PBYI/USD – 30-Min Long Trade Setup !📌🚀

🔹 Asset: PBYI (Puma Biotechnology, Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $3.58 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $3.37 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $3.86 (First Resistance Level)

Puma Biotechnology | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Puma Biotechnology

- Double Formation | Downtrend

* Triangle Subdivision

- HH & HL | Uptrend Infliction

- Entry Bias Hypothesis | 012345

- Retracement | Wave Confirmation

Active Ses

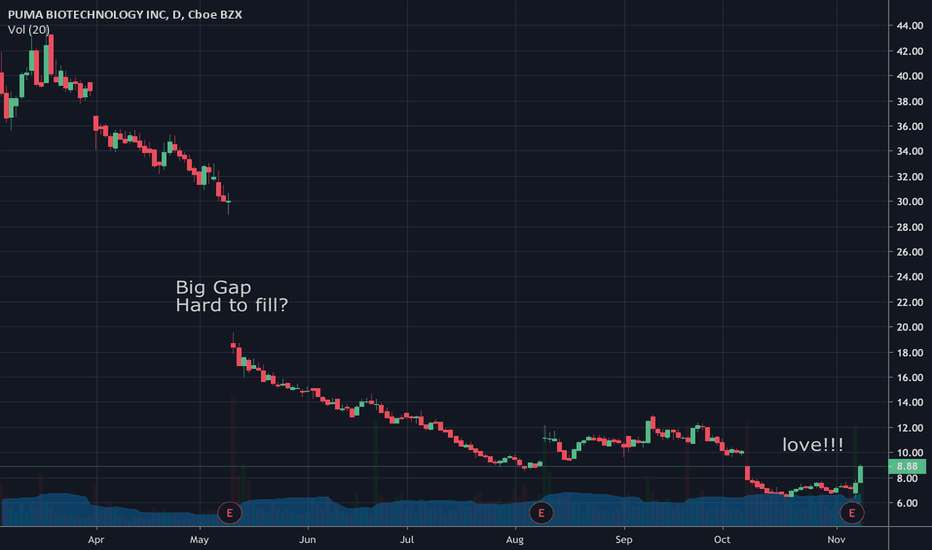

PBYI a speculative biotech LONGPBYI according to the recent earnings as no earnings nor revenue. This is typical in the biotechnology sector.

This 4H chart shows a consistent downtrend with a couple of minor pullback corrections shown with a Doji followed

by a green engulfing candle but with low volume and the K/D lines of the

Puma Biotech in Red. PBYIStart of new zigzag is confirmed. Conservative Fib extension will actually show like end of next downward A Wave. We have reason to believe that there is much more room for Puma to pounce much, much lower.

We are not in the business of getting every prediction right, no one ever does and that is no

PBYI, Aroon Indicator entered a Downtrend on June 29, 2020.For the last three days, Tickeron A.I.dvisor has detected that PBYI's AroonDown red line is above 70 while the AroonUp green line is below 30 for three straight days. This move could indicate a strong downtrend ahead for PBYI, and traders may view it as a Sell signal for the next month. Traders may

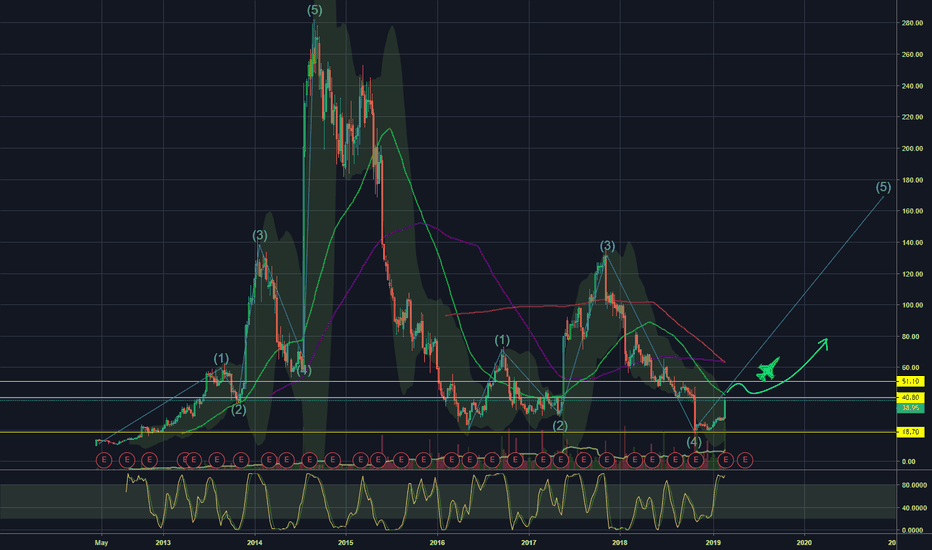

Downward (Re-test All time Low?) - Monthly Interval - PBYIHello Successful Investors,

The stock (PBYI) presents a worrisome investor consensus as enough there have been minimal price jumps, the overall trend is quite significantly negative (bearish). Considering this month's bearish trend, there may be an opportunity to cultivate all time lows. Await conf

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.