Global Market Overview. Part 4: BITCOINPreliminary Context — See Above

Bitcoin: Euphoria, Fear, and a Foundation That Withstood It All

If we were to describe the mood of the crypto market over the past few months in a single phrase, it wouldn't be just a roller coaster — it’s been a full-blown thrill ride, driven by geopolitics, news hype, and emotional burnout among participants. Public sentiment toward Bitcoin this year has swung across the entire spectrum — from wild excitement and $200K price forecasts after Trump’s projected victory, to total pessimism with claims like: “That’s it, Bitcoin’s going back to $20K — crypto is a scam.”

And, as is so often the case, both camps were wrong.

The market survived — not on hype, but on fundamentals.

I make no secret of the fact that I remain a Bitcoin optimist. Not because I want to believe — but because when you mute the media noise, one thing remains: the strongest macroeconomic foundation the crypto market has ever had.

Let’s be honest: it’s getting harder and harder to find a solid reason why Bitcoin should collapse back to $50K — let alone $20K. Strip away the emotion, and here’s what we’re left with:

What do we have, in fact?

1. Regulators are no longer suffocating the market — they’re participating.

The SEC has dropped major investigations into crypto projects, including Ethereum and leading DeFi platforms.

The U.S. Senate has approved legislation to create a national crypto reserve — for now, it’s based on confiscated assets, but it marks the first precedent of crypto being recognized as part of state strategy.

Meanwhile, the European Union has officially launched the MiCA regulatory framework, making crypto a fully legal asset class in the EU with clear compliance norms, a tax model, and open access to institutional clients.

2. Institutions are playing big.

Crypto ETFs have launched not only in the U.S., but also in Europe. This means one thing:

Pension funds, insurance companies, and hedge funds are entering the market.

The capital is not speculative — it’s strategic.

These are not "hot" retail dollars chasing tweets — they’re building portfolios for the long haul.

3. Exchanges are drying up. Whales are accumulating.

Bitcoin reserves on centralized exchanges are at historic lows.

This tells us:

Long-term holders aren’t selling.

Large players are moving assets to cold wallets.

Retail hype hasn’t kicked in yet — which, frankly, makes it a perfect entry point.

When the crowd starts buying, it’ll be too late.

4. Even a trade war couldn’t break the market.

The tariff escalation between the U.S. and China has hit global trade hard, triggering corrections across traditional markets. Yet despite that:

Bitcoin held strong above $70K, rising from the $110 levels.

This zone has become ironclad support — a sign that the market has matured.

There’s panic in the headlines, but not in the charts.

Even Wall Street veterans are cautiously suggesting Bitcoin may be a necessary hedge against fiat devaluation.

5. China is silent — for now. But if that changes...

Any positive signal from Beijing — even a hint at easing restrictions or partial legalization of crypto ownership — would cause an immediate surge. Because:

Chinese capital is waiting.

The tech infrastructure is already in place.

And if the government gives the green light, the market will relaunch overnight.

What do I think?

The current Bitcoin price range is a prime entry zone for medium-term positions.

The 70K–85K range is a fundamental accumulation corridor, where:

Strong hands are already in.

Weak hands have been shaken out.

FOMO and retail hype haven’t even started.

By Fall 2025, even modest optimism in geopolitics or trade could push the market to new all-time highs — not on hype, but on dry institutional demand.

Final thoughts

I’m not a fan of conspiracy theories.

But this setup is too clean to be a coincidence.

The crypto market has survived it all: bans, lawsuits, regulatory crackdowns, exchange collapses, hacks, FTX, LUNA, and every form of digital black magic.

But it's still here.

More than that — it’s quietly becoming a legitimate part of the global financial system. Without noise. Without asking permission.

While everyone else is talking panic — the market is already in an accumulation phase.

And those who understand the cycles don’t look to the news for validation.

They look at the fundamentals — and act accordingly.

BEARUSD trade ideas

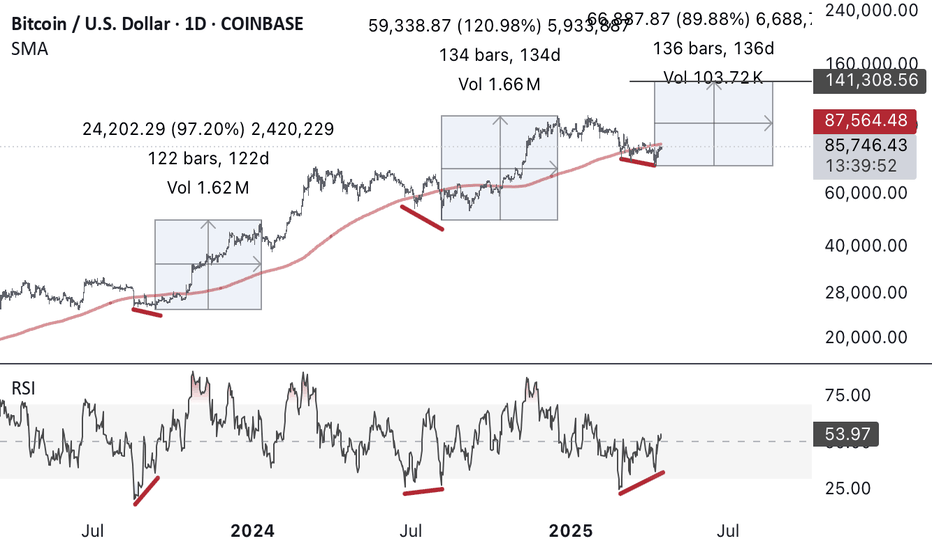

Bitcoin - 2025After a long consolidation around $100,000, and a correction of ~32% from the top, it seems we are preparing for a new move.

In the previous idea, I mentioned that there could be either consolidation or a healthy correction, but both happened.

I will describe several scenarios that I see.

I will describe only positive, super-positive and ultra-positive ones.

Since the negative sounds like this - we have already reached the peak, there will be a small over-high, and we will go bearish.

Positive scenario - parabolic growth, with a new peak in the region of $150,000-$200,000

Super-positive scenario - parabolic growth, with a new peak in the region of $200,000-$300,000

Ultra-positive scenario - parabolic growth, with a new peak in the region of $300,000-$400,000

Now you must ask - can we really reach $400,000, how is this possible, with the current price of $84,000, and April outside the window?

I will tell you that there is nothing complicated or incredible here, that is why it is ultra-positive.

But you should focus only on positive and negative scenarios, and not float in the clouds hoping for a miracle.

As for altcoins, in this scenario, I don't think Bitcoin dominance will last long, so high, in any case, soon there will either be an overflow and altcoins will start shooting, or we will all die from the paws of bears

HOLD YOUR BEARS, IT'S NOT OVER

I think BTC is forming and inverse head and shouldersI believe that BTC is going to test the resistance once more with some buying pressure. Then reject it and create a higher low while also touching the support to breakout above the resistance level and create higher highs. Price is also testing the 50MA from below on the Daily chart and is quite stagnant but I believe that is just building explosive pressure to breakout upward or at least establish a new high to keep that slight uptrend in motion. On the weekly chart we are pretty bullish as well. Price seems to be trying to use the 50MA as support hopefully propel itself upward. My sentiment currently for BTC is BULLISH.🐂

BTC LONG TP:91,000 15-04-2025🚀 Time to go Long! Targets are set between 90,000 and 91,000, with the 4-hour and 8-hour timeframes showing a strong bullish trend.

We expect this movement to materialize within 2 to 3 days, so be sure to enter and average down as needed.

Stay tuned for updates to optimize your gains. Follow me to stay informed, and let’s work together to boost those profits! 💰🔥

$BTC Weekly Chart AnalysisCRYPTOCAP:BTC Weekly Chart Analysis (All numbers in USD)

Current Price: $85,194

Timeframe: Weekly – my preferred timeframe for long swing trades or investment theses

⸻

Bull Case 🟢

To reignite bullish momentum, Bitcoin needs to:

1. Break above the 0.382 Fib @ $87,303

2. Follow through by breaking the 20-Week Moving Average @ $92,496

If both of these levels are cleared, I believe we’ll be heading back toward All-Time Highs ($109K) fairly quickly. I currently assign 50% odds to this scenario.

Above those levels, we enter new price discovery, which would require a fresh analysis.

⸻

Bear Case 🔴 (Also 50% odds overall)

⚠️ First Lines of Support:

• 50-Week MA @ $77,321

• 0.382 Fib @ $73,783

→ 30% odds of retesting this level.

It’s possible the market ranges between GETTEX:87K and FWB:73K for a while, which would actually be bullish long-term — allowing BTC to build a strong support base through accumulation.

🛑 Second Major Support (Very Strong):

• Multi-year Cup & Handle Breakout Zone

• Strong Volume Shelf

• 0.5 Fib @ $62,855

→ 20% odds of reaching this.

If we do test this level, I believe it’s very unlikely to break below.

🚨 Final Support Warning:

• GETTEX:48K = Critical level

→ <1% odds of reaching

A break below would signal the end of the bull cycle in my view.

⸻

Final Thoughts

As Bitcoin is a non-producing asset with no fundamentals or balance sheet to anchor it, all of this is purely price action-driven — so I won’t assign timelines to these scenarios.

📌 Personally, I do not hold any BTC currently. With the odds at 50/50, the risk-reward doesn’t appeal to me right now — I see better opportunities elsewhere. However, I’ll reconsider if the bullish breakout scenario plays out.

⸻

Hope this breakdown helps! Make sure to adjust your strategy based on your own risk tolerance.

Bitcoin (BTC/USD) – 30-Min Long Setup!📈

Chart Pattern: Symmetrical Triangle Breakout (Pending confirmation)

Bias: Bullish – expecting breakout to the upside

✅ Trade Plan – Long Position

Entry: ~$84,521 (on breakout of triangle resistance)

Stop-Loss (SL): ~$84,000 (below trendline & consolidation base)

Take Profit (TP) Levels:

TP1: $85,137 (local horizontal resistance – yellow line)

TP2: $85,460 (stronger horizontal resistance – green line)

📐 Risk-Reward Ratio: ~1 : 2+

🟢 Favorable for momentum entry if volume supports breakout.

🔍 Technical Highlights

Triangle formation tightening with decreasing volume → breakout likely soon

Previous breakouts (circled) showed strong follow-through

Horizontal zones respected → key levels remain reliable

Bullish structure still intact above $84k

Bitcoin is heading into its final low before bull market?Bitcoin got rejected at the 1-Day Cycle top and is now pulling back toward the 1-Day Cycle lows.

While most investors are getting bored and slowly shifting their attention elsewhere, crypto is quietly consolidating and gearing up for a BIG move...

Will we break above $100K, or are we heading into a recession and full-on bear market mode?

Next week will be a decisive one for the entire crypto market this year.

If Bitcoin manages to hold above $77,000 as the 1-Day Cycle hits Day 20, we could be on the verge of a run toward $100K. But if we drop below the previous 1-Day Cycle low, trouble’s coming.

Confused? Just check out this chart.

It’s easy to lay out both the bullish and bearish cases—but it’s a whole different game to quantify, commit to a position, and wait for the more probable outcome to play out.

Which scenario is more likely?

In short: the green one . Here’s why:

The 2-Week Cycle has spent over 4 weeks below 20, completely crushing bullish sentiment.

The 1-Week Cycle has been below 20 for over 2 months—the longest stretch in the past 5 years.

The 3-Day Cycle hasn’t fully reset, but reversed to the upside last week due to positive price action.

We’re on Day 46 of the 60-Day Cycle, and price has been holding up well. We’ve tested the $80K zone a couple of times, and Bitcoin still seems eager to push higher.

For the first time in a while, there are more bears than bulls (according to Polymarket).

On that note—check the Polymarket predictions

BTC/USD Technical Outlook📊 BTC/USD Technical Outlook

Rounded Top Formation signals exhaustion of bullish momentum.

Price respecting a descending channel, showing structured bearish correction.

Supply Zone: $96K–$100K – major resistance; price likely to reject here if tested.

Key Levels:

Support: $80.5K → $74.7K → $56K → $48.6K → $39.7K

Resistance: Descending trendline & supply zone

Two Scenarios:

✅ Bullish: Break above channel + $96K = retest ATH zone.

❌ Bearish: Rejection + break below $74.7K = targets $56K and lower.

Current Bias: Bearish unless breakout confirms above descending structure. 📉 Fundamental View

Bitcoin Halving supports long-term bullish case.

Fed’s policy & inflation will drive short-term volatility.

Institutional news already priced in; any surprises = big moves.

BITCOIN WEEKLY ANALYSIS - April 18th, 2025BTC/USD is currently hovering just below a major descending trendline and key horizontal resistance near the 91,500 level. 🧱

🔍 What We’re Watching:

- Price has tested the downtrend line multiple times — the structure is weakening.

- A breakout above 87,500 could trigger a strong bullish move.

- Until then, "Wait for the Breakout" remains the strategy. No confirmed long entries yet.

📉 Current Price: $84,500

📈 Breakout Confirmation: Clean close above resistance zone + volume spike = 🔥🔥 potential rally.

🧠 Pro Tip: False breakouts are common. Watch for confirmation — not just a wick!

Stay sharp, stay patient. Breakouts give the best reward-risk trades! 💹

BTC CLOSES ABOVE 50 MABitcoin finally closed a strong daily candle well above the 50-day moving average – a notable technical development, especially since that moving average is beginning to curve upward again. It’s the first convincing close above the 50 MA in months, signaling a potential shift in short-term trend.

However, the move came on low volume – which tempers the enthusiasm. Without a surge in buying interest, this breakout could lack staying power. The 200-day moving average remains overhead as resistance, and the horizontal level at $88,804 is still the key barrier to flip market structure and print a higher high.

Encouraging – but not convincing – yet. Bulls need to follow through with strength.

BTCBTC oversold on daily timeframe formed regular bullish divergence.

Tariff war makes perfect panic selling.

Last 2 times it happen price went up almost 2x.

Price was grabbing liquidity under 200 day MA.

It was good place to add spot for long term hold.

Now expecting some good times ahead, if something terrible doesn’t happen.

BTC – Strong Buy Signals, Sentiment Reversing, Final Push?BTC is clearly in a place of rising trust

- Fear & Greed Index improving: last week 24 (Extreme Fear), yesterday 31, now 38 (Fear), last month low was 3

- Several bullish divergences visible: RSI and MACD show higher lows vs. price, momentum indicators curling up, OBV ticking higher despite weak price action

- Price is sitting at the lower Bollinger Band and holding an ascending trendline

- Multi-indicator (mostly RSI-based) showing clustered buy signals, similar to previous rallies

- Simple Fibonacci retracement from the recent high (~73K) shows potential move toward 130K, assuming continuation and break above ~109K

- Last S-BUY signal was 14 bars ago, still active

- Structure is clean and holding

- If this is the final leg up, we could be entering danger or euphoria territory soon

BTCUSD swing shorts setupBTCUSD has been trading within a tight consolidation range on the daily timeframe, indicating market indecision and potential buildup of liquidity. After this extended period of sideways movement, we anticipate a bearish breakout as the market seeks to sweep liquidity below the current range.

Price has failed to make a strong higher high, suggesting weakening bullish momentum. If BTC breaks below the range support and confirms with a retest, this could be a strong signal for short entries. Key support levels and order blocks should be monitored for confirmation.

Confluences for the short bias:

Loss of bullish momentum on daily candles

Liquidity resting below the consolidation range

Potential break of market structure

Bearish divergence on RSI (if applicable)

Proximity to a key resistance zone or supply area

BITCOIN BULLISH TO $114,000 - $116,000In Q1 2025 I said I expect a retracement back towards $86,000 - $78,000 as Wave IV retracement.

BTC has now hit our Wave IV target. So according to my report & analysis, our next target is Wave V. Priced around the $114,000 region.

Market Structure Invalidation: $74,450❌

Technical Analysis on BitcoinHey guys

Bitcoin has recently broken out of a long-term descending channel, which has caught the attention of many traders. Typically, once the price stabilizes outside of such a channel with confirmed candlestick closes, buyers enter the market in anticipation of a bullish move. However, it's important to be cautious.

There is still a possibility that the price may retrace to a highlighted liquidity zone below, where it can gather enough momentum and liquidity for a stronger upward movement.

Therefore, traders should be aware of potential false breakouts and wait for solid confirmations before fully committing to long positions.