ETHUSD.P trade ideas

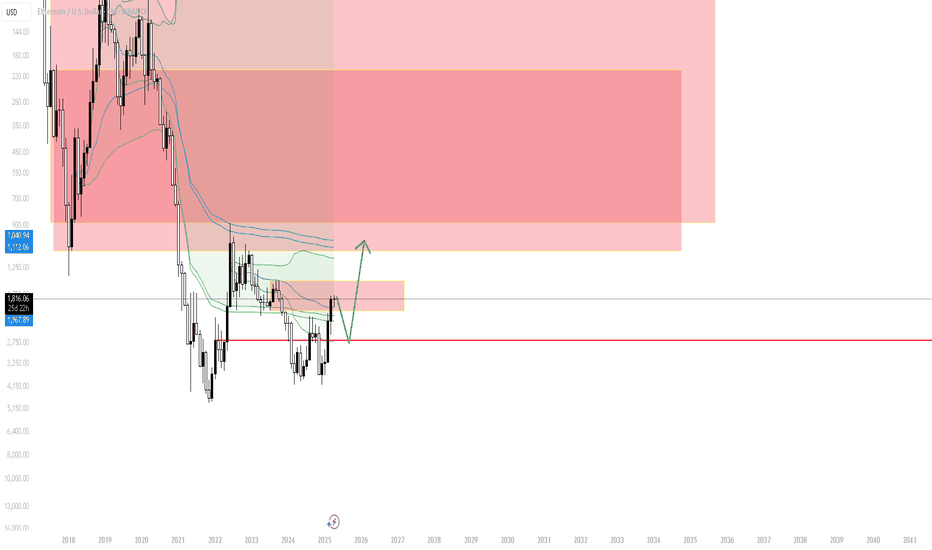

waiting for external market shiftsBack at the market bottom two years ago, we knew there were catalysts like ETF approvals, Bitcoin’s halving, and the Hong Kong market developments on the horizon. The market also believed in narratives like Layer 2 solutions, DePIN, and staking. At that time, "diamond hands" led the charge in accumulating assets like SOL CRYPTOCAP:SOL , BNB CRYPTOCAP:BNB , and SUI at the bottom.

Now, aside from waiting for external market shifts, there seems to be little else we can do. The much-discussed Ethereum staking ETF and SOL ETF within the crypto space are still at least months away, with the most optimistic timelines pointing to the summer and second half of the year. #SolanaETF #Pectra #ETFsOnFire

Hold NASDAQ:GT to claim free airdrops and get a boost!

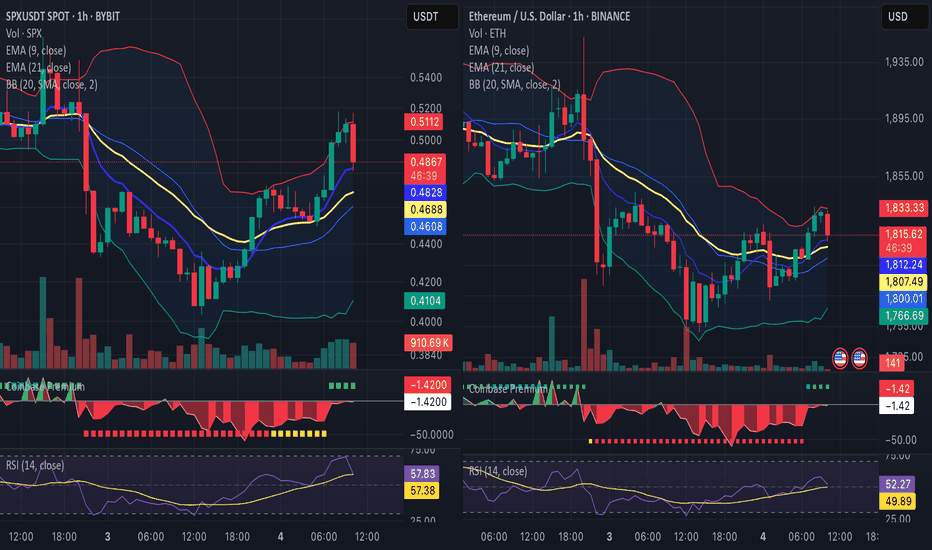

SPX & ETH: Market Manipulation or Final Pump Before Dump?Just as the market shows a strong move up — with SPX hitting 0.5169 and ETH reclaiming 1813 — we receive breaking news:

🇨🇳 China will impose an additional 34% tariff on U.S. goods.

Combined with upcoming key events — Non-Farm Payrolls , Unemployment Rate , and Powell's Speech — this could trigger a dramatic shift in sentiment.

Technical clues:

• SPX drops sharply after touching the upper Bollinger Band;

• ETH also rejects resistance;

• RSI overheated (above 66);

• Weak institutional demand (Coinbase Premium barely positive);

• Selling pressure increasing with higher volume.

Conclusion: I’m staying out for now. This move could be a trap — a setup to lure in retail buyers before major volatility. Better safe than sorry.

Patience > FOMO.

SPX + ETH — Pre-NFP Pullback or Trap?Both SPX and ETH showed a strong rally, but now we’re seeing early signs of rejection:

• SPX dropped sharply from 0.5169 to 0.4861 (≈ -6%), printing a bearish candle at the top of the Bollinger band.

• ETH follows with a rejection near the upper band too.

• RSI on both charts was above 57 — momentum was hot, but likely overextended.

• Coinbase Premium still barely positive at +2.78 — no strong institutional demand behind the rally.

• Volumes on the sell candle spike — smart money unloading?

Timing matters: All this happens just 2 hours before major economic data (NFP + Unemployment) and a Fed speech.

My View: This smells like a setup to trap late buyers. No long positions until after the news drops. I’d rather miss a few % than get caught in algo-driven volatility.

Protect capital first. Patience wins.

ETH Market Check – April 4, 2025Let’s take a closer look at Ethereum (ETH) – not just following SPX, but showing some of its own behavior lately.

1. Structure & Indicators

- ETH is currently retesting the 200 EMA zone on the 1h chart, and candles are starting to flatten near resistance (around 1833–1835).

- RSI is at 56–57 and losing momentum, approaching overbought on low volume.

- Coinbase Premium is still negative (-36 earlier, now -21), meaning institutional buying pressure is not behind this move – it’s likely retail-driven .

- Bollinger Bands show price hugging the upper band, often a signal of a temporary stretch.

2. Volume Analysis

- Volume on the move up was decent but fading .

- No strong spikes that would suggest big buyers stepping in.

It looks more like shorts covering and FOMO buying.

3. Divergence Risk

- We’re seeing early signs of bearish divergence on RSI vs price – ETH pushing up while RSI is not following with strength.

- This usually signals weakness in continuation , especially near key resistance zones.

4. News & Macro Correlation

- ETH will likely react sharply to today’s NFP data and Powell’s speech, even if it’s crypto – macro still rules.

- If SPX dumps, ETH will follow , especially with its current weak spot structure.

My View:

ETH is not showing organic strength . This climb seems forced and light , with clear signs of hesitation.

Unless we get positive macro surprise , I expect ETH to either:

- stall at current levels and chop sideways

- or pull back fast toward 1795 / 1755 zone

So I’m not entering longs here. Watching for rejection confirmation and possibly a short setup if conditions align after the news.

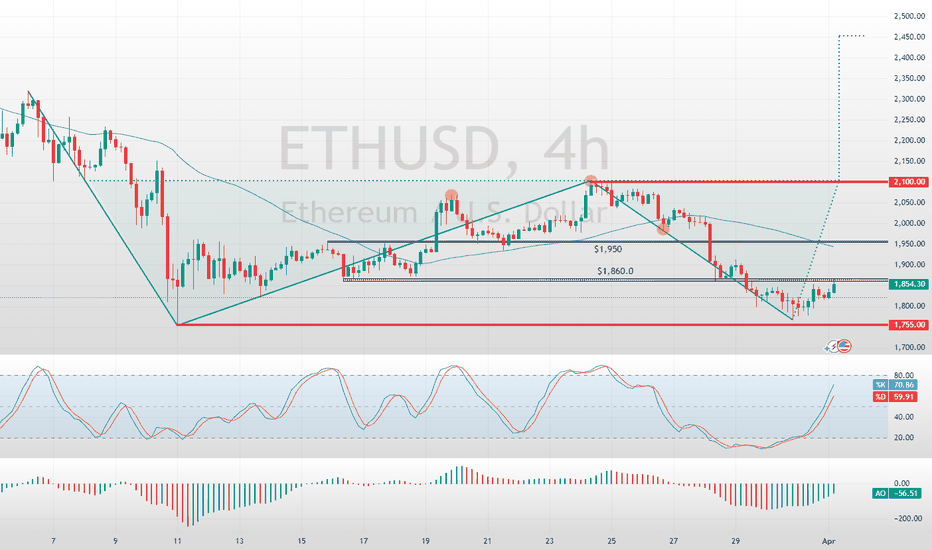

Ethereum at Critical Support – Breakout or Breakdown?Ethereum is currently testing a key support zone within a falling wedge structure. This level is crucial for bulls to hold if they want to push higher.

📊 Market Structure Update

ETH remains within a falling wedge, a pattern that often precedes breakouts.

Price is now at a key decision point—holding here could trigger upside momentum.

🔎 What’s Next?

A strong reaction from this support could lead to a breakout attempt.

Failure to hold may open the door for further downside.

Ethereum traders, how are you playing this setup?

(ETH/USD) Breakout from Falling Wedge – Bullish Momentum Ahead?Ethereum (ETH/USD) Breakout from Falling Wedge – Bullish Momentum Ahead?

This 4-hour Ethereum chart shows a breakout from a falling wedge pattern, a bullish reversal formation. The price has started forming higher lows, signaling potential upside movement. The projected target is around $2,411, indicating a significant recovery.

A successful retest of the breakout level could confirm further upward momentum. Traders may consider long positions while monitoring resistance levels.

📌 Key Levels:

Support: ~$1,879

Target: ~$2,411

Resistance Zones: $2,100 - $2,200

Would you like me to refine this further? 🚀

Ethereum’s drop is due to market issues, but upgrades may helpEthereum , one of the most popular and widely used blockchain platforms, is going through a rough patch. Since its launch in 2015, the cryptocurrency has drawn attention for its decentralized nature and its capabilities for smart contracts and decentralized applications (DApps). However, despite its early success, Ethereum has experienced significant price fluctuations in recent years. According to analysts, its price has dropped approximately 45.4% in the last quarter alone.

Several key factors are driving Ethereum’s recent price decline. First , increasing competition from faster and cheaper blockchains like Solana and Cardano is drawing in users and developers, reducing demand for Ethereum. Second , high transaction fees — especially during times of network congestion — make the platform less attractive for users who prioritize speed and cost-efficiency. Finally , delays in implementing upgrades such as the full transition to Ethereum 2.0 have eroded investor and user confidence, negatively impacting the token’s price.

Despite the current challenges, Ethereum remains one of the most promising cryptocurrencies. In 2025, its value and adoption may rise significantly due to several critical developments:

Full transition to Ethereum 2.0: The long-awaited move to Ethereum 2.0 — set to improve transaction speed, enhance security, and reduce fees — could serve as a major growth driver. The switch from Proof of Work (PoW) to Proof of Stake (PoS) will improve the network’s energy efficiency, making it more eco-friendly and cost-effective. With these enhancements, Ethereum could better compete with rival blockchains and attract more users and investors.

Boom in Decentralized Finance (DeFi): Ethereum serves as the foundation for many DeFi applications, which continue to gain popularity. In 2025, the growth of DeFi projects and the increasing total value locked in these apps may fuel demand for Ethereum. Ongoing development and integration of new financial instruments in the Ethereum ecosystem will further cement its role in the crypto economy.

Emergence of Layer 2 technologies: Layer 2 solutions like Optimistic Rollups and zk-Rollups could greatly enhance Ethereum’s scalability by reducing the load on the mainnet and lowering transaction fees. These technologies are essential for mass adoption, helping Ethereum scale efficiently while maintaining decentralization.

Growth of NFTs and asset tokenization: As tokenization and NFTs continue to rise in popularity, Ethereum remains the leading platform in this space. By 2025, we could see further expansion in the NFT market and tokenized assets, driving increased demand for Ethereum as the go-to platform for creating and exchanging digital assets.

Global crypto adoption and regulatory clarity: In 2025, regulatory frameworks for cryptocurrencies are expected to become clearer around the world. With growing government acceptance and legal recognition of crypto assets, Ethereum could become a foundational element of future financial systems—attracting fresh investment and pushing its value higher.

Despite the current headwinds, Ethereum has strong potential for recovery and future growth. FreshForex analysts predict a rebound could occur as early as Q3 or Q4 of 2025, driven by upcoming upgrades and network improvements. Don’t miss the chance to get in at the right time!

Exclusive offer for our readers: Get a massive 10% bonus on your balance for every crypto deposit of $202 or more! Just contact support with the promo code 10CRYPTO , fund your account, and trade with extra power. Full bonus terms available here.

At FreshForex, you can open trading accounts in 7 cryptocurrencies and access over 70 crypto pairs with up to 1:100 leverage — trade 24/7.

Karma hit fastKarma hit fast.

Hacker steals 2,930 ETHETH CRYPTOCAP:ETH ($5.4M) from zkLend... then gets phished while using Tornado Cash.

All 2,930 ETHETH CRYPTOCAP:ETH ($5.4M) gone — to another thief.

Trade ETHETH CRYPTOCAP:ETH , come to Gate – no need to think of reasons, just a pure recommendation! 😄

ETHUSD INTRADAY downtrend continues below 2,171The ETH/USD pair is exhibiting a bearish sentiment, reinforced by the ongoing downtrend. The key trading level to watch is at 2,171, which represents the current intraday swing high and the falling resistance trendline level.

In the short term, an oversold rally from current levels, followed by a bearish rejection at the 2,171 resistance, could lead to a downside move targeting support at 1,872, with further potential declines to 1,770 and 1,670 over a longer timeframe.

On the other hand, a confirmed breakout above the 2,171 resistance level and a daily close above that mark would invalidate the bearish outlook. This scenario could pave the way for a continuation of the rally, aiming to retest the 2,272 resistance, with a potential extension to 2,345 levels.

Conclusion:

Currently, the ETH/USD sentiment remains bearish, with the 2,171 level acting as a pivotal resistance. Traders should watch for either a bearish rejection at this level or a breakout and daily close above it to determine the next directional move. Caution is advised until the price action confirms a clear break or rejection.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Ethereum Price Rebounds: Key Levels to WatchFenzoFx—Ethereum's downtrend stabilized at $1,755, a key support level. Currently, ETH/USD trades at $1,854, testing resistance.

A double bottom pattern on the 4-hour chart suggests potential growth if bulls secure a close above $1,860. The next target could be $1,950, supported by the 50-period moving average.

LONG ON ETHEREUM (ETH/USD)Ethereum has given a change of character (choc) to the upside on the 4 hour timeframe...

followed by a nice sweep of engineered liquidity!

Its currently respecting a key demand are and I believe it will now rise for 300-500 points this week.

I am buying Eth to the next level of resistance.