Bitcoin RSI Cooldown Before $88K? Key Support Levels to WatchBitcoin is showing strength towards the $88,000 mark, but the RSI on the 1-hour and 4-hour timeframes is significantly overbought, signaling the need for a healthy retracement.

I’m expecting CRYPTOCAP:BTC pullback to the RSI 50 midline, which could align with a price retrace to around $85,000–$83,000. If BTC loses the $85K level, FWB:83K comes next. A deeper retest could bring it back to $80K, which may serve as a high-conviction long zone.

Trading Plan:

Short scalp while RSI is overheated.

Long entries: $85,600 zone if structure holds.

Keep your eyes on volume and RSI reaction near key levels.

BULLUSD trade ideas

Consolidation Divergence - Range Trading StrategyLast week, BTC continued to oscillate in the 83K-86K range. Technically, the daily MACD showed increasing volume but a deviation from the price. At the same time, the Bollinger Bands narrowed sideways, and the market entered a typical "pre-breakout momentum" stage.

Before an effective breakthrough, you can rely on the range to sell high and buy low, strictly set stops, and pay close attention to changes in volume and energy and confirmation of the breakthrough direction.

BTCUSD

sell@86500-85500

tp:84500-83500

buy@83000-84000

tp:85000-86000

I hope this strategy will be helpful to you.

When you find yourself in a difficult situation and at a loss in trading, don't face it alone. Please get in touch with me. I'm always ready to fight side by side with you, avoid risks, and embark on a new journey towards stable profits.

This 3 Step System Has Caught The Bullrun In BitcoinThe rocket booster strategy is a classic

indicator which we have been using for a long

time.

Right now the strategy is trending in BItcoin.

This is your chance to see the strategy.

This strategy has 3 steps:

1-The price has to be above the 50 EMA

2-The price has to be above the 200 EMA

3-The price has to Gap up

--

Last week we caught the bull run in

gold and the crash of the dollar

This week we have caught the bull run

In Bitcoin CRYPTO:BTCUSD

Watch this video to learn more

Also rocket boost this content

to learn more

--

Disclaimer:Trading is risky.

please learn risk management and

profit taking strategies.Also feel free to

use a simulation trading account

before trading with real money.

$BTC: Trapped Between Two Major Levels🔸

BTC is consolidating between $77K (support) and $90K (resistance), forming a tight 10% range with compression indicating a major move brewing. Current price near $87,500 shows strength but lacks breakout confirmation.

🔸 Key Support Zone at 77,000 (Green Line):

This level previously acted as a breakout base. Multiple successful retests confirm its strength. As long as BTC stays above this level, the bullish structure remains intact.

🔸 Upside Target: 95,000 – 100,000+

A breakout above the GETTEX:89K –$90K zone (orange resistance) will unlock a continuation trend, targeting new all-time highs.

🔸 Risk Level at 74,000 (Red Line):

If BTC breaks below $77K, the structure flips bearish. Failure here opens downside toward $66K and possibly the $50K–$55K range.

🔸 Action Plan:

Break & Hold Above 90K: Close short, ride spot

Retest 77K: Reload spot buys

Break Below 77K: Exit spot, ride short further

Macro Catalysts to Watch:

✅ Fed Rate Cuts

✅ China–US Deal

✅ Powell removal rumors

✅ M2 liquidity surge

✅ Trump policy changes

✅ Elevated VIX & fear

Bitcoin (BTC/USD) Weekly Analysis - W3 April | Master The MarketBitcoin continues to dominate the cryptocurrency market, and its price action provides valuable insights for traders. Here's a detailed breakdown of Bitcoin's performance in Week 3 of April:

Monthly Chart: Long-Term Uptrend

The monthly chart shows that Bitcoin remains in a long-term uptrend. However, last month saw some consolidation, with prices pulling back slightly. This indicates a healthy correction after a prolonged upward movement. Traders should focus on key support and resistance levels to identify potential breakout or reversal zones.

Weekly & Daily Charts: Consolidation Below the Cloud

On the weekly chart, Bitcoin’s price is currently trading below the Kumo cloud but above critical support levels. The daily chart highlights a defined trading range between $74,000 and $93,000 . A breakout above the cloud could signal renewed bullish momentum, while a retest of the $74,000 support level may indicate further consolidation.

Key Levels to Watch

Support: $74,000

Resistance: 93,000Tradersshouldmonitortheselevelsclosely.Asustainedmoveabove93,000 could open the door for higher targets, while a break below $74,000 might lead to deeper corrections.

Trading Strategy

Buy Opportunity: Wait for a pullback to the cloud support or a retest of $74,000 before entering long positions.

Risk Management: Place stop-loss orders below key support levels to protect against downside risks.

Bitcoin remains highly volatile, so patience and discipline are crucial. Keep an eye on macroeconomic factors like interest rate decisions and geopolitical events, as they can significantly impact BTC/USD price movements.

BTC/USD Long Setup – Bullish RSI DivergenceWe’re currently looking at a textbook bullish divergence on BTC/USD. While price printed a lower low, the RSI formed a higher low on the 4H chart, signaling a potential reversal in momentum. This divergence often precedes a trend change or at least a relief rally.

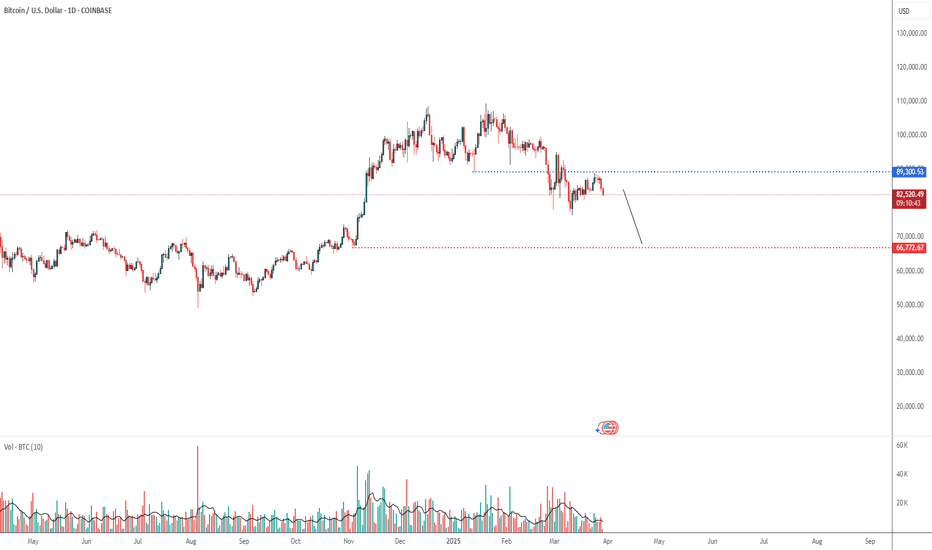

BTC SHORT TP:82,300 17-04-2025🚨 Time to go Short! The targets are set between 82,000 and 82,500, with the 4-hour and 8-hour timeframes indicating a bearish trend.

We anticipate this downward movement to unfold within the next 2 days. It’s crucial to enter at the right moment and consider averaging down to maximize your potential gains.

Keep an eye on market updates to adjust your strategy accordingly. Following me will ensure you stay informed about any changes and the latest insights. Let’s navigate this market together and aim for those profits! 📉💰

Bullish rise?The Bitcoin (BTC/USD) is falling towards the pivot and could bounce to the 1st resistance which is slightly below the 61.8% Fibonacci retracement.

Pivot: 81,863.58

1st Support: 76,689.89

1st Resistance: 94,753.96

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

BTCUSD Sell Signal @ 85100A bearish signal has been triggered for Bitcoin against the US Dollar at the 85,100 level. This indicates a potential trend reversal or correction from recent highs, suggesting sellers may be stepping in at this price point. Traders might consider this an opportunity to short BTCUSD or take profits on long positions. As always, proper risk management and confirmation from additional technical indicators (e.g., RSI, MACD, trendlines) are recommended before taking action.

Bitcoin: Watch For These Break Out Scenarios.Bitcoin is consolidating within a very tight range: between 83 and 86K. Which way it breaks is a matter of catalyst, but recognizing the break can help to better shape expectations on this time horizon. IF 83K breaks, I will be watching for the higher low scenario (see blue square), for confirmations to go long. IF 86K breaks, I will be anticipating a test of the 88 K resistance (see arrow). What happens after that is anyone's guess. This is NOT about forecasting the future, it is about considering multiple scenarios and then adjusting as the market offers new information.

This evaluation can be helpful on multiple time frames if you know how to use it. For example, a break of the 83K support can be a great day trade opportunity on time frames like the 5 minute. A test of the 78K to 80K area followed by a confirmation can offer a long opportunity on the swing trade or day trade time frames. A test of the 88K or 90K resistance levels can offer aggressive short opportunities on smaller time frames as well. You have to be prepared for the possibility of the corresponding pattern to appear (bullish/bearish reversal) and confirmation. From there risk can be effectively quantified and taking action becomes reasonable.

Getting stuck on 1 scenario rather then being prepared for multiple possibilities makes you inflexible because there is NO precision in financial markets (unless you're on the micro structure level MOST retail traders are NOT). The scenarios I explained here can unfold over the week or take longer, AGAIN is it a matter of catalyst or surprise news event.

As far as the bigger picture, nothing has changed. The 76K AREA low is a double bottom, which translates into a broader higher low when you look back over the year. This higher low structure implies Bitcoin is still generally BULLISH which means betting on resistance levels can be considered a lower probability outcome. This also means current prices are still attractive investment levels as long as you are sizing strategically. IF price manages to break below 65K over the next quarter, then I would say investing should be more limited since such a break implies the impulse structure is no longer in play.

Other than that, seasonal volume typically peaks around this time of year in the stock market, which means the next few months are more likely to be less eventful and contain smaller price ranges etc. There are always exceptions and news catalysts will still cause price spikes, but the dramatic nature like we have seen will likely be smaller. So unless there are any surprises in Bitcoin, be prepared for slow grinds or less eventful movements generally speaking.

Thank you for considering my analysis and perspective.

If the market reaches the $88,490 level, we'll look for selling.BTCUSDT Weekly Analysis: Navigating the Range-Bound Market

Bitcoin (BTC) is currently trading in a range-bound market, showcasing a delicate balance between buying and selling pressures. As traders, it's essential to identify key levels and potential trading opportunities.

Key Selling Area: $88,490

We've identified a crucial selling area at $88,490, where sellers are actively participating. This level has the potential to cap upward movements, and we're waiting for the market to reach this zone.

Trading Strategy:

1. Sell Setup: If the market reaches the $88,490 level, we'll look for selling opportunities, targeting lower levels and taking advantage of potential downward momentum.

2. Alternative Scenario: If the market doesn't reach the $88,490 zone, we'll wait for a clear breakdown from the current range, with a candle closing below the range. This would signal a potential shift in market sentiment.

Market Outlook:

The range-bound market presents both challenges and opportunities. By monitoring key levels and waiting for confirmation, we can make informed trading decisions and navigate the markets effectively.

What to Watch:

1. $88,490 Level: A key selling area that could determine the next move.

2. Range Boundaries: Monitoring the current range and waiting for a breakdown or breakout.

3. Market Sentiment: Keeping an eye on market sentiment and adjusting our strategy accordingly.

By staying vigilant and adapting to market conditions, we can capitalize on potential trading opportunities and navigate the complexities of the cryptocurrency market.