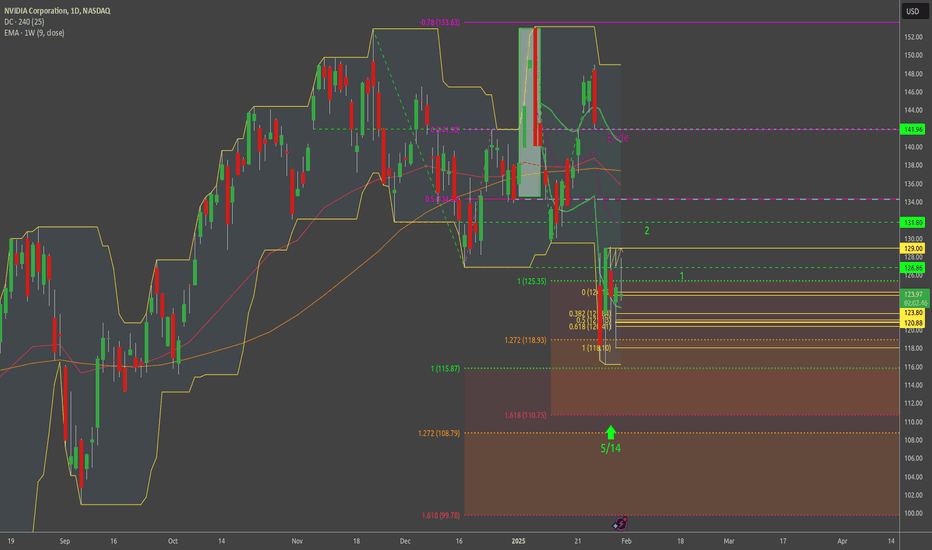

NVIDIA has reached the first targetNASDAQ:NVDA created a perfect double top pattern, breaking the baseline forcefully and offering up to two perfect pullbacks that only confirmed that the $127.7 level had ceased to be support and had become a critical resistance .

A few weeks ago, we already warned that considering shorts on NVDA was feasible due to the breakdown of a previous pattern (see previous ideas). Now that the double top has broken down, the most common target would be to see prices around the $103 area , which, given NVDA's strong fundamentals and monopoly in AI, seems unlikely.

But with Trump, you never know! If market uncertainty persists, the most extreme level would be around the $90 area, where a significant amount of money should appear to buy NVDA at a substantial discount.

NVDA trade ideas

Spike Not Yet DigestedIt looks that we are building a bottom after the broad spike 2-3 days ago.

There is big volatility as the market is not yet aware whether the fallis over already. The more it is option expiration day today.

Thus today is decisive whether we are able to close the spike which would be healthy.

I think that we we settle down today to open higher on Monday when the otions will have expired.

NVDA Trading Plan: Waiting for a Break Above SMA 150 at 130.84Currently, the price of NVDA is 117.81, which is below the 150 SMA (128.9). The suggested entry point is 130.84, which is safely above the SMA 150, indicating a confirmation of upward momentum.

Entry Strategy:

Wait for the price to break above 130.84.

Ensure the SMA 150 continues to trend upward for additional confirmation.

Stop Loss:

Set the stop loss was at 126.97, below the SMA 150, to minimize risk.

Target:

Monitor the price action for key resistance levels to determine potential profit targets.

Alerts:

Set an alert on TradingView at 130.84 to notify you when the price breaks the entry level. NASDAQ:NVDA

NVDA - Waiting for a pullback to add to my short exposureThe first NVDA analysis went pretty well.

Let's see what we can do from here.

Over the weekend the world was going crazy once more. This knocked the markets down and they opened in the red, and so does NVDA.

I would like to see a pullback to the 1/4 line. Because this would give me the chance to load the short even more.

Target is the Center-Line.

(Former analysis linked)

Incoming 50% correction for NVIDIA to $50Patiently we waited and finally it has happened.It was the month of January 2025 when this immense bubble would break support. 2 years after it first confirmed in September 2022.

A number of reasons now exist for a bearish outlook. Look left. On the above 5 week chart:

1) Price action and RSI support breakouts.

2) RSI support confirms resistance on past support.

3) Looking left previous corrections were at least 50% from the support exit, that’s $50 today should that repeat.

4) Looking left the chart suggests this correction is over after 210 days. In other words August 10th presents a unique long term investment opportunity.

Is it possible price action continues upward trend? Sure.

Is it probable? No.

Ww

NVIDIA at Crossroads: Will $116 Hold as the New Support? Jan. 3Technical Analysis:

* Trend Overview: NVDA has recently broken below the short-term support trendline, aligning with a bearish pattern. The stock is testing a critical support zone around $116, with declining momentum.

* Key Indicators:

* MACD: Bearish crossover with increasing negative divergence indicates selling pressure.

* Stoch RSI: Currently near oversold levels, showing possible consolidation or a short-term bounce.

* Volume: Rising sell volume signals strong bearish conviction as the price approaches key support.

Support and Resistance Levels:

* Immediate Support: $116 (critical level).

* Secondary Support: $110 (aligned with the next significant demand zone).

* Resistance Levels:

* Near-term resistance at $124.

* Further resistance at $128.95 and $149.10 (as noted by the CALL wall).

Options and GEX Analysis:

* Highest Positive GEX Level: $128.95, serving as the next potential gamma resistance.

* PUT Dominance: Significant PUT support around $116 aligns with technical support, offering a strong defensive zone.

* Volatility Metrics:

* IVR: 70.4% (indicating above-average implied volatility).

* Options Flow: 41.4% CALLs dominance suggests a lack of bullish sentiment, though potential for a rebound remains.

Scenarios:

1. Bullish:

* Entry: Above $124 on strong momentum.

* Target: $128.95 or higher if the gamma squeeze accelerates.

* Stop Loss: Below $120.

2. Bearish:

* Entry: On a breakdown below $116 with strong volume.

* Target: $110 or lower.

* Stop Loss: Above $118.

Conclusion:

NVDA is testing a critical support zone. A break below $116 could intensify the bearish momentum, while holding this level might attract short-term buyers aiming for $124+. Options data suggests bearish sentiment dominates, yet watch for unusual activity at support.

Range or Double top on Hourly?Range or Double top?

Is NVDA going to continue the short-term down trend or have a price reversal? Hypothetically if the price moves below 118.33, the chance increases for more bearish activity, if price closes above the high wave candle the 120-price range and price does not consolidate there is a possibility of price movement to 128.92. Please keep in mind the MACD (Chris Moody) indicator is very close to having a bearish cross over and the Stochastic RSI is bearish; and in addition, we had some very interesting news events this weekend that may sway the markets acting like invisible engulfing candles.

NVDA I am thinking this scenario over the next few months, I am thinking of DCA'ing into some long term shares. some NVDL 2X leveraged for Swing trades, and some LEAP options.

I personally am not fond of short term options on this name. IV is often high and the moves are large.

I would likely take less risk with spreads or sell premium.

I'm not a professional, just like to participate and this is accountability for me...

$NVDA Dominance in NASDAQ: $NVDA vs NASAD IndexAll of us in crypto are used to looking at the BTC.D Chart (Bitcoin Dominance). With BTC.D stuck in a range between 57% and 60% we try to look at a new dominance chart which no one is talking about. Same as DeFI in TradFI we can look at one of the most famous Asset which is NASDAQ:NVDA vs its dominance in tech heavy NASDAQ index. Let’s call it ‘ NASDAQ:NVDA Dominance’ (NVDA.D) © 😉. Further usage of the ticker should be copyrighted to me. 😊

$NVDA.D is now below its 200 Day SMA. If we plot NASDAQ:NVDA vs NASDAQQ Index, we get $NVDA.D and there we see that NVDA.D is making multi months lows and below 200 Day SMA. We have not seen this kind of weakness in $NVDA.D since CHAT GPT was launched in Nov 2022. The last time $NVDA.D was below the 200 Day SMA it spent almost 6 months consolidating during the 2022 Tech bear market before AI sparked the new bull market.

Nvidia - uptrend broken ?Just a simple chart with a few channels.

In January 2024 Nvidia transitioned from one rising channel into a even steeper rising channel with increased volatility.

Looks like price has been working on a new falling channel since November.

These large swings we experienced in January marked the upper line of this channel and now price has left the rising channel entirely.

There were a couple of retests of the green channel in the last few days but they have all failed.

So I am currently not considering long positions until the price gets back into the green channel or creates a new rising trend.

Sliding From The Top? Hello traders,

As we roll into these next upcoming weeks, especially with the most recent news on tariffs, I feel the need to share my thoughts.

First and foremost, let's talk about the story. After the inauguration, markets ran up. The S&P followed a narrow upward channel and it broke on Friday, giving signal that some kind of news was bound to come out the following Monday... and it did.

Boom. DeepSeek comes out of nowhere, wiping 600 billion from NVDA's market cap and SPY takes a 12+ point dip.

There's a saying I heard from a trader; "It's the tail that wags the dog." as in, it's the price action that drives the news in some situations. More than not.

Now, let's talk resistance. NVDA struggled around the 150 range time and time again. Charting back to my old "sticky note zone" around 114-116, there is a potential bounce. After that, just below, 111 is going to be a nice spot too.

Personally, I'd like to see 95-97 before going long on calls, but the bounce will be handled in a real-time situation. Likely, when SPY decides it's had enough and they rip it back towards the upside.

I'm predicting this with about 50% technicals and 50% experience. Key advice is to be patient and wait for a definitive bounce. Better to jump in late before jumping in early.

Happy Trading!

Nvida, do we get the bounce from the 2024 trend line.Nvidia's pulled back, but so far, based on the daily timeframe for 2024, the stock has pulled back to this trendline and then later moved up 46% (trough to peak: Feb 21st - Mar 8th), 86% (Apr 19th - Jun 20th), and 68% (Aug 5th - Nov 21st). On Tues it hit the trend line again.

Mr.Million | NVDA Chart and potential Buy AreaIn my last post, I shared three (3) reasons why I was bearish on NVDA 📉:

Thanks to China and #DeepSeek_AI challenging NVDA’s monopolistic dominance in AI-related graphics chips, NVDA has since nosedived to ~$120.

What now? I believe there’s still more room to fall (and I’ll be waiting). 📉

🔥~$90-100 = Strong Buy 🚛🚛🚛

TESLA – BUY AND DON’T QUESTION IT!

Tesla was not just the first car to move away from traditional fuels—now it seems to be distancing itself from any logic or traditional method of analysis as well.

For almost two years, I’ve been saying the same thing: Tesla is no longer innovating, no longer developing, no longer a pioneer in the industry.

While SpaceX continues to amaze, Tesla keeps disappointing. It’s as if its engineers have been relocated to another office—where they’re working… still for SpaceX, which, surprise surprise, isn’t publicly traded!

Earnings reports? Logic? Who needs them anymore?

Yesterday, Microsoft reported solid results but dropped after-hours. Tesla reported a disaster, yet it surged post-market. Mind-blowing!

Some time ago, I told you I was reducing my Tesla holdings—and I did. I only kept a few shares here and there as indicators, but until I see signs of change, I’ll be watching from the sidelines.

Tesla is no longer a company valued based on its financials—it’s a name: Musk!

And since Musk climbed so fast on society’s escalator, Tesla seems to be compensating for its lack of performance by replacing every actual result with just one word: Musk!

But… how high can Musk climb? If he goes any higher, he might end up colliding with his own satellites in orbit!

Earnings Call – A Broadway Show with a Predictable Ending

Yesterday, Musk appeared on the earnings call and promised the moon and the stars. Firm, determined, bullish.

If you want Tesla, don’t bother analyzing it. Not technically, not fundamentally, not based on reliability.

Everywhere you look, the message is BUY, regardless of the actual results.

If you want Tesla, buy without thinking! For now, on Musk’s reputation alone!

Close your eyes and dream…

Imagine the moment a robotic arm retrieves the booster of a launched rocket, picture SpaceX, then… buy Tesla.

You’re not taking any risks. It’s a legal drug!

All in green!! (Even Tesla)

P.S. I don’t think the after-hours rally will hold during