Will AAPL temporarily go below 205 this week?My overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I have been wrong many times before so I will just take this thing in stages and see if it plays out. After this massive decline, we should be in for a great market rally of many decades. While the market has seen a brief rally, the primary question is when will the rally end? Friday turned in mix answers to that question. The next step in my opinion will be a decline, possibly sharp with a quick bottom in some sectors AHEAD of the reciprocal tariff deadline on April 2.

My wave 3 indicator tends to signal wave 3s and 3 of 3s with additional end of wave (overbought/sold) conditions. See my scripts for the specifics of the indicator. It currently signaled 3 of 3 based on the bottom in mid-March meaning another drop is likely soon.

While the other stocks I have studied mainly topped at all-time highs in mid to late February, AAPL topped at the end of 2024. The movement of AAPL may be a leading indicator of future market movement as the market appears to be trading as a micro wave structure inside of AAPL's more macro movement.

My market expectations are for their first semi-major wave 1s to end within the next few weeks. Each wave 1 will be followed by a multi week wave 2 up. AAPL may end its wave 3 structure (yellow 3) when the others finish their wave 1s. AAPL would then experience wave 4 up, when the other stocks and S&P 500 index experience their second wave.

This chart applies select movement extensions based on wave 1's movement on the left and then another based on wave 3's movement on the right. I keep the values between 0%-100% on the chart for wave 2s and 4s retracements of the preceding wave's movement for reference even though the retracement values would be inverted.

I will refer to the yellow waves a Minor waves and the green as Minute waves. The extension/retracement data on the left is based on Minor wave 1's movement and is applicable to Minor waves 2 and 3. It provides a rough location of levels for Minor wave 3 to end. The extension on the right attempts to determine Minute wave 5's end points based on Minute wave 3. An intersection of Minor wave 1 extension levels and Minute wave 3 extension levels are general targets for bottoms. One of these is between 203-204 for AAPL.

Lastly, I apply similar levels to determine Minor wave 3's length based on Minor wave 1's length of 45 bars (on the 3 hour chart). Minor wave 3 is currently longer than 45 bars. The vertical dashed bars provide similar locations with the next vertical bar occurring on the morning of Monday March 31. I am therefore watching to see if the next bottom for AAPL occurs at this time.

If this bottom truly comes into focus, I will then attempt to forecast Minor wave 4 for AAPL which could occur in late April.

AAPL trade ideas

AAPL Short: Short at Support turned ResistanceWhere to short AAPL? I think the red line price of $219.71 is a strong resistance because it is the price where there were 2 previous lows (first 2 red arrows pointing up).

Take note that there is a chance that the recent low point is the end of the entire correction if that is a wave C. My Primary count that it is just wave 1 of C is a BIAS. Just keep that in mind.

I would say that the stop loss is about $10 above $219.71.

Good luck!

Apple - Will Apple visit the $200 zone again?Apple has officially started its daily downtrend. The $200 support zone is a level that has been respected often in the past, with a high confluence of the Golden Pocket. It is highly possible that Apple could revisit this level and make a strong bounce. Until then, there is a high probability that this level could be revisited until the downtrend is broken.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Lets chat in the comment section. See you there :)

Apple Wave Analysis – 20 March 2025

- Apple reversed from resistance level 220.00

- Likely to fall to support level 208.00

Apple recently reversed down from the pivotal resistance level 220.00 (former strong support from November and January, acting as the resistance level after it was broken previously).

The donwward reversal from this resistance level 220.00 stopped the previous short-term correction 4 – which belongs to wave (C) from February.

Apple can be expected to fall to the next support level 208.00 (which reversed the price earlier this month).

$AAPL TIME TO LOAD UP?As of March 12, 2025, Apple Inc. (AAPL) is trading at $217.21, reflecting a slight decrease of 1.64% from the previous close.

Apple continues to demonstrate strong financial health, maintaining robust cash flows and a solid balance sheet. This financial stability enables ongoing investments in research, development, and strategic acquisitions, positioning the company for sustained growth.

While Apple has traditionally taken a measured approach to artificial intelligence, this strategy has proven advantageous. The company's cautious AI investments have allowed it to avoid the pitfalls faced by competitors with higher AI expenditures. This prudent approach has contributed to stock stability, even as the broader tech market experiences volatility.

Apple's integrated ecosystem—including devices like the iPhone, iPad, Mac, and services such as the App Store and Apple Music—fosters strong customer loyalty. This ecosystem not only encourages repeat purchases but also attracts new customers, providing a steady revenue stream and opportunities for cross-selling.

Apple's position as a leader in the technology sector, coupled with its strong brand recognition, offers a competitive advantage. The company's ability to set industry trends and command premium pricing supports robust profit margins and market share.

Despite recent stock fluctuations and external challenges, Apple's solid financial foundation, strategic investments, cohesive product ecosystem, and strong brand equity contribute to a positive long-term outlook for AAPL stock.

Apple (AAPL): -50%. According to the planElliott Wave Analysis of Apple stock

.

● NASDAQ:AAPL |🔎TF: 1W

Fig. 1

The long-term wave markup has not been adjusted for the past three years. Except that the orthodox tops and bottoms and targets for third waves are slightly refined.

.

● NASDAQ:AAPL |🔎TF: 1W

Fig. 2

Earlier, at the end of 2023 , we have already suggested wave ((iv)) in 3 in the form of a running flat. As we can see, the attempt was unsuccessful, the formation of a sideways correction continues to this day. It can be a running flat or an expanded flat, the latter of which assumes a break of the 124.17 low.

AAPL Bullish Reversal – Is the Rally Just Starting?Technical Analysis & Options Outlook

📌 Current Price: $216.15

📌 Trend: Bullish Reversal with Smart Money Confirmation

📌 Timeframe: 1-Hour

Price Action & Market Structure

1. Bullish Breakout Confirmed – AAPL has broken above trendline resistance, confirming a shift in sentiment.

2. BOS Validation – The break above $215 confirms buyers stepping in aggressively.

3. Retest Zone Possible – Price may pull back to $215–$213 before continuing higher.

4. MACD & Stoch RSI – Showing strong momentum, but nearing overbought territory, meaning potential consolidation before continuation.

Key Levels to Watch

📍 Immediate Resistance:

🔹 $217.50 – 53% CALL Resistance

🔹 $220 – 3rd CALL Wall Target

🔹 $222.50 – Highest CALL Target

📍 Immediate Support:

🔻 $215 – BOS Retest Zone

🔻 $210 – Highest Negative NETGEX / PUT Support

🔻 $208.42 – Critical Demand Zone

Options Flow & GEX Sentiment

* IVR: 52.3 (Moderate Implied Volatility)

* IVx: 32.4 (-3.28%) (Declining volatility, favoring breakouts)

* GEX (Gamma Exposure): Bullish Shift Detected

* CALL Walls: $217.50, $220, $222.50 (Upside targets)

* PUT Walls: $210 & $208 (Demand zones)

📌 Options Insight:

* Above $217.50, expect a gamma-driven move toward $220+ if momentum sustains.

* Below $215, risk increases for a retest of $210 before bouncing back.

My Thoughts & Trade Recommendation

🚀 Bullish Case: If AAPL holds above $215, expect a continuation to $220–$222.50.

⚠️ Bearish Case: If AAPL breaks below $215, expect a retest of $210–$208 before another move higher.

Trade Idea (For Educational Purposes)

📌 Bullish Play:

🔹 Entry: Retest of $215 support

🔹 Target: $220–$222.50

🔹 Stop Loss: Below $213

📌 Bearish Play (Hedge Idea):

🔻 Entry: Rejection at $217.50

🔻 Target: $210 PUT Wall

🔻 Stop Loss: Above $218

Disclaimer

This analysis is for educational purposes only and does not constitute financial advice. Always perform your own research and manage risk accordingly.

Final Thoughts

AAPL has confirmed a bullish structure, but $215 needs to hold as support for the next leg higher. A breakout above $217.50 would confirm a move to $220+, while failure to hold could lead to a pullback before resuming upward. Watch for a BOS retest for optimal entries.

APPLE Trading Opportunity! SELL!

My dear subscribers,

This is my opinion on the APPLE next move:

The instrument tests an important psychological level 244.56

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 234.19

My Stop Loss - 250.52

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

———————————

WISH YOU ALL LUCK

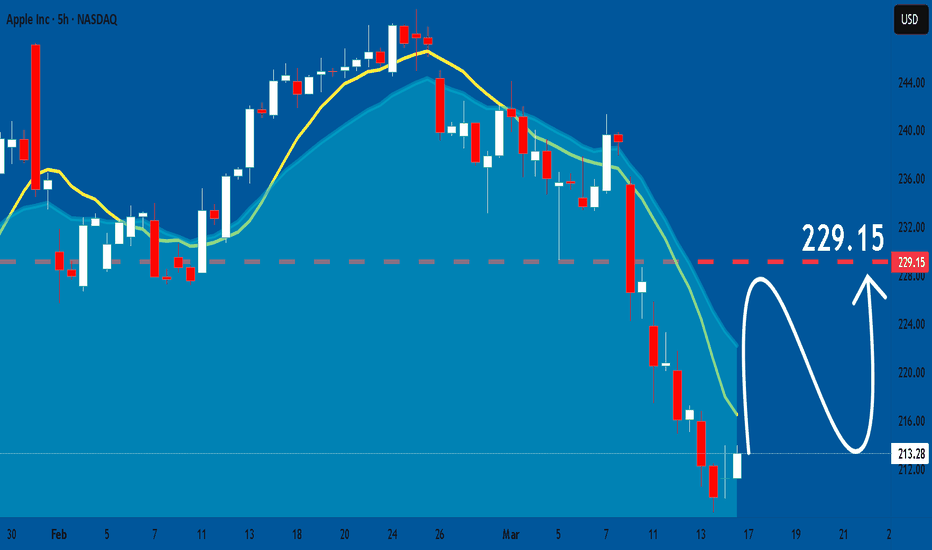

APPLE The Target Is UP! BUY!

My dear friends,

Please, find my technical outlook for APPLE below:

The instrument tests an important psychological level 213.28

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 227.02

Recommended Stop Loss - 205.96

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

———————————

WISH YOU ALL LUCK

Apple - A is almost finishedLooking at the pattern / structure being carved out, I believe we need another slight low for this part of the pattern to be considered complete. We also have yet to hit the red 1.0 ($0.33 cents away) and are just shy of tagging the white 1.618 @ $207.76. This technically isn't required, but in my experience, far more times than not, a=c. We could always extend down to the red 1.618 @ $182.21, but I do not find that likely at this juncture. I find it far more likely we get the slight OML and then begin moving higher in minor wave B.

Should price decide it does want to extend out, the next fib lower I would want to be watching is the red 1.382 @ $192.09. The next target higher for minor B, should be in the $240-$250 range. Should it extend down to the 1.382, that will lower the target for B by about $10. Hopefully this week we can kick off minor B.

AAPL at Crucial Support! Bounce or Breakdown Ahead? Mar 17 WeekHere's a quick analysis on AAPL based on the 4-hour chart.

📈 Technical Analysis (TA):

* AAPL just touched a key demand zone around $210, forming a potential reversal area.

* A clear Break of Structure (BOS) at $210 signals this level as critical support.

* Immediate resistance is visible at $225, with a further hurdle around $229–$230.

* Watch out for a major resistance zone above at $241–$249 if bullish momentum returns.

* Descending trendline resistance currently around $225–$229 is also significant for bullish confirmations.

📊 GEX & Options Insights:

* Strong PUT support at $210 marked by highest negative NET GEX—important level for potential bounce.

* CALL resistance currently at $217.50; breaking above could lead to a gamma-driven upside move.

* High IV Rank at 66% indicating rich premiums, ideal for options sellers or premium collection strategies.

* PUT ratio at 6.5% indicates bearish sentiment dominating option flows.

💡 Trade Recommendations:

* Bullish Play: Enter cautiously on bullish confirmation above $217.50, targeting $225 initially. Tight stop below $210.

* Bearish Play: Consider puts on strong rejection at $217.50, targeting retests of $210 and possibly lower to $200.

* Neutral strategies: Selling premium through credit spreads or Iron Condors between clear range ($210–$225).

🛑 Risk Management: Ensure clear entries and disciplined stops, especially with heightened volatility.

Let's trade smart and stay safe!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

AAPL (Apple): Has a Large Correction Begun? More Downside Ahead?On this chart, we are currently tracking the potential beginning of a larger downtrend, which could be a larger-degree Wave 4 correction. It is possible that a larger-degree third wave topped in December 2024 at $260, and for now, I am assuming this is the case. While further confirmation is needed, the price has already broken below our first signal line, which supports the idea that a larger decline has begun—unless the next rally develops into a clear impulse structure.

At the moment, the price appears to be in the late stages of Wave C of Circle Wave A to the downside. Immediate resistance sits between $220 and $224, and only a break above $224 would indicate that Circle Wave B to the upside may have already started.

One important note: Circle Wave B could technically overshoot to the upside, meaning that if Circle Wave A completed as a three-wave pullback, we could even see a new high in the next bounce before the larger downtrend continues. This is something to keep an open mind about, as it is still early to confirm a substantial top on the long-term chart.

For now, as long as resistance at $224 holds, the assumption remains that Circle Wave A needs one more low before a stronger bounce occurs.

APPLE: Expecting Bullish Continuation! Here is Why:

Looking at the chart of APPLE right now we are seeing some interesting price action on the lower timeframes. Thus a local move up seems to be quite likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

AAPL BULLS ARE GAINING STRENGTH|LONG

AAPL SIGNAL

Trade Direction: long

Entry Level: 213.28

Target Level: 232.17

Stop Loss: 200.88

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.