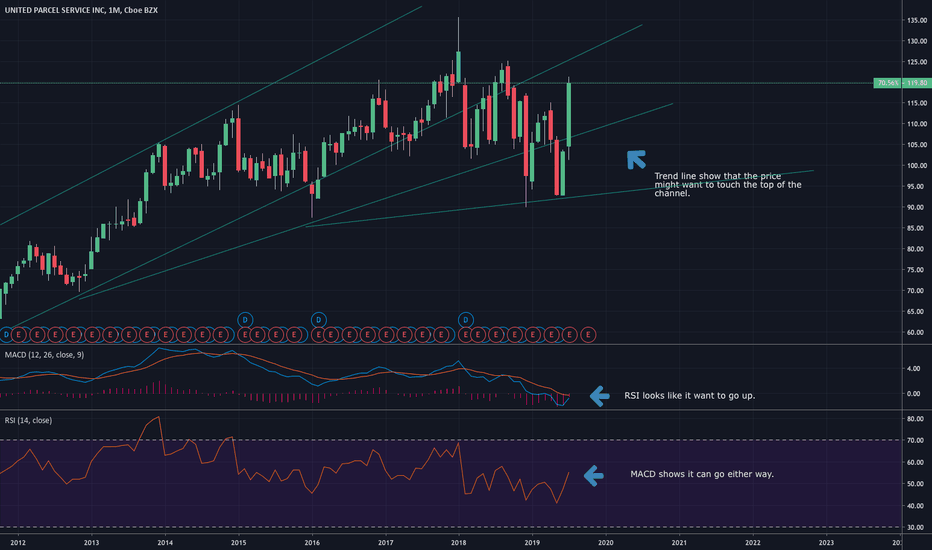

UPS trade ideas

Bullish S/R flip and DMA Golden Cross on UPS.UPS is currently building support on top of old resistance around $112 (which confirms the bullish support and resistance flip), and is consolidating in what looks to be a bull flag-like pattern. We also have a daily golden cross (50 day moving average crossing the 200 day moving average) and we could see the momentum continue to carry this stock higher. R/R is pretty good here, but I've had what I thought were good setups turn south pretty quickly (EA and SQ for example), so be cautious and use proper risk management if you decide to take this trade.

Moving average guide (All daily for this post):

50 day moving average in Green.

100 day moving average in Yellow.

200 day moving average in Red.

Entry: 112.30-114.50

Target 1: 118.00

Target 2: 120.60

Target 3: 125.00

SL: 110.50 (below the 50 and 200 day moving averages, and below our support zone at 112.)

-This is not financial advice. Always do your own research and own due-diligence before investing and trading, as for investing and trading comes with high amounts of risk. I am not liable for any incurred losses or financial distress.

UPS approaching resistance, potential drop! UPS is approaching our first resistancce at 111.51 (horizotnal swing high resistance, 78.6% fibonacci retracement, 61.8% fibonacci extension) where a strong drop might occur below this level pushing price down to our major support at 103.68 (horizontal pullback support, 38.2% fiboancci retracement).

Stochastic (89,5,3) is also approaching resistance where we might see a corresponding drop in price.

UPS sets up to be a low-risk short!The market has been in a never-ending buy-the-dip mode lately. With the Fed out of the picture and Trump tweeting about a China trade deal everyday, the stock market has seen very few decliners. Picking shorts has been a losing battle for 8 weeks now. I've found that it's never a good idea to arbitrarily pick tops unless I can give myself a solid technical setup with a decent fundamental reason to do so. In this case, UPS is meeting both of these conditions.

Like many stocks, UPS went into a classical head and shoulders pattern, which it broke down from. It has since retraced all the way back to an important trendline (as it has now tested this trendline 7 times!). On Friday, XPO, another shipping and logistics company reported a bad quarter citing weakness in France and the UK. This news had a heavy read-through to FDX but not as much to UPS (FDX was down 5% on the XPO news at one point). However, UPS has still failed to breakout above the shown trendline and has very little fundamental reason to do so. Although old news, Amazon has entered the shipping space and is now a direct competitor of UPS and FDX. This may be more of a reason to see less upside and more downside from the shipping stocks.

I think we can short UPS here around $111:

Target $104 (neckline of H&S)

Stop: Any close above the drawn trendline

UPS Approaching Resistance, Potential Reversal!UPS is approaching its resistance at 103.882 (100% Fiboancci extension, 50% & 38.2% Fibonacci retracement, horizontal overlap resistance) where we expect to see a reversal to its support at 96.91

Stochastic is approaching resistance at 95% as well where a corresponding reversal could occur.