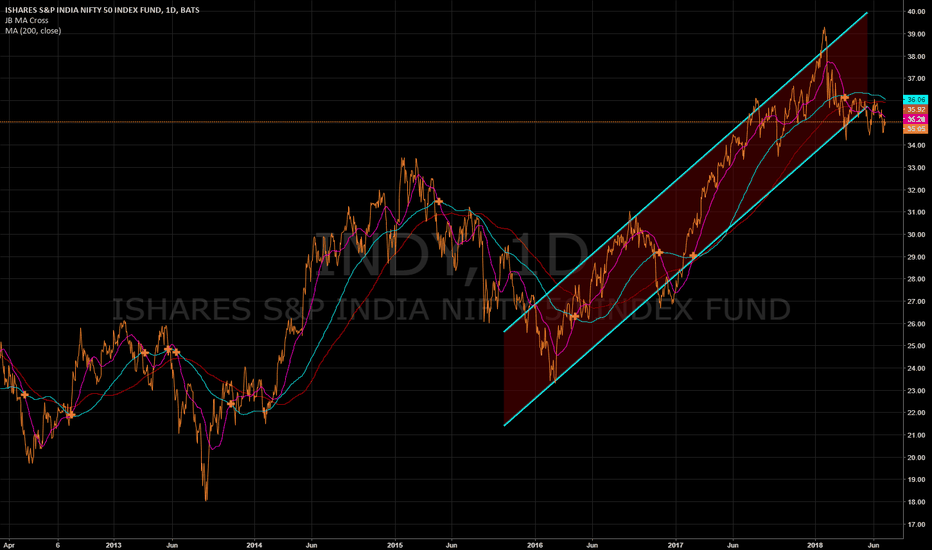

$INDY: Update - Buy signal in monthly scale here...🚨🚨🚨

If you are not exposed to India, now is a good time to join.

📢

Train is leaving the station here, monthly suggests immediate upside in the order of 8-10% in the coming quarter, which will likely trigger a breakout away from the long term consolidation here, to trace my expected path long term...

This can be the beginning of a huge long term advance, quarterly chart is very close to triggering a trend signal, so the reward to risk in this idea could be astronomical.

Best of luck!

Cheers,

Ivan Labrie.

INDY trade ideas

India is the long term winner of de-globalizationIndia is the winner for the next decade ahead, and with its manufacturing expansion, energy.

Fossil fuels, coal in particular, are set to benefit long term as India absorbs a chunk of China’s manufacturing footprint.

The reshoring / nearshoring / friendshoring theme, can reverse some of the impact of globalization, and perhaps trigger huge upside in India (and Mexico), perhaps echoing the performance of China’s stock market since 1989.

Their opportunistic geopolitical neutrality is a tactical move that is likely to pay dividends for Modi. Maintaining relations with Russia allows them to benefit from low-cost oil barrels that nobody else wants. Being able to leverage coal and fossil fuels and not be slowed down by ESG mandates can bring wealth generation to masses of poor people as the country makes a huge leap forward.

Clearly there is lots of room to improve, infrastructure is FAR behind the developed world, and population density and demographic trends are extremely bullish long term, so the growth potential is clearly there as more and more industries and companies establish factories in India, following NASDAQ:AAPL ’s lead.

The stock market index priced in local currency shows a long-term Time@Mode trend that warrants impressive long-term upside, and the US ETF IDX:INDY will likely follow suit in this regard.

Daily and weekly trends are already bullish, giving a low-risk entry to gain exposure to India’s top 50 companies safely from US brokerage accounts. Quarterly timeframe can trigger a trend as well, it seems to be a matter of time before the forecast confirms, perhaps during Q4 2023 or Q1 2023.

Best of luck!

Cheers,

Ivan Labrie.

India INDY ETF bounced off supportAn interesting observation here...

The weekly chart for INDY has recent bullish candlestick patterns after bouncing off a long term support level at 41.50. This is the second test in 2022, and the bounce closed above the next (gap) resistance level, above 43. The technical indicators are turning bullish, as RPM tuned up for a crossover.

The daily chart shows the past two weeks series of higher lows and higher highs and a gap up, marubozu-like candlestick. Technical indicators crossed over bullish, and are supportive of a test on the EMA band.

Taken together, there appears to be a 8-15% upside off this support bounce.

Interesting time juncture...

Stay well and stay safe!

India - Long on fundamentalsI can't tell you why exactly why India is a buy, as I do not know much about macroeconomics. The main ideea is that elections are coming and investors are confident this will change India's economy. This is an ideea coming from the macro analyst I follow, and he is yelling Buy Buy Buy since February. It might be a little late now, as India rallied strongly.

Technically, there is a flag pattern at a very strong resistance area, MACD started turning up from a buying area and so did the Force Index.

This chart doesn't serve as a good picture, I did the analysis on the Index itself. Candlesticks don't offer a good perspective, and there might be some fluctuations on the MACD histogram.

As I said, it might be a little late to go in, but I think it's worth trying. I will keep this position until the Fundamental picture changes.