NVDA trade ideas

NVIDIA Corporation Will Start Growing (Recover) —New ATH In 2025I gave you the bad news but only because the market peaked and turned bearish. When the chart is bearish, I call it bearish. In reverse, when the chart turns bullish, I will share with you exactly what the share says.

All possible scenarios?

No! I will tell you the future before it happens...

Put your seatbelt on.

Join the ride.

Let's trade!

The markets today are not the same as they were 100 years ago. Today, bear markets are short, bull-markets are long.

Money is easily accessible now.

Companies that are in trouble do not have to go bankrupt. The system has many tools to protect the market and its participants. The business world and finance, continues to improve, advance and evolve. With time, bear markets will continue to become shorter while bull markets will continue to expand.

Prosperity and stability will be the norm.

Humanity is in an ascending trend. We are going up, worldwide, civilization wise...

The correction you saw between early January and today was the end. Three months going down and a total drop of 43% (-43%). That's it, NVDA is going up next.

NVDA produced a peak in June 2024. There was a correction and support was found at 91 in August. After some sideways, distribution, the drop was resumed and the same level activated again. NVDA bottomed yesterday at 92 and today it hit 86 but just to recover right away.

The recovery is really strong and also a positive signal. This recovery is happening on a Monday and is producing high volume. This is a long-term support level and it holds.

Minimum, we get a bounce now and prices move up because of this support. Once support is tested, the action moves back to resistance. By the time our previous resistance level is hit the market will be bullish and strong; interest rates will be lowered and in May we will have Mars (astrology) with a stabilized orbit, the action planet, which means that we will moving ahead with full force.

These signals combined are telling us that the down period is no more.

This is a friendly reminder: NVDA is going up.

I love you.

Thanks a lot for your continued support.

Namaste.

PEG @ 0.22 DEBT/ASSET @ 0.09 NVIDIA LOOKS CHEAP WITH SELL-OFFFundamental metrics favour NVIDIA and with the company's return on equity (ROE) stands above 119%, NVDA stock price looks irresistible below 105.

N.B!

- NVDA price might not follow the drawn lines . Actual price movements may likely differ from the forecast.

- Let emotions and sentiments work for you

- ALWAYS Use Proper Risk Management In Your Trades

#nvda

#nasdaq

#nyse

NVIDIA Update 3 Rangebound with new Low for longsIn this video I bring to your attention what we could possibly expect if we lose the current level and if we do then where is the next crucial zone to look for Longs.

If you have read this then pls do Boost my work and any questions then leave them below

Trade the range until it breaks Nvidia updateThis video is a quick recap on the previous video after the levels I gave produced 30% move to the upside after patiently waiting for the move down to 90$.

So what now is the big question after the unprecedented move we had yesterday .

I outline the next best Short/Long setup and define why I think we stay inside of the range until Earnings Data .

NVDA rebound after PANIC SELLING

This idea is a perfect example of how the market gives you different signs at the reversal points.

Let's recap from the beginning:

1. First, there was the CRACK pattern of the support, which warns of a bearish move.

2. There was an attempt to go higher which did not work out.

3. There was a GAP DOWN, that needed to materialize the CRACK pattern to the downside, but it did not act right, and did not spill right away and there was a bounce above the broken pink support line.

4. After #3, you would expect a Bullish move, the BLUE trajectory, since #3 acted as a real-time lookalike of a SPRING by Wyckoff methodology. But the BLUE did not materialize, so it did not "act right" according to Jesse Livermore.

5. When we started going down again on wider and wider bearish candles, this confirms again the CRACK PATTERN.

What is the CRACK PATTERN?

The crack pattern is when there is a CLEAR support/resistance line, that has been "cracked", but then there is a "retest" a false move, to the other side, as if the CRACK is the false move, but the CRACK signifies the upcoming strong move. Once the CRACK is being CRACKED again, the big explosive move should come.

6. The CRACK pattern materialized, and we got the spilldown = STRONG SHORT MOVE.

7. See my educational idea about this CRACK PATTERN, as "found" before the fact, this time it was more tricky than usual since it did not follow "the right way" as right away as usually happens on a weaker stock since NVDA has a bullish outlook. So it "put out a fight. Or in the puppet master view... if the public want to buy higher before the fall... there is no reason to sell him lower... so the price rebound and the fall did not materialized right away.

8. The moral lesson from this, is that in realtime, you need to change your hypothesis as you go. Once a signs for strong movement happen, then you want it to "ACT RIGHT". If it does not act the way you know, you need to quickly change your direction.

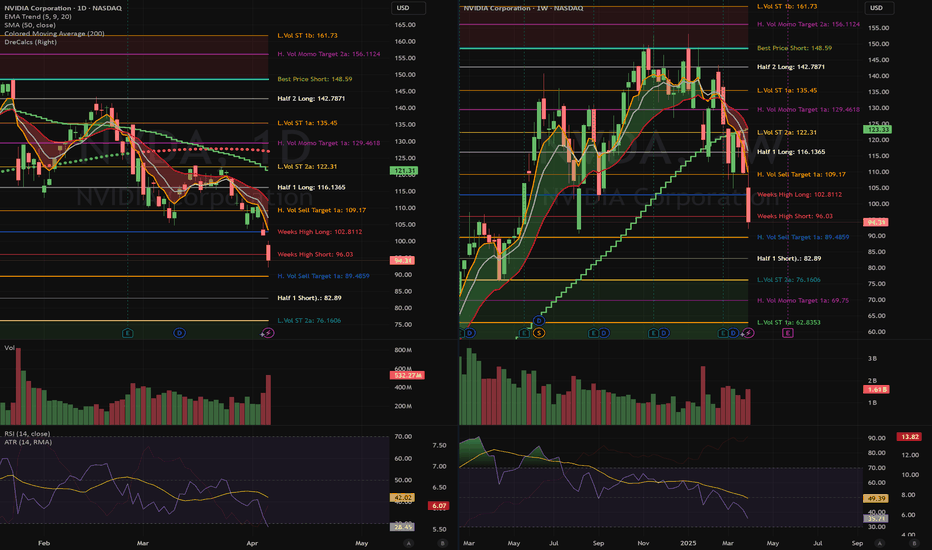

NVIDIA (NVDA): Oversold or Start of a Larger Correction?Overview & Market Context

NVIDIA just saw a major sell-off, dropping around 7% in a single session and slicing below key support levels. This abrupt move has raised questions: Is NVDA oversold enough for a bounce, or are we at the onset of a broader bearish trend? High trading volume suggests significant institutional distribution, so caution is warranted for both bulls and bears.

1. Price Action & Volume

* NVDA closed near the $94.31 mark after the sharp decline.

* Volume spiked (~532M), confirming that large players have been active—often a sign of heightened volatility and potential trend changes.

2. Moving Averages

* The 200-day SMA sits near $127.07, which NVDA fell below decisively. Historically, losing the 200-day often signals a medium-term bearish bias, making it a key level to watch on any rebound attempts.

3. RSI & Momentum

* The RSI on the daily timeframe is hovering around the high-20s, indicating oversold conditions. While this can lead to a short-term bounce, oversold can remain oversold if negative momentum persists.

Key Levels to Watch

Immediate Resistance:

* $96–$100 Range: Minor overhead supply; if price rallies here, watch to see if it rolls over again.

* $105–$110: This region aligns with prior support-turned-resistance. A strong push above $110 would challenge the bearish thesis.

Primary Support Targets

* $90 (Psychological Marker): Could be the first zone for a pause or bounce.

* $82.89 (“Half 1 Short” from algorithmic levels): A logical next stop if the sell-off continues.

* $76 Area: Deep support from earlier consolidation zones; if selling intensifies, the stock may reach these levels.

Potential Trade Setups

1. Bearish Continuation (Short)

Entry:

* On a weak bounce into the $96–$100 zone, or

* A breakdown below $94 on strong volume.

Stop Loss:

* Conservative approach: Above $105–$110, where a bullish reversal could invalidate the short setup.

Profit Targets:

* $90 (near-term psychological level),

* $82.89 (algorithmic short target),

* $76 (longer-term support).

2. Contrarian Bounce (Long)

* Entry: Around $90 or upon a clear intraday reversal signal (e.g., a bullish engulfing candle on strong volume).

* Stop Loss: Below $88 to reduce risk of a deeper flush.

* Profit Targets:

* $96–$100 (short-term push),

* Extended target near $105–$110 if momentum sharply reverses.

Thought Process & Strategy

* The extreme volume and steep decline reflect a high-conviction move. Usually, when you see volume spikes on a breakdown, it suggests institutional selling, meaning rallies may be met with further supply.

* However, the oversold reading (RSI in the high-20s) hints that a bounce might come soon—though it could be short-lived unless macro or fundamental conditions shift.

* Clearly defining both bullish and bearish scenarios—along with exact stop-loss levels—removes emotion and helps avoid “decision paralysis.” Trading is about probabilities, not certainties.

Final Notes

* Risk Management: Always size positions so that a single trade does not jeopardize your account.

* Emotional Control: These levels are algorithmically defined, aiming to reduce subjective bias. Watch how price reacts at each support/resistance zone.

* Stay Vigilant: With elevated volatility, rapid intraday swings are possible. Monitor real-time price action for confirmation.

Disclaimer: This is not financial advice. Perform your own due diligence, and trade responsibly.

Its crazy but possible Short $NVDA targeting 70sOf course it is difficult to short NVDA :) but watching RSI weakness and high volume with red candles suggest short term bearish trend or correction move - the stock in consolidation for almost a year - the idea is to short after earning report on Wednesday - Main supports at 113-104-94 strongest one then the gap at 70

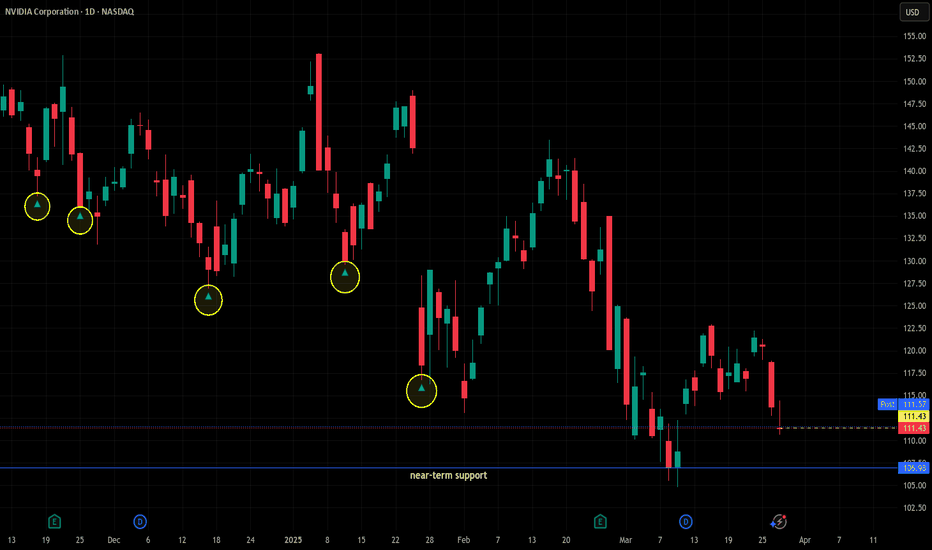

NVDIAgain...long at 111.43This is gonna be my 6th long idea on NVDA since Mid-December. Sorry if this is getting boring, but if it keeps working, why stop?

It's not in a great pattern, but then again it wasn't the other 5 times, either. It has been in a downtrend since early December, but even stocks in downtrends don't have to go down in straight lines, and that's what I'm counting on here. There is some support semi-close by, too.

It's a good company, and trading them in tough times (I think the last 6 weeks qualifies there, don't you?) gives me the best odds of making money. NVDA has never let me down - literally never. Sometimes it takes longer than others, but it always pays. I haven't updated my W/L record on it lately, but the 5 trades on the chart are the last 5 I've made and it was undefeated before all of them. You can go back and look at them if you desperately want to know - I know it's in at least one of those but I don't feel like going back and looking for the exact number right now. I know it's at least 100s to 0. Edit: I felt bad being lazy so I went and looked it up. It's 722-0, and that's a good enough reason for me to trade it today.

So I'm long at 111.43, but I am making a little twist to my usual trade plan. I will be adding if it falls, but not using my usual methodology. It's a twist I've been working on for trading downtrending stocks. It's complicated, so I'll just update here whenever I add, and the adds will still be near the close when I make them. I will still use FPC (first profitable close) to exit any lot on the day it closes at any reasonable profit.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

NVIDIA: Still has a long way to go.NVIDIA turned from oversold to neutral on its 1D technical outlook (RSI = 48.969, MACD = 44.021, ADX = 44.021) and is about to do the same on 1W too, as today's 90-day tariff pause announcement is giving the market an aggressive comeback. Technically though that doesn't seem enough to restore the tremendous bullish sentiment of 2023 and 1st half of 2024 as the trend is currently restricted by not only the 1D MA50 and MA200 but a LH trendline also coming straight from the ATH.

The same kind of LH kept NVDA at bay on its last main correction to the August 5th 2024 bottom. This started a +44.46% rally that got rejected on the LH trendline. If we apply that today we get a projected 1D MA200 test just under the LH trendline. A TP = 125.00 fits perfectly on the short term, but long term we still have a long way to go.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Phase 4 broken, the hyperwave will be completedWe've seen this cycle across more or less in all kinds of assets. the MAG7 is no exception. As today, we've broken down from Phase 4, despise you like it or not, once these structures break down, PA(price action) will always find its way back to its true fair value.

Already called it, but this time, we get a closer look towards the TA in NVDA.

Sequentials are settled in, we're going for a 9 monthly count of sequential bars down, the intensity of the moves is yet to be known, but alas, we will have to look at SMA's and the range of the monthly Linear Regression, they all have supports around 80, 40, 20.

And as usual, be safe, don't long this.

We’ve seen a solid correction in NVDA - Bullish?We’ve seen a solid correction in NVDA following its rally since early 2024. The stock has broken through key levels and managed to hold within the resistance zone between $80 and $90. We will most likely enter a sideways movement until the situation regarding tariffs becomes clearer. This could extend into June, after which we might expect an upward move toward the $132.95 zone. By early 2026, we are likely to see a new all-time high, especially if the trade tensions and tariffs between China and the US are resolved and overall uncertainty decreases.

NVDA 09-04-2025NVDA fighting for its life trying not to establish confirmation on another bearish trend but price movement will probably continue lower. How much lower remains uncertain but the old support is turning into an established resistance line more and more by the day. If price does a retest and now established a down trend price movement will probably gain enough momentum to move down quite strong. However i will wait and see what price trend the price movement establishes into and then make my position. I would much rather just wait til the bearish trend reverses and buy many shares then for a greater profit margin on my bullish entry then hold a bad short position with uncertain price movements as the NVDA chart right stands as.

NASDAQ:NVDA

NVDA TO $176 BY JUNE THEN $1000 END OF YEARNVDA to $176 by June Then $1000 End of Year: A Bold Thesis

Key Points

It seems likely that NVDA could reach $176 by June 2025, supported by strong AI market trends and upcoming earnings, but reaching $1000 by year-end is highly speculative and controversial.

Research suggests Elliott Wave analysis shows a potential bullish trend, but specific price targets like $1000 lack broad analyst support.

The evidence leans toward significant growth potential due to NVDA's leadership in AI and new product launches, yet such aggressive targets involve high uncertainty.

Current Price and Market Context

As of April 9, 2025, NVDA's closing price on April 8 was $96.30, with pre-market trading at $98.22. This reflects recent volatility, with a 52-week range from $75.61 to $153.13. The stock's performance is tied to its dominance in AI and GPU markets, which are experiencing robust growth.

Analysis for $176 by June

Reaching $176 by June 2025, an 83% increase from $96.30, is ambitious but plausible. Upcoming earnings on May 28, 2025, estimate an EPS of $0.93 and revenue of $43.34 billion, with potential beats driving price surges. Elliott Wave analysis suggests NVDA may be completing a corrective phase, with a falling wedge pattern indicating a possible upward breakout, supporting short-term targets around $176.

Analysis for $1000 by Year-End

The prediction of $1000 by December 2025, a 940% increase, is highly speculative. While some analyses, like a Forbes article, suggest NVDA could see a tenfold rise by 2026 due to the Blackwell architecture, most analyst targets range from $170 to $235. This target lacks broad support and involves significant market and fundamental risks.

Unexpected Detail: Stock Split Impact

An unexpected factor is NVDA's 10-for-1 stock split in June 2024, adjusting prices from over $1,000 to current levels, making historical comparisons complex. This split aligns the $1000 target with post-split valuations, but achieving it requires unprecedented growth.

Survey Note: Detailed Analysis of NVDA's Potential Price Surge to $176 by June and $1000 by Year-End

Introduction

NVIDIA Corporation (NVDA), a leader in graphics processing units (GPUs) and artificial intelligence (AI), is currently trading at approximately $96.30 as of April 9, 2025, based on the closing price from April 8, with pre-market activity showing a slight uptick to $98.22. This analysis explores the feasibility of NVDA reaching $176 by June 2025 and an ambitious $1000 by the end of the year, leveraging Elliott Wave theory and other validated analytical methods. Given the stock's recent performance and market context, we examine technical patterns, fundamental catalysts, and long-term growth potential.

Current Market Position and Historical Context

NVDA's stock has shown volatility, with a 52-week range from $75.61 to $153.13, and a year-to-date change of -11.36% over the past week and -12.23% over the past month, per recent data. The all-time high was $153.13 on January 6, 2025, indicating significant upside potential from current levels. The market capitalization stands at $2.35 trillion, with a beta of 2.40, reflecting high volatility. Key financial metrics include an EBITDA of $83.32 billion and an EBITDA margin of 63.85%, underscoring strong profitability.

A critical context is the 10-for-1 stock split in June 2024, which adjusted share prices from over $1,000 to current levels, making historical comparisons complex. This split, detailed in a CNBC article (Nvidia announces 10-for-1 stock split), was aimed at making ownership more accessible, aligning with the user's post-split price targets of $176 and $1000.

Metric Value

Closing Price (Apr 8) $96.30 USD

Pre-Market Price (Apr 9) $98.22 USD

52-Week Range $75.61 - $153.13 USD

Market Cap $2.35T USD

Beta (1Y) 2.40

Earnings Next Report May 28, 2025, EPS Estimate $0.93, Revenue Estimate $43.34B USD

Last Quarter EPS $0.89 (estimated $0.85, +4.96% surprise)

Dividend Yield (TTM) 0.04%

Elliott Wave Analysis: Technical Insights

Elliott Wave theory, a method identifying market psychology through wave patterns, suggests NVDA may be in a corrective phase, potentially completing wave (4) of a larger five-wave structure. Recent analyses, such as those on TradingView (NVIDIA Stock Chart), indicate a falling wedge or ending diagonal formation, often signaling a reversal and start of an upward trend. This could support a move to $176 by June, as wave (5) projections often extend to 1.618 times wave (1), potentially aligning with such targets.

Specific Elliott Wave analyses, like those from ElliottWave-Forecast (Elliott Wave Expects New All Time High), suggest NVDA has completed corrections and is resuming higher, with wave counts indicating impulsive rallies. However, these analyses lack explicit price targets reaching $1000, focusing more on trend continuations.

Short-Term Target: $176 by June 2025

Reaching $176 by June 2025, an 83% increase from $96.30, is ambitious but supported by several factors. The earnings report on May 28, 2025, is a critical catalyst, with estimates for EPS at $0.93 and revenue at $43.34 billion. Given NVDA's history of beating estimates, as seen in the last quarter with EPS of $0.89 against an estimate of $0.85, a strong report could drive significant price appreciation.

Technical indicators, such as a breakout from the falling wedge, align with this target. Analyst price targets, ranging from $125 to $220 with an average of $177.19 per Zacks (NVIDIA Price Target), also support the possibility, with some forecasts reaching $235.92 (NVDA Forecast). However, achieving this in two months requires sustained bullish momentum and favorable market conditions.

Long-Term Target: $1000 by Year-End 2025

The prediction of $1000 by December 2025, a 940% increase from current levels, is highly speculative. Most analyst forecasts, such as those from MarketBeat (NVIDIA Stock Forecast) and TipRanks (Nvidia Stock Forecast), range from $170 to $235, far below $1000. However, a Forbes article from May 25, 2024 (Nvidia Stock Tops $1,000), suggests NVDA could see a tenfold rise by 2026 due to the Blackwell architecture, potentially supporting a $1000 target by late 2025 if growth accelerates.

Blackwell, a new GPU architecture, is expected to enhance NVDA's AI and data center offerings, potentially driving revenue growth. CoinCodex forecasts a high of $260.32 by December 2025 (NVIDIA Stock Forecast), still below $1000, indicating the target is outlier and involves significant risk. Market volatility, competition, and macroeconomic factors, such as tariff impacts noted in CNN reports (NVDA Stock Quote), add uncertainty.

Fundamental Catalysts and Risks

NVDA's fundamentals are strong, with consistent revenue growth and high EBITDA margins. The company's expansion into AI, autonomous systems, and supercomputers, as noted in LiteFinance (Nvidia Stock Price Prediction), supports long-term growth. However, short-term corrections due to overvaluation or market sentiment, especially around tariff concerns, pose risks.

X posts, such as one from @1000xStocks (X post), highlight NVDA's EPS growth reflecting AI monetization, suggesting bullish sentiment, but lack specific $1000 targets. Another from @ravisRealm (X post) notes adding positions at lower prices, indicating confidence but not supporting the $1000 target.

Conclusion

While reaching $176 by June 2025 is plausible with strong earnings and technical breakouts, the $1000 target by year-end is highly speculative, lacking broad analyst support and requiring unprecedented growth. Investors should monitor earnings reports, product launches like Blackwell, and market trends, while employing risk management strategies given the high uncertainty.

NVIDIA About to TANK? Or Just Cooling Off?After one of the most explosive bull runs in tech history, NVIDIA is showing signs of exhaustion — and this chart’s screaming a massive correction incoming.

🧠 Chart Insights (2W Time Frame):

Current Price: ~$96.30

All-Time High: $152.89

Key Breakdown Levels:

🔵 Pullback Zone: $134.29 — Broken & Completed

🟠 Neckline Support: $90.69

🎯 Major Fibonacci Target: $66.25 (61.8% retracement)

💀 Extreme Support Zone: $10.81 (not likely unless disaster strikes, but chart says what it says...)

🔎 What’s Really Happening:

Bull run started October 2022 and went parabolic into late 2024

Price attempted to consolidate above $130–140 (pullback zone) but failed to hold

Bearish momentum confirmed as we’ve broken through key zones

We’re now headed straight toward the $90s neckline, with $66.25 as a Fibonacci target if trend continues

⚠️ Why This Matters:

This isn’t fear — it’s structure. Nvidia doesn’t have to collapse to zero, but even a healthy correction to $66 would be a 30%+ drawdown from current levels.

That would:

✅ Flush out weak hands

✅ Offer long-term buyers a better setup

✅ Rebalance the overextended rally from 2023–2024

👀 What to Watch:

Retest of $90.69 neckline

Reaction at the 61.8% retracement

Volume spikes on weekly red candles

If bulls don’t step in soon, this is just the beginning of the cooldown

📌 This is not financial advice — just chart surgery.

🔖 Hashtags:

#NVIDIA #NVDA #StockMarketCorrection #BearishStructure #TechStocks #TradingViewCharts #MarketMomentum #PriceAction #FibonacciAnalysis

NVIDIA: Time for a Graphic Comeback?🔍Analysis:

Following up from a previous breakdown, NVIDIA has now tapped into a high-probability Weekly Order Block (OB) just above the sell-side liquidity zone at $88.97. This level also aligns with a structural area of support, making it a prime zone for a potential bullish reversal.

Key signs:

Price is showing early signs of displacement from the OB.

If this zone holds, we could be looking at a 77% move back up to the buyside liquidity at $157.92.

Watch for a strong weekly candle close above $96.30 to confirm the bounce.

🛑 Invalidation:

If price fails to hold this OB and breaks below $88.97, expect a deeper move into the $76.06 zone.

💡 Summary:

Patience is key. We’re sitting on a solid base for a potential bullish push — now it’s all about the confirmation candle. 📊

DYOR — Don't just HODL, study the chart!

NVDA Technical Analysis – April 9, 2025NVIDIA (NVDA) just got rejected at the top of a falling wedge channel on the 1H chart and is showing clear signs of continued bearish pressure. After testing a key resistance around the $102–$103 zone, price has sharply reversed and is now threatening to revisit lower trendline levels.

Market Structure & SMC Insight:

* NVDA remains in a strong downtrend with price confined in a descending wedge.

* There was no confirmed CHoCH (Change of Character) or BOS (Break of Structure) indicating strength—only a lower high rejection.

* A red resistance zone remains around $103.70, while major support lies around $86.74.

* MACD is curling down after a bearish cross.

* Stoch RSI is pointing lower from the mid-zone, signaling more downside may be ahead.

* Volume has increased on this rejection, giving the move more credibility.

TrendInfo Sentiment Summary:

* MA: Bearish (-2.21%)

* DMI: Bearish (38.33)

* RSI, MACD, Stoch: All showing bearish confirmation.

* DPR (Directional Pressure Ratio): Bearish (43.5%)

* Fear & Greed: Fear (-15.78), overall Sell rating of 75%.

This suggests that short-term traders are risk-off and sentiment is skewed toward more downside.

Options GEX Analysis (Gamma Exposure & Sentiment):

* Current GEX shows strong PUT dominance at 28%, aligning with a bearish directional expectation.

* IV Rank (IVR) at 107.2 with IVx avg at 108.7 indicates high volatility; premiums are rich, great for credit spreads or directional put plays.

* Key Put Support at $90 with heavy GEX clustering below. This is your downside magnet.

* Call resistance sits near $102–$105 range, aligning with the recent rejection. Gamma walls at $108–$111 cap the upside.

Trade Scenarios:

Bearish Scenario:

* Rejection confirmed. If NVDA breaks $94 again, a fast drop to $90 and even $86 support is on the table.

* Put Options with strikes at $90 or debit spreads can work well.

* Watch for continuation volume confirmation.

Bullish Reversal Setup (Low Probability for Now):

* Needs a reclaim of $103.70 with volume.

* A CHoCH + strong bullish candle would trigger potential upside targets of $108 and $111.

* Call debit spreads or long shares only if reversal is confirmed.

My Thoughts: NVDA continues to reflect sector-wide weakness in semis. Without strong market support, the path of least resistance remains down. Given the macro volatility and sentiment tilt toward fear, it's wise to position conservatively and trade with tight risk.

Final Suggestion:

* Put Bias Active

* Avoid heavy call exposure unless reclaim of $103 occurs

* Sell premium if IV stays elevated (e.g. credit spreads)

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.