ORCL - Weekly - The PlayClick Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!!

________________________________________________________

________________________________________________________

..........✋NFA👍..........

📈Technical/Fundamental/Target Standpoint⬅️

1.) The most recent two earnings

No news here

Looks like there's nothing to report right now

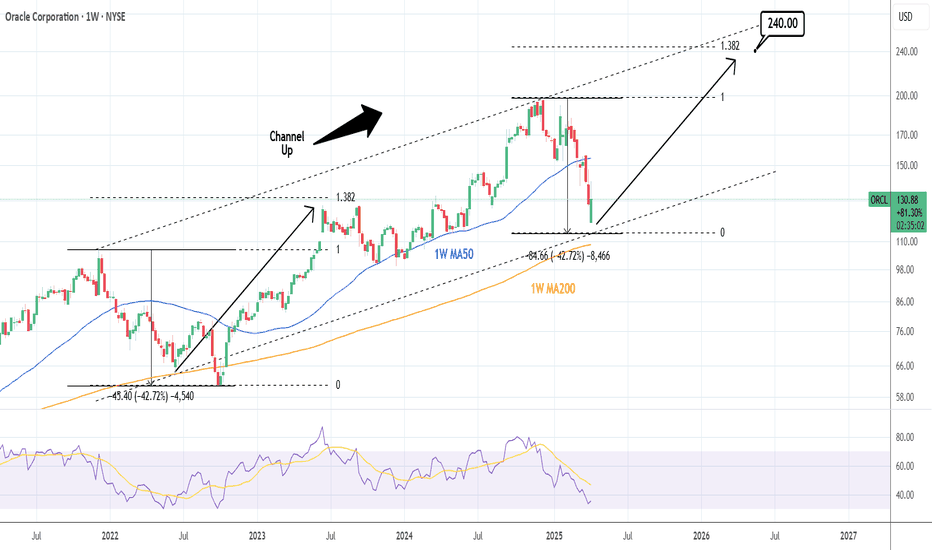

ORACLE: On a 3 year bottom. Buy opportunity for 240 long termOracle is bearish on its 1W technical outlook (RSI = 35.862, MACD = -4.360, ADX = 42.565) as this week it reached almost the same levels of correction as the 2022 Bear Market (-42.72%). This is also nearly a HL bottom for the 3 year Channel Up and as the 1W MA200 is right below, a great long term bu

NLong

NShort

NShort

ORCL for BuyOracle Corporation (ORCL) has recently reported its fiscal third-quarter earnings, with adjusted earnings of $1.47 per share on sales of $14.1 billion, slightly below Wall Street forecasts of $1.49 per share on $14.4 billion in sales. Despite this, the company provided a strong sales forecast for th

NLong

Check Out Oracle’s Chart Heading Into Next Week’s EarningsOracle NYSE:ORCL is set to report fiscal third-quarter results next Monday (March 10) after the closing bell rings in New York. What is technical and fundamental analysis saying about the software/cloud/AI giant’s stock heading into the results?

Oracle’s Fundamental Analysis

As I write this, t

Projected Growth Post-CorrectionKey arguments in support of the idea.

Remaining in Focus: Announced $500 Billion Investment in AI Infrastructure.

Primary Cloud Infrastructure Development Partner for All Big Tech Companies.

Investment Thesis

Oracle Corporation (ORCL), an American technology titan, excels in crafting and

NLong

Oracle: Tilting Downward…After a sharp rebound from the $152.02 support following the steep drop from the peak of the beige wave II, Oracle is once again tilting downward as expected. The next step should see the price fall below $152.02 to reach the projected low of the beige wave III. After a countermovement of wave IV, t

SHORT ORCLOracle Corporation (ORCL) has recently experienced a decline due to underwhelming earnings and concerns over its valuation.

The stock is currently trading at $183.47. Given the elevated implied volatility in the options market, a short call strategy may be more cost-effective than purchasing puts

NShort

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where ORCL is featured.