DigiByte Will Launch The 2025 Bull Market (2,753% Or 4,479% ???)Just for context. After a strong decline between mid-2019 and March 2020, DigiByte produced a 7,000%+ bullish wave. The cycle peaked in April 2021 and the rise had a duration of 413 days. A year and two months.

This info opens up some questions and gives fuel for some speculation:

» Will DigiByte

DigiByte Will Be A Market Leader (Top Performer) —Obey Me!Maybe you don't believe me or you disagree; do not argue with me, just listen to what I say. Grasp the meaning of my words; logic, understand.

This is the signal. DigiByte (DGBUSDT) tends to move first and it is already moving ahead. It closed green last week after some shakeouts while producing a

#DGB/USDT#DGB

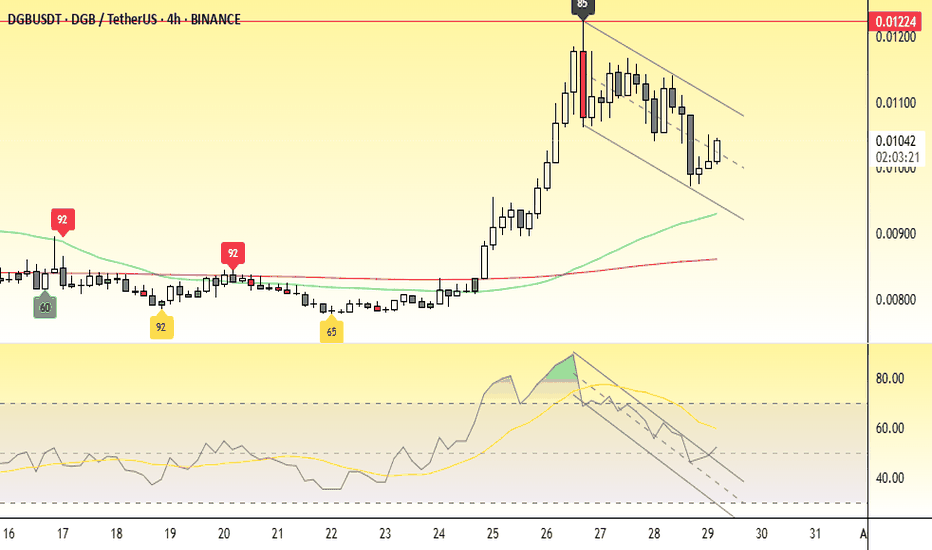

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area

Long Entry Signal for DGB/USDT DigiByteMLR Nearing SMA: The MLR (blue) is below but approaching the SMA (pink), hinting at a potential bullish crossover.

MLR > BB Center: MLR exceeds the Bollinger Bands Center Line (orange), signaling growing bullish momentum.

PSAR: PSAR dots (black) are below the price, supporting an uptrend.

Price >

DGB DGB / USDT

1D time frame

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trad

DGB/USDT Technical Analysis: Fibonacci Levels and RSI InsightsThe DGB/USDT pair on Binance is currently in a strong uptrend, as seen in the 1-hour chart. The price has surged, breaking key resistance levels and reaching 0.01078 USDT. The Fibonacci retracement levels suggest potential support at 0.618 (0.00975) and 0.5 (0.00999), which could act as buy zones if

See all ideas