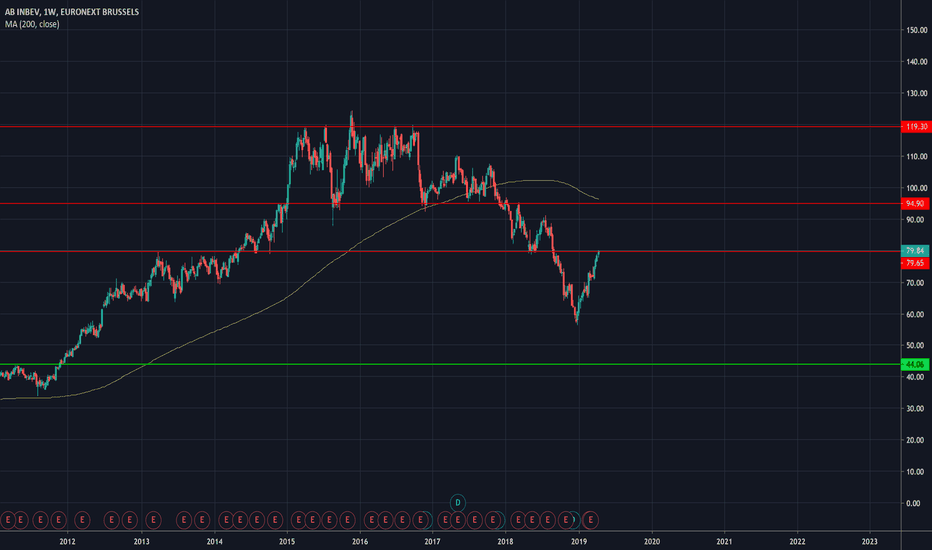

BUD trade ideas

The HangoverBad miss from Anheuser-Busch today – Q1 vs estimates

* Q1 REVENUE USD 12.59 BILLION VERSUS USD 12.77 BILLION IN REUTERS POLL

* Q1 NORMALIZED PROFIT ATTRIBUTABLE TO EQUITY HOLDERS OF AB INBEV $2.52 BILLION VERSUS $2.64 BILLION IN REUTERS POLL

Technically, the price graph is not looking promising, with a break and close below R1220, most probably lookin to test the support levels at R1550. If I was long with a short-term position, last mentioned will also be a stop-loss, with a break and close below this support only looking for support at February's levels of R1030. Share price coming off overbought levels according to its 14-day RSI.

$JSEANH - Beginning of more Froth or heading for a Trough?So confession time – this will be the one that got away for me in 2019 thus far. What’s not to like about the product?

Great recovery coming from $JSEANH since the start of 2019, bring the price at a point where investors need to be sober and alert. Currently, at year-to-date performance of 31.5%, ANH finds itself at the top of the diagonal parallel channel. The price broke for a brief moment, but find itself back into the channel. The company is still overbought according to its 14-day RSI, but watch out for that Golden Cross.

A pullback could see the price test resistance at both the 50-day & 200-day moving averages (R1180). A break and close below this level, could see a test of the diagonal resistance line (GREEN) at R1140. If I was long (and again, sad to say…I’m not) this will be my stop-loss, with a breakthrough these levels most probably creating one hell of a hangover & a test of 26 February’s level of R1030. Investors should also monitor any excessive Rand movement.

On the upside, Thomson Reuter consensus target price for ANH is currently R1336, which indicate still some possible upside fundamentally. Should ANH finally break and close above these R1250 levels, September last years (2018) level of R1345 become my next target, which coincide with the consensus target prices.

$JSE-ANHJSE:ANH

Made inverted head and shoulders and broke above neck line. Unfortunately break was stopped by resistance at 118000

Currently making small flag consolidation.

Break above 118000 will open 129000 as target for head and shoulders.

Pull back towards neckline around 111000/112000 area would be great place to buy.

BUD: Sort opportunityAn intraday high potential, Back Tested Sort Analysis.

We ll try to enter into the correction of the uptrend movement.

DETAILS ON THE CHART

NOTE: Entry range area above the entry point, is calculated upon 80% of the recorded pullback back tested past performances

DISCLAIMER: This is a technical analysis study, not an advice or recommendation to invest money on.