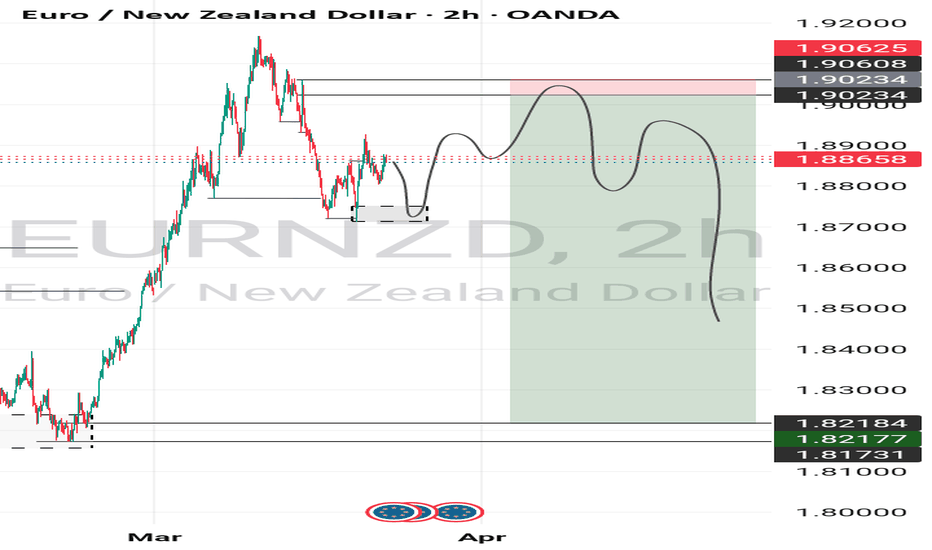

WHY EURNZD IS BULLISH AGAING ?? DETAILED ANALYSISEUR/NZD is currently trading at approximately 1.886, having completed a retesting phase following a bullish breakout. This technical development suggests the potential for a renewed upward movement toward the target price of 1.9300. With strong bullish momentum building, traders are closely watching for confirmation signals to enter long positions.

Fundamentally, the Reserve Bank of New Zealand (RBNZ) recently implemented a 50 basis point rate cut, reducing the benchmark rate to 3.75%, with indications of further easing to stimulate the economy. This dovish monetary policy stance tends to exert downward pressure on the New Zealand dollar, thereby supporting the EUR/NZD pair. Meanwhile, the Eurozone has maintained a more stable monetary policy, contributing to euro strength relative to the New Zealand dollar. This divergence in central bank policies enhances the bullish outlook for EUR/NZD.

Technical indicators further reinforce this perspective. The pair has been in a downward channel since mid-February; however, recent bullish candles indicate a potential short-term reversal or correction. The price has swiftly moved from the lower Bollinger Band to the upper band, breaking through the middle band in a strong bullish move. Additionally, EUR/NZD is currently testing the 50% Fibonacci retracement level, a key decision point for traders.

Considering these technical and fundamental factors, the EUR/NZD pair appears poised for a bullish wave toward the 1.9300 target. Traders should monitor key resistance levels and employ appropriate risk management strategies to capitalize on this potential upward movement. If momentum continues, this setup could present a profitable long trade opportunity in the coming sessions.

EURNZD trade ideas

EURNZD Long BiasThe EURNZD pair is currently breaking out of a descending trendline on the 4H timeframe, signaling a potential shift in momentum. The price has recently bounced from a key demand zone, aligning with the 38.2% Fibonacci retracement level, suggesting strong bullish interest.

Additionally, the price is now trading above key moving averages, reinforcing the bullish bias. A sustained break above the breakout level could confirm further upside potential, with the next target around the 1.92 zone. However, if the price fails to hold above the breakout level, a potential retest of the demand zone near 1.87 could be expected before resuming upward momentum.

KEEP IT SIMPLE STUPID!!! SELL EURNZDAll the information you need to find a high probability trade are in front of you on the charts so build your trading decisions on 'the facts' of the chart NOT what you think or what you want to happen or even what you heard will happen. If you have enough facts telling you to trade in a certain direction and therefore enough confluence to take a trade, then this is how you will gain consistency in you trading and build confidence. Check out my trade idea!!

www.tradingview.com

Bearish reversal?EUR/NZD is rising towards the resistance level which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 1.89747

Why we like it:

There is a pullback resistance level that line sup with the 61.8% Fibonacci retracement.

Stop loss: 1.90810

Why we like it:

There is a pullback resistance level that lines up with he 78.6% Fibonacci retracement.

Take profit: 1.8743

Why we like it:

There is a pullback support level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

EUR/NZD: Watching for a Short Setup After CorrectionIt looks like EUR/NZD has potentially completed a five-wave structure downward, which could set the stage for short positions if the following conditions are met:

1️⃣ A corrective three-wave structure forms, ideally reaching around 1.89960, aligning with the 61.8% Fibonacci retracement.

2️⃣ A downward move follows, breaking below 1.88014, confirming a potential wave B breakout of the correction.

3️⃣ A potential continuation of the decline toward 1.85230.

However, if the pair fails to form a proper correction and instead continues to rally—breaking above 1.91700—this will invalidate the short setup and suggest an alternative wave scenario.

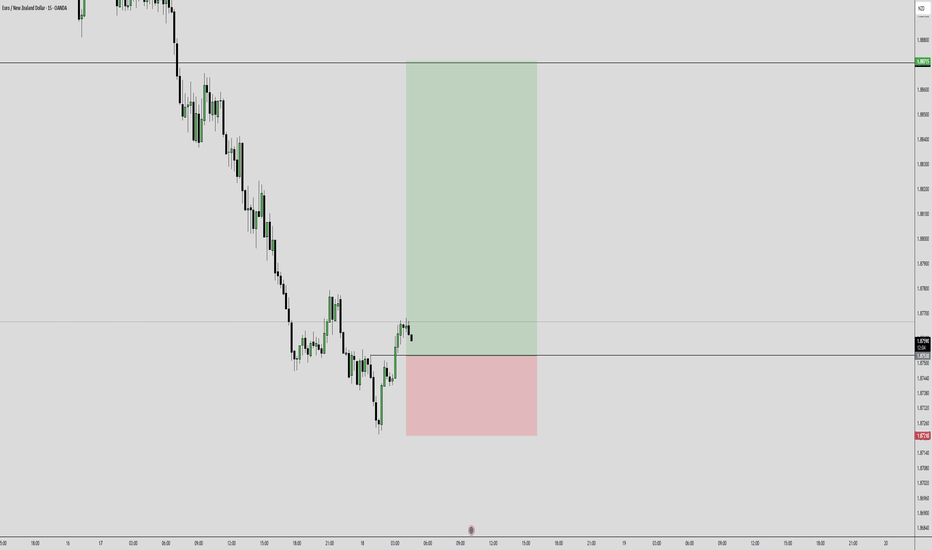

EURNZD Downtrend in Play – Key Breakdown & Bearish OutlookThe 4H chart of EURNZD shows a descending trendline resistance, indicating a sustained bearish trend.

Price is rejecting the 1.8850 resistance level, aligning with the 38.2% Fibonacci retracement, reinforcing the bearish bias.

A potential breakdown could lead the pair towards the 1.8726 support level (50% Fibonacci), followed by the 1.8200 key demand zone.

Trade Setup & Levels:

Entry Zone: Below 1.8820 after a confirmed rejection.

Target 1 (TP1): 1.8726 – mid-support level

Target 2 (TP2): 1.8200 – major demand zone & 100% Fibonacci extension

Stop Loss (SL): Above 1.8987 to avoid false breakouts.

Bearish Confirmation Factors:

✅ Lower highs and trendline rejection, confirming downward momentum.

✅ Breakdown of support zones, leading to extended selling pressure.

✅ Fibonacci confluence, reinforcing downside targets.

Conclusion:

A break below 1.8726 will accelerate selling momentum, with 1.8200 as the ultimate bearish target. Traders should watch for confirmation signals before entering short positions. 📉

EUR/NZD at a Turning Point: Is the Rally Over?Why is the EUR/NZD pair in the spotlight as the week comes to an end?

At the beginning of this year, the euro rose by more than 6%, reaching its highest levels since November 2024. Meanwhile, the New Zealand dollar was experiencing a decline at the end of last year, touching its lowest levels since October 2022. But what has changed this week?

From the beginning of February until today's trading session on March 25, 2025, the New Zealand dollar has risen by approximately 4.37%, breaking through the 0.57729 level. This level represents the last significant lower high recorded in the market, and surpassing it indicates a shift in trend from bearish to bullish. From a technical perspective, this is considered a positive signal for the New Zealand dollar in the short to medium term.

On the other hand, after reaching its highest levels since October 2022, the euro has shown some declines and weakening bullish momentum this week. If the U.S. dollar index experiences a corrective rise, further weakness in the euro is expected.

In this scenario, we have a positive outlook for the New Zealand dollar and a negative outlook for the euro, increasing the likelihood of a decline in the EUR/NZD pair, especially since it is currently trading at its highest levels since March 2020!

The recent rise in EUR/NZD gave a bearish signal during this week's trading after breaking below the 1.87675 level (which represents the last significant high low recorded) and forming a lower low. The recent rise to the 1.90668 level appears to be a corrective move before continuing the downward trend toward the 1.88120 level. However, the bearish scenario would be invalidated if the price rises above 1.91663 and closes daily above this level.

Bearish drop?EUR/NZD has rejected of the pivot which is a pullback resistance and could drop to the 1st support.

Pivot: 1.88951

1st Support: 1.86727

1st Resistance: 1.89710

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EUR/NZD BUY SETUP – BULLISH OUTLOOK! EUR/NZD BUY SETUP – BULLISH OUTLOOK! 📈

🔹 Pair: EUR/NZD

🔹 Bias: Bullish ✅

🔹 Entry Zone:

🔹 Stop Loss (SL): 🔴

🔹 Take Profit (TP): 🏆

🔍 Market Analysis:

✅ Strong bullish structure with higher highs & higher lows

✅ Institutional order flow supporting buyers

✅ Liquidity grab before the move up

✅ Confluence with key support zone

📊 Chart shows a high-probability buy setup. If price holds above support, expect bullish continuation. 🚀

💬 What’s your outlook on EUR/NZD? Comment below! 👇🔥

#ForexTrading #EURNZD #SmartMoneyConcepts #TradingView #FXSignals #ForexAnalysis

EURNZD - Swing trade IdeaHi everyone! The EURNZD shows a nice bearish momentum and a CHoCH/BOS on the 4-hour time frame. I am looking for a sell entry when it reaches the 71% Fib level and setting the take profit (TP) at the next demand zone area. Please conduct your own analysis before entering any trades

Sell Limit Order:

Sell @ 1.89600 - 100 pips

SL @ 1.90600 - 100 pips

TP1 @ 1.88600 - 100 pips

TP2 @ 1.87600 - 200 pips

TP3 @ 1.86600 - 300 pips

RR 1:3, better to move the SL to BE when the trade hits TP1.

Cheers.

EURNZD See See Look Look Don't Take Risk 2031SGT 19032025Tempted to sell here because this setup looks perfect, and is in my watchlist for some time and seems riped now according to what I waited for it to become.

Price rejected the Daily Time Frame's Resistance area and has now came down with this consolidation towards the downside. I am looking to enter on the Hourly Time Frame, but I will not enter it for real, just eyeballing.

I do it in this way because I am practicing restrain.

There's no need to hop onto every setup you see, for now, especially when I am still not profitable in the long run which means something I done definitely isn't right.

I think one of it is because I deviate from my strategy after I traded for some time, and I deviate due to emotional and PNL issues which didn't hit my goals.

Just see and look. Take 1 to 3 trades, and take a break for awhile, maybe a week or so. Don't do this seeing and looking thing either, especially when you haven't been outside for some time taking in the yang energy from outside, but has been simmering in the yin energy at home for too long. How to know if long is too long? If you have cabin fever or symptoms like such, or if your hair is longer than you usually like it to be, or unkempt, messy room, unwashed dishes, unpaid bills etc. Too much yin energy. Too little yang energy, no balance.

I think I shouldn't be seeing and looking, but since I already am seeing and looking, then I would have to practice some restrain and go out tomorrow.

I have too much yin energy now. Especially when its raining outside, too. Monsoon season.

Singaporeans overall are actually not really rich. They are just paper rich, and their paper rich is being restricted when they do want to materialise their gains. Not that there's anything wrong, just one or two big overwhelming issues would use up all the gains they gotten, and become dirt poor, just like any other people from other countries. So, nothing special here.

The thing however is just like any first world country, you will survive if you get a job. If you would thrive or not, or recoup your losses depends on how you manage your current holdings.

I am talking about myself.

See you when I see you.

2041SGT 19032025

EUR/NZD BEST PLACE TO BUY FROM|LONG

EUR/NZD SIGNAL

Trade Direction: long

Entry Level: 1.881

Target Level: 1.888

Stop Loss: 1.876

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Bearish drop?EUR/NZD is rising towards the pivot and could drop to the 50% Fibonacci support.

Pivot: 1.88686

1st Support: 1.86727

1st Resistance: 1.89710

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

EURNZD Bearish Trend Structure Indicates Potential ContinuationH1 - Bearish trend pattern

Strong bearish momentum

Potential drop if the resistance levels will not be broken.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.