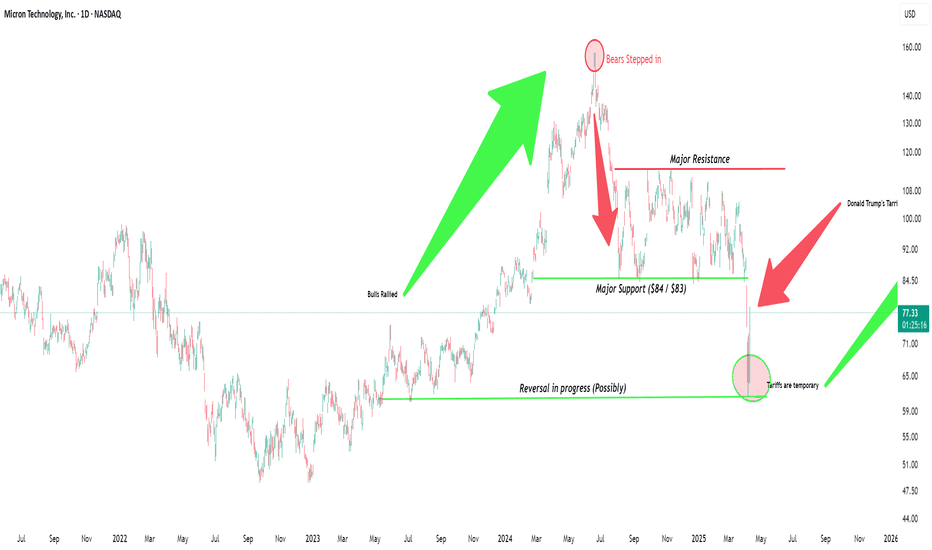

Micron Technology - The Chart Is Still Perfect!Micron Technology ( NASDAQ:MU ) will reverse right here:

Click chart above to see the detailed analysis👆🏻

If you actually want to explain technical analysis to somebody, just show them the chart of Micron Technology. Almost every structure makes perfect sense, with this stock respecting all major trendlines and horizontal levels and with the current support area, the bottom is now in.

Levels to watch: $70, $210

Keep your long term vision,

Philip (BasicTrading)

MU trade ideas

(MU:NASDAQ)A Massive Rally Could Be Ahead to Macrion Technology Over 200%+ Recoveries.

🔍 Overall Market Structure & Key Observations:

Major Cycles & Price Movements:

Pre-COVID Drop: Sharp decline (~49.29%) around Feb 2020, consistent with the broader market crash due to COVID-19.

Post-COVID Rally: A massive +212.88% rally over 653 days, suggesting a strong recovery and bullish sentiment.

First Major Correction: Followed by a -50.81% drop over 354 days—indicative of macroeconomic pressures and sector-specific weakness.

Second Rally: Another impressive +228.51% rally over 541 days.

Current Major Decline: The most recent bearish leg shows a steep -60.94% drop over 290 days, breaking key support levels.

Support/Resistance & Price Targets:

Gap-Fill Zones:

Two "GAP FILLED" labels indicate prior gaps in price action have now been closed—this often precedes strong moves in either direction due to liquidity.

Key Resistance Zones:

$86.70: Likely a neckline or prior support-turned-resistance.

$101.35 and $130.52: Marked as mid and upper targets in the potential recovery phase.

Falling Wedge or Channel:

Price seems to be in a falling wedge pattern, which is traditionally a bullish reversal pattern.

Volume Analysis:

Volume boxes (e.g., Vol 4.81B, 6.13B) are used to emphasize the strength or exhaustion of trends.

The declining volume during the last downtrend suggests bearish momentum may be weakening, which supports the reversal thesis.

Moving Average (Likely 200-Day SMA):

Price is currently below this moving average, showing that MU is in a long-term downtrend—but potential for a reversal is present if the price can reclaim and hold above it.

📊 Technical Implications

Bullish Potential:

If the falling wedge confirms a breakout above resistance (~$86.70), a bullish target of $101.35 and eventually $130.52 is reasonable.

Volume divergence (less selling pressure) and gap fills suggest the bottom may be in or forming.

Historical symmetry in price rallies (over 200%+ recoveries) indicates that the stock is capable of massive upside once sentiment shifts.

Bearish Risks:

A breakdown below the recent low (around $61.52–$74.21) could invalidate the wedge and trigger further downside.

Broader economic concerns (rate hikes, recession fears) could delay recovery.

🧠 Strategic Takeaways

For Swing Traders: A breakout above the falling wedge and reclaim of $86.70 could trigger a long entry with a target at $101.35, then $130+.

For Long-Term Investors: Historically, buying near these massive pullbacks (-50% to -60%) has yielded high returns, especially post-consolidation.

For Risk Managers: Keep an eye on the $61–$74 level. If that fails, it could lead to capitulation.

🧮 Summary Table:

Event % Change Duration Volume Notes

COVID Drop -49.29% Feb 2020 — Market-wide selloff

Post-COVID Rally +212.88% 653 days 9.21B Strong recovery

2022 Correction -50.81% 354 days 4.72B Fed tightening, macro pressure

Mid-Term Rally +228.51% 541 days 6.13B Strong bull phase

Current Correction -60.94% 290 days 4.81B Present leg, gaps filled, wedge base

Micron's Time to Be THAT Semiconductor is coming and FastNASDAQ:MU is extremely undervalued, I produced this chart last night. Its time that the market appreciates this monster with such solid fundamentals. Micron since 2022 has been working hard to become a major producer in the United States. I believe that Trump and his government could get behind the only major memory company to be based in the United States.

-----------------------

Balance Sheet:

Cash: $8.22b

Debt: $11.54b

Equity: $48.63b

Total Liabilities: $24.42b

Total Assets: $73.05b

All Stated in $ USD

-----------------------

Valuation:

Price To Sales: 2.72

Price To Earnings: 18.30

Forward Price To Earnings: 6.84

-----------------------

Micron Technology Inc - Rectangle bottomRectangle bottom as seen in the chart.

Tend to breakout from support.

Option A: To buy @ 83 which is at the bottom of the rectangle.

If it does not break out, we can minimize loss if it breaks downward.

Option B: To buy @ 114 when it breaks out of the chart.

Indicator

Break upward, when the candles closes above the support trend line

Stop loss:

Break downward, when the candle closes below the resistance trend line.

Micron Technology (MU): AI Powerhouse Trading at a 40% Discount!1️⃣ AI Boom: Micron’s advanced DRAM and NAND solutions are fueling growth in AI and cloud computing, with Nvidia’s ecosystem showcasing its critical role.

2️⃣ Analyst Targets: With 42 ratings averaging $131.47 and highs of $150, Micron offers over 50% upside from current levels.

3️⃣ Automotive Growth: As the top memory supplier for autonomous vehicles, Micron dominates a market set to grow at a 27% CAGR.

4️⃣ Technical Momentum: Breaking $75 resistance, a golden cross and rising volume confirm strong bullish signals.

💹 Trade Setup:

TP1: $100

TP2: $110

TP3: $120

SL: $80

Micron is a top-tier AI play at a deep discount. With massive growth catalysts, it’s primed to soar! 🚀

Target 95 let me explain, congested a lot of detail swing stateThe Fibonacci retrace and sideways swing indicate that the stock likes to come back around this area, from where it currently is at the resistance fib, with a liquidity sweep candle, stopping in the buffer zone. A volume slowdown dictates a crashing move up before volatility winters it down significantly. It is one of the more realistically sideways swinging stocks of 25, and based on the parallels and colorful detail, I anticipate this to be my chart of the week, with no surprises!

Micron Technology - Fully Resisting The Stock Market Crash!Micron Technology ( NASDAQ:MU ) is one of the few bullish stocks:

Click chart above to see the detailed analysis👆🏻

Despite the stock market kind of "crashing" lately, Micron Technology is one of the few stocks which remains in a rather bullish environment. Following the uptrend, the bullish break and retest and the beautiful cycles on Micron Technology, this strength will soon become reality.

Levels to watch: $90, $180

Keep your long term vision,

Philip (BasicTrading)

MU, bound for more significant RISE ahead this 2025! from 100.Micron Technology, Inc. is an American producer of computer memory and computer data storage including dynamic random-access memory, flash memory, and solid-state drives. It is headquartered in Boise, Idaho.

Based on latest metrics, MU is now at basing zone finally after experiencing heavy downtrend since last years peak at 153 on June 2024.

The stock is currently on a massive SHIFT in trend hinting of a weighty reversal to the upside. It already bounced more than 20% from its lows at 80 levels since late last year.

Fridays' closing price of +6% is already conveying its directional context for the rest of the year -- more RISE ahead.

Also factoring its last QTR Results which are all in greens.

(USD) Nov 2024 Y/Y

Revenue 8.71B 84.28%

Net income 1.87B 251.54%

Diluted EPS 1.67 249.11%

Net profit margin 21.47% 182.23%

Operating income 2.17B 292.73%

Net change in cash -355M 30.39%

Cash on hand - -

Cost of revenue 5.36B 12.6%

----------------------------------

Spotted price at 100.

Interim target at 150

Mid at 200.

TAYOR. Trade safely.

How Long Can Micron Hang On?Micron Technology has remained above a key level despite weakness in the broader market. Is it vulnerable to a breakdown?

The first pattern on today’s chart is the September 12 low of $84.12. MU has remained above that level, but would-be sellers may watch for a potential close below that support.

Second, the 50-day simple moving average (SMA) is below the 100-day SMA. Both are under the 200-day SMA. That may suggest its longer-term trend has gotten more bearish.

Third, our 2 MA Ratio script in the lower study shows the 8-day exponential moving average (EMA) has crossed below the 21-day EMA. That may suggest bears are gaining an edge in the short term.

Next, TradeStation data shows MU is the twelfth-busiest options underlier in the S&P 500. (Average volume in the last month is about 175,000 contracts per session.) That could make some traders look to position for moves with calls and puts.

Finally, earnings after the closing bell on March 20 may serve as a potential catalyst for movement.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

$MU getting accumulated with PT $140-220- NASDAQ:MU GAAP eps is growing substantially in 2025 and 2026 but market hasn't rewarded NASDAQ:MU

- It appears that whales are accumulating the stock and/or suspicious of NASDAQ:MU future demand.

- If analyst expectation and company's projection is true then this stock is grossly undervalued.

Based on the fundamentals:

Year | 2025 | 2026 | 2027

Gaap EPS | 6.32 | 9.65 | 11.27

EPS growth | 730.48% | 52.72% | 16.80%

Bear case ( for. p/e = 15 ) | $94.8 | $144.75 | $169.05

Base case ( for. p/e = 20) | $126 | $193 | $225

Base case ( for. p/e = 25 ) | $158 | $241 | $281.75

Bull Case ( for p/e = 35 ) | $189 | $289 | $338

Can Micron Undo the DeepSeek Selloff?Micron Technology plunged two weeks ago when China’s DeepSeek model disrupted Silicon Valley. But some traders may see potential for a rebound.

The first pattern on today’s chart is the gap from Monday, January 27. Does that empty space create potential for prices to fill?

Second is the September 12 low at $84.12. MU remained above the level despite the DeepSeek fears. That higher low on the weekly timeframe may be consistent with resumption of a longer-term uptrend.

Third, cautious guidance drove prices lower in December but the memory-chip maker held its September low. That could reflect optimism about business improving.

Next, the stock is below its 200-day simple moving average (SMA). Given secular growth in its business thanks to AI, some investors may see a long-term value opportunity.

Finally, MU has traded an average 215,500 options contracts per day in the last month. (It’s the 13th most active underlier in the S&P 500 in that time, according to TradeStation.) That could help traders looking to position for a rebound with vertical spreads.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. If you're born to trade, we could be for you. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

Options trading is not suitable for all investors. Your TradeStation Securities’ account application to trade options will be considered and approved or disapproved based on all relevant factors, including your trading experience. See www.TradeStation.com . Visit www.TradeStation.com for full details on the costs and fees associated with options.

Margin trading involves risks, and it is important that you fully understand those risks before trading on margin. The Margin Disclosure Statement outlines many of those risks, including that you can lose more funds than you deposit in your margin account; your brokerage firm can force the sale of securities in your account; your brokerage firm can sell your securities without contacting you; and you are not entitled to an extension of time on a margin call. Review the Margin Disclosure Statement at www.TradeStation.com .

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.