GPS trade ideas

THE WEEK AHEAD: GPS EARNINGS; KRE, XLE, EWZ, IWM/RUTEARNINGS:

Only one underlying makes my cut for a earnings announcement volatility contraction play: GPS (25/70/14.9%),* which announces on Tuesday after market close, so look to put on a play in the waning hours of Tuesday's session.

To me, it's small enough to short straddle, with the pictured setup paying 3.72 (.93 at 25% max). Alternatively, go short strangle: the December 18th 22/29 was paying 1.25 (.62 at 50% max).

Of a defined risk bent? Go iron fly with the December 18th 20/25/25/30 and get better than risk one to make metrics, with the setup paying 3.00 even as of Friday close (.75 at 25% max).

EXCHANGE-TRADED FUNDS RANKED BY BANG FOR YOUR BUCK (JANUARY 15TH EXPIRY):

KRE (22/40/14.0%) (Yield: 3.43%)

XLE (25/43/12.5%) (Yield: 6.15%)

EWZ (17/43/12.2%) (Yield: 2.89%)

GDX (13/37/11.7%) (No dividends)

SLV (22/37/10.8%) (No dividends)

BROAD MARKET RANKED BY BANG FOR YOUR BUCK (JANUARY 15TH EXPIRY):

IWM (24/30/8.5%)

QQQ (20/26/7.6%)

SPY (18/23/6.2%)

EFA (16/19/5.3%)

* -- The first metric is volatility rank/percentile (i.e., where 30-day implied volatility is relative to where it's hung out the past 52 weeks); the second, 30-day implied; and the third, what the December at-the-money short straddle is paying as a function of stock price ("Bang for Your Buck").

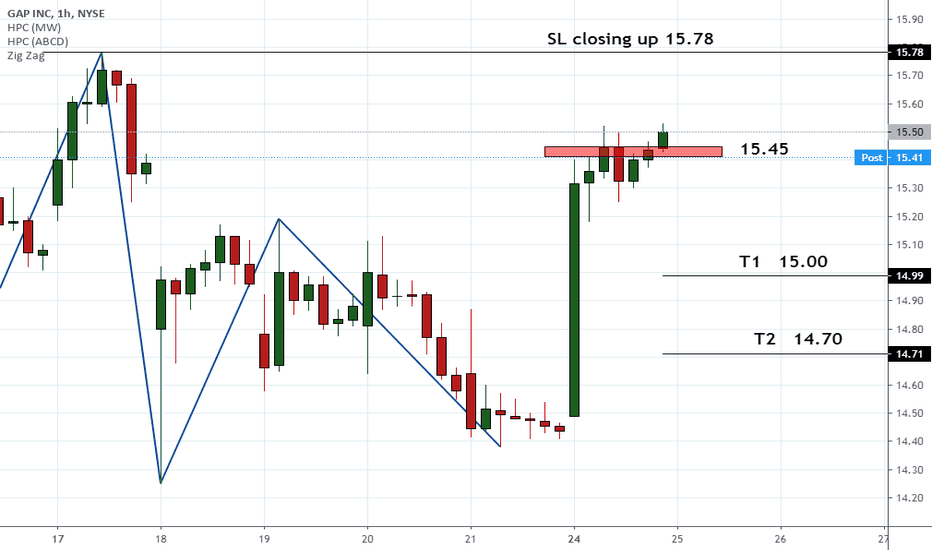

GAP short set up8/25 bar broke out the trend channel line forming from 7/8 and 7/26 high and 8/26 was reversal bear bar. put the short stop entry right below 8/26 low. the stop loss is right above 8/26 high.

LATE POST/OPENING: GPS SEPTEMBER 18TH 12/17/17/22 IRON FLY... for a 2.49 credit.

Metrics:

Max Profit: $249/contract

Max Loss: $251/contract

Break Evens: 14.51/19.49

Delta/Theta (Currently): -8.91/3.12

Notes: Couldn't post this yesterday due to the number of "Update" posts I did ... .

High implied at 87.5% with earnings to be announced today after the close. A classic risk one to make one iron fly which I'll look to take profit at 25% max.

$GPS Gap Inc Long Into Earnings Gap inc long into earnings, the commentary could move the stock more than results.

Stock has a high 17% short interest

Gap fill at $20.50 a possible target

THE WEEK AHEAD: GPS; SLV, GDX/GDXJ, XOP, IWM/RUTEARNINGS:

GPS (37/82/17.0%) is really the only earnings announcement that interests me from a volatility contraction perspective. Pictured here is a September 18th skinny short strangle, which was paying 2.03 as of Friday close.

EXCHANGE-TRADED FUNDS SCREENED FOR IMPLIED >35% AND WHERE THE OCTOBER AT-THE-MONEY SHORT STRADDLE IS PAYING >10% OF STOCK PRICE:

SLV (50/61/17.4%)

GDX (22/47/14.1%)

XLE (21/37/11.6%)

GDXJ (19/55/16.7%)

EWZ (18/45/13.2%)

XOP (14/49/14.0%)

Juice as a function of stock price resides in SLV (17.4%), followed by GDXJ (16.7%), GDX (14.1%), and XOP (14.0%).

BROAD MARKET:

QQQ (23/28/8.2%)

IWM (23/29/8.4%)

EFA (17/21/5.6%)

SPY (16/22/5.8%)

IWM/RUT is where the premium is, relatively speaking, followed by the QQQ's.

DIVIDEND YIELDERS:

XLU (18/22/6.8%)

EWA (18/22/7.8%)

EWZ (18/45/13.2%)

IYR (17/22/6.9%)

EFA (16/22/5.6%)

SPY (16/22/5.8%)

HYG (15/13/3.3%)

TLT (14/16/4.6%)

EMB (11/10/2.8%)

Brazil ... again?!

BIG Potential for GAP Hey people, GAP is in a bearish configuration facke stable volume of purchase we notice on the TIMEFRAME 5 Min the beginning of a bullish force. By breaking the Vwap we can climb to the top of the consolidation zone, it is very plausible of a breakout to reach another zone if the buyers continue their momentum. We can still see a breakout of the area to get to the last precedent higher on the TIMEFRAME Daily.

Please LIKE & FOLLOW, thank you!

GPS Ascending ChannelHello Community!

Before we begin please support my idea with a thumbs up and a comment. It'll be greatly appreciated and will motivate me to post a little more!

Lets keep it simple.

We see GPS Inc trading in an ascending channel on the daily. If it plays out perfectly it'll pass $15 to retest the top of the channel which is just about the same location as the next major resistance zone "Top Green Line". If it gets rejected there's a good chance it'll retest the bottom on the channel "Bottom Green Line" which is right around $12. Let's watch closely.

This is not Financial advice.

Safe Trading Calculate Your Risk/Reward & Collect!

Simplicity Wins

$GPS in a higher degree Impulse Wave 1 of 1 Disclaimer: I have been trading in the markets for about a year. After several months of charting various instruments, my eyes have gotten trained to recognize different candle formation patterns like Bear & Bull Flags, Head & Shoulders, and others. This was good. But, not enough for me to accurately forecast the next following moves and market structure after these patterns had been completed.

For me my next evolution as a Trader came with a more fine-tuned approach to Market Structure, The Elliott Wave Theory. There are two books that were recommended to me as I started this journey.

1. Elliott Wave Principle: Key to Market Behavior by Robert Prechter and A. J. Frost, www.elliottwave.com

2. Visual Guide to Elliott Wave Trading by Wayne Gorman and Jeffrey Kennedy, www.elliottwave.com

I am still learning. I accept the fact that my analysis may be wrong. But, these are my charts as I continue my journey. I am open to all feedback on my analysis as I continue to improve.

GAP INC DAILY ANALYSISHi friends

The daily graph of this market shows with a high probability that it will experience a downtrend but at the same time we must be vigilant of the change in the direction of the market.

rejected at trend lineTook some august 10P's here. If Kanye can't help you breakout then no one can. $XRT

Gap looking SolidResistance has become support at 9.60

Take profit at 13.50

Set a buy stop for 11.00 dollars to buy the rise

Stop loss at 10.00 dollars or 9.60.

Good Luck Money Trading Crew