BULLUSD trade ideas

Volume fades, double top forms – is Bitcoin headed to 70k?CRYPTOCAP:BTC is showing signs of exhaustion near the $83,500–$84,000 zone, with repeated rejections indicating weakening bullish momentum. Volume is steadily declining, which typically signals a lack of conviction from buyers.

We may be witnessing the formation of a potential double top – a bearish reversal pattern. If confirmed, this could trigger a correction toward $78K, $74K, or even the $70K–$68K zone.

Key Levels to Watch:

Resistance: $83,500–$84,000

Support: $78,000 → $74,000 → $70,000 → $68,000

This corrective move could be healthy for the market, potentially flushing out weak hands and injecting fresh liquidity for a stronger upward rally in the coming weeks.

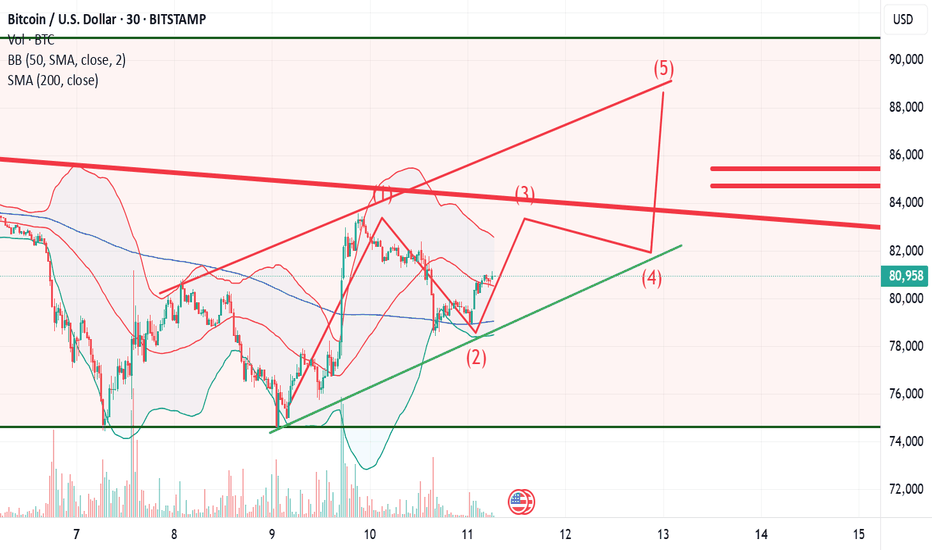

BTC Last growth before a serious plunge! We're approaching the final leg up in this bull cycle. My projection puts the ultimate ATH around $120K, likely reached in the coming months. But don't get too comfortable—what follows could shake the market.

I'm expecting a 5-wave ABCDE correction that could bring BTC back down to the $58–60K zone, with the correction likely concluding around March 2026.

This could be the last major pump before a multi-year reset. Buckle up and plan your exits wisely. 📉📈

#BTC #Bitcoin #Crypto #CryptoAnalysis #BTCUSD #Altcoins #CycleTop #BearMarketPrep

BTCUSD INTRADAY oversold bounce capped at 88000Recent price action in Bitcoin (BTCUSD) suggests an oversold bounce, with resistance capping gains at the 88,000 level. The continuation of selling pressure could extend the downside move, with key support levels at 76,144, followed by 74,420 and 73,283.

Alternatively, a confirmed breakout above 84,600, accompanied by a daily close higher, would invalidate the bearish outlook. In this scenario, Bitcoin could target 88,000, with further resistance at 91,890.

Conclusion:

The price remains below pivotal level, with 88,000 acting as a key resistance. Failure to break above this level could reinforce downside risks, while a breakout could shift momentum back in favor of bulls. Traders should watch for confirmation signals before positioning for the next move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Bitcoin Trade Setup: Bullish Breakout Targeting $87K!🔹 Key Levels Identified:

📌 Target Point: 87,008.21 USD 🏁🔵

👉 Expected price move (+9.07%) 🚀

📌 Entry Point: 79,719.00 USD ✅

👉 Suggested buying level in demand zone 🏦

📌 Stop Loss: 78,213.25 USD ❌🔻

👉 Risk management level 📉

📊 Technical Analysis:

📈 Trendline Support:

🔵 The price bounced off the trendline 📊, confirming an uptrend 📈

🔵 Demand Zone:

🟦 Marked blue area = Buyer interest 📊

💰 Expected reversal zone if price retests

📊 Moving Average (DEMA 9):

🔸 82,343.85 USD (current level)

🔺 Price slightly below DEMA ➝ possible bullish reversal 🚀

⚡ Trade Setup:

✔️ Risk-to-Reward Ratio:

🟢 Potential profit: +7,220.76 USD

🔴 Risk: -1,500 USD

📊 Favorable trade setup with high reward vs low risk ✅

✔️ Momentum Confirmation:

🟢 Above 79,719 USD = 🚀 Bullish breakout

🔴 Below 78,213.25 USD = ❌ Stop Loss triggered

🔮 Conclusion:

🔥 Bullish setup if price holds demand zone!

🚀 Target: 87,008 USD

⚠️ Manage risk with stop loss! 📉

Bitcoin Wave Analysis – 11 April 2025- Bitcoin reversed from support zone

- Likely to rise to resistance level 87785.00

Bitcoin cryptocurrency recently reversed from support zone between the support level 76685.00 (former low for wave (A) from the start of March, as can be seen below), lower daily Bollinger Band and the 61.8% Fibonacci correction of the upward impulse from September.

The upward reversal from this support zone stopped the earlier short term wave B - which belongs to ABC correction (B) from the start of March.

Bitcoin can be expected to rise to the next resistance level 87785.00, which stopped the previous wave A.

BTC 97K Long Target Inverse Head and ShouldersTHIS BLUE NECKLINE IS 100% THE LINE TO FOLLOW

Inverse Head And Shoulders

Active Long Target - 97,050

What To Expect?

Trump's tweets are highly volatility just like the markets so rather then trying to call the exact bottom use this for your bull / bear transition. I'm not saying when it will happen... but above the blue line bullish, below it flip bearish despite it would take a number in the 60Ks to invalidate this target.

Downside seems to be the orange support line in 73.8... but money is on 97K sooner than later and this chart staying valid.

The latest analysis of Bitcoin is in a downward channelBTC is currently trading within a well-defined descending channel, showing consistent lower highs and lower lows since mid-March.

Descending Channel: The upper and lower boundaries have acted as reliable resistance and support zones.

Double Bottom Pattern: Price action recently formed a double bottom near the $75,000 zone (marked "HUNT2"), which is typically a bullish reversal signal.

Breakout Target: The neckline breakout from the double bottom targets the $85,000–86,000 zone, which aligns with the upper boundary of the channel — a confluence resistance.

Fakeouts (HUNT1 & HUNT2): These "hunt" zones likely represent liquidity grabs or stop-loss sweeps, indicating strong institutional manipulation before major moves.

Bullish Scenario: After touching the lower level of the neckline, it goes to touch the top line of the channel and touches the target of the pattern.

.

Bearish Scenario: Rejection from the $85K zone could send BTC back down toward

73K

–$ 74 K. Further downside could bring the $69K–$70K zone into focus.

BITCOIN Is Very Bearish! Short!

Here is our detailed technical review for BITCOIN.

Time Frame: 12h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is trading around a solid horizontal structure 82,277.86.

The above observations make me that the market will inevitably achieve 75,083.32 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

BTC Continuation to the down sidei shared BTC analysis on DEC 17,2024,

The chart showed a potential rising wedge and breakout from a rising wedge pattern, a subsequent -30.12% drop (over 3.2 million pips), and a key support level should retest around the GETTEX:64K zone

before the next huge up trend

don't forget to take your profit at GETTEX:64K

BTC/USD Short Setup I have entered a short position on BTC/USD following a failed breakout and 4-hour candle close back below the key horizontal resistance level. This level also aligns with the mid-range of the recent consolidation zone. Price attempted to reclaim this level but was firmly rejected, signaling potential bearish continuation.

Entry: $81,517.95 (Rejection confirmation at resistance)

Stop Loss: $84,720.67 (Above the recent swing high and invalidation zone)

Risk Management Level: $79,552.34 (Move SL to BE once TP1 is hit)

Target Levels:

TP1: $79,552.34 – Moving SL to BE at this point to manage risk

TP2: $75,012.31

Trade Rationale:

The 4H rejection candle confirms sellers defending the resistance zone, with price unable to close back above — a signal of continuation lower within the broader range.

A clean break and retest of the ascending short-term trendline may further confirm bearish momentum.

Risk is defined above the most recent supply zone to allow space for natural price volatility.

Targets are mapped based on previous support reactions and potential liquidity pools below current levels.

BITCOIN Can it start an insane rally on CHEAP MONEY??Bitcoin (BTCUSD) seems to be at a point where it last was at the beginning of its current Bull Cycle in October 2022. And that's the point where the Global Liquidity Cycle Indicator (black trend-line) bottomed and started rising, confirming the more on Higher Lows.

This huge buy formation has been present on every BTC Cycle, usually at its bottom (but on the 2015 case, a little after) and signaled the huge monetary supply into the global markets, which translates into rising prices and rallies.

This is the first time we see the same rising liquidity formation twice in a Cycle. Can this be the driving force that BTC needs for its final and strongest parabolic rally of the Cycle towards the end of the year?

Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

BTC🚨 BTC approaching key resistance zones – don’t get overconfident!

Price has reached 81,538, which is a strong supply zone. Next major resistance lies between 82,487 and 83,638.

If you're planning to sell, go with half lot – market is still volatile.

Avoid full entries without proper confirmation, stay smart and safe!

📍 Key Resistance Zones:

• 81,538.95

• 82,487.56 – 83,638.84

📉 Timeframe: 15min

🔐 Risk Management is Everything!

#BTCUSD #BitcoinAnalysis #CryptoChart #SupplyZone #ResistanceLevels #SmartTrading #HalfLotEntry #VolatileMarket #FXFOREVER #PriceAction #CryptoTraders

BTCUSD Market Discrepancy Analysis (April 11, 2025)

📉 Chart Overview:

The chart reflects Bitcoin (BTC/USD) on the 1-hour timeframe, with significant price movements between 77,417 (support) and 83,846 (resistance). The asset recently rallied to fill a Fair Value Gap (FVG) before facing resistance and dropping back to retest the lower region.

1. Resistance Rejection at $83,846:

- The price spiked aggressively into the resistance zone, but quickly reversed after failing to sustain above it.

- This price rejection is clear evidence of strong seller presence.

- The FVG zone just below the resistance appears to have been filled, triggering a sharp correction.

2. Failed Breakout or Bull Trap:

- The s…

- This suggests that buying pressure was temporary, and mostly driven by short-term momentum traders rather than real demand.

4. Incomplete Fair Value Gap at77,417:

- Price moved sharply down and almost touched the FVG area near 77,417, but did not completely fill it.

- This leaves an imbalance and suggests that the market may revisit this area to fully mitigate it.

5. False Break of Lower High:

- The high near 82,290 was breached temporarily, but price did not close above convincingly.

- Indicates a fake breakout structure within a broader bearish context.

---

🔧 Technical Summary:

| Zone | Level | Status |

|------------------|-----------------|-------------------------|

| Resistance | 83,846 | Rejected |

|…

This chart shows a clear discrepation between price momentum and volume confirmation. While price temporarily surged into a resistance zone, it lacked the strength to hold above key breakout levels, suggesting the rally was unsustainable.

> The Fair Value Gap (FVG) at77,417 remains unfilled, and current price structure points to a potential return to that zone. Expect bearish continuation unless BTC reclaims and sustains above $82,290 with volume.

---

Let me know if you want this in a simplified caption format for social sharing!

TC/GOLD: Could 1 BTC Reach 6,000 oz of Gold by 2027 ($19.2M US)The chart tracks Bitcoin (BTC) priced in ounces of gold (oz) on a logarithmic scale, revealing its historical growth and a speculative projection. As of April 2025, 1 BTC equals approximately 25 oz of gold, which translates to $80,000 per BTC at an implied gold price of $3,200/oz (derived from the projection).

The chart forecasts a dramatic rise to 6,000 oz of gold by 2027, a 240x increase from the current level. At $3,200/oz for gold, this would value 1 BTC at $19.2M, resulting in a market cap of $378 trillion (19.7M BTC in circulation). Historically, Bitcoin has shown exponential growth, with significant spikes during bull cycles (e.g., 2017-2018 and 2024-2025, as circled). Factors like Bitcoin’s capped supply, post-2024 halving scarcity, and potential for increased adoption as "digital gold" could support such a run.

What are your thoughts? Could Bitcoin achieve this monumental target, or is the projection too optimistic? Let’s discuss!

TL;DR: BTC/GOLD ratio is set to ****ing pump! From 25 oz now to 6,000 oz by 2027—1 BTC could hit $19.2M. Buckle up for a wild ride!