ETHBULLUSDT trade ideas

ETH: Possible Scenario!Hello Traders,

Here's a quick update on ETH in the weekly timeframe.

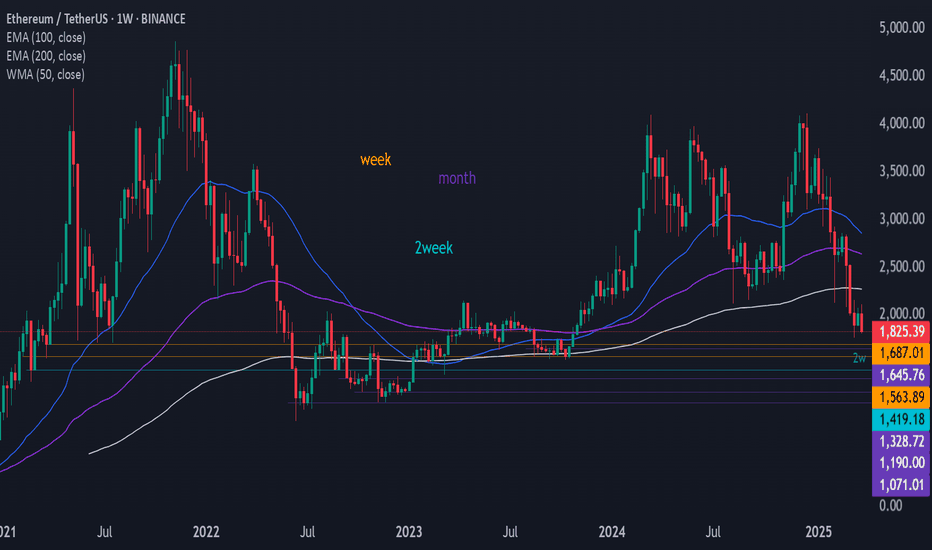

ETH is currently in a downtrend, trading at $1,890. It has already faced a 57% drop, and the trend is likely to continue.

Based on this weekly analysis, I expect ETH to drop to $1,400, where we have a support level. In a worst-case scenario, it could fall to $1,000. A rebound toward $2,200 is possible from the current market price, but it may not sustain for long.

Conclusion:

✅ Potential Accumulation Range: $1,000 - $1,400

✅ Lower Support: $1,000

Note: Always do your own research and analysis before investing.

ETH-----More around 1865 target 1800 areaTechnical analysis of ETH contract on March 30: Today, the large-cycle daily level closed with a small negative line yesterday, the K-line pattern continued to fall, the price was below the moving average, and the attached indicator was running with a golden cross and shrinking volume. The big trend was still very obvious, but I would like to remind you that the current price deviates from the moving average, and if there is a rebound trend in the future, it is also a correction trend. Don't be misled; the short-cycle hourly chart showed that the European market fell and the US market continued to break the low yesterday, and the morning support rebounded and corrected. The current K-line pattern continued to rise, and the attached indicator was running with a golden cross, so it still needs to be corrected within the day, and the high point of the US market correction yesterday was in the 1865 area.

Today's ETH short-term contract trading strategy: sell at the rebound 1865 area, stop loss in the 1895 area, and target the 1800 area;

ETH as well in a big opportunity as btc eth is in a big ascendant channel, where is formed a big falling wedge inside the channel, we are now on the support of the channel and of the wedge, so should be a nice level hard to let it down, there is even fib retracement to fill the gap formed, so i expect eth a nice move of 20/30% if trump doesnt say shit as every day of his life !!! trade safe and open a max leverage of 10x

ETH USDT NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

ETHUSDT NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

ETH(20250329) market analysis and operationTechnical analysis of Ethereum (ETH) contract on March 29: Today, the large-cycle daily level closed with a medium-yin line yesterday, the K-line pattern continued to be negative, the price was below the moving average, and the attached indicator was golden cross and running with shrinking volume. The decline in the general trend was still relatively obvious. The previous corrective rise was also to lay the foundation for the second decline. This point is very clear, so we are still firmly bearish in the direction; the support position below that needs to be paid attention to is near the 1750 area; the short-cycle hourly chart yesterday's price fell and broke through the previous low position, and the morning support rebounded and corrected. The current K-line pattern is continuous and positive, and the attached indicator is running with a golden cross. It needs to be corrected during the day, and the correction high pressure position is near the 1920 area.

Today's ETH short-term contract trading strategy: sell at the rebound 1920 area, stop loss at the 1850 area, and target the 1860 area;

ETH - Nice Prediction I was expecting a drop. The drop was forming as "3 Fan Principle". The perfect FP didn't happen but the drop was expected. BOOM the drop.

Almost 7% an going on ... 🎯 👌

Original TA here:

Follow for more ideas/Signals. 💲

Look at my other ideas 😉

Just donate some of your profit to Animal rights and rescue or other charity :)✌️

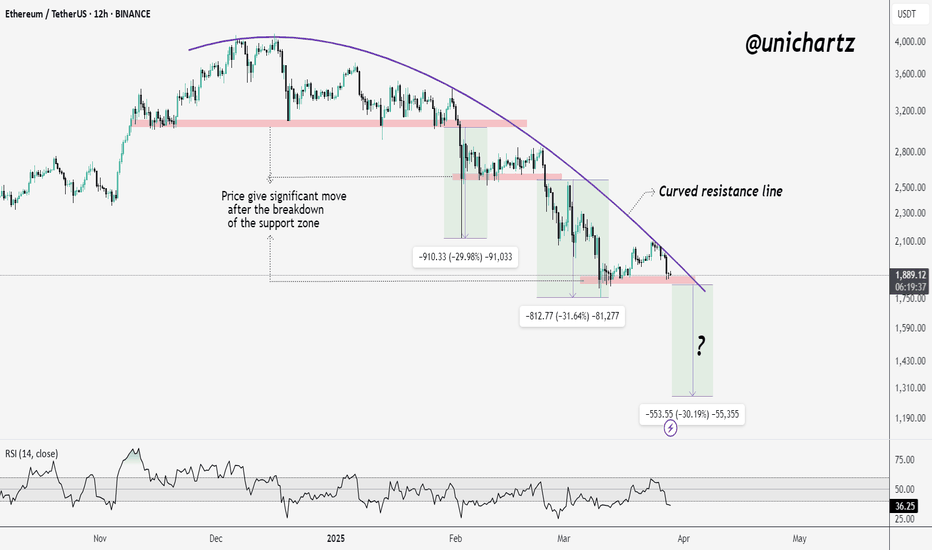

Will Ethereum Survive This Critical Level?Ethereum (ETH/USDT) on the 12-hour timeframe is currently displaying a strong downtrend structure, highlighted by a well-defined rounded top pattern and a descending arc acting as dynamic resistance. Since reaching its peak above $4,000, ETH has consistently printed lower highs and lower lows, respecting this curved resistance line.

The price is currently trading around $1,887, testing a significant horizontal support zone near $1,880–$1,900. This level has held multiple times in the past and now serves as a crucial line in the sand for bulls. If this support fails to hold, Ethereum could see further downside toward the next demand zones around $1,700 or even $1,600.

The RSI indicator stands at 36.11, which suggests that momentum is weak and the asset is nearing oversold territory. While this can often lead to short-term relief bounces, the overall trend remains bearish unless ETH breaks above the descending arc and reclaims key resistance levels near $2,050. A bullish scenario would require strong buying volume and a structure shift to higher highs

ETH USDT Critical Support Under PressureThe analysis for ETHUSDT on the 4-hour timeframe indicates significant bearish pressure as the price approaches a well-defined support zone, where a potential bullish reversal reaction from buyers can be anticipated. Scenarios include either a bounce from the support level with subsequent growth towards the upper resistance zone or a breakdown below, which could signal further trend weakening.

Ethereum Wave Analysis – 28 March 2025

- Ethereum reversed from the resistance level 2120.00

- Likely to fall to support level 1800.00

Ethereum cryptocurrency recently reversed down from the resistance level 2120.00 (former multi-month support from August and February) standing near the 38.2% Fibonacci correction of the downward impulse from February.

The downward reversal from the resistance level 2120.00 stopped the previous ABC correction ii.

Given the strong daily downtrend, Ethereum cryptocurrency can be expected to fall to the next support level 1800.00 (which stopped the previous impulse wave i).

ETH(20250328) market analysis and operationMarch 28 Ethereum (ETH) contract technical analysis: Today, the large-cycle daily level closed with a small negative line yesterday, the K-line pattern continued to fall, the price was below the moving average, and the attached indicator was running in a golden cross with a shrinking volume. The general trend is still very obvious. According to the current trend, the trend of the second big drop I mentioned earlier may come early, and next week is the focus, because the time for correction in exchange for space is basically consumed at present; the short-cycle hourly chart fell under pressure the day before, and the European session continued but did not break down, so the US session was still volatile. The correction high point was under pressure for the second time this morning. The current K-line pattern is continuous and the attached indicator is running in a dead cross, so there is a high probability that it will fall during the day. Whether the European session can break the low is the key.

Today's ETH short-term contract trading strategy: sell directly at the current price of 2005 area, stop loss in the 2035 area, and target the 1940 area;

Right now is the best time to be accumulating $ETH.Repeating Market Cycles (ChartPrime Indicator):

The ChartPrime oscillator shows a recurring pattern of market lows around the green-marked dates:

June 13, 2022 (Bear market bottom)

September 11, 2023 (Temporary low)

August 19, 2024 (Another correction)

March 24, 2025 (Potential bottom forming)

If this pattern holds, ETH could be near a cycle low, signaling a potential reversal soon.

Indicators Confirm Oversold Conditions:

The oscillator is near the lower green zone, historically aligning with market bottoms.

Past similar signals led to strong recoveries after a consolidation phase.