Flexible: Markets shift fast, keep an eye on news and adjust your plan as needed.

bch buylimit midterm"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

BCH is ranging the coin is in range bound like an abcde correction and we are observing inverse cup and handle pattern following downward fall indicating potential bearish toward specified fibo level .if the coin recovers itself from the fibo level we will see a short rally

let's what the market will play out

In-depth critical analysis of Bitcoin Cash$BINANCE: BCHUSDT

### Technical Analysis of Bitcoin Cash (BCH)

**Date: March 1, 2023**

**Current Price Action**:

Bitcoin Cash (BCH) has demonstrated a strong bullish response, bouncing off projected support levels. The significant bounce indicates renewed bullish sentiment among traders, suggesting that the bulls are back in the game after consolidation.

**Price Patterns**:

The breakout from the falling wedge pattern is a notable bullish signal. Falling wedges typically signify a potential trend reversal, and the break above the upper trend line means that momentum may be shifting towards the upside.

**Targets**:

Given the bullish breakout, the following price targets are established:

1. **First Target**: $425

2. **Second Target**: $450

3. **Third Target**: $475

4. **Fourth Target**: $550

These targets are based on previous resistance levels and Fibonacci retracement levels, which suggest potential price points where momentum could meet resistance.

**Support Levels**:

1. **Strong Support**: $290 - $270

This range has been tested previously and shown resilience, indicating a significant level for bulls to defend.

2. **Invalidation Level**: $240

A one-day candle close below this level would invalidate the bullish outlook and signal a potential shift to bearish market conditions.

**Market Sentiment**:

Overall, the market sentiment appears bullish, with increased buying pressure indicated by the bounce from support and the breakout from the falling wedge. If momentum indicators were bullish, this outlook would be further supported.

**Conclusion**:

The technical setup for Bitcoin Cash is positive, with key price targets set for the upside. However, traders should closely monitor potential pullbacks and the $240 invalidation level to reassess market conditions. Monitoring volume during any price movements is advisable to confirm the trend's strength and validate entry or exit strategies.

**Disclaimer**:

This analysis is for informational purposes only and should not be considered financial advice. Always conduct your research and assess the risks involved in trading cryptocurrencies.

BCH Daily TIMEFRAME UPDATE (ON DEMAND)❤️ THIS POST AND I WILL SHARE NEXT pair

Bitcoin Cash was created as an alternative to the first and most valuable cryptocurrency — Bitcoin (BTC). In 2017, BCH developers modified the BTC code, releasing their software version and a full-fledged competitive product, which split Bitcoin into two blockchains: Bitcoin and Bitcoin Cash

ANY THOUGHTS ON SET:BCH ?

BCH Long Sl -12%BCH/USDT Long Setup

Reason:

Successfully Breakout of trend.

Break of Internal Structure.

Strong Bullish Momentum

All technical indicators suggesting Strong bullish Wave

Best Regards,

The Panda

💲 Pair: BCHUSDT.P

📊 Type: LONG

💰 Suggested Leverage: 8x

🏆 Winrate of Strategy: 88%

🔰 Entry: 326.525

Take Profits:

🎯 Tp1: 345.07 (5.679%)

🎯 Tp2: 377.54 (15.623%)

🎯 Tp3: 435.27 (33.303%)

🎯 Tp4: 489.39 (49.878%)

❌ Stoploss: 284.45 (12.886%)

🛡 Breakeven Target: Tp2

Best Regards,

The Panda⚔️

Bitcoin Cash ($BCH) Surged 35% Today Gearing Up for 70% SpikeThe peer-to-peer electronic cash system that aims to become sound global money with fast payments, micro fees, privacy and larger block size Surged 35% Today amidst crypto market volatility potentially gearing up for a 70% spike to the $500 resistance.

Bitcoin cash ( SET:BCH ) was created as an alternative to the first and most valuable cryptocurrency — Bitcoin (BTC) in 2017. Bitcoin cash ( SET:BCH ) chart pattern exhibited series of consolidation pattern that connotes to an upcoming surge and the 35% surge is a prelude to what's coming.

With the Relative Strength Index (RSI) at 65, SET:BCH is more than ready to capitalize on the current bullish engulfing pattern exhibited on the chart.

As of the time of writing, SET:BCH is up 21.78% with data from DefiLlama showing about $7.28M locked in Bitcoin cash network With about $1.92 Billion in volume for the past 5 days.

Bitcoin Cash Price Live Data

The live Bitcoin Cash price today is $388.10 USD with a 24-hour trading volume of $1,009,964,576 USD. We update our BCH to USD price in real-time. Bitcoin Cash is up 25.15% in the last 24 hours. The current CoinMarketCap ranking is #20, with a live market cap of $7,699,166,324 USD. It has a circulating supply of 19,838,141 BCH coins and a max. supply of 21,000,000 BCH coins.

Super Bullish Bitcoin Cash: Double-Bottom Clear SignalHere is another chart that reveals the truth of the market. Bitcoin Cash (BCHUSDT).

Notice a very clear and strong double-bottom based on the new 2025 baseline level. So Bitcoin Cash is now confirmed bullish and trades at the best possible price ever before a massive bullish wave.

This type of signal and chart data confirms what I've been saying, that is, the bottom is in and we are very soon going up.

This soon doesn't mean months nor weeks away, no, we are going up within days. In fact, Bitcoin Cash is super bullish now and moving forward and this growth cannot be stopped. This is a big strong project, not a small project and yet, look at the chart.

The volume is very very low on the drop. The main low already happened on February the 3rd. Here we have a double-bottom while some other pairs produced a higher low. It doesn't make much difference truly. After this event that is happening now, we are going up. Very high up. New All-Time Highs all across.

In 2025 we will have a major bull-market. The bull-market is not over because it is yet to start.

The chart is clear and the signals are clear and we can all agree with what the market has to say. We have so much positive news and positive developments across the market, this will reflect in the price faster that you can expect.

Three days, four days, five days... It is normal to see some consolidation before a massive bullish wave.

Cryptocurrency is going up. Mark my words.

It is very easy right now to buy Altcoins cheap.

It is very easy to buy and hold.

Think long-term.

Namaste.

Bitcoin Cash BCH price analysisThis idea is probably more for ancient #BCH holders, because the coin is slow)

They have been accumulated for a year and does not allow it to fall much below $300.

🔝 If this trend continues, then sooner or later, but still #BitcoinCash at $1500 will be seen again)

P.S:

If you like this project, then just in case, put a “bucket” to buy OKX:BCHUSDT at $190-200 for the coming days)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

BCH USDT#Bitcoin Cash ( SET:BCH ) – Cup and Handle

The BCH chart is forming a Cup and Handle pattern, a strong technical indicator signaling a potential bullish reversal. This pattern illustrates a period of accumulation followed by a pullback, forming a rounded bottom, and is now gearing up for a potential breakout to the upside.

T: $832.2 🔥

Bitcoin Cash at Critical Trendline – Next Big Move?Bitcoin Cash (BCH/USDT) is currently showing signs of a strong reversal after testing a key support zone and the ascending trendline. This level has acted as critical support in previous price cycles, making it an important area to watch.

The price has rebounded from the strong support line, which aligns with the accumulation zone from early 2023. Additionally, BCH remains within a long-term descending channel, with the upper resistance line acting as a ceiling for previous bullish moves.

bch midterm sell limit"🌟 Welcome to Golden Candle! 🌟

We're a team of 📈 passionate traders 📉 who love sharing our 🔍 technical analysis insights 🔎 with the TradingView community. 🌎

Our goal is to provide 💡 valuable perspectives 💡 on market trends and patterns, but 🚫 please note that our analyses are not intended as buy or sell recommendations. 🚫

Instead, they reflect our own 💭 personal attitudes and thoughts. 💭

Follow along and 📚 learn 📚 from our analyses! 📊💡"

Bitcoin Cash Quintuple Bottom & $2,595 2025 All-Time High TargetBitcoin Cash just tested our 2025 baseline for the fifth time this week. This action gives us a long-term quintuple bottom. A clear establishment of long-term support.

Good afternoon my fellow Cryptocurrency trader, I hope you are having a wonderful day.

This type of action is very good because it clearly reveals what comes next. Both the lows in August 2024 and earlier this month (3-Feb. 2025) ended up lower than the low hit this current week. This is a minor detail but can be really important as it tells of the fact that buyers where ready and waiting at support.

If the low was a lower low, prices moving below 3-February and below August 2024, this would mean that buyers were not present. Even if buyers later show up it is not the same as buyers being ready beforehand. Buyers being ready beforehand means that they know what is happening and know what is coming. This correction is no surprise move but instead well planned. By who? Nobody cares. The truth is that after prices move up they tend to move back down and, after moving down then we get another move up. This is what is important. We are now entering this move-up period/cycle/phase.

Now, this is nothing new. In late 2022 we had a long sideways pattern followed by a break-up (price jump). In 2023 the same dynamic is repeated; sideways prices and then another bullish jump. Finally, 2024 did the same but smaller for this pair. Since Bitcoin Cash moved strongly in 2023 it performed weakly in 2024. Those that performed weakly in 2023 performed strongly in 2024, examples exist such as Cardano.

2025 will be different. Here we have no sideways pattern but instead a long-term lower high. This can be a double-top or lower high, makes not much difference. What matters is the fact that our baseline, Bitcoin Cash's long-term support holds. This holding is the most relevant part because the new rise will start from a strong level, which means that prices will move even higher in the coming months.

2022, 2023, 2024... This is all down. Cryptocurrency moves in a 4 year cycle based on Bitcoin's halving. The year after the halving is the bull-market year. Bitcoin halved in 2020 and the bull-market happened in 2021. Bitcoin halved in 2024 and the bull-market happens now, 2025; Thanks a lot for your continued support.

We are ready for the next price jump, "break-up," as it happened before. But this one will be something especial. A bullish wave within a bullish cycle in a bull-market year ending in a bull-run. Did you notice something in this line? The bears are gone!

Prepare for massive growth.

You can profit massively if you approach the market in the right way.

You can profit with spot or lev. it is all the same.

It would be wise not to become greedy, accept what comes to you.

If you are going to run, say a marathon, you start by training, the training starts with slow walking. Then you start throttling and then finally you run. At first, you only run for a short period of time but you increase little by little, run more and more. Eventually, you can run for hours, but it all started with a slow walk.

It is the same with trading. You can start by earning and accepting the small and little trades. You can earn 10-20%, over and over, again and again. As you get used to the winning you will eventually start to win more. Then you can earn 50%, 100% and continue going higher until you become a winner at the traders marathon.

You cannot start by running 10 miles on the first day.

You cannot start by going all-in with 20-100X.

Let us start small.

If we can create a winning habit, we will be able to win more over the long-run.

Namaste.