Johnson & Johnson Beats Q1 Estimates, Premarket Not Doing WellJohnson & Johnson (NYSE: NYSE:JNJ ) on Tuesday reported better-than-expected Q1 results and lifted its sales forecast for the full year.

Johnson & Johnson (NYSE: NYSE:JNJ ), together with its subsidiaries, engages in the research and development, manufacture, and sale of various products in the h

Key facts today

Third Point Capital has bought a stake in Johnson & Johnson's spinoff, Kenvue, amid growing pressure from activist investors, raising speculation about a possible takeover.

About Johnson & Johnson

Johnson & Johnson is a holding company, which engages in the research and development, manufacture and sale of products in the health care field. It operates through the following segments: Consumer Health, Pharmaceutical, and Medical Devices. The Consumer Health segment includes products used in the baby care, oral care, beauty, over-the-counter pharmaceutical, women's health, and wound care markets. The Pharmaceutical segment focuses on therapeutic areas, such as immunology, infectious diseases, neuroscience, oncology, pulmonary hypertension, and cardiovascular & metabolic diseases. The Medical Devices segment offers products used in the orthopedic, surgery, cardiovascular & neurovascular, and eye health fields. The company was founded by Robert Wood Johnson I, James Wood Johnson and Edward Mead Johnson Sr. in 1886 and is headquartered in New Brunswick, NJ.

Buy JNJ for Stable Gains Amid Earnings Optimism Next Week

- Key Insights: Johnson & Johnson demonstrated robust earnings performance with

an EPS of $2.77, surpassing consensus estimates and reinforcing its

defensive stock status. Its diverse portfolio and consistent ability to

execute in volatile markets make it a strong candidate for growth-oriente

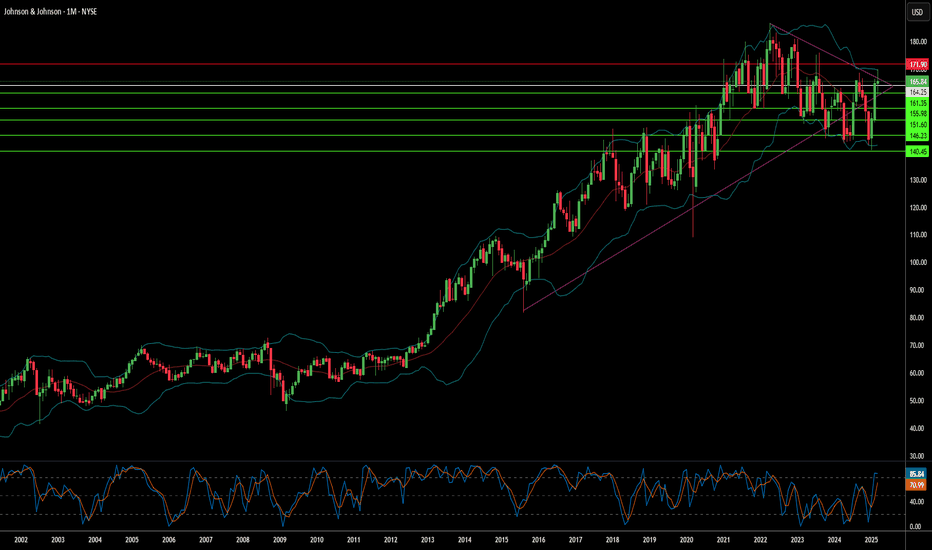

Johnson & Johnson Wave Analysis – 18 April 2025

- Johnson & Johnson rising inside weekly price range

- Likely to test resistance level 165.60

Johnson & Johnson continues to rise in the primary upward impulse wave 3, which started earlier from the major support level 145.00 (lower border of the weekly sideways price range from 2023).

The up

Johnson & Johnson (JNJ) Shares Drop Over 7%Johnson & Johnson (JNJ) Shares Drop Over 7%

As the chart shows, Johnson & Johnson (JNJ) shares declined by approximately 7.6%, reaching their lowest level since late February. This marked one of the worst performances in the stock market yesterday.

Why Did JNJ Shares Fall?

Two major bearish fac

Cracks Appearing in J&J's Armor?Johnson & Johnson, a long-established leader in the global healthcare sector, confronts substantial challenges that raise significant questions about its future trajectory and stock valuation. Foremost among these is the persistent and massive litigation surrounding its talc-based baby powder. With

Johnson&Johnson: Rejected AgainJohnson&Johnson has now been rejected at the $168.75 resistance level for the second time, pulling back more noticeably in response. However, in our primary scenario, we still expect an imminent breakout above this level, which should allow the turquoise wave X to establish its high well above it. A

Johnson and Johnson Falling Off a Cliff. JNJA much larger ABCDE formation is complete, not pivoting back to gravity. There is confirmation with MIDAS cross of price action with supporting of RSX exiting OBOS area and VZO/Stoch duo being bearish divergent for some time now. The incoming stream could be a tumultous C Wave impulse to the bears,

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where JNJ is featured.