BULLUSD trade ideas

$BTC Tracks $GOLD Very Closely With 12-Week LeadCould it really be this simple?

Maybe we can just throw Global M2 out the window and track TVC:GOLD with a 12-Week Lead.

Someone pointed this out to me yesterday when I posted Gold's near 1/1 tracking with Global M2.

*Note the deviation in CRYPTOCAP:BTC PA from the ETF hype.

The Journey of the Orange SunFrom whispers in the digital void in 2012

to the roaring crowd at $93,000 in 2025 —

Bitcoin’s arc bends not just toward price,

but toward a revolution written in blocks.

Each Fibonacci line is more than math —

it’s prophecy, patience, and power.

The chart doesn’t just show price;

it echoes belief.

Where others see candles,

I see constellations.

And we’re still charting the stars.

🚀📈

#BTC #Bitcoin #CryptoArt #ChartPoetry #FibLevels #BTCUSD

Altavics Group: Why Smart Investors Embrace CryptoVolatility Isn't the Enemy — It's the Opportunity

The crypto market is known for its fast and sharp moves. Yes, Bitcoin can drop 10% in a day. But it can also rise 40% in a month.

This is exactly why cryptocurrency remains one of the most profitable asset classes over the past decade.

At Altavics Group, we believe that fearing short-term price swings means missing out on long-term strategic opportunities.

Why Invest in Crypto?

1. Blockchain is not the future — it's already here

Web3, DeFi, and Central Bank Digital Currencies (CBDCs) are shaping a new financial system, where cryptocurrencies are the backbone of innovation.

2. Limited supply = growing value

There will never be more than 21 million Bitcoins. That makes BTC a digital equivalent of gold. In a world of inflation and excessive debt, scarcity is strength.

3. Portfolio diversification

Crypto assets help reduce exposure to traditional markets. Especially in times of geopolitical or economic instability, decentralized currencies offer a non-political, borderless hedge.

What if the market crashes?

Crypto corrections are not the end — they’re accumulation phases. Some of the best opportunities are found when the market is fearful.

Bitcoin dropped to $3,000 in 2018. Today it trades above $90,000.

Ethereum was $80 in 2019. Today it’s over $1,600.

The history of crypto is one of crashes and recoveries. Those who stay in smartly — win big.

What Altavics Group Offers

A secure, advanced platform for buying, storing, and trading cryptocurrencies

Real-time analysis and expert trading signals

Custom investment strategies aligned with your goals and risk appetite

Education for beginners and seasoned investors

Altavics Group’s Final Word

Investing in crypto doesn't mean taking blind risks. It means thinking ahead.

Those afraid of volatility today may regret missing the upside tomorrow.

Strong investors don’t chase comfort — they seek potential. And crypto is exactly that: proven potential.

Bitcoin Aligns with the 2017 Cycle ModelThere’s growing speculation that the current Bitcoin cycle mirrors the market behavior seen in 2017.

Intrigued by this, I conducted my own analysis. I overlaid the 2014–2017 cycle pattern onto the current chart for comparison.

The results?

A striking resemblance in both the overall shape and the distinct correction and impulse phases.

It seems history may not repeat itself exactly, but it certainly rhymes. 📊

BTC/USD 6 Month Chart (2 Year Bitcoin Accumulation Chart)Hello traders. Just wanted to post a quick Bitcoin chart showing how to stack some Sats :) I was thankful to have gotten in weeks before the big push up, about 6 months before the halving. I have bought every signifcant dip and even caught one more shown toward the top of the chart. Big G gets all my thanks. I am not sure if people really know what is going to happen with Bitcoin but I have studied it. And I believe in it. My personal thoughts, which mean nothing, is for this bull run to tap $265k a coin as a bearish case scenario. Let''s see how the next few months play out. Be well and thanks for checking out my chart.

It's a trapThe break above the 200 SMA is hopeful for bulls, but it was not on high volume. My simple position trading strategy has not indicated to re-enter, it looks for both a cross of the 200 SMA and a cross on the MACD. The former has happened but the MACD crossed on the 12th and has stayed above since. It uses conservative values to avoid entering into bear market rallies. Trend reversal to the upside could be real, but the probability of a sucker's rally is greater.

BTCUSD Short Setup – Bearish Reaction from Supply ZoneBTC recently broke out of an accumulation range, highlighted by the yellow box on the chart. Following the breakout, price surged and tapped into a nearby supply zone, showing signs of rejection. Current movement suggests a potential shift in momentum to the downside. We are currently monitoring a potential short setup on BTCUSD after price tapped into a clear supply zone around the 94,600 to 94,800 level.

Trade Idea Summary:

- Bias: Sell/Short

- Stop Loss: 95,000

- Take Profit: 88,830

- Risk to Reward Ratio: 1 to 2.57

Key Levels:

- High: 94,577

- Zone of interest: 94,600 – 94,800

- Support and target: 88,827

- Previous range low: 84,016

Notes:

This setup is based on a bearish reaction at the supply zone. A clean break of the 93,000 support level would provide further confirmation. Intraday volatility is high, so manage risk carefully.

Bitcoin Macro View – Post-Halving StructureThis monthly chart outlines Bitcoin’s long-term ascending channel with key horizontal resistance levels. Following the April 2024 halving (highlighted), price action has continued respecting the macro uptrend with higher lows. Blue projection suggests potential for continued bullish momentum, testing upper channel boundaries into late 2025.

Key zones:

• Major support: GETTEX:23K (2022 low, Fibonacci zone)

• Resistance: $60K–$69K range (previous ATH supply zone)

• Current structure: Bullish continuation above trendline support

Watching for confirmation of a breakout above previous highs, with potential upside extension toward $90K–$100K by 2026 if momentum sustains. 📊🚀

#Bitcoin #Crypto #BTC #TechnicalAnalysis #BTCUSD #HalvingCycle #CryptoTrading #MacroView

Bitcoin on 'Pause' for brief moment!Seems like Bitcoin is making its moves in bullish fashion and is now exiting from the pause phase . Let me break down those phases for you: Consolidation, Bull, Pause, Bull...

On the chart, I’ve highlighted these phases:

Consolidation Phase: This is represented by a channel pattern , where the price moves within a defined range.

Bull Phase: This is the parabolic movement , showing strong upward momentum.

Pause Phase: This takes the shape of a triangle , signaling a temporary slowdown before the next move.

What’s fascinating is that all these patterns — channel, parabolic, and triangle shapes —have unfolded during the 2023–2024 bull run . Together, they form a rising channel , reinforcing the broader bullish structure.

Let’s see where Bitcoin heads next! 🚀

#BTC Update (1H Chart)Trade Bias Verification: Long (with caution for short-term bearish momentum)

Confidence Score: 6.5 out of 10 (slightly reduced due to bearish MACD crossover and RSI divergence)

Hypothesis Refinement:

The bullish continuation hypothesis still holds, but the MACD bearish crossover and RSI divergence on the 1-hour chart signal a stronger short-term pullback or consolidation phase. The price is likely to test the demand zone near 92,000 - 92,934 before resuming the uptrend. Traders should wait for signs of momentum recovery (MACD crossover back up, RSI turning up from support) before entering.

Key Levels:

Entry: Near demand zone 92,000 - 92,934, ideally after MACD bullish crossover and RSI support confirmation.

Stop-Loss: Below demand zone and Ichimoku cloud, around 91,000.

Take-Profit: Near recent highs (94,000) and daily resistance (95,000 to 100,000).

Actionable Insight:

Avoid chasing the current pullback; wait for momentum indicators to confirm a reversal near the demand zone.

Use a momentum-based entry strategy on the 1-hour timeframe, entering once MACD crosses back above the signal line and RSI shows upward momentum.

Set alerts for price approaching the demand zone and for MACD/RSI bullish signals.

Maintain stop-loss discipline below the demand zone to protect against deeper corrections.

Monitor volume for increasing buying interest on the bounce to confirm strength.

BTC/USD) breakout up trand analysis Read The ChaptianMr SMC Trading point update

bullish analysis of Bitcoin (BTC/USD) on the 4-hour timeframe, showing a potential breakout and rally scenario. breakdown:

---

1. Market Structure:

Downtrend Channel: Price has been moving within a falling channel.

Double Bottom Pattern: Marked by two green arrows — a bullish reversal signal.

Breakout Attempt: Price is testing the upper trendline and 200 EMA (~$83,952), suggesting possible breakout.

---

2. Key Zones:

FVG (Fair Value Gap): Around $78,678 — a demand zone where price could retest before moving higher.

Breakout Confirmation Zone: ~$85,130 — breaking above this with volume signals strength.

Target Point: $95,206 — an upside target projecting ~31.77% gain from the breakout.

---

3. Indicators:

200 EMA: Currently acting as resistance. Break above it confirms bullish momentum.

RSI: Around 60 — pointing upward with bullish divergence from recent lows, showing increasing buying pressure.

---

4. Scenarios:

Scenario 1 (Bullish Continuation):

Breaks above trendline and 200 EMA.

Retest (optional) and then heads toward $95,206 target.

Scenario 2 (Retest First):

Price dips into the FVG/demand zone.

Finds support and launches upwards, confirming a strong base.

Mr SMC Trading point

---

Summary of the Idea:

This is a buy setup on breakout or on pullback:

Aggressive Entry: Break and close above $85,130.

Safe Entry: Pullback into $78,678 area (FVG).

Target: $95,206

Risk Zone: Below $78,000 (invalidates bullish structure).

Pales support boost 🚀 analysis follow)

Bitcoin will return to the moon!!BTC/USD 1D - Well as you can see price has played out exactly as we predicted yesterday providing us with an amazing push to the upside. I do however want to see price correct itself before the next push up.

I have gone ahead and marked out the order block I have in mind that I would like to see price come and clear before it continues in this hawkish way. I feel this could be a great area to get involved in those longs from.

As we know there are some great prospects for BTC so its important that we are always looking for key areas of interest for us to buy in from with this market being a bullish one.

$125k BTC in May? Bitcoin is poised to reach $125,000 by mid-May driven by a convergence of strong macroeconomic trends and crypto-native catalysts. The recent halving event has once again reduced miner rewards, compressing supply at a time when institutional demand—fueled by the approval of Bitcoin ETFs and growing interest from traditional asset managers—is surging. Historical post-halving rallies typically peak several months after the event, and this timeline aligns perfectly with the May target. Furthermore, Bitcoin’s increasing correlation with a weakening U.S. dollar and the Federal Reserve's anticipated dovish pivot adds momentum. As inflation fears subside and risk-on sentiment strengthens, capital rotation into digital assets could accelerate, helping push Bitcoin toward the $125K mark.

However, a healthy correction between June and September is both likely and necessary to sustain long-term price growth. As new investors enter at higher price points and early cycle holders begin to take profits, the market may experience a 20–30% pullback—possibly exacerbated by macro uncertainty or regulatory headlines. This cooldown period would shake out short-term speculation and reset key technical indicators. By Q4, renewed buying pressure, stronger fundamentals, and increased mainstream adoption could reignite the uptrend. With Bitcoin reentering price discovery mode, the final leg of the cycle rally could push it toward a new all-time high of approximately $155,000 by November, reflecting the maturity of this bull cycle and the growing role of Bitcoin as a macro hedge.

Will XRP catch up with BTC and give us a 22% return?XRP has turned bullish after triggering an inverse head and shoulders pattern, suggesting prices could rise by up to 22 percent. Ripple now looks to catch up with Bitcoin and several altcoins that have already posted similar gains. Watch the video for full details and share your thoughts in the comments.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

BTC BREAKS BULLISHBitcoin has officially left the chat... and the downtrend.

We’ve broken through the descending resistance from the all-time high with conviction, and cleared the key $88,804 level that had marked every failed rally for the past few months. Not only that – price has exploded above both the 50-day and 200-day moving averages, reclaiming them as support.

The breakout came with strong volume, validating the move. This is also a confirmed higher high, flipping market structure back to bullish for the first time since the March top.

Of course, nothing moves in a straight line, and some consolidation or retest wouldn’t be surprising. But this is exactly the kind of clean breakout technical traders look for – a textbook trend reversal.

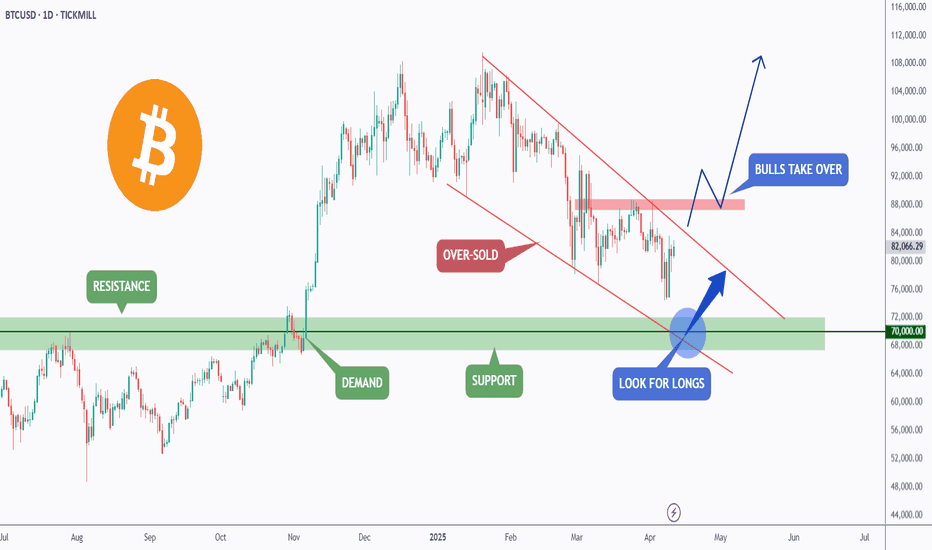

BTC - Two Bullish Scenarios...Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

📉 BTC has been overall bearish, trading within the falling channel marked in red.

The $70,000 area is a key confluence zone — it aligns with the lower red trendline, horizontal support, a psychological round number, and a potential demand zone.

📚 According to my trading style:

As #BTC approaches the blue circle zone, I’ll be looking for bullish reversal setups — such as a double bottom pattern, trendline break, and more.

🏹In parallel, for the bulls to take over long-term, and shift the entire trend in their favor, a break above the last major high marked in red at $88,888 is needed!

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

BITCOIN SENDS CLEAR BEARISH SIGNALS|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 96,964.04

Target Level: 86,587.12

Stop Loss: 103,865.43

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅