ALLY1 trade ideas

Ally Financial an undervalued stock setting up for a bounceI don't love banking stocks right now because they have so much bad debt on the books, but Ally Financial looks good for at least a short-to-mid-term play. With a P/E of 7.62 and a valuation rating of 94/100 from S&P Global Market Intelligence, Ally looks very attractively valued. It beat estimates and raised guidance on its last earnings report, its earnings grew 10% last quarter vs. the same quarter the previous year. With a 2% dividend yield, Ally offers decent quarterly cash return as well as good growth potential. Best of all, Ally is sitting on a support and looks ready for a bounce from $30 per share. This is definitely my pick of the day.

For more market news, stock analysis, and educational videos for traders, check out my YouTube channel, "Wall Street Petting Zoo."

ALLY still in area of interestALLY failed to fulfill my breakout to $34 and hit resistance at $32.5 retracing back toward $30. 5MA and 10MA have crossed below 90MA and the EW oscillator is bearish from the recent correction but ALLY is well supported here around $30.5 and it should consolidate here again. Set stop loss at $30 and hold through consolidation.

Look to grab the bounce on Ally FinancialQuite possibly Ally Financial will bounce from its current price after dropping on an earnings beat. However, I am looking for it to bounce from the high-volume node at 30.01 tomorrow, and I've got a buy order set at that price. Ally has an attractive P/E of 8 and has a 95/100 valuation score from S&P Capital IQ. It faces some political risk from a possible third interest rate cut this year, but should perform well in the long term.

$ALLY long term buy, short term shortALLY I like the future of this company and stock, but for now it needs to complete its healthy correction pattern to prep for a next leg up. Looking for mid-28's in this apparent C-Wave. WIll seek entry around that level for a long term hold stock portfolio. Happy hunting and GLTA!!

ALLY very precise tradeWrite sometning about your psyhology thinking before trade? after one week of illness it is quite good that I can trade again

Describe the trade. What you see? price will advence to the level of the upper resistance and than bounce down to support line

What have I done well for this trade? enter point was ok and when I saw the extended move I went out by hand a few ticks before the target. Decision looks was ok.

What can I take away to help with later trades? target was maybe a little bit too optimistic.

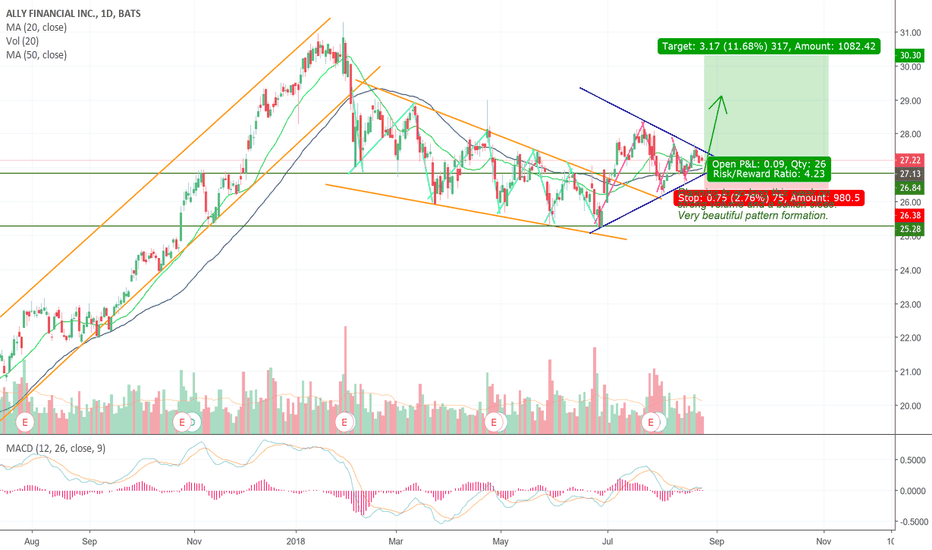

Long on ALLY.. possible breakoutALLY has recently been upgraded by Zacks.com to a rank 1 (strong buy). It has beaten earnings for the past 4 quarters. It is currently setting up for a possible break out. I will be looking to go long this week on the close above the upper trendline of the symmetrical triangle.