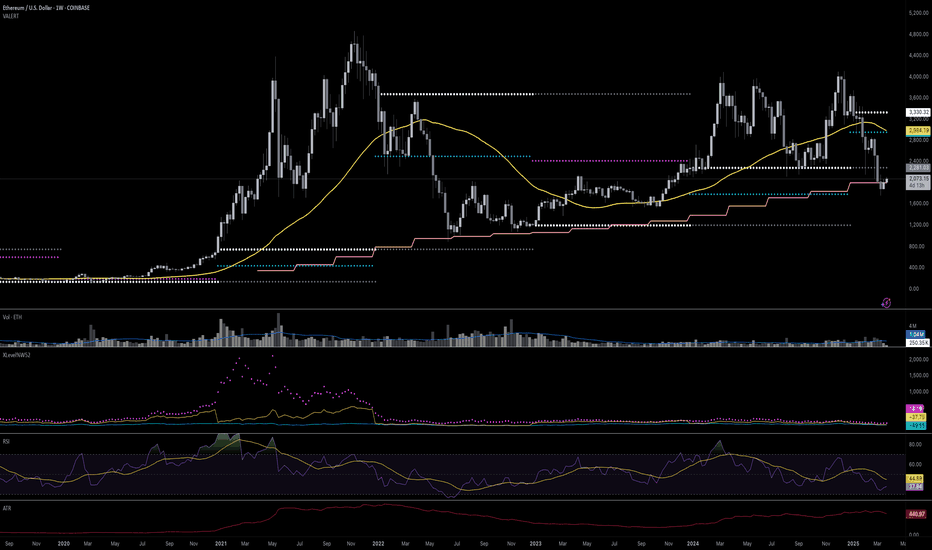

ETHUSD is testing multi year support. I bought today.ETH is currently at a critical juncture. The price is testing a key support level at 2,074.52 USD after a 31% pullback from its recent high. Technical indicators like RSI and volume suggest that the downward momentum may be slowing, but confirmation of a reversal is needed (e.g., a break above 2,281.03 USD with increased volume). On the other hand, a break below 2,074.52 USD could lead to further downside.

For Bulls: If you’re looking to buy ETH, watch for a strong bounce at this support level with confirmation from volume and RSI. A break above 2,281.03 USD would be a good entry point for a potential swing trade targeting 2,984.22 USD.

For Bears: If the price breaks below 2,074.52 USD, it could be a good opportunity to short ETH with a target of 1,800 USD or lower.

For Long-Term Holders: The current pullback appears to be a normal correction after a strong uptrend. If you believe in ETH’s long-term fundamentals (e.g., its role in DeFi, staking, and layer-2 scaling), this could be a good level to accumulate, especially if the price holds above 2,074.52 USD.

ETHBULLUSD trade ideas

The ETHUSD market is bullishETHUSD has currently successfully broken through the resistance level of 2,100 and has re-entered a new range.

The ETHUSD market is bullish. The current price is 2,075, and the intraday fluctuation range is between 2,044 and 2,080. There are signs that ETHUSD has initially formed a bottom. Judging from the 4-hour candlestick chart, the price is attempting to break through upwards, with the key resistance level at 2,160.

Looking ahead to 2025, the expected price range of ETHUSD is between 2,904 and 4,887. This week, ETHUSD has shown a strong and positive performance. In the following period, the key focus should be on whether ETHUSD can break through the key resistance level of 2,160, which will play a decisive role in its short-term and medium-term trends.

💎💎💎 ETHUSD 💎💎💎

🎁 Buy@2040 - 2050

🎁 TP 2070 2080 2090

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

Ethereum (ETH/USD) Bullish Breakout – Eyes on $2,500+ Target 📈 Chart Overview:

Timeframe: 4H (Ethereum/USDT)

Trend Reversal: Ethereum has broken out of a falling wedge pattern, indicating a shift from bearish to bullish momentum.

Support Level: Around $1,800 - $1,900, where price previously found strong buying interest.

Retest Confirmation: ETH successfully retested the breakout level (~$2,020), confirming a potential bullish continuation.

Resistance Zone: The next key resistance area is around $2,250, followed by a potential move towards the $2,530 - $2,550 target zone.

📊 Trade Setup:

Bullish Bias: Price action suggests an upward move towards $2,250 and potentially $2,530.

Risk Management: A stop-loss can be set below $2,020 to minimize downside risk.

🔥 Conclusion: If Ethereum maintains momentum above the retest zone, it could see a strong rally in the coming days! 🚀

LTCUSD INTRADAY at decisive point Technical Analysis of LTC/USD

Trend Overview: LTC/USD exhibits a neutral sentiment within a prevailing range-bound trading structure. The recent price action suggests an oversold bounce-back, forming a bearish sideways consolidation. This indicates indecision in the market, with neither bulls nor bears taking full control.

Key Levels:

Resistance: 960.00, 988.50, 1031.40

Support: 883.00, 840.10, 808.80

Price Action Analysis: The key resistance level at 960.00 serves as a crucial pivot point. An oversold rally from current levels could face rejection at this zone, leading to further downside movement. Failure to break this resistance may result in renewed bearish momentum, targeting lower support levels at 883.00, followed by 840.10 and 808.80 in the longer timeframe.

Alternatively, a confirmed breakout and daily close above 960.00 would shift sentiment to bullish, potentially opening the door for an upward move towards 988.50 resistance. Further bullish momentum could drive LTC/USD to 1031.40, reinforcing a stronger uptrend.

Conclusion: LTC/USD remains in a consolidation phase, with the 960.00 level acting as a decisive point for future price direction. A bearish rejection at this level could reinforce a downward trajectory, while a breakout above it would invalidate the bearish bias, signaling potential further gains. Traders should closely monitor price action near 960.00 to assess the next significant move.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ETHUSD Bearish Continuation pattern resistance at 2,171The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,171, which represents the current intraday swing high and the falling resistance trendline level.

In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,171 resistance, could lead to a downside move targeting support at 1,872, with further potential declines to 1,770 and 1,670 over a longer timeframe.

On the other hand, a confirmed breakout above the 2,171 resistance level and a daily close above that mark would invalidate the bearish outlook. This scenario could pave the way for a continuation of the rally, aiming to retest the 2,272 resistance, with a potential extension to 2,345 levels.

Conclusion:

Currently, the ETH/USD sentiment remains bearish, with the 2,171 level acting as a pivotal resistance. Traders should watch for either a bearish rejection at this level or a breakout and daily close above it to determine the next directional move. Caution is advised until the price action confirms a clear break or rejection.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

ETHUSD – Bullish Quasimodo + iH&S Breakout | Upside Targets!Ethereum (ETHUSD) has completed a textbook bullish Quasimodo pattern in confluence with an Inverse Head & Shoulders (iH&S) on the 15-minute timeframe. Price has broken out with strong bullish momentum, and the structure suggests more upside ahead.

📊 Technical Breakdown

1. Quasimodo Pattern

A well-defined Quasimodo reversal formed at the swing low, providing early signs of a bullish trend shift.

This pattern combines a higher low and reclaimed structure—offering an excellent base for trend continuation.

2. Inverse Head & Shoulders

Left Shoulder, Head, and Right Shoulder clearly structured with neckline breakout confirmed.

Breakout above neckline resulted in a 5.38% rally into minor resistance.

3. Bull Flag Formation

A short consolidation just below the recent highs resembles a bull flag, typically a continuation signal.

Breakout from the flag would trigger the next leg toward the final target.

🎯 Targets

Minimum Target: 2,121.41 — aligns with neckline projection.

Final Target: 2,229.90 — 6.27% projected move based on iH&S measured move.

📌 Trade Idea

Entry Zone: On bull flag breakout above 2,093

Stop Loss: Below 2,060 (flag low support)

TP1: 2,121

TP2: 2,229

🔎 Key Confluences

Pattern Breakouts ✅

Strong Momentum ✅

Clean Structure & Price Geometry ✅

ETH bulls have reclaimed short-term control. If momentum sustains, the upside targets are well within reach.

ETH/USD – Bullish Breakout & Buying OpportunityEthereum has broken out of a descending channel and is consolidating near a key support zone. The price action suggests a potential bullish continuation, with a buying opportunity forming above the $2,000 - $2,100 support level.

Key Levels to Watch:

Support: ~$2,000, ~$1,800

Resistance Zone: ~$2,250

Target: ~$2,530

Trading Plan:

Buy Entry: On breakout and retest above $2,250

Stop-Loss: Below $2,000

Take-Profit: $2,530

If Ethereum successfully breaks resistance with volume confirmation, it could rally toward $2,500+, making this a strong bullish setup. Keep an eye on price action for confirmation. 🚀

How "Max Pain" Can Become Your Ally in ETH TradingImagine standing on the edge of a cliff, peering down at a raging river below. That’s the feeling traders experience as the options expiration date approaches. At this moment, all bets are off, and the market is primed for sharp movements. Have you ever wondered how to turn this uncertainty into an advantage?

Let’s break it down. The ETH market is buzzing with tension: open interest in options is soaring, and the ratio of in-the-money to out-of-the-money puts stands at 48% to 52%. This means nearly half of all puts have intrinsic value. Professional market participants, like skilled magicians, hedge their positions, transforming them into delta-neutral setups.

But how do they do this? Right, by buying futures! This is the hidden growth driver we’ve been witnessing over the past few days. While I won’t dive into other factors like news, it’s crucial to understand that this dynamic could be the key to success.

Now, let’s talk about “Max Pain.” The Max Pain level for this options series landed on the March 2nd trigger point, where we saw a powerful bullish candle. But are the bulls stuck there? I’m pretty sure they are. Now, we’re left to watch whether the market can break free from this grip.

Personally, I see an opportunity to open a short position. But let’s see if the “law of gravity” will hold true for Max Pain this time.

Stay tuned If you want to stay updated on forex and crypto trading nuances!

ETHUSD New trendETHUSD has currently successfully broken through the resistance level of 2,100 and has re-entered a new range.

Hold for the long term

💎💎💎 ETHUSD 💎💎💎

🎁 Buy@2050 - 2080

🎁 TP 2200 2300 2400 2500

The market has been extremely volatile lately. If you can't figure out the market's direction, you'll only be a cash dispenser for others. If you also want to succeed,Follow the link below to get my daily strategy updates

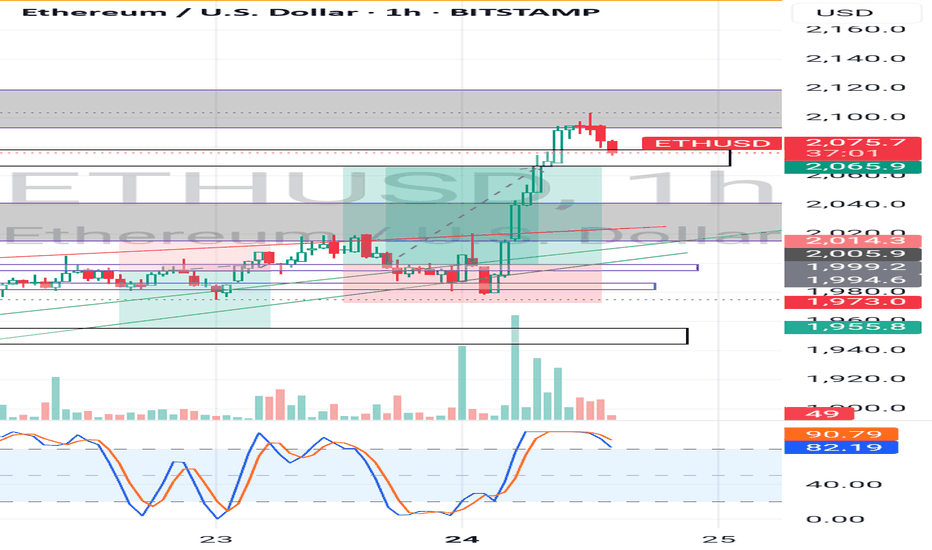

ETH/USD Breakout – Long Position Activated!Hi Traders ! Ethereum on the 1H chart has been trading within a descending channel and is now testing the upper boundary. I’ve placed a long entry expecting a breakout, targeting the $2,061 - $2,070 zone. Stop-loss set in case of a false breakout. RSI is showing signs of recovery. Let’s see how it plays out! 🔥👀

Disclaimer: This is not financial advice. Trade at your own risk. 🚨

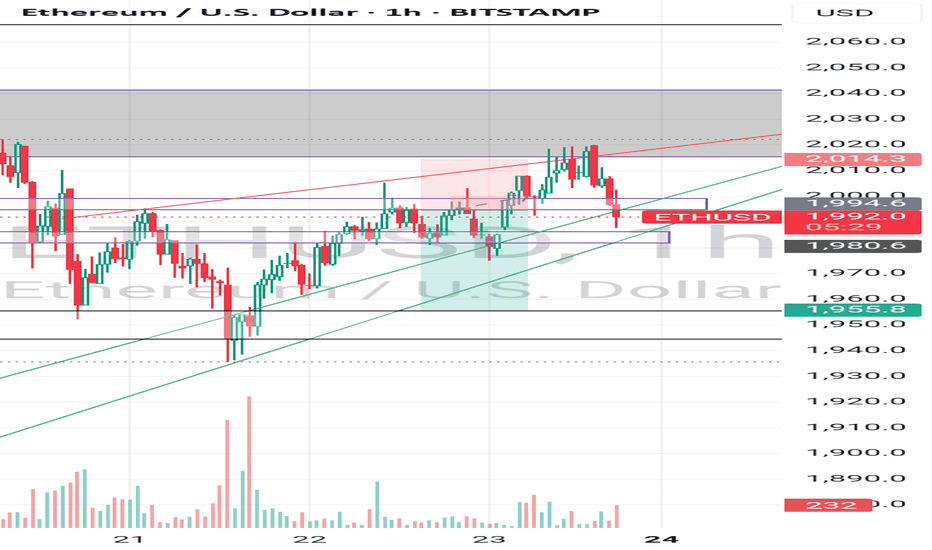

ETH ready for a rebound towards 2.5k- after breaking the magical line of 2000$, expectation was that the final capitulation for ETH has started

- that did not happen however and ever since that 2k break, bulls have consistently shown strength on low time-frames

- with the recent S/R flip, it is likely ethereum and by extension the entire crypto market gets a relief rally

- Bitcoin could go all the way to 110k however, if that happens, it is likely the move is going to be a short

Ethusd buy zone @2092 H4 chart analysis📈 ETH/USD Trade Update - H4 Chart

✅ Confirmation Factors: Bullish structure, RSI above 50, and MACD bullish cross with increasing volume.

📊 Key Zone: Confirmation around $2000-$2050 strengthens bullish outlook.

🔹 Buy Zone: $2088

🎯 Target 1: $2324

🎯 Target 2: $2533

🎯 Target 3: $2830

💡 Stay patient for confirmation and manage risk wisely.

Would you like to add stop loss guidance or risk management tips?

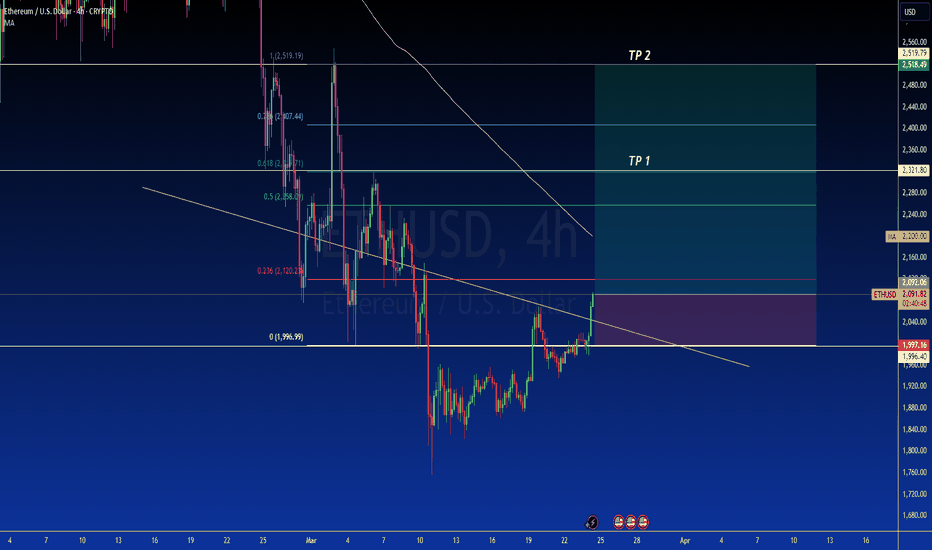

Ethereum (ETH/USD) Price Analysis: Breakout PotentialThis Ethereum (ETH/USD) 4-hour chart from TradingView presents a technical analysis focused on a potential breakout. The chart incorporates Fibonacci retracement levels, trendlines, and moving averages to identify key price levels. The price of Ethereum is currently testing a breakout above a descending trendline, suggesting a bullish reversal.

Key Fibonacci levels are highlighted, with the 0.236 level at $2,120.21, 0.5 at $2,158.8, and 1.0 at $2,519.19, indicating potential resistance and support zones. The chart also outlines two take-profit (TP) targets, with TP1 around $2,321.80 and TP2 near $2,518.49. A major moving average (MA) at $2,200.00 acts as an additional resistance level.

Ethereum's price is currently at $2,092.75, with bid-ask values matching at $2,092.95. The market is reacting to key support at approximately $1,996.99. A successful breakout above resistance could confirm an upward trend, while failure might lead to a retest of lower support zones.

This technical setup is essential for traders monitoring ETH/USD, as it provides insight into price action, key support and resistance levels, and potential breakout opportunities based on Fibonacci retracements and trendline analysis.

LOW RISK ETH SHORTSimply hopped into an ETH Short at around 11;15 pm EST

about a 40 pip SL @ $2,580

Looking for a 1:4 or 1:5

TP 1 : 2,487

TP 2 : 2,420

TP 3 : 2,355

If you can handle volatility hold till possible $2,100 or below!

Always good to scale in and out protecting your capital EFFICIENTLY!

Let's Get it PPFX Fam! Peace

ETH Breakout Setup: Eyeing $2,550 Target!"Key Observations:

Strong Support Level: ETH has bounced from a strong support zone around $1,792 - $1,905.

Retest & Buy Zone: Price has broken above a key level and is now retesting it, indicating a potential buy opportunity.

Resistance Zone: A key resistance zone is marked near $2,557.71.

Target Levels: The first target is set at $2,557.71, with a possible further extension to $2,854.38.

Bullish Confirmation: If ETH maintains support above $1,981, the uptrend towards the target is likely.

Trading Idea:

Entry: Buy on successful retest.

Stop Loss: Below the strong level at $1,905 - $1,792.

Take Profit: First target at $2,557.71, extended target at $2,854.38.

This setup follows a classic breakout and retest strategy, suggesting bullish momentum if Ethereum sustains above key levels.