Intel on the verge of a 80% plummet to $5** The months ahead **

After decades of semiconductor dominance, Intel faces unprecedented threats to its business model. AI computing revolution, manufacturing missteps, and relentless competition from AMD and NVIDIA have created what some analysts call "a potential death spiral" for the tech gian

Key facts today

China has removed 125% tariffs on select U.S. semiconductors, including integrated circuits, benefiting Intel (INTC) and underscoring China's dependence on foreign chipmakers amid trade tensions.

Intel (INTC) fell after a weak revenue and profit forecast, citing trade war impacts and competition. Despite this, the stock rose 6% over the week.

JP Morgan has maintained its 'Underweight' rating on Intel (INTC) as of the latest update.

About Intel Corporation

Intel Corporation engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms. The firm operates through the following segments: Client Computing Group (CCG), Data Center Group (DCG), Internet of Things Group (IOTG), Non-Volatile Memory Solutions Group (NSG), Programmable Solutions (PSG), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCG segment includes workload-optimized platforms and related products designed for enterprise, cloud, and communication infrastructure market. The IOTG segment offers compute solutions for targeted verticals and embedded applications for the retail, manufacturing, health care, energy, automotive, and government market segments. The NSG segment constitutes of NAND flash memory products primarily used in solid-state drives. The PSG segment contains programmable semiconductors and related products for a broad range of markets, including communications, data center, industrial, military, and automotive. The All Other segment consists of results from other non-reportable segment and corporate-related charges. The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968 and is headquartered in Santa Clara, CA.

INTC Intel Corporation Options Ahead of EarningsIf you haven`t bought INTC before the recent rally:

Now analyzing the options chain and the chart patterns of INTC Intel Corporation prior to the earnings report this week,

I would consider purchasing the 25usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately

INTEL CORPORATIONIntel’s stock has been falling sharply due to a combination of poor financial performance, strategic challenges, and market pressures, which have shaken investor confidence significantly.

Key Reasons for Intel’s Stock Decline

Weaker-than-Expected Earnings and Profitability Issues

Intel reported disa

INTEL BUY 2030Claro, aquí tienes el texto completamente limpio, sin negritas ni símbolos especiales:

---

Preliminary Projection: Intel's Potential Workforce Transformation (2025–2030)

As Intel continues its restructuring and integrates more AI-driven systems into its operations, significant changes are expecte

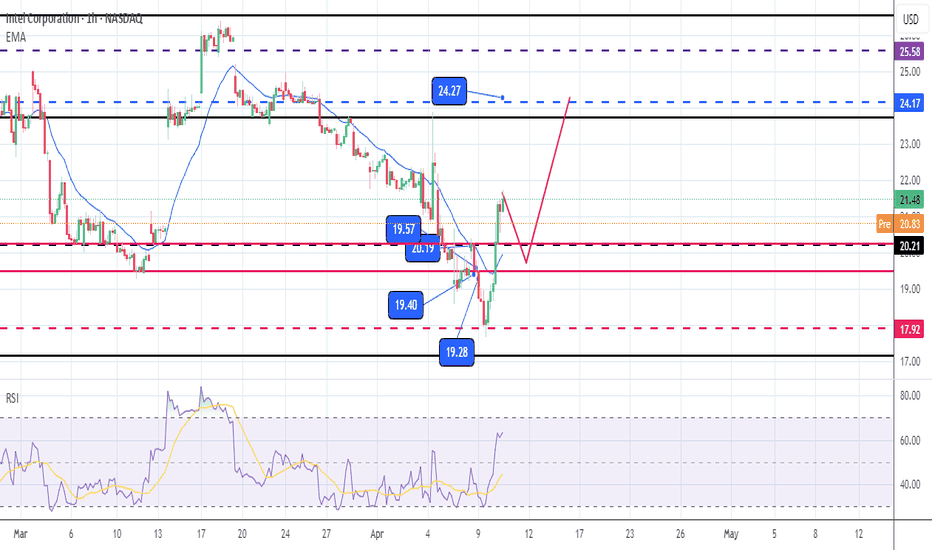

INTC Trade LevelsI like this set up for affordable and stable LEAP's. If price can break above the range, we will see a run to 31.

INTC's fundamentals are still a bit iffy, BUT the chip industry is hot. This would make a great sympathy play- I'd lean towards buying equity over options contracts.

For Day Trades-

Support to Buy Intel-All stocks rallied after Trump declared a pause on tariffs. Intel is showing good momentum and may continue to rise.The support On My chart is a good support to going long if the price make a pullback. Invalid if The Price break the support area. This is not a buy call, just sharing idea. Thanks

[INTC] Crashing to $1-$5—Bankruptcy Ahead?Intel has underperformed recently, trapped in a bear market since 2019 while broader equities soared. Since 2000, shareholders have seen no gains—even with dividends included—leaving long-term investors increasingly frustrated. A market-wide 2008-style crash (see related ideas) could push Intel towa

At it again INTC - LONGGood Morning,

INTC what a fun trade, I have ran 3 profitable runs since December with INTC.

Investors do not seem to want to let go of the 19$ support zone. This is a great sign and as you can see from the many many bottoms, it wants to start moving up again.

Volume is still bearish......howev

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.