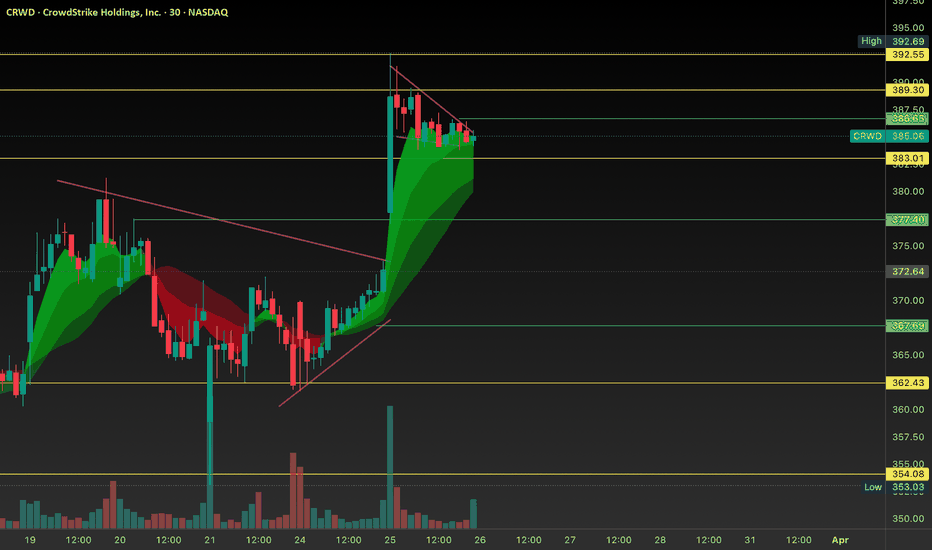

CRWD: in main resistance for one more leg down Price has now reached an ideal resistance zone, aligning with the 2024 summer top, where a bounce (wave B) is to complete itself.

As long as price remains below the 425 level, I see the odds favoring another leg lower, targeting the macro support zone around 300–270.

Thanks for your attention

CrowdStrike: Member of a Small ClubThe broader market has been tumbling for months, but CrowdStrike has stood its ground.

The first pattern on today’s chart is the March 10 low of $303.79. While the Nasdaq-100 has revisited levels from over a year ago, CRWD has held lows from a month prior. Support at such a recent level may reflect

CRWD 3 hours idea expecting exact up and downThis analysis provides insights into the future movement of Pulp (CRWD) stock based on the 3-hour chart. By examining key technical indicators, price action, and support/resistance levels, we anticipate potential price fluctuations in the short term. The 3-hour chart offers a closer view of the stoc

Long on CRWD: Focus on Strategic Entry Within Range

-Key Insights: CrowdStrike Holdings, Inc. is currently seen within a strategic

trading range between $300 and $400. Recent market activity places it mid-range

with momentum to potentially capitalize on buy opportunities as it approaches

the lower support boundary. The security's market attention al

Consider Going Long on Crowdstrike: A Strategic Insight - Key I- Key Insights: CrowdStrike remains a formidable player in the cybersecurity

market, buoyed by the AI-driven Falcon platform. Despite recent market

fluctuations, its growth trajectory and strategic innovation suggest

potential for future recovery, making now a possible entry point for long-

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CRWD is featured.