DOW JONES: Starting the final stage of 3year Bull Cycle.Dow Jones got oversold on its 1D technical outlook (RSI = 29.297, MACD = -550.130, ADX = 76.606) as it is currently testing its 1W MA50. This is a level that has been intact since November 2023 and is of high importance to the trend as it has a key cyclical attribute. The driving growth pattern of Dow since the 2009 bottom is a Channel Up and every time a Bull Cycle starts, the 1W MA50 is the first level of support, with every touch of it being the strongest buy opportunity. When the 3 year Bull Cycle is coming to an end, the 1W MA50 breaks and the index approaches the 1M MA50 during its Bear Cycle correction, which becomes the ultimate buy entry for the new long term 3 year Bull Cycle.

The current Cycle should starts getting completed technically after September 2025, so there is a high chance that the 1W MA50 holds here. The three Bull Cycles we've had so far had a fairly similar growth percentage, rising by +70.38% to +76.64%. If the +70.38% minimum range is followed on the current (4th) Bull Cycle, then we're aiming at 48,000 (TP) towards the end of the year. The 1M CCI seems to be printing the exact same build up to the Bear Cycle as in the past.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

US30 trade ideas

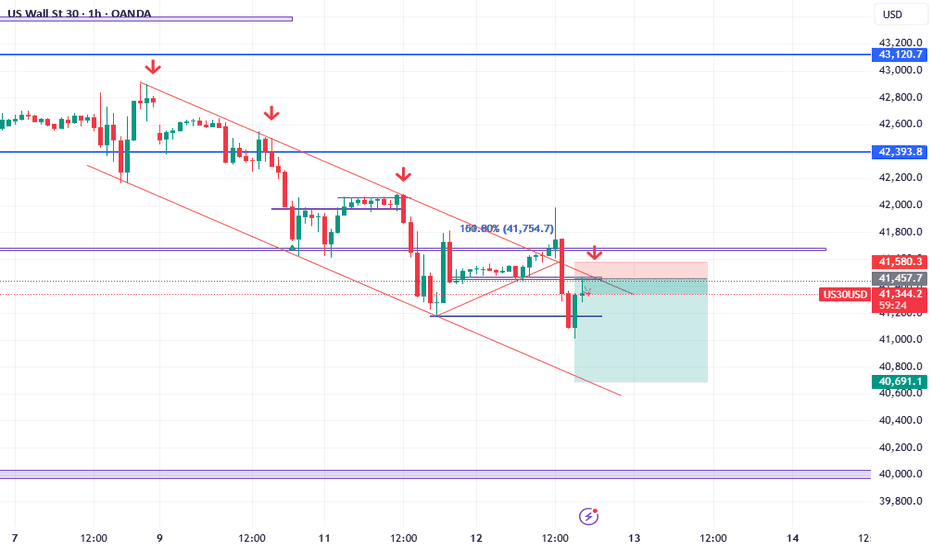

US30 BUYOANDA:US30USD

We caught a massive sell on US30. At this moment, price is retesting a Key-Level on the Daily time frame. The break beneath the 41,736.5 area seems to be a huge liquidity grab while also retesting this structural level. If price fails to break this zone, there is a big chance that we will see a retest of the highs over the month. We enter this trade at the lows, and we're already in profit. Let's see how it holds up.

US30 Trade Outlook – 12/03/2025📊 Market Structure & Key Levels

US30 is still in a downtrend, but we are seeing a bullish reaction from recent lows. Price is testing resistance around 41,718 - 41,800, a key zone for potential rejection or breakout.

🔍 Key Observations:

✅ Bearish Trend – Price remains below major EMAs, but attempting a recovery.

✅ Key Resistance – 41,800 level is a crucial decision point.

✅ Bullish Breakout? – If price holds above 41,800, we could see a push toward 42,200+.

🎯 Trade Plan:

🔹 Short if rejection at 41,800, targeting 41,628 & 41,400.

🔹 Long if clean breakout & retest above 41,800, targeting 42,200 - 42,400.

💡 Patience. Confirmation. Risk Management.🔥

DowJones INTRADAY Key Trading Levels post CPI dataThe softer-than-expected inflation data has fueled optimism among equity investors, as cooling inflation could alleviate pressure on the Federal Reserve to maintain an aggressive tightening stance. The positive market reaction suggests that participants are increasingly pricing in the possibility of a more gradual approach to interest rate adjustments.

With inflation appearing to moderate, the Federal Reserve may be more inclined to pause or slow the pace of rate hikes in the coming months. The data supports the case for a more dovish stance, as policymakers assess the effectiveness of prior rate increases and the risk of economic slowdown. Markets will continue to monitor upcoming economic releases and Federal Reserve statements to gauge the likelihood of a shift toward a less aggressive monetary policy.

Key Support and Resistance Levels

Resistance Level 1: 42256

Resistance Level 2: 42600

Resistance Level 3: 43000

Support Level 1: 41150

Support Level 2: 40576

Support Level 3: 40073

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

US30 (Dow Jones) Buy Analysis: GTEUS30 has successfully pushed through an Inverse Fair Value Gap (IFVG) on the 1-hour timeframe, confirming bullish momentum. Price action suggests a continuation upward, with the next target being the top trendline around 41,950 - 42,000.

With CPI news scheduled for tomorrow morning, we can anticipate further volatility, but until then, US30 is likely to maintain its bullish structure. As long as price holds above the recent support zone around 41,500, the bias remains bullish towards the higher resistance levels.

Potential longUS30 may find bullish pressure from the 41,500, as it was a previous resistance turning into support.

As long as price action is below 41,500 - 41,000 region, the indice will likely continue it's downward trajectory.

Remaining above the 41,500 may lead to a rise aiming for the above resistance barriers.

Dow Jones Potential DownsidesHey Traders, in today's trading session we are monitoring US30 for a selling opportunity around 41900 zone, Dow Jones is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 41900 support and resistance area.

Trade safe, Joe.

Flat correction in DOW JonesA flat correction differs from a zigzag in that the sub wave sequence is 3-3-5, as shown in chart. Since the first actionary wave, wave A, lacks sufficient downward force to unfold into a full five waves as it does in a zigzag, the B wave reaction, not surprisingly, seems to inherit this lack of countertrend pressure and terminates near the start of wave A. Wave C, in turn, generally terminates just slightly beyond the end of wave A rather than significantly beyond as in zigzags.

Dow Jones: A Make-or-Break Buy Setup with Smart Money BackingDow Jones Industrial Average - Buy Setup

Technical: U.S. markets have struggled recently due to uncertainty over tariffs imposed by President Trump. While the S&P 500 and NASDAQ have broken key support levels, the Dow remains resilient, holding the critical 41,648 support. A break below would confirm a large double-top pattern, signaling a bearish outlook. This is a pivotal moment. The rebound from overnight lows is encouraging, but with the U.S. CPI release tomorrow, caution is warranted. While speculative, COT and seasonal data favour a short-term move higher.

Fundamental: The latest Commitment of Traders (COT) Report shows increasing long interest in the Dow, suggesting "smart money" accumulation.

Seasonal: Historically, from March 12 – May 2, the Dow has posted gains 84% of the time, averaging +3.68% over the past 25 years.

Setup:

Entry: 41,800 – 42,000

Stop Loss: 41,285 (below the Nov 2024 low at 41,648)

Target: 44,290

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Financial Apocalypse? Markets Crash as Billions Flow into Cash –A New Wave of Market Turbulence: How Trade Wars and Uncertainty Affect Investors

The US stock market is currently undergoing a massive sell-off, which analysts compare to previous financial crises. Both institutional and retail investors are actively exiting equities and high-risk instruments, including cryptocurrencies. The accumulated anxiety is driven not only by the global economic cycle but also by specific political decisions: trade wars and protectionist measures are putting significant pressure on corporate earnings and market expectations.

Early Signs: Tariffs and Escalation

When Donald Trump announced increased tariffs on imports from China a few years ago, the stock market reacted sharply but briefly. Many analysts hoped the tensions would turn out to be short-lived negotiating tactics. Ultimately, however, the trade confrontation evolved into a prolonged phase, affecting not only the US and China but also European partners.

Today we see a continuation of this policy, where new restrictions and tariff threats have been added to the previously introduced measures. This has prompted capital outflows and increased uncertainty, as global supply chains have come under question, and the prospects for global trade recovery are murky.

Parallels with the 2008 Crisis

Comparisons to 2008 are inevitable due to the scope and speed of the drop in stock prices. However, while the primary trigger in 2008 was the collapse of the subprime mortgage market and the banking sector, the current negative factors lie in the realm of trade and geopolitical tensions.

Leading companies' financial results are declining because of rising costs for raw materials and logistics due to mutual tariffs. Global demand is weakening, and heightened instability is causing management teams to cut back on investment programs. All this is reflected in stock market indices, which continue to lose several percentage points in a single trading session.

Buffett’s Role and the Cash Accumulation Strategy

Warren Buffett, one of the largest and most conservative investors, prepared for such a scenario by amassing an unprecedented amount of cash. Buffett’s approach does not involve “catching a falling knife” at the peak of panic, but as soon as the situation stabilizes or compelling long-term opportunities arise, he will likely begin buying undervalued assets.

This strategy is typical for major players who focus on fundamental indicators. They are not looking at short-term fluctuations but rather the potential gains when the market recovers and prices return to fair value.

Cryptocurrencies: Expectations vs. Reality

Many assumed that cryptocurrencies would serve as a haven during crises. However, experience shows that in periods of global uncertainty, risk-averse investors exit digital assets alongside everything else. Bitcoin and Ethereum have lost 20–30% since the latest “flare-ups” began, and even statements about a “national bitcoin strategy” have so far failed to influence their prices.

Meanwhile, fundamental factors—limited supply, the development of blockchain technology, and IT-sector interest—have not disappeared. These arguments gain traction when investors’ risk appetite returns. But when the market is dominated by fear of further declines, they tend to avoid risky trades and prefer liquid, proven instruments.

Where the Money Goes

Unlike previous downturns, capital has not rushed into gold. While gold prices reached their peak a few weeks ago, their growth has since slowed, as some investors opt to keep their funds in cash, considered the safest choice.

Such behavior may suggest that the sell-off is nearing its climax: when capital remains “on the sidelines,” it eventually starts seeking new opportunities—whether in bargain-priced shares of large industrial giants, the tech sector, or even the cryptocurrency market with its depressed valuations. The volume of outflows from the US stock market is colossal; over the last couple of weeks, the total market cap of leading indexes has fallen by several trillion dollars. It is expected that a substantial portion of this money will re-enter the market, though likely redistributed among different asset classes.

Medium- and Long-Term Outlook

Investors with a six-month or longer horizon often see the current levels as potential entry points. Historically, global conflicts and economic crises end sooner or later, opening opportunities for those who can tolerate temporary volatility.

However, short-term trading remains extremely risky: as uncertainty persists, we may see more waves of sell-offs that knock out speculators with weak nerves or insufficient liquidity. During such moments, those who remain disciplined and steadfast can find profitable opportunities.

Conclusion

Today’s financial market conditions stem from a convergence of factors: aggressive trade policies, geopolitical risks, and the natural winding down of certain economic cycles. The mass sell-off of stocks and cryptocurrencies indicates that investors are unwilling to take on new risks until tariff disputes calm down, a clearer picture emerges for corporate profits, and major economic centers reach some form of agreement.

Nevertheless, the market retains its cyclical nature: historical parallels show that after the steepest drops, recovery periods often follow. The only question is when the turnaround will occur and who will be the first to capitalize on it.

DOW JONES Can the 1W MA50 hold and spark an end-of-year rally?Dow Jones (DJIA) has been trading within a Channel Up pattern since the late July 2023 High. The decline of the last 30 days can be technically seen as the Bearish Leg that will price its new Higher Low bottom.

The price isn't only close to the Channel's bottom but also the 1W MA50 (blue trend-line), a level that has been supporting since the October 30 2023 bullish break-out. As a result, a 1W MA50 hit will be a potential double support test, with the 1W RSI also printing a Bearish Leg similar to the one that led to the October 2023 bottom.

On the other hand, the ranged price action since the late November 2024 High, resembles the sideways volatility of the first half of 2024. Both were initiated after Higher High pricings at the top of the Channel Up. The rallies that led to those tops have been +21.00% and +23.72% respectively.

If there is a decreasing rate on each Bullish Leg, then the new one should be +17.30% (i.e. -3.30% less than the previous one), which falls marginally below the 1.5 Fibonacci extension, which is where the November 2024 High was priced.

As a result, as long as Dow is closing its 1W candles above the 1W MA50, the 2-year Channel Up is more likely to push upwards again for its new Bullish Leg, potentially targeting 48900 (+17.30%).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇