Bearish drop?The Bitcoin (BTC/USD) is reacting off the pivot which is a pullback resistance and could reverse to the pullback support.

Pivot: 94,119.93

1st Support: 88,510.65

1st Resistance: 99,362.24

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

BEARUSD trade ideas

btcusd 50% down to 50000 till end of year like 2021-2022 Bitcoin could drop -50% like in 2021-2022 Bear Market close to 40-50 000 $

One year long Bear market is possible due to economic and geopolitical turmoil by further idiotic decisions of trump administration that will surly happen many times this year

Bitcoin Waiting for Pullback into 90–92 K Entry ZoneBitcoin has just broken above its long-term downtrend and the Ichimoku cloud on the daily chart, signaling a fresh bullish regime. Here’s my game plan:

Trend & Cloud Breakout

Price closed above the red Kumo (~84.5–86.6 K) and pierced the yellow downtrend line.

Tenkan-sen (88.8 K) has crossed above Kijun-sen (84.5 K), while the Chikou Span confirmed this bullish shift.

Overbought Caution

Daily RSI14 sits at ~68 and 1-hour RSI14 is ~72, so a 1–3 day consolidation or shallow 2–3% pullback is likely.

High-Probability Entry

Entry Zone: $90 000–$92 000 (daily Tenkan/Kijun area)

Trigger: Close back above Tenkan/Kijun on your chosen timeframe (5-min for aggressive entries, 1-hr for conservative)

Stops: Just below Tenkan (5-min ≈ 90.8 K / 1-hr ≈ 90.2 K)

Targets & Management

First Target: Today’s high (~94.5 K)

Secondary Target: Psychological $100 000 once 95 K is convincingly cleared

Trail: Use your 1-hr Kijun or daily Tenkan as your stop-trailing levels

Bottom Line:

Bitcoin’s daily Ichimoku setup has flipped bullish, but RSI is overbought. I’m waiting for the textbook “breakout retest” into 90–92 K before adding new longs. A clean close above Tenkan/Kijun in that zone gives me sub-2% risk and a clear reward path toward 95–100 K. Good luck, and trade safe!

$BTC Tracks $GOLD Very Closely With 12-Week LeadCould it really be this simple?

Maybe we can just throw Global M2 out the window and track TVC:GOLD with a 12-Week Lead.

Someone pointed this out to me yesterday when I posted Gold's near 1/1 tracking with Global M2.

*Note the deviation in CRYPTOCAP:BTC PA from the ETF hype.

Time for a Bitcoin pull back?Finally bitcoin broke out of its consolidation/ down trend.

it looks like we could get lucky and have a nice little pullback to the green box.

If we are so lucky, buy with all you have. It may be the last time you see this price for a long time. When you see it next you probably wont want to touch Bitcoin with a 10 foot pole.

Bitcoin H4 | Potential pullback before bouncing higher?Bitcoin (BTC/USD) could fall towards a pullback support and potentially bounce off this level to climb higher.

Buy entry is at 88,033.50 which is a pullback support.

Stop loss is at 85,500.00 which is a level that lies underneath a pullback support.

Take profit is at 92,708.20 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

Global Market Overview. Part 4: BITCOINPreliminary Context — See Above

Bitcoin: Euphoria, Fear, and a Foundation That Withstood It All

If we were to describe the mood of the crypto market over the past few months in a single phrase, it wouldn't be just a roller coaster — it’s been a full-blown thrill ride, driven by geopolitics, news hype, and emotional burnout among participants. Public sentiment toward Bitcoin this year has swung across the entire spectrum — from wild excitement and $200K price forecasts after Trump’s projected victory, to total pessimism with claims like: “That’s it, Bitcoin’s going back to $20K — crypto is a scam.”

And, as is so often the case, both camps were wrong.

The market survived — not on hype, but on fundamentals.

I make no secret of the fact that I remain a Bitcoin optimist. Not because I want to believe — but because when you mute the media noise, one thing remains: the strongest macroeconomic foundation the crypto market has ever had.

Let’s be honest: it’s getting harder and harder to find a solid reason why Bitcoin should collapse back to $50K — let alone $20K. Strip away the emotion, and here’s what we’re left with:

What do we have, in fact?

1. Regulators are no longer suffocating the market — they’re participating.

The SEC has dropped major investigations into crypto projects, including Ethereum and leading DeFi platforms.

The U.S. Senate has approved legislation to create a national crypto reserve — for now, it’s based on confiscated assets, but it marks the first precedent of crypto being recognized as part of state strategy.

Meanwhile, the European Union has officially launched the MiCA regulatory framework, making crypto a fully legal asset class in the EU with clear compliance norms, a tax model, and open access to institutional clients.

2. Institutions are playing big.

Crypto ETFs have launched not only in the U.S., but also in Europe. This means one thing:

Pension funds, insurance companies, and hedge funds are entering the market.

The capital is not speculative — it’s strategic.

These are not "hot" retail dollars chasing tweets — they’re building portfolios for the long haul.

3. Exchanges are drying up. Whales are accumulating.

Bitcoin reserves on centralized exchanges are at historic lows.

This tells us:

Long-term holders aren’t selling.

Large players are moving assets to cold wallets.

Retail hype hasn’t kicked in yet — which, frankly, makes it a perfect entry point.

When the crowd starts buying, it’ll be too late.

4. Even a trade war couldn’t break the market.

The tariff escalation between the U.S. and China has hit global trade hard, triggering corrections across traditional markets. Yet despite that:

Bitcoin held strong above $70K, rising from the $110 levels.

This zone has become ironclad support — a sign that the market has matured.

There’s panic in the headlines, but not in the charts.

Even Wall Street veterans are cautiously suggesting Bitcoin may be a necessary hedge against fiat devaluation.

5. China is silent — for now. But if that changes...

Any positive signal from Beijing — even a hint at easing restrictions or partial legalization of crypto ownership — would cause an immediate surge. Because:

Chinese capital is waiting.

The tech infrastructure is already in place.

And if the government gives the green light, the market will relaunch overnight.

What do I think?

The current Bitcoin price range is a prime entry zone for medium-term positions.

The 70K–85K range is a fundamental accumulation corridor, where:

Strong hands are already in.

Weak hands have been shaken out.

FOMO and retail hype haven’t even started.

By Fall 2025, even modest optimism in geopolitics or trade could push the market to new all-time highs — not on hype, but on dry institutional demand.

Final thoughts

I’m not a fan of conspiracy theories.

But this setup is too clean to be a coincidence.

The crypto market has survived it all: bans, lawsuits, regulatory crackdowns, exchange collapses, hacks, FTX, LUNA, and every form of digital black magic.

But it's still here.

More than that — it’s quietly becoming a legitimate part of the global financial system. Without noise. Without asking permission.

While everyone else is talking panic — the market is already in an accumulation phase.

And those who understand the cycles don’t look to the news for validation.

They look at the fundamentals — and act accordingly.

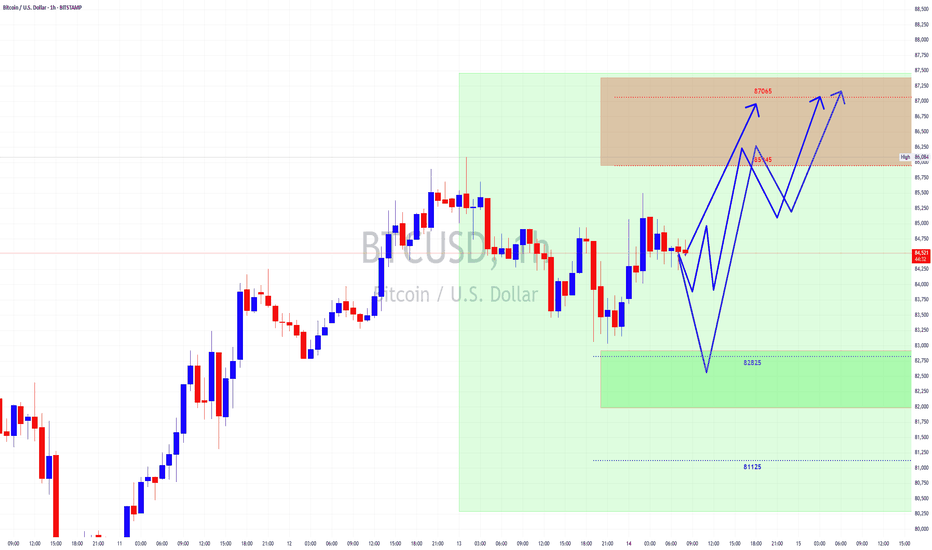

Bitcoin Getting Ready to Continue up to Test $87k again.Well...well....well, looks like bears still playing lazy.

Anyways TIME is running out for bears to make their case so knowing that bearsstill have like

8 to 11 1hr candles to make their case so we came out with 3 scenarios and are as follow.

(1)- it breaks out from where it is right now or

(2)- It makes another narrow sideways move and then breakout or

(3)- Drops quick in a couple of candles with nasty wicks just to bounce back up quick.

I'm inclined for the #3 option cause there's still TIME to happen but all depends on volatility, the bright side of this dilemma is that all of them will end up above the $85k line during the week, once it gets there will take another look. Place your bets ladies and gentlemen and buckle up, and get ready for a wild ride.

Mastering Volatile Markets: Why Patience is Your Biggest Edge█ Mastering Volatile Markets Part 3: Why Patience is Your Biggest Edge

If you've read Part 1 about position sizing and Part 2 on liquidity , then you already know how to adapt to the mechanics of volatile markets. The next great tool in your arsenal will be patience.

Your biggest opponent in wild markets is your own mind.

In volatile markets, your emotions can easily get the best of you. Fear of missing out (FOMO) is one of the most dangerous emotions that drives poor decisions.

█ FOMO (Fear of Missing Out) Hits Hardest in Volatile Markets

Wild price swings, like 300-500 point moves in the Nasdaq or Bitcoin jumping $1000 in seconds, can make it feel like easy money is everywhere.

You can quickly get the overwhelming temptation to chase moves , especially when it seems like you're missing every opportunity.

This is where most traders lose.

Let me state some harsh truths that I had to learn the hard way through many losses:

Volatility doesn't equal opportunity.

Fast moves don't mean easy trades.

Most wild price moves are designed to trap liquidity and punish impatience.

The true reality is that the market wants you to overreact in these conditions.

It wants you to buy after a big move.

It wants you to short after a flush.

It thrives on you being emotional, chasing, and reacting.

Because reactive traders = liquidity providers for smart money.

Every single trader has made this mistake — not just once, but over and over again. Jumping into the market after a big move, hoping it will continue… but what usually happens? The market snaps back and stops you out.

Can you relate? Share your story or experience with this in the comments below!

█ What Experienced Traders Do Instead

⚪ They Know the First Move is Often the Trap

Breakout? Expect a fakeout.

Breakdown? Expect a snapback.

New high? Watch for stop hunts.

New low? Watch for a flush.

Effectively speaking, pro traders don't chase the market. We wait for stop hunts to complete, liquidity grabs to finish, price to return into their zone, and for confirmations before entering the market.

⚪ They Train Patience Like a Skill

Professional traders aren't more patient because they're "special." We are patient because we’ve learned the hard way that chasing leads to pain.

⚪ They Know When Not to Trade

It is bad to trade when there’s no clear structure, no clean confirmation, if the spread is too wide or when the liquidity is too thin.

Instead, pro traders let the market come to them , not the other way around.

⚪ They Turn FOMO into Confidence

Instead of saying, "I'm missing the move…" , I recommend you think:

"If it ran without me — it wasn't my trade."

"If it comes back into my setup — now it's my trade."

█ So, what have we learned today?

Volatility triggers FOMO. FOMO triggers bad decisions. Bad decisions trigger losses.

To win long-term, you must stay calm, selective and professional. Let other traders be emotional liquidity. That's how you survive volatile markets.

█ What We Covered Already:

Part 1: Reduce Position Size

Part 2: Liquidity Makes or Breaks Your Trades

Part 3: Why Patience is Your Biggest Edge

█ What's Coming Next in the Series:

Part 4: Trend Is Your Best Friend

-----------------

Disclaimer

The content provided in my scripts, indicators, ideas, algorithms, and systems is for educational and informational purposes only. It does not constitute financial advice, investment recommendations, or a solicitation to buy or sell any financial instruments. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, backtest, or individual's trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

#BTC is ready to move! Bullish Move Ahead!#BTC Weekly Update:

Bitcoin's weekly chart is looking strong.

IMHO, the risk of not being invested at this stage is higher than the risk of being invested.

Everything is aligning well when we analyze these fractals.

This current bull market has been different from previous cycles, with Bitcoin underperforming compared to earlier runs, but that only makes this moment even more crucial.

The worst seems behind us, and we’re entering a new bullish phase. 🌅

Do you agree?

Please hit the like button if you like it.

Thank you

#PEACE

BTC latest analysis strategyBitcoin is currently approaching a significant resistance zone in the $88,000 to $89,000 range. This area is densely liquid and many stop-loss orders may have accumulated slightly above the previous local wick. In such situations, it is not uncommon for prices to briefly rise, catch liquidity and trigger stop-loss orders, and then reverse the trend. A short-term stop-loss run followed by a move downward is not surprising and is in line with typical market behavior in such situations.

On the daily chart, BTC has successfully broken out of the descending trendline that had previously limited price action. While the initial breakout was a positive sign for bulls, prices have since consolidated outside the trendline and have yet to make a higher high. Until then, the overall market structure remains bearish in this timeframe. Confirmation of a higher high is needed to reverse the daily trend back to bullish.

The Stochastic RSI on the daily chart has been in overbought territory for more than a week, which is usually difficult to sustain for long. Such prolonged overbought conditions usually foreshadow a pullback. The key question is not whether a pullback will occur, but how big it will be. Ideally for bulls, a minor pullback followed by a higher high would be constructive and could signal the start of a stronger uptrend. But until then, caution is warranted.

Currently, Bitcoin is trading in a well-defined range between $75,000 and $88,000. This is a key area that traders should be watching. As long as the price remains in this range, we are in a range-bound market, not a trending market.

If the price gets blocked in the resistance zone, downside targets to watch include the $84,000, $80,000, and $75,000 support levels. These levels could offer range-bound bounce opportunities. Unless the price breaks below $75,000 outright, there is no need to predict a significant drop below this level. Similarly, upside targets above $89,000 should not be considered until a true breakout and continuation is seen.

We should view the current market as range-bound until there is evidence that proves otherwise. This means respecting range-bound volatility: a move into the resistance zone around $88,000

-

$89,000 is a potential selling opportunity, while a drop to the support around $75,000 to $80,000 could be an area to look for buying opportunities. Until neither support or resistance is breached, expect this volatility to continue and trade accordingly.

Bitcoin Getting Ready to DropNow that Bitcoin has entered the top area of the last stage of the 1hr UP move is time to analyze the chart again and the read is as follow. Within the next six 1hr candles price will start to drop to go and test the $83465 area then pause or make a failed little bounce to then continue lower to the 2nd stage which is the $82645 once it gets there we'll take another look .

Bitcoin on Edge: US Deregulates, China Cracks DownHello,

Bitcoin Bearish Outlook – April 2025

Market Structure & Technical Overview

Bitcoin continues to underperform as a safe haven asset, falling short of the optimism once compared to gold. Following a consistent formation of lower highs, BTC has once again broken down—hinting at a potential continuation of this bearish trend.

Current Price: Just below the 1M Pivot Point (PP) at $84621.067.

This area is crucial — if price accepts this level as resistance, we are likely to see further downside.

The most recent 1M high stands at $88,781.70 — a level to watch but currently being respected as a ceiling.

Should the price fail to reclaim 84k, the next target is the 1Y PP at $80,283.483. A rejection here opens the door for a move toward strong 1M support at $72,345.065.

Below that, 1Y PP structural support comes into question. If the support gives out, the maximum decline target sits near $56,000, which would represent a full reset of the bullish macro narrative.

Fundamental Headwinds: A Storm Brews

Trump's Latest Move: President Trump has repealed the IRS rule expanding the "broker" definition to decentralized exchanges, a move aimed at deregulating crypto and laying groundwork for a potential U.S. Bitcoin reserve.

China’s Crackdown Intensifies:

China’s courts and local governments are actively liquidating seized crypto through offshore channels.

The lack of a centralized system raises corruption concerns, but near-consensus is forming around formal asset recognition and centralized liquidation.

Despite a domestic ban, China holds 15,000 BTC, potentially making it the 14th largest holder globally.

The decentralized anonymity principle of cryptocurrency is under increasing threat, as both China and the U.S. shift toward centralized control, regulation, and even reserve-building strategies. This movement contradicts the original ethos of Bitcoin, leading to a bearish sentiment among long-term holders.

Sentiment Snapshot

Metric Status

Technical Structure Bearish

Market Sentiment Neutral, leaning bearish

Macro Fundamentals Bearish

Key Resistance (1M PP) $84,621.067

Next Support (1Y PP) $80,283.483

Strong Support (1M) $72,345.065

Max Decline Scenario $56,000

📉 Mark these key levels:

$88,781.70 – Previous 1M High

$84,621.067– 1M Pivot (Current Resistance)

$80,283.483 – 1Y Pivot (Mid Support)

$72,345.065 – 1M Strong Support

$56,000 – Max Bearish Target

Overlay sentiment zones:

Green (above FWB:88K ): Bullish

Orange (between $80k– FWB:88K ): Neutral

Red (below $80k): Bearish Continuation

The Support and Resistance outlined in green and red are the respective support/resistance for this pair currently for 1M-1Y timeframes!

No Nonsense. Just Really Good Market Insights. Leave a Boost

TradeWithTheTrend3344

BTC vs Nikkei 225 strong match for declineI've been using the Nikkei 225 for at least 2 years to make forecasts as the big players have been involved in the Japanese Carry Trade.

Gains in the Japanese Nikkei 225 equity market have carried onto Bitcoin BTC.

Now I am afraid BTC could collapse from 120k and above to well under 50k. Not just for a short duration but permanently. It will begin with a volatile ABC, but could commence into a deep wave 3 down, where waves before the ABC is wave 1.

You should be considering selling all your Bitcoin BTC and Crypto.

There will be no come back from this.

I'd advise followers to make use of the following SHORT methods.

1. Use Short ETF's were you cannot be scam wicked.

2. Only use European Style Put Options on short durations e.g Derebit.

3. MSTR Option Shorts and Short ETFs will be a good way to capitalize on this volatility.

Be aware that the majority of exchanges are going to go bust from this event.

It would be advisable to solely trade on a ON RAMP exchange or with a reputable Stock Broker that has insurance or Gov payback schemes on your fiat.

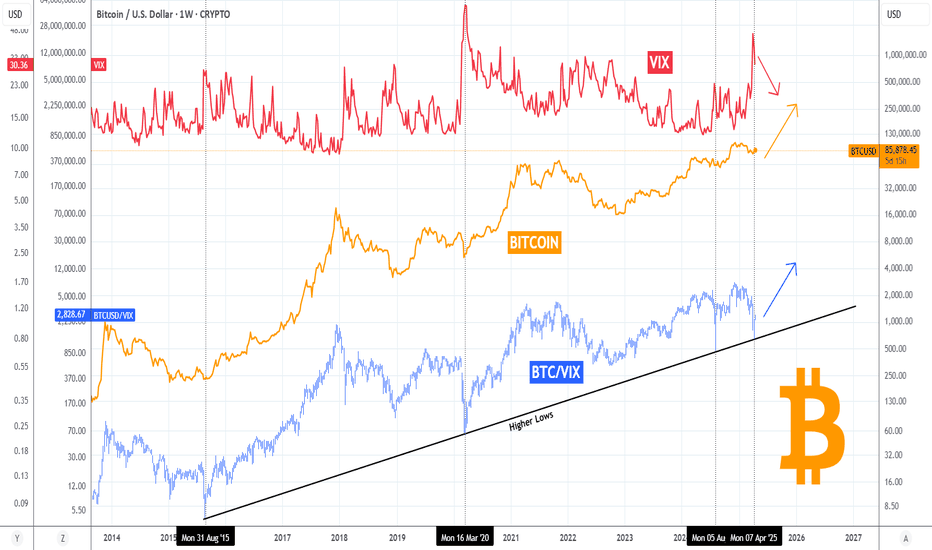

BITCOIN's ultimate VIX bottom signal-Last time gave +100% profitBitcoin (BTCUSD) is attempting to make yet another green day, yesterday not only did it close above its 1D MA50 again but was also the 4th green day in the last 6. This attempt is showing that the trend is gradually shifting again towards long-term bullish but today we'll present to you another one, this time in relation to the Volatility Index (VIX).

BTC's (orange trend-line) recent rise is naturally on a negative correlation with VIX (red trend-line) which is currently pulling back after it's most aggressive spike since the COVID flash-crash (March 2020).

Their ratio BTCUSD/VIX (blue trend-line) made a very interesting contact with the Higher Lows trend-line that has been holding since the August 24 2015 Low, which was the bottom of the 2014 Bear Cycle. Since then it made Higher Lows on March 16 2020, August 05 2024 and the most recent, April 07 2025. Every time it was a bottom indication and a massive rally followed. The 'weakest' of all was the previous one, which 'only' gave a +105% rise approximately. Based on that, there is no reason not to expect BTC to hit at least $150k by the end of this Bull Cycle.

Do you think that's a plausible target? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC is in strong support area based Fib RetracementHi again, for a long time I don't share my ideas here, so I'm trying to consistent share my thought here.

Technical

BINANCE:BTCUSD in strong support line based Fib Retracement on $76,113.25 (on daily Timeframe)

The price currently below the EMA 200

MACD still doesn't give the sign to long

BTC Dominance still high (60.39% based on Coinstast )

Macro

Based on similiar correlation with S&P500, it's still give no good sign to bounce back (it maybe going deeper)

About the global economy, US Tariff still give the global uncertainty and cold vibes haha

Summary

If you going long term, maybe you can go buy BTC in small size, is a good price to add the collection

If you going short term, I think it will be go deeper first

Thanks for your time!

I hope everyone have a good time and good health!

BTCUSD: Wait for a pullback and then be bullishBitcoin's price continued its upward trend today with a relatively significant increase, and the trading volume also remained at a high level, indicating a high level of attention and participation in Bitcoin in the market, and investors are relatively optimistic about its future trend.

BTCUSD Trading Strategy

buy @ 92000-92200

sl 91300

tp 93500-93800

Waiting patiently to go long on pullbacks or short at high levels can be profitable.

If you want to learn more trading insights, you can check my profile to find the content you're interested in.👉👉👉

BTCUSD...15m chart patternlooking at a BTC/USD long trade setup:

Entry: 92,550

Stop Loss (SL): 92,000

Take Profit (TP): 93,000

Here's a quick breakdown:

Risk: 550 points

Reward: 450 points

Risk-Reward Ratio (RRR): ~0.82

This is a bit below the ideal 1:1 RRR. You might want to:

Tighten your SL slightly (if structure allows), or

Aim for a higher TP to improve the RRR