CMCSA In the midst of an adjustment trend of downward direction 19-JUL

www.pretiming.com

Investing position: In Rising section of high profit & low risk

S&D strength Trend: In the midst of an adjustment trend of downward direction box pattern price flow marked by limited rises and downward fluctuations.

Today's S&D strength Flow: Supply-Demand strength has changed from a weak selling flow to a strengthening selling flow again.

Forecast D+1 Candlestick Color : RED Candlestick

%D+1 Range forecast: 0.6% (HIGH) ~ -0.9% (LOW), -0.1% (CLOSE)

%AVG in case of rising: 1.3% (HIGH) ~ -0.5% (LOW), 0.9% (CLOSE)

%AVG in case of falling: 0.6% (HIGH) ~ -1.1% (LOW), -0.4% (CLOSE)

CMCS34 trade ideas

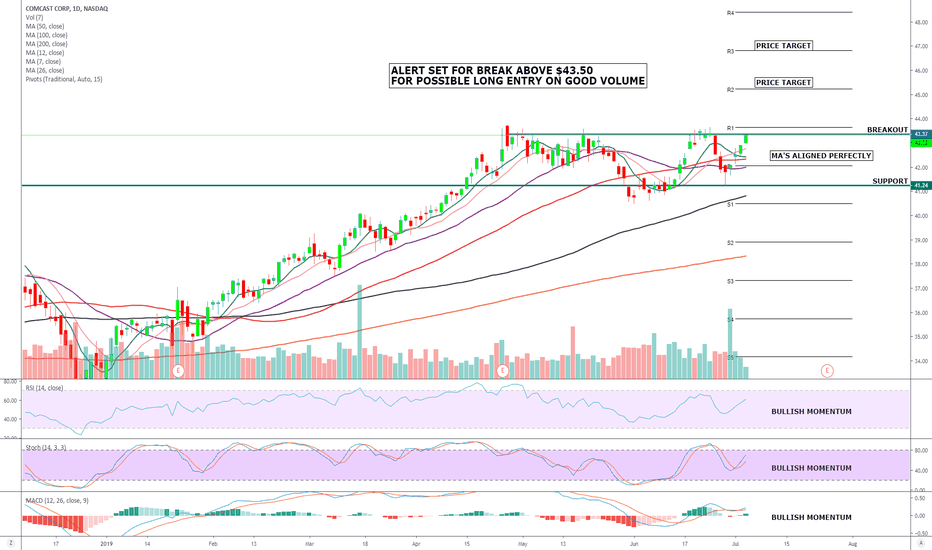

Comcast holds great potential for the second half of 2019 COMCAST CORP. NASDAQ (CMCSA) HAS OUTPERFORMED ITS PEERS FOR SOME TIME AND HAS REWARDED INVESTORS WITH A 30% RETURN IN 2019 WHILE ALSO HAVING A HEALTHY DIVIDEND OF 2% .

INITIAL PANIC OVER THE SKY DEAL HAS EASED.

COMPANY IS HIGHLY DIVERSIFIED WITH MULTIPLE REVENUE STREAMS.

LOW VULNERABILITY TO TRADE DISPUTE.

GREAT TRACK RECORD OF DOUBLE DIGIT REVENUE GROWTH ANNUALLY.

VERY REASONABLE VALUATION.

STOCK IS IN A VERY BULLISH CONSOLIDATION, BREAKOUT EXPECTED VERY SOON IF THE MARKET SENTIMENT CONTINUES TO BE BULLISH

AVERAGE ANALYSTS PRICE TARGET $48.14

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 16.5

SHORT INTEREST 1.5%

COMPANY PROFILE

Comcast Corp. is a media, entertainment, and communications company, which engages in the provision of video, Internet, and phone services. It operates through the following segments: Cable Communications, Cable Networks, Broadcast Television, Filmed Entertainment, Theme Parks, and Corporate and Other. The Cable Communications segment provides video, Internet, voice, and security and automation services under the Xfinity brand. The Cable Networks segment consists of national cable networks, regional sports, news networks, international cable networks, and cable television studio production operations. The Broadcast Television segment includes NBC and Telemundo broadcast networks. The Filmed Entertainment segment involves in the production, acquisition, marketing, and distribution of filmed entertainment. The Theme Parks segment consists of Universal theme parks in Orlando, Florida; Hollywood, California; and Osaka, Japan. The Corporate and Other segment includes operations of other business interests, primarily of Comcast Spectacor. The company was founded by Ralph J. Roberts in 1963 and is headquartered in Philadelphia, PA

CMCSA stock price forecast timing analysis.Stock investing strategies

Read more: www.pretiming.com

Investing position about Supply-Demand(S&D) strength: In Falling section of high risk & low profit

S&D strength Trend Analysis: In the midst of a rebounding trend of upward direction box pattern stock price flow marked by limited falls and upward fluctuations.

Today's S&D strength Flow: Supply-Demand(S&D) strength flow appropriate to the current trend.

D+1 Candlestick Color forecast: GREEN Candlestick

%D+1 Range forecast: 1.0% (HIGH) ~ -0.9% (LOW), 0.3% (CLOSE)

%AVG in case of rising: 1.5% (HIGH) ~ -0.3% (LOW), 1.0% (CLOSE)

%AVG in case of falling: 0.7% (HIGH) ~ -1.5% (LOW), -0.8% (CLOSE)

Stock Price Forecast Timing Criteria: Stock price forecast timing is analyzed based on pretiming algorithm of Supply-Demand(S&D) strength.

COMCAST Bearish Mode ONThe stock dropped below the 200 and 50-day moving average. My PV is at $42 a share, but in my case, I’m already short on it and I'll wait to take some actions for a proper chance to buy around $32.83 and then take profit around $42. Wall Street is targeting this share around $43.

Learn how to beat the market as Professional Trader with an ex-insider!

Be part of an elite trading group.

Have a Nice Trading Week!

Cream Live Trading, Best Regards!

CMCSA Crossroad for nowPersonal liking aside, CMCSA is in the midst of a crossroad between utopia and dystopia :)

In an ideal world, I hope the uptrend line is supported with a break above 36.60 for more upside towards 38.17 and a longer term target of 42.

Yet in the event that it should break 34.50 then the market would have decided that it favors the downside more than my personal liking or bias.

Reflection: The key is not knowing for sure what a stock is going to do next, but knowing what it should do. Then it's just ensuring if the train is on schedule or not and adapting to the situation presented.

CMCSA Holding Bullish Channel SupportCMCSA is holding the medium term bullish channel support. Price target is $36.50 - $37.50 with a quick recovery during October.

The content is for informational purposes only, you should not construe any such information or other material as investment, financial, or other advice.

-Wextini