Bitcoin BEARISH - BTC Strong Resistance On Weekly TFBitcoin has reached strong resistance on the weekly TF. The resistance line goes the whole way back to 2017. So it's very reliable. A strong move downwards is very likely!

Based on previous times this line was tested, Bitcoin could fall 50% or more. However, the 74000-75000 level looks like a good support level. This would be about a 30% drop which is still very significant.

I expect profit taking very soon and short sellers to come in. There could possibly even be global headline news to cause this drop.

Be very careful in buying near the tops. Trade with your brain and not emotions. This is only an idea and anything can happen, but it's a weekly chart and seems very reliable.

BEARUSD trade ideas

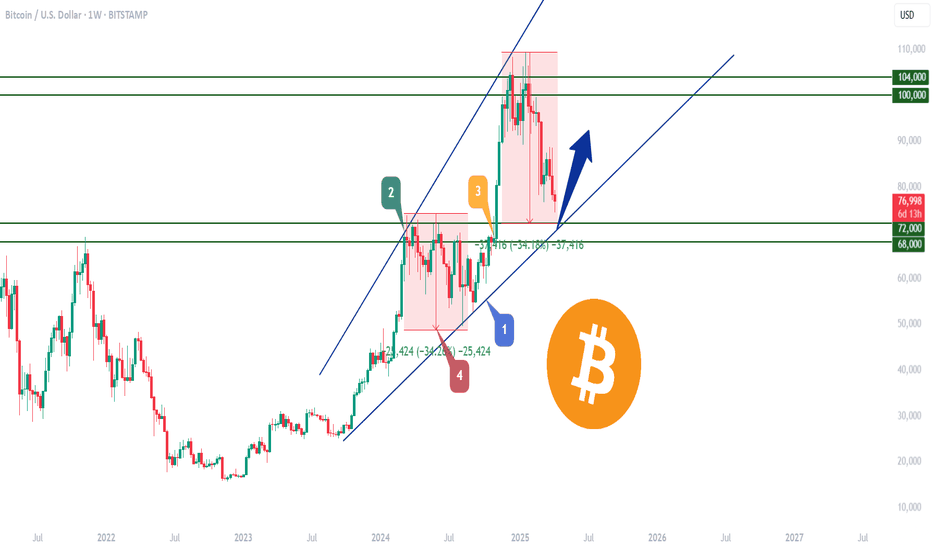

Bitcoin new all time high by AugustHere's a Bitcoin 1 week chart, 5 year view, with price and time notes. Bitcoin is poised to make new all time highs around 130k by August 18th 2025. It may not seem that way today, when all global markets are drastically down because of Tariff news. But here's the bull case:

1) Uptrend channel: Bitcoin is trading at support in it's several years uptrend channel.

2) Last halving cycle 5/11/20 it took 336 days to hit it's first peak.

3) Last halving cycle 5/11/20 it took 546 days to hit it's second peak.

4) Last halving cycle 5/11/20 it took 98 days to drop and reverse bullish. And that was because China banned crypto.

5) This halving cycle 4/20/24 it took 280 days to hit it's first peak.

6) This halving cycle 4/20/24 Bitcoin has been in a downtrend for 77 days so far. And that is because China Deep Seek AI news, followed by Tariff news.

7) Last halving cycle 5/11/20 it took 210 days from the first to second peak. This halving cycle 4/20/24 210 days from the first peak to the possible second peak would land on 8/18/25.

8) Bitcoin 2021 high of $69k is a major support level that closely aligns with it's current uptrend channel support.

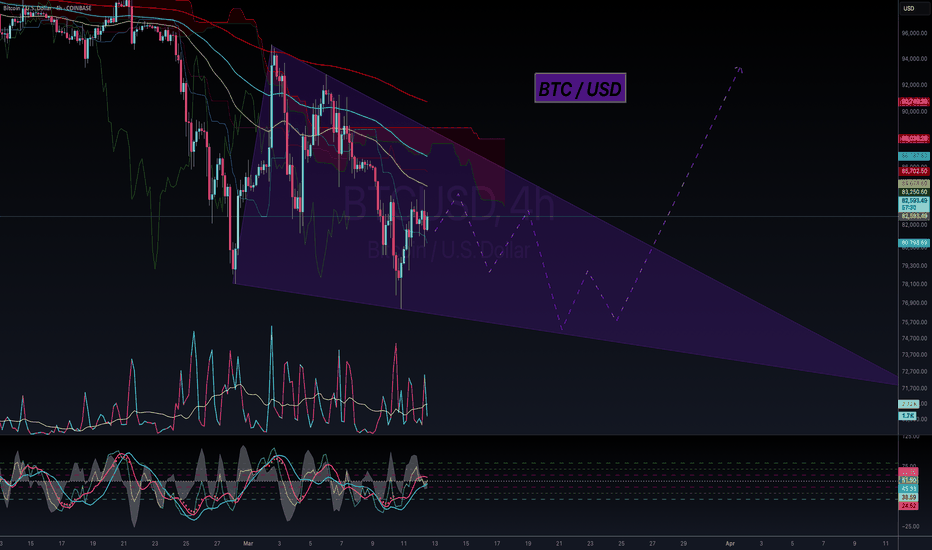

Bitcoin BEARISH 4 Hour Chart - Trend Line Support BrokeBitcoin has broke down through an important trend line support level on the 4 hour chart. It is currently in the process of re-testing the line before a continuation down again. It's possible that Bitcoin may gain short-term up to around $100000 before the re-testing is complete. Or it may just start falling like a rock before then.

The trend line was tested multiple times and is a reliable signal of what is to come. This also agrees with my analysis on the weekly chart too. Both charts indicate a potential drop for Bitcoin to around $75000.

Please note: this is a crazy world and anything could happen, but this is my analysis based solely on the chart. I would say the same if it were corn, copper, or whatever else. Be cautious buying Bitcoin anytime soon based solely on hype! As I said above, it could gain short term to re-test the line which is now resistance, but it will probably be short-lived.

BTC headed to 75k? dead cat at 77.7k then 73-75k support comingBTC was holding well against the market's Tariff-Tantrum.

But a significant dip is starting on a Sunday (as often does).

If sentiment continues into Monday, we should see 75k soon.

====================================================

Previous Charts below

====================================================

$ 105k cycle Top call:

$ 82K Bounce call:

$ 73K previous cycle top (and current retest target):

============================================================

Bitcoin's Next Big Move: My Take on the Market TrendsHey everyone!

Lately, Bitcoin has been keeping us all on our toes, and I wanted to share my latest thoughts on where BTC/USD might be heading. The current price action shows some interesting developments, with a descending channel taking shape and key levels like $72,561.89 and $66,763.00 in the spotlight. Indicators like RSI and MACD are hinting at a potential shift in momentum—could we be gearing up for a bullish reversal?

In the broader market, experts have been weighing in with mixed opinions. Some foresee a corrective dip toward $62,075, while others emphasize Bitcoin's resilience as "digital gold," holding strong despite broader market pressures. At around $83,000, BTC/USD seems to be at a critical point, balancing between bearish pressures and bullish opportunities.

I've outlined my analysis on the chart, highlighting potential breakout zones and targets. Let me know what you think—are we about to see a breakout, or is more consolidation on the cards? The crypto market is never dull, and the next chapter in Bitcoin's journey promises to be just as exciting.

Stay tuned!

Bitcoin Holding Strong — Next Stop: $150K?BTCUSDT Technical analysis update

BTC price is currently retesting its major support zone, which was previously a strong resistance area, now acting as support at the $70K–$75K level. The price has just touched the $75K support zone, and we can expect a consolidation above the $70K level followed by a potential bounce back or a V-shaped recovery from the current level.if we see a strong bounce from the current support level, the next potential target could be around $150K

BTCUSD ChatGPT: This chart shows Bitcoin (BTC/USD) on a 4-hour timeframe with key price levels, trends, and targets identified. Let's break down the analysis and potential scenarios for the future price movement:

Key Observations:

1. Price Action & Trend:

- The price of Bitcoin has been in a downward trend, forming a descending channel (shown with blue trendlines). The price has been making lower highs and lower lows, indicating bearish market conditions.

- Recently, Bitcoin tested the resistance zone around 84,067, and after multiple rejections at this level, the price has started to decline.

2. Resistance Zone:

- The resistance zone is marked at 84,067, a key price point where Bitcoin has faced multiple rejections. This level represents a supply zone, and traders …

ChatGPT: 4. Bearish Price Action:

- The chart shows a sharp bearish drop after hitting the resistance zone, suggesting that the market is currently in a correction phase. The price has fallen from higher levels toward the support zone and is likely to experience further downside pressure.

5. Target Level:

- The target for the ongoing bearish move is marked as 78,885, which lies just above the support level at 77,082. This target indicates a potential continuation of the decline towards this support level, and if this support holds, it could be a buying opportunity for a bounce.

Potential Scenarios:

1. Bearish Continuation:

- If the price continues its decline and breaks below 77,082, it would suggest a bearish breakout, with the next target around 78,885 or eve…

ChatGPT: - If the price approaches the 77,082 support level and shows signs of rejection (such as forming a bullish engulfing candle or double bottom pattern), there could be a reversal towards the resistance level at 84,067. In this case, traders may look for a long position, targeting the resistance zone for profit-taking.

3. Consolidation and Range-Bound Behavior:

- There is also a possibility that the price could start consolidating between the resistance and support levels, moving in a sideways pattern. If the price repeatedly tests these boundaries without breaking through, traders can look for range-bound trading strategies with buy orders at support and sell orders at resistance.

4. Breakout Above Resistance:

- If the price breaks above the resistance zone…

ChatGPT: The current chart suggests that Bitcoin is in a downtrend, facing resistance at 84,067 and heading towards the support zone at 77,082. Traders should monitor price action at this support level for potential bounces or breakdowns. If the price rebounds at 77,082, it could move back to test the resistance at 84,067. Conversely, if the price breaks below the support, further downside movement may occur with a target around 78,885 or lower. The descending channel provides a structured view of the market, and a breakout could lead to a bullish reversal or continuation of the bearish trend.

BTC is still bullish!!!🚨 CRYPTOCAP:BTC is dipping hard! 🚨

📍 All eyes on $72,000 — this could be the ultimate buy zone:

🔽 Why this level matters:

1️⃣ Bottom of the blue wedge

2️⃣ Flipped resistance → support

3️⃣ Major demand zone

4️⃣ Classic -34% pullback move

📊 This could be a textbook entry point.

Are you ready to catch the bounce?

This could be a bitter end for BTC or an opportunity !!!Do you think this will happen, or do you see Bitcoin below $50K in the future?

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

BTC - One More Leg...Hello TradingView Family / Fellow Traders!

This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish , trading within the falling channel marked in red.

But the big question is — where could the potential bottom be?

👉 I’m watching the $70,000 zone!

Here’s why:

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

Bitcoin (BTC): We Are In Profits, "Bloody Monday" "Bloody Monday," as they call it, is currently breaking every local support zone on smaller timeframes, and we have more and more BOS on the way.

While we are not yet where we want to be, we are keeping a close eye on our target zone, which we are going to reach, no doubt.

After that we will see how price will reach that zone and determine if we fall more or have the push we've been needing.

Swallow Academy

Bitcoin If you missed the rally do not top blast. Do not fomo. Do not trade with emotions.

If you bought the rally, congrats. Pay yourself. Do not get blinded by greed. Do not roundtrip

Back in 2022 most where celebrating there unrealized gains, and got liquidated when the market corrected. Every asset in the world follows one simple rule, nothing goes up forever.

The is no more liquidity on the up-side, we will go down. Gather liquidity for the next rally and bounce, just like 2022.

Bitcoin will be the most important asset you can have, but it has to follow the basic rules and will not go up forever.

BTC/USD Forming Bullish Falling Wedge – Potential Target📐 2. Technical Pattern – Falling Wedge

A falling wedge forms when the price consolidates between two converging downward-sloping trendlines. It suggests diminishing selling pressure and a likely reversal.

Key Characteristics in This Chart:

Upper Resistance Trendline: Formed by connecting the series of lower highs.

Lower Support Trendline: Formed by connecting the lower lows.

The price respects both boundaries, confirming wedge structure.

Volume generally decreases during the wedge (implied but not shown).

✅ Bullish Implication: Once price breaks above the upper resistance, it often triggers a sharp upward move due to the squeeze of supply and the build-up of demand.

🧱 3. Support and Resistance Zones

🔻 Resistance Zone:

Area: ~100,000 to ~108,000 USD

Marked as a wide horizontal band (beige-shaded area).

Previous price peaks and consolidations suggest this zone is strong supply.

Breakout above this zone could trigger momentum towards the higher target.

🔹 Support Zone:

Area: ~72,000 to ~75,000 USD

Historical reaction level where buyers previously stepped in.

Coincides with the lower wedge boundary and recent bounce points.

Repeated tests strengthen this as a reliable accumulation zone.

🎯 4. Trade Setup Strategy

💼 Entry Strategy:

Trigger: A confirmed breakout above the wedge’s upper trendline (black diagonal line).

Confirmation: A strong bullish daily close above the trendline, ideally with volume spike.

The current price (~77,130) is near the lower boundary—offering a potential early entry or low-risk setup with a tight stop.

📌 Stop-Loss Placement:

Level: 70,916 USD

Below the wedge’s lower support and beneath the broader support zone.

Ensures exit if the pattern fails or bears regain control.

🧭 Target Projection:

Target Price: 114,562 USD

Based on the height of the wedge projected from the breakout point, a standard wedge breakout measurement.

Aligns with historical highs and psychological resistance.

🧮 Risk-Reward Ratio: Assuming entry around 77,130:

Risk (Stop-Loss): ~6,200 points

Reward (Target): ~37,432 points

R:R Ratio ≈ 1:6 – Highly favorable

⚙️ 5. Market Psychology & Price Action Insight

The falling wedge pattern suggests exhaustion of sellers.

Buyers are defending the support zone aggressively—creating higher lows within the wedge.

Each bounce is slightly more aggressive, indicating growing bullish sentiment.

A breakout from the wedge could act as a catalyst for rapid price acceleration as sidelined bulls enter and shorts cover.

📊 6. Summary of the Setup

Component Detail

Pattern Falling Wedge (Bullish)

Timeframe 1-Day Chart

Entry Point Breakout above upper trendline

Stop Loss 70,916 USD

Target 114,562 USD

Support Zone 72,000–75,000 USD

Resistance Zone 100,000–108,000 USD

Risk/Reward Approx. 1:6

Bias Bullish

📌 Final Thoughts

This setup provides a technically sound opportunity with clear invalidation (stop loss) and a well-defined profit target. The risk-to-reward ratio is attractive, and the price structure suggests a bullish reversal is likely, pending a confirmed breakout.

Bitcoin Tests 2024 HighBitcoin is sitting at a critical inflection point on the daily chart. After breaking down from the symmetrical triangle with strong momentum, it continued lower, with volume confirming the move.

It’s now landed squarely in the FWB:73K –$75K region – a zone that just so happens to be the May 2024 all-time high. I’ve casually mentioned for over a year that a retest of that level wouldn’t be out of the question – and here we are.

Both the 50 MA and 200 MA were already acting as resistance going into this drop, so there were plenty of warning signs before the breakdown. With price now resting above major horizontal support, bulls need to hold the line here to keep the broader uptrend intact. A bounce would be constructive and could eventually form a higher low on the larger timeframe. But if this level fails, the door opens for a much deeper correction.

Bottom line: this is a massive test. The next move will likely shape the tone for the rest of the quarter.

I'm Bullish, but... BTC / USDHello my friends,

At a minimum we're looking at 30 days inside this wedge before breaking out and testing the $96k range once again. Trust me, Bitcoin must form a bullish structure before doing anything interesting.

It could wick to FWB:73K but I'm thinking the heavy orders around $75k might hold and we range instead of dumping more.

Keep an eye on this wedge.

Trade thirsty, my friends!

BTC - Slight Distribution After Nearly 10xMorning my fellow traders, and happy new year!

I hope you do not have a hangover right now. But if you do, get a tea going, it usually does the trick for me!

I can't deny the possibilities for another rally to take out the highs, but I'm thinking what the market makers are planning is a simple inverted Adam & Eve pattern that will lead us to new opportunities within the next month or so.

Keep in mind that for sometime now Alts have not been giving, and I believe that after this next Alt season (which I believe we will still get), they will keep giving less and less.

I sold near $100k for probably a couple weeks now. Did not get a perfect $108k sale, which is fine. Now I'll focus on a reentry if this plays out.

Trade thirsty, my friends!

Pullback to 80KMorning folks,

So, our long-term bearish journey that we were following for 4-5 weeks comes to an end. BTC more or less hit our 74K target and strong weekly support area .

The next one stands around 69K, but market strongly needs a new driving factor to break ~70K support area, and hardly this will happen this week.

Taking in consideration that market is oversold, now we set a tactical target- pullback to 80K resistance area , and then we will see, should be sell again or not.