Tim's Fundamental View LayoutHere is the way that I view any stock for an initial analysis to get an idea of what the market is valuing and viewing the company.

I first look at the free cash flow, so that is directly under the price chart. Free cash flow is the life-blood of the company and can be used to pay dividends and to

Key facts today

New budget talks indicate potential repeal of electric vehicle tax credits, impacting Rivian Automotive. Consumer credits could end soon, while business credits may be gradually removed.

After Rivian Automotive's earnings report, Stifel raised its price target to $18, maintaining a 'Buy' rating, while Bernstein set a target of $7.05, rating it 'Sell'.

Rivian Automotive obtained a $6.57 billion loan for a new Georgia plant to produce smaller, affordable electric vehicles starting in 2028, finalized during President Biden's last weeks in office.

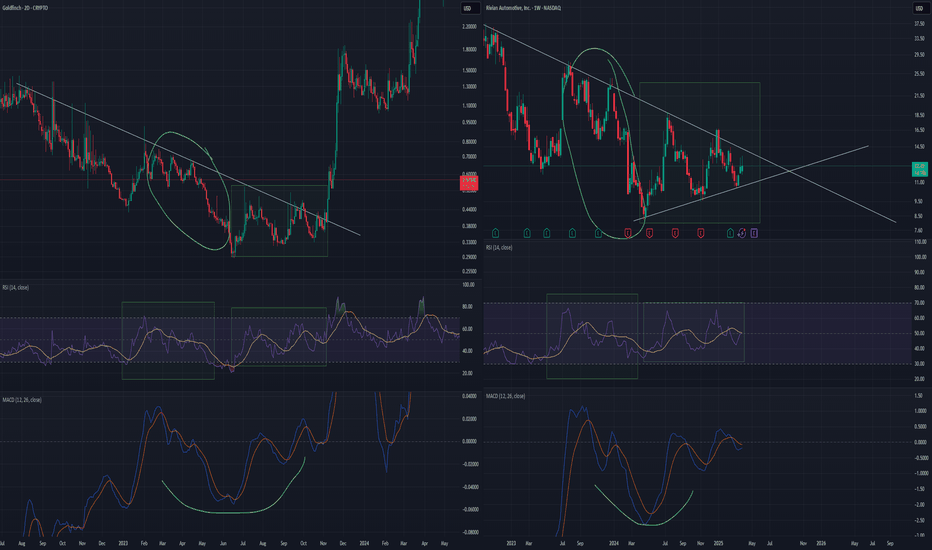

Is the trend changing for Rivian?NASDAQ:RIVN 's stock price, which has dropped by nearly 80% since September 2022, has started to move upward again in November 2024 with renewed demand.

The possibility of retesting the trendline formed during the 2022-2024 period has strengthened with the demand seen in the past month.

If this

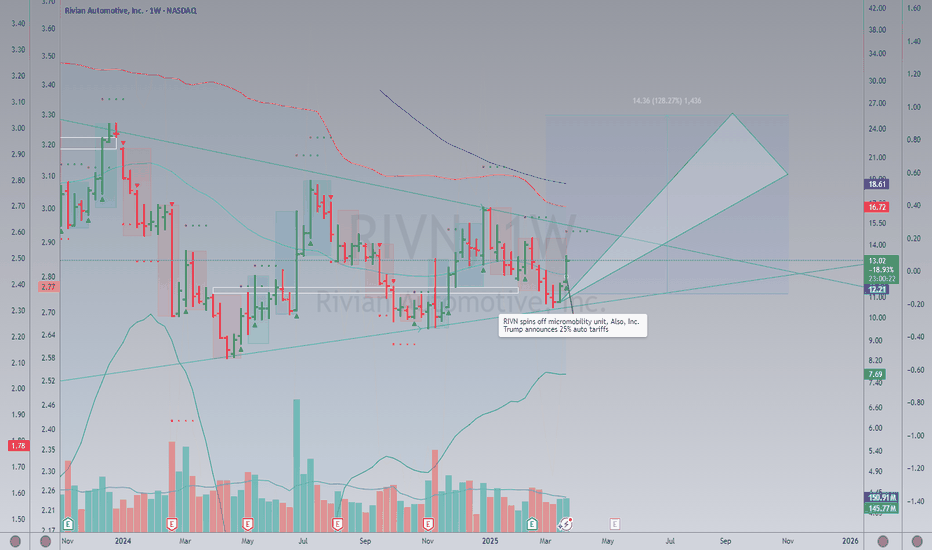

Trading idea - Entry point > 12.24/61.80%Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 12.24/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the botto

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back h

RIVIAN Stock Chart Fibonacci Analysis 032525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 12.3/61.80%

Chart time frame: C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: B

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.