Ethereum (ETH): Strong Rejection From Re-Test ZoneWe are seeing strong rejection from the local re-test zone, where we are aiming now to see a further drop until the $1,820, where we expect to see some kind of support to form.

Once we see the support zone form there, we will be looking for upward movement, but for now let's bleed a little bit more.

Swallow Team

ETHBULLUSDT trade ideas

Ethereum targetting 1,912$ or 1,776$I see here 2 possibilities.

First look at the uptrend break and retested. Therefore, it may drop to a lower Fibonacci level which is 1,912$

The other option is the triple top formation target which is around 1,776$

* What i share here is not an investment advice. Please do your own research before investing in any asset.

* Never take my personal opinions as investment advice, you may lose all your money.

ETH Rising Wedge: Are We Headed for a Bearish BreakdownHey traders! 👋

We’re seeing a rising wedge pattern on ETH, which is generally considered a bearish setup. 📉 We’ve also had a solid touch at the Fib 0.382, which is acting as strong resistance right now.

With that in mind, we’re opening a market order and targeting the daily FVG (Fair Value Gap) for the next move down. What’s even more interesting is that our eclipse indicator is showing bearish signals across all timeframes, adding even more weight to the trade. 🛑

We’re going for it—how about you? Let’s see how this plays out! 💪

Note: This is not financial advice. Always do your own research before making any trading decisions!

ETH-----Sell near 2010, target 1920 areaTechnical analysis of ETH contract on March 27: Today, the large-cycle daily level closed with a small negative line yesterday, the K-line pattern was a continuous positive single negative, the price was still at a low level, the attached indicator was a golden cross with a shrinking volume, and the general trend was still obviously downward. The current pullback trend is to prepare for the next big drop; the technical trend of the four-hour chart has touched the high point of 2110 twice in a month, which is quite obvious. The current K-line pattern is a continuous negative, and the attached indicator is a dead cross, so there is a high probability that there will be a continued retracement trend; the short-cycle hourly chart fell in the European session yesterday and the US session continued to break the low, and the high point of the correction was near the 2025 area. Similarly, today we need to see a continued decline, and the pullback cannot break the high point of the correction.

Today's ETH short-term contract trading strategy: sell at the current price in the 2010 area, stop loss in the 2040 area, and target the 1920 area;

ETH - As long as the $1,950 holds...Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After breaking above the $2,000 level, ETH has been overall bullish trading within the rising orange channel.

Moreover, it is retesting as strong support zone, so we will be looking for longs as long as the $1,950 level holds.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of support and lower orange trendline acting as a non-horizontal support.

📚 As per my trading style:

As #ETH approaches the blue arrow zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Ethereum (ETH): Successful Re-Test, Sellers Taking Over The ZoneEthereum is seeing a good rejection where buyers failed to break from the local resistance zone. We are currently looking for the price to fall more, where at one point we should see an order of buys to form a strong wall of support.

Once we see any signs of reversal, we will be looking for a buying entry.

Swallow Team

ETHUSDT DIVERGENCE Hi

This is a technical analysis chart of Ethereum (ETH/USDT) on a 1-month timeframe. Here’s a breakdown of what’s happening in the chart:

1. Triangle Pattern (Yellow Lines)

The price is forming a symmetrical triangle, with resistance around $4,000 and support near $1,500-$2,000.

A breakout above the upper trendline could signal a bullish move.

A breakdown below support may indicate further downside.

2. Divergences & Indicators

RSI (Relative Strength Index): Shows a potential bullish divergence (price making higher lows while RSI makes lower lows).

MACD (Moving Average Convergence Divergence): Indicates weakening bearish momentum, possibly setting up for a bullish reversal.

3. Possible Scenarios (Yellow Arrow & Question Marks)

The yellow arrow suggests a possible breakout toward the $4,000 level.

The question marks indicate uncertainty—whether ETH will break upwards or get rejected at resistance.

Conclusion

ETH is at a critical decision point.

If it breaks above the triangle resistance, it could rally toward new highs.

If it fails and gets rejected, it may test lower support levels.

ETH Chart - SECRET in the INVERTETH is losing ground quickly after a nasty bearish pattern formed in the weekly.

The bearish M-pattern we're currently observing in the macro timeframe:

We know this is a bearish patter, not only because we've seen it many times before but also because it is the opposite of the W-Bottom. (we can actually confirm this by flipping the chart):

In this case, the bullish confirmation would have been a support retest of the neckline:

And so, if we flip it again back to the original view - the opposite can be true. As we get rejected on the resistance line, an even lower price is likely:

____________________

BINANCE:ETHUSDT

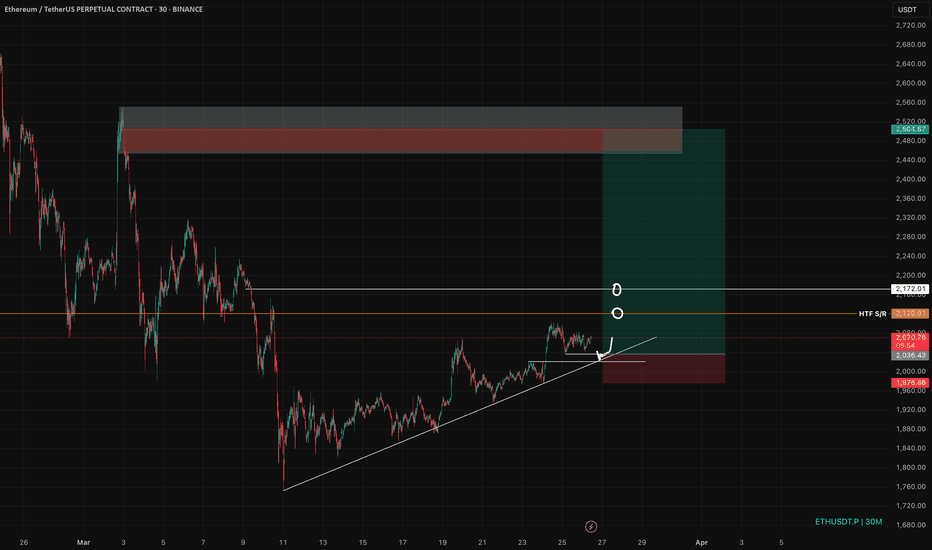

ETH – do we dare?ltf looks constructive, but honestly it depends a lot on what BTC does here going forward, like most alts.

Problem is that we are sitting right below previous year-long range low (orange line), longing here makes no sense to me.

We can look for a ltf entry though, run the lows at 2035, tag the small imbalance we left there. If we manage to keep the uptrend intact, a reclaim could give us an entry where we can take first partials on the htf s/r and at 2200 imbalance fill. Then leave a runner for if we fill the entire imbalances towards 2500.

Ethereum ETH Will Crash After Small PumpHello, Skyrexians!

Recently we have already told that potentially BINANCE:ETHUSDT has been finished the correction and is ready to reach $7-10k, but today we recalculated waves and can tell that one more leg down will happen with the high probability.

Let's take a look at the daily chart. Minimum Awesome Oscillator wave tells us that recent dump was only wave 3. Now asset is in wave 4. When AO crosses zero line it means that the min requirement for the wave 4 has been complete. At this point price shall reach the target area at 0.38-0.5 Fibonacci approximately at $2600. There we have to be very careful and if will see the bearish divergent bar the wave 5 will come. The target is $1600.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Ethereum (ETH): Sellers Are Still Dominating Current Resistance!Ethereum struggles to have a proper breakout from our re-test zone, which is good.

Upon seeing the price rejection there, we can consider it as a successful re-test of the broken zone, which then would send the price for another smaller correction, before a bigger upward movement, which we are waiting for!

Anything above $2000, in our opinion, is a good price for accumulating the ETH into spot.

Swallow Team

Ethereum (ETH): Buyers Are Trying To Take Over The ZoneEthereum buyers are still pressuring the broken support zone, where we are expecting to see yet another proper rejection (similar to the first time we touched that zone).

There are 2 entries for long for us here, where the first one would be once we would get a rejection and form a double bottom pattern and the second one would be if we see buyers to overtake the zone above 200EMA and keep dominance for at least a couple of days.

Swallow Team

ETH ANALYSIS AND NEXT TRADE IDEA.ETHUSDT is trading at 2060$, if we look its previous chart then we can see a clear MS after liquidity sweep which cause bullish structual moves and also did bullish BOS. I have found OB+FVG+SSL setup in the move which caused BOS. And this is our buy zone for next 2200 target.