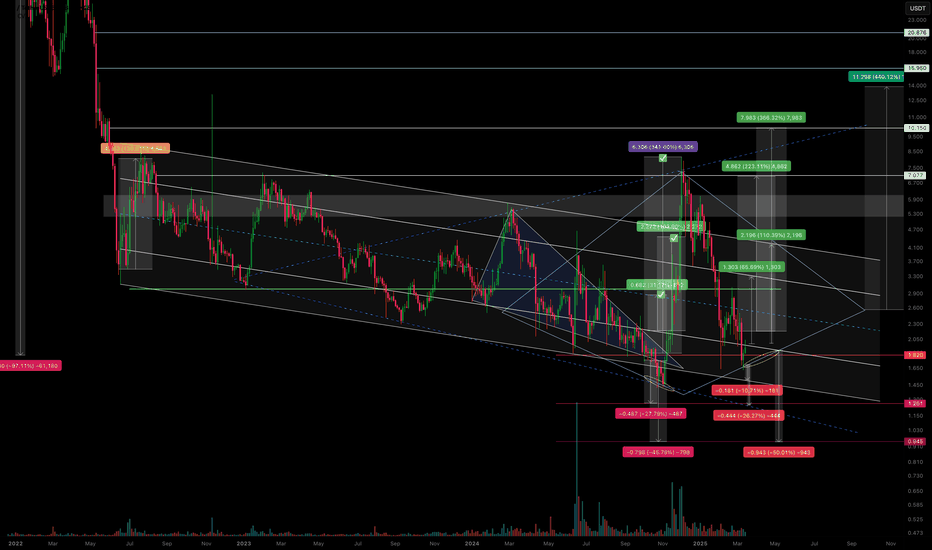

#CVX/USDT#CVX

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support a

CVXUSDT | Critical Resistance Zones – Precision Trading Required🚨 High-Importance Levels Identified – Stay Ahead of the Crowd

The red box and red line represent key resistance zones where sellers are likely to be aggressive. Blindly longing into resistance is how most traders lose money, but we trade with precision and confirmations.

🔴 Short Scenario (Rejectio

CVX/USDT – Is the scenario repeating? Continuing to work.The previous trading idea has played out with 3 out of 4 marked zones reached.

We saw a false breakout from the descending channel, followed by a pullback in line with the overall market—returning to the channel’s support zone.

I’ve noticed a potential formation of either a diamond pattern or an e

If it receives support at 2.179-2.862, it is time to buy

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

(CVXUSDT 1D chart)

The key is whether it can receive support near 2.835-2.862 and rise above 3.267.

Since the StochRSI indicator

#CVX/USDT Ready to launch upwards#CVX

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.85

We have a downtrend on the RSI indicator that is about to

CVXUSDT %184 Daily Volume Spike! Strategic Blue Box LevelsCVXUSDT has shown a 184% daily volume increase , highlighting heightened interest in this asset. You may have noticed that my blue boxes are progressively moving lower. This is a conscious decision , as the current market conditions demand targeting only highly meaningful levels to justify tak

See all ideas

Displays a symbol's price movements over previous years to identify recurring trends.

Related pairs

Frequently Asked Questions

Convex Finance / Tether (CVX) reached its highest price on May 15, 2022 — it amounted to 10,000.0000 USDT. Find more insights on the CVX price chart.

See the list of crypto gainers and choose what best fits your strategy.

See the list of crypto gainers and choose what best fits your strategy.

Convex Finance / Tether (CVX) reached the lowest price of 1.4384 USDT on Nov 3, 2024. View more Convex Finance / Tether dynamics on the price chart.

See the list of crypto losers to find unexpected opportunities.

See the list of crypto losers to find unexpected opportunities.

The safest choice when buying CVX is to go to a well-known crypto exchange. Some of the popular names are Binance, Coinbase, Kraken. But you'll have to find a reliable broker and create an account first. You can trade CVX right from TradingView charts — just choose a broker and connect to your account.

You can discuss Convex Finance / Tether (CVX) with other users in our public chats, Minds or in the comments to Ideas.