ETHBULLUSD trade ideas

ETHUSD INTRADAY downtrend continuation below 2,171The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,171, which represents the current intraday swing high and the falling resistance trendline level.

In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,171 resistance, could lead to a downside move targeting support at 1,872, with further potential declines to 1,770 and 1,670 over a longer timeframe.

On the other hand, a confirmed breakout above the 2,171 resistance level and a daily close above that mark would invalidate the bearish outlook. This scenario could pave the way for a continuation of the rally, aiming to retest the 2,272 resistance, with a potential extension to 2,345 levels.

Conclusion:

Currently, the ETH/USD sentiment remains bearish, with the 2,171 level acting as a pivotal resistance. Traders should watch for either a bearish rejection at this level or a breakout and daily close above it to determine the next directional move. Caution is advised until the price action confirms a clear break or rejection.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Ethereum’s Rebound: V-Shaped Surge to an October 2025 PeakI have come today with a new ETH perspective, one that I think is more accurate than my last ETH TA.

Take a look here at how I got this one wrong, mainly because I was counting too much on this diagonal support to hold. Why didn’t it hold? Because there were too many traders looking at it, and when too many people are watching, the opposite happens, and it breaks.

I would advise looking at this TA first before you carry on with this one because the two tie together neatly.

My view is that from here, we will start a V-shaped recovery that will send ETH to $15,000–$18,000 by mid-October 2025. There is a very interesting fractal playing out that I discovered.

So, my alarm went off with this "Wyckoff Spring" indicator. It has only fired off two other times in history: once at the bottom of the COVID crash and the other time at the December 2016 bottom when ETH was just $8. So, I thought, well, let’s take a look to see if the first cycle has anything interesting.

As soon as I flipped to the daily chart, I immediately saw similarities. What if ETH is forming the fractal from the first cycle before the massive run-up? The timeframe and the drawdown percentages are nearly the same, the fractal is nearly identical, and the fact is, the Wyckoff Spring has fired off now, forming this fractal like in 2016. What are the chances…?

When you overlay the fractal, it lines up with mid-October 2025.

I have scanned the entire history of ETH, and I cannot find a fractal closer to this one. This could very well be the pico bottom for ETH this year.

ETH Weakness and the Bearish Flag targeting $1300 levels ETH is currently showing signs of weakness. I anticipated stronger buying pressure and a significant bounce from the $1900 levels. However, this scenario hasn't played out, and instead, a bearish flag has formed on the daily chart. This pattern suggests a potential target around the $1300 range. Stay cautious—avoid FOMO and refrain from entering long positions at this stage.

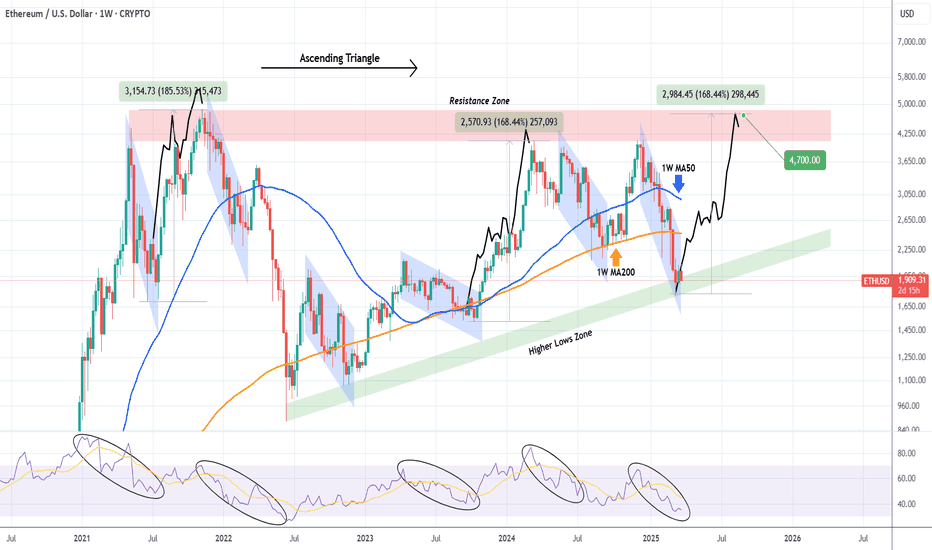

ETHEREUM Ascending Triangle bottomed and is targeting $4700.Ethereum (ETHUSD) hit 2 weeks ago the bottom (Higher Lows Zone) of its 4-year Ascending Triangle pattern, following the recent 3-month correction. That correction has technically been the pattern's Bearish Leg and during those 4 years we've had another 5 similar to this, all with the exception of one, producing a Higher High.

This is actually more similar to the October 09 2023 and June 21 2021 bottoms, so at worst we should get a +168.44% rally from here that will interestingly enough test the Triangle's top (Resistance Zone) a $4700.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ETH PoV - 1.600$? Ethereum is going through a phase of challenges and opportunities, with its current price approaching the target i've set for a potential purchase of $1600. In recent months, Ethereum has faced a significant price correction, with Ether's value dropping by about 40%, largely due to the growing competition from other blockchains like Solana and Cardano, which are gaining popularity due to their speed and low transaction costs. Additionally, the rise of memecoins and recent developments in the cryptocurrency regulatory landscape have shifted attention away from Ethereum, while other cryptocurrencies, such as Bitcoin, seem to enjoy greater favor among investors. Internally, Ethereum is still facing delays and challenges related to technical updates, as well as some tensions within the developer community, which has made it harder to maintain market leadership. The decision not to acquire Ether for a U.S. cryptocurrency reserve by the Trump administration has also disappointed many investors, fueling outflows from ETFs invested in Ethereum. Despite these difficulties, long-term prospects for Ethereum remain positive. In fact, some analysts suggest that if demand and supply stabilize, and if Ethereum can overcome internal challenges and effectively respond to competition, it could reach new all-time highs, with a target potentially surpassing $5000 in the next 12 months. This scenario is supported by the continued interest in ETFs that invest in Ether, the expansion of its network, and improvements in regulations, which could further incentivize institutional and retail adoption. Ultimately, while there are risks to consider, investing in Ethereum could be highly rewarding in the long term, with the possibility that the cryptocurrency could recover ground and set new value records in the next 12 months. Achieving a $5000 target, however, will depend on Ethereum's ability to innovate, address internal issues, and navigate the evolving regulatory landscape, but if it can maintain its central role in the cryptocurrency ecosystem, it may continue to grow significantly.

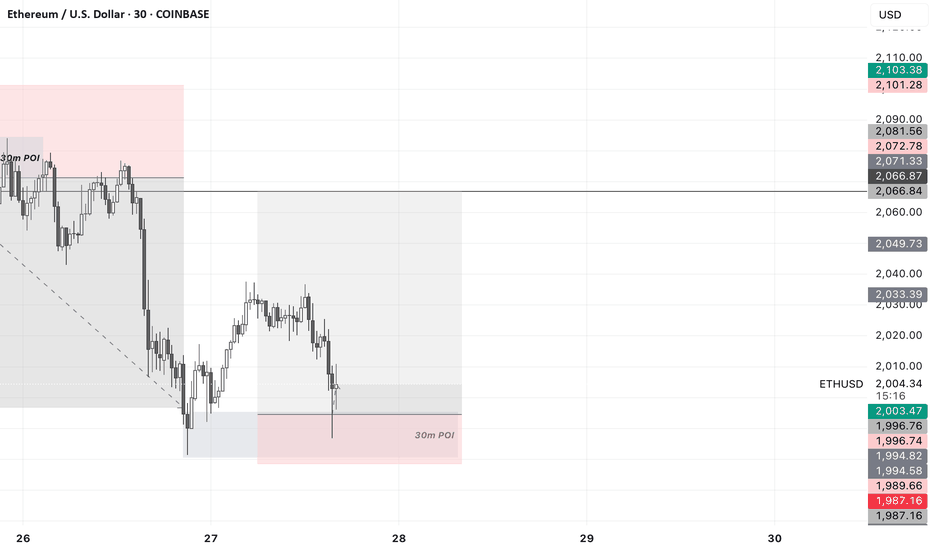

ETHUSD Buy Opportunity – Key 30m POI Support Zone COINBASE:ETHUSD

Ethereum (ETH/USD) has reached a key 30m POI (demand zone) at 1,987 - 1,994 , offering a potential buy opportunity. If this level holds, we could see a push toward 2,066.85.

📌 Trade Setup:

✅ Entry: 1,994.64

✅ Take Profit: 2,066.85

✅ Stop Loss: 1,978.50

A strong reaction here could trigger a bullish move. Are you taking this trade? 🚀

ETHUSD ETHEREUM Long following TechNasdaq turns, crypto follows.

Eth,Solana and bitcoin ,also XRP temporarily changing their directions to follow tech hype, and Trump´s tariffs-announcments.

There is no rational reason in behind of it: As traders we never care,what people say or do! We only follow the price,changes,and our trading rules.Only! What others say in the news or Social media, doesnt care us as traders,because we have understood that only the market is right.If the market says,go long,we follow.If market says,Sell! Then we go short.

Also dealing with quick profit taking is essential. We see that our profit target showing us attractive and lucrative profit numbers, and we get emotional: But the market says:Take that little profit and Get out here! Or Come with me in my direction,otherwise I will take away your profits!

As traders we have no emotional, and zero tolerance for emotional issues,regarding trading!

Therefor we are flexible. We have only one goal: Making Money!

As much and as many as we can! sIMPLE1

4 approches,with short term,midterm,profit taking targets.

Also keep it mind that the green zones are no stop loss zones,but they represent areas where we can cover more longs.

ETHUSD-BUY strategy 6 hourly KAGI chartIt feels possible that we may have seen a temporary bottom for ETH for the short-term. We are basing, and the change is of $ 2,350 test again.

Long-term seeing much lower levels, but its as noted a short-term chart and idea.

Strategy BUY current $ 1,875- 1,950 and take profit near $ 2,275 for now.

The key is whether it can rise to 2271.0-2356.31

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

The April TradingView competition is sponsored by PEPPERSTONE.

Accordingly, we will look at the coins (tokens) and items that can be traded in the competition.

I will talk about the ETHUSD chart.

--------------------------------------

(ETHUSD 1W)

If you look at the 1W chart, you can see how important the current price position is.

If it continues to decline this time, it is likely to fall to around 1337.54.

Therefore, the key is whether it can maintain the price by rising near the Fibonacci ratio of 0.236 (2089.91).

In order to turn upward on the 1W chart, it must rise near the Fibonacci ratio of 0.382 (2646.14) and maintain the price.

-

(1D chart)

Since the HA-Low indicator on the 1D chart is formed at the point of 1935.88, the key is whether it can receive support and rise near this area.

If it does not and falls below 1871.55, it is highly likely to fall to around 1626.95.

-

The M-Signal indicator on the 1W and 1M charts is passing near the Fibonacci ratio of 0.382 (2646.14).

Therefore, in order to turn into an uptrend, the price must rise above the M-Signal indicator on the 1W and 1M charts and be maintained.

To do so, we need to see if it can naturally rise above the M-Signal indicator on the 1W and 1M charts while maintaining the price by rising around 2271.0-2356.31.

However, in order to continue the uptrend, it is expected that the price must rise above the Fibonacci ratio of 0.382 (2646.14) and be maintained.

-

If the OBV does not rise above the upper line of the price channel and show an uptrend, it is likely that it will be difficult to sustain even if an uptrend appears.

The StochRSI indicator is showing a downward trend in the overbought zone.

Therefore, if the StochRSI indicator turns upward again and maintains the price around 1935.88, it is expected that it will lead to an attempt to rise to around 2271.0.

Therefore, when the competition started,

- If the StochRSI indicator did not turn upward,

- If the OBV did not rise above the upper line and showed an upward trend,

- If it did not receive support near 1935.88, it is expected that the SHORT position would be advantageous.

-

Thank you for reading to the end.

I hope you have a successful trade.

--------------------------------------------------

- Here is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire range of BTC.

I rewrote the previous chart to update it while touching the Fibonacci ratio range of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems that it has been maintaining an upward trend following a pattern since 2015.

That is, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

Based on the BTCUSDT chart, I think it is around 42283.58.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely that they will act as volume profile ranges.

Therefore, in order to break through these ranges upward, I think the point of interest is whether they can be supported and rise near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising range in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) range.

In order to do that, we need to see if it is supported and rises near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but based on the previous decline, we expect it to fall by about -60% to -70%.

Therefore, if it starts to fall near the Fibonacci ratio of 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the bear market starts.

------------------------------------------------------

ETHEREUM Is $14000 even possible??Short answer? Yes it is.

Ethereum / ETHUSD is trading inside a 7 year Channel Up and lately has found itself under the 0.618 Fibonacci retracement level for the first time since November 2020.

This is technically a temporary overreaction like the bullish breakout over the 0.382 Fib in March 2024.

Based on the final year rallies inside this Channel Up, we can clearly see that, though very optimistic, $14000 is within reach and won't even be at the top of the Channel Up.

Follow us, like the idea and leave a comment below!!

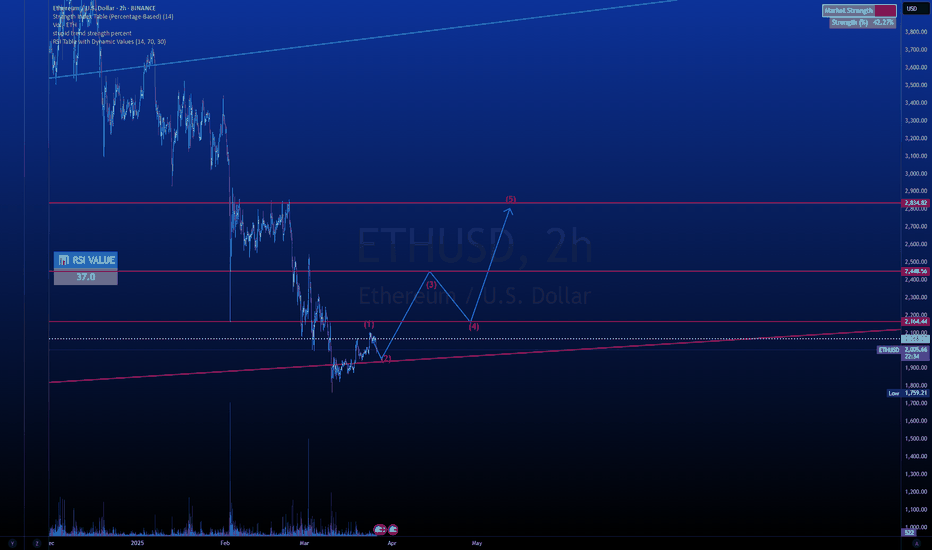

(ETH/USD) Poised for a Major BreakoutMarket Structure & Analysis:

Falling Wedge Breakout: Ethereum previously broke out of a falling wedge pattern, which is a bullish reversal signal.

Ascending Triangle Formation: Price is currently forming an ascending triangle, indicating potential for a breakout.

Support Levels:

$2,021 – Local support.

$1,926 - $1,873 – Strong demand zone.

Resistance Levels:

$2,120 - $2,251 – First resistance zone.

$2,531 - $2,564 – Final bullish target zone.

Trading Plan:

Buy Setup:

Enter long on breakout above $2,120 with strong momentum.

Stop Loss: Below $2,021 (support level).

Take Profit Targets:

TP1: $2,251 (first resistance).

TP2: $2,531 (main target).

TP3: $2,564 (extended bullish target).

Risk Factors:

A failure to break $2,120 could result in a pullback to $1,926.

Macroeconomic factors or Bitcoin’s movement may impact Ethereum’s trend.